Consignment

advertisement

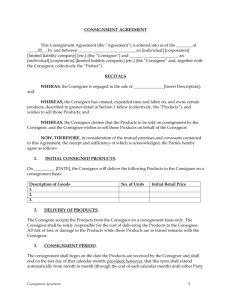

Consignment 1 Consignment Consignor (Owner of the goods) •Consignment account •Goods sent on Consignment account •Consignee account Goods Consignee (Agent) Net proceeds + Account sales •Consignor account 2 Nature of a consignment If the owner of the goods does not have retail outlets, he can consign the goods to an agent. The agent will sell the goods for him and receive a commission in return. 3 1. Consignor • The owner of the goods who sends the goods to an agent for sale. 2. Consignee • Who sells the goods for the consignor. • Sells the goods and collects the money from the customers. • Will pay the consignor the net proceeds (Proceeds – Expenses – Commission) and provide the consignor an account sales showing all the proceeds and expenses. 4 3. Goods sent on consignment • Goods sent on consignment are the property of the consignor until the goods are sold. • The consignor should include all the unsold goods on consignment in his closing stock. 5 Consignor’s Books Consignment account 1. • It is a profit and loss account for the consignment. Consignment Account Expenses Income 6 2. Consignee account Consignee Account Amount owing form consignee Amount owing to consignee e.g. Sales e.g. Expenses, commission 7 3. Goods sent on consignment account Goods sent on consignment account Transferring to trading account Cost of goods sent 8 4. Summary of procedures Transactions 1. Goods sent on consignment 2. Expenses incurred by the consignor. 3. Expenses incurred by the consignee and the commission payable to the consignee. 4. Sales recorded on the account sales Double entries Dr Consignment Cr Goods sent on consignment Dr Consignment Cr Bank Dr Consignment Cr Consignee Dr Consignee Cr Consignment 9 5. Normal loss No entry Normal loss of stock of the consignment which was not insured. (Normal loss: damaged stock, obsolete stock) 6. Insurance claim received for normal stock loss 7. Abnormal loss Abnormal stock loss credited to consignment account. (Abnormal loss: fire loss, burglary loss, stolen in transit) Dr Bank Cr Consignment Dr Bank/Insurance company Dr Profit and Loss Cr Consignment(Total loss) 8. Payment from the consignee by cheque or bill Dr Bank/Bills receivable Cr Consignee 9. Cost of goods sent on consignment credited to trading account. Dr Goods sent on consignment Cr Trading account 10. Profit on the consignment is Dr Consignment transferred to the profit and loss account. Cr Profit and loss (Reverse the entries if it is a loss.) 10 Goods sent on consignment account $ 9. Trading x $ 1. Consignment x 11 Consignment $ 1. 2. 3. Goods sent on consignment Banks-consignor’s expenses Consignee- consignee’s expenses consignee’s commission 10. P & L-profit on consignment x x x $ 4. 6. 6. 7. Consignee-sales Bank/Insurance Co.-claim Bank/Insurance Co.-claim Profit and Loss-net stock loss x x x x x x x _ x 12 Consignee $ 4. Consignment-sales x _ x $ 3. Consignment-consignee’s expenses consignee’s commission 8. Bank-settlement from consignee x x x x 13 Consignee $ Consignment-sales 18,000 ______ 18,000 $ Consignment-expenses -commission 8. Bank 2,400 1,800 13,800 18,000 14 E. Bad debts of Consignments A consignee(agent) sells goods and collects money on behalf of the consignor. If he can’t collect the debts, these debts should be treated as the bad debts of the consignor. Accounting entries in the books of the consignor: Dr Consignment Cr Consignee 15 Consignment $ Consignee-bad debts x Consignee $ Consignment-bad debts x 16 If a consignee receives an additional commission (del credere commission), he must bear all the losses from the bad debts. In case of a bad debts arising from sales of goods on consignment, no entry is required in the books of the consignor. 17 Accounting entries in the books of the consignee Dr Bad debts Cr Debtors (with the bad debts borne by the consignee personally) 18 Valuation of stock If there are unsold goods on consignment at the end of the accounting period, the value of the unsold stock will be carried down to the following period. 19 Consignment $ Year 1 x x Year 2 Balance b/d $ Year 1 Balance c/d – value of unsold stock x x x 20 Valuation of stock = Consignor’s Cost +Consignee’s Expenses 21 Consignor’s cost = Total consignor’s cost * Units of closing stock / Total units of goods SENT on consignment = [Cost of goods on consignment + Consignor’s expenses] * Units of closing stock / Total units of goods SENT on consignment 22 Consignee’s expense = Total consignees expenses (excluding marketing expenses) * Units of closing stock / Total units of goods RECEIVED by consignee (after normal loss) Marketing expenses e.g. advertising expenses,ordinary commission,del credere commission, salesmen’s salaries, bad debts, discounts allowed, delivery charges(to customers), selling expenses, distribution expenses. 23 Example 24 Consignment $ Goods on Consignment Bank - freight - insurance Chan – port charges 60,000 500 200 700 - delivery charges to warehouse 1,280 - advertising 1,000 - delivery charges to customer 900 - dis. allowed 320 - ordinary com. 4,700 ($94000*5%) - del credere com. 500 (50000*1%) Chan – sales (500+440)*$100 94,000 25 Workings Value of the stock loss (10 boxes) Stock loss = (1,000 * $60 + $500 +$200) * 10/1,000 = $607 26 Consignment $ Goods on Consignment Bank - freight - insurance Chan – port charges 60,000 500 200 700 - delivery charges to warehouse 1,280 - advertising 1,000 - delivery charges to customer 900 - dis. allowed 320 - ordinary com. 4,700 ($94000*5%) - del credere com. 500 (50000*1%) Chan – sales (500+440)*$100 Bank – claim Profit and Loss – stock loss (607-300) 94,000 300 307 27 Workings Value of the Closing Stock Consignor’s Cost: ($1,000 * $60 + $500 + $200) * 50/1,000 Consignee’s Expenses: ($700 + $1,280) * 50/990 3,035 100 3,135 28 Consignment $ Goods on Consignment Bank - freight - insurance Chan – port charges $ 60,000 Chan – sales 500 (500+440)*$100 200 Bank – claim 700 Profit and Loss – stock loss - delivery charges to warehouse 1,280 (607-300) - advertising 1,000 Balance c/d - delivery charges to customer 900 - dis. allowed 320 - ordinary com. 4,700 ($94000*5%) - del credere com. 500 (50000*1%) Profit and Loss – Profit on consignment 27,642 94,000 97,742 97,742 300 307 3,135 29 Chan Consignment - sales $ 94,000 94,000 Consignment -port charges -delivery changes to warehouse -advertising -delivery charges to customers -dis. allowed -ordinary com. -del credere com. Bank $ 700 1,280 1,000 900 320 4,700 500 84,600 94,000 30 Consignee’s books A consignee collects sales proceeds and pays expenses on behalf of the consignor. A consignor account should be maintained to record the money due to or due from the consignor. 31 Summary of procedures Transactions Double entries 1. Goods received form consignor. 2. Expenses paid by the consignor. No entry 3. Commission received (ordinary and del credere commission). 4. Expenses paid on behalf of the consignor. Dr Consignor Cr Commission Received 5. Discounts allowed to customers/ No entry Dr Consignor Cr Bank Dr Consignor Cr Debtors 32 6. Bad debts borne by the consignor. 7.Bad debts borne by the consignee personally. (When the consignee receives a del credere commission, he should bear all losses from bad debts) 8. Cash sales 9. Credit sales 10. Payment to the consignor by cheque or bill Dr Consignor Cr Debtors Dr Profit and Loss/Bad Debt Cr Debtors Dr Bank/Cash Cr Consignor Dr Debtors Cr Consignor Dr Consignor Cr Bank/Bill payable 33 Consignor Account $ Bank – consignee’s expenses Commission Received - ordinary - del credere Debtors – dis. allowed Debtors – bad debts Bank / Bill payable – to consignor x x x x x x x x $ Bank – sales Debtors – sales x x _ x 34 Example The facts are the same as in the pervious example, but the transaction would be shown in the books of consignee. In Chan’s Books Tang – Consignor Account Bank -port charges -delivery changes to warehouse -advertising -delivery charges to customers $ 700 1,280 1,000 Debtor – sales (500 x $100) $ 50,000 Bank – sales (440 x $100) 44,000 900 Commission Received -ordinary -Del credere Bank – to consignor 4,700 500 84,600 94,000 94,000 35 Further Considerations 36 A. Consignments and the Final Accounts The accounts related to a consignment would be disclosed in the final accounts as follows: 37 In Consignor’s Book Trading and Profit and Loss Account $ Opening Stock Add Purchases T Less Goods on Consignment C Less Closing Stock Cost of Goods Sold Gross Profit Expenses Stock Loss of Consignment Net Profit $ N N N N N N N N C T T Sales $ N Gross Profit Consignment Profit N N C T N=figure from normal trading; C=figure from Consignment T= Total figures 38 Balance Sheet (Extract) $ Current Assets Stock (N+C) Consignee Account (if it is a debit balance) $ Current Liabilities T OR Consignee Account C (if it is a credit balance) C 39 In Consignee’s Book The only entries needed is for the commission received. Trading and Profit and Loss Account $ Opening Stock Purchases Less Closing Stock Cost of Goods Sold Gross Profit $ N N N N N N N N N Expenses Bad Debts Bad Debts (If he has received a del credere commission, he will bear the Consignment’s bad debts) C Net Profit T Sales $ N N N Gross Profit Commission Received (from consignor) C T T 40 Balance Sheet (Extract) $ Current Assets Stock Consignor Account (if it is a debit balance) $ Current Liabilities N OR Consignor Account C (if it is a credit balance) C 41 Consignments and Joint Ventures: If the party to a joint venture sends some goods to an agent for sale, the transactions will be entered as follows: No consignment account is opened If no consignment account is kept, all the transactions of the consignements should be recorded in the foint venture account. A consignemnt account is opened 42 (i) No consignment account is opened Joint Venture Account $ Bank – joint venture expenses X Bank – consignment expenses incurred by the consignor X Consignee – consignment expenses incurred by the consignee $ Bank – joint venture sales X Consignee – consignment sales X Stock c/d – unsold stock of joint venture and consignment X X Profit and Loss – share of profit X Bank – settlement X X X 43 Memorandum Joint Venture Account $ Expenses – joint venture and consignment $ Sales – joint venture and X consignment X Stock c/d – joint venture and Share of Profit: A X B X consignment X X X X 44 (ii) A consignment account is opened Joint Venture Account $ $ Bank – joint venture expenses X Bank – joint venture sales X Profit and Loss – share of profit X Goods Sent on Consignment X Bank – settlement X Consignment – profit X Stock c/d – unsold stock of joint venture only X X X 45 Consignment Account $ $ Goods Sent on Consignment X Sales – joint venture only X Bank – expenses X Goods Sent on Consignment X Consignee – expenses X Consignment – profit X Joint Venture – consignment profit X Stock c/d – joint venture only X X X 46 Memorandum Joint Venture Account Expenses – joint venture only $ X Share of Profit: A X B X X X Sales – joint venture only $ X Goods Sent on Consignment X Consignment – profit X Stock c/d – joint venture only X X 47

![lecture_8_(2)lscm[1] - Head Scratching Notes](http://s2.studylib.net/store/data/005495268_1-06056aa40ae4298d0ab041c29bbcab92-300x300.png)