MANAGERIAL ECONOMICS 11th Edition

advertisement

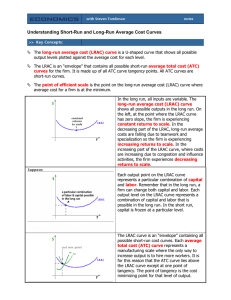

Chapter 6 Cost analysis and Measurement KEY CONCEPTS • • • • • • • • • • • • • historical cost current cost replacement cost opportunity cost explicit cost implicit cost incremental cost profit contribution sunk cost cost function short-run cost functions long-run cost functions planning curves • • • • • • • • • • • operating curves fixed cost variable cost short-run cost curve long-run cost curve economies of scale cost elasticity capacity minimum efficient scale multiplant economies of scale multiplant diseconomies of scale learning curve OVERVIEW • • • • • • • • • • • What Makes Cost Analysis Difficult Opportunity Cost Incremental and Sunk Costs in Decision Analysis Short-run and Long-run Costs Short-run Cost Curves Long-run Cost Curves Minimum Efficient Scale Firm Size and Plant Size Learning Curves Economies of Scope Cost-volume-profit Analysis 一. Nature of costs • 1.Accounting cost and Economic cost 2. Historical costs Versus Current Costs Historical cost: the actual cash outlay Current cost: the present cost of previously acquired items 3.Replacement Cost – Cost of replacing productive capacity using current technology. • 4.Opportunity Cost – foregone value. – second-best use. • 5.Explicit and Implicit Costs – Explicit costs= cash expenses – Implicit costs= noncash expenses • 6.Incremental Cost and marginal cost – Incremental cost: the change in cost tied to a managerial decision. – Incremental cost can involve multiple units of output. Marginal cost: a single unit of output. • 7.Sunk Cost – Irreversible expenses incurred previously. – **Sunk costs are irrelevant to present decisions. Definition of the Operating Period – At least one input is fixed in the S.R. – All inputs are variable in the L.R. • Fixed and Variable Costs 二.Short-run Costs 1.Categories: Total Cost = Fixed Cost + Variable Cost – ATC = AFC + AVC – MC = ∂TC/∂Q 2. Cost curves **Short-run Cost Relations – Short-run cost curves show minimum cost in a given production environment. True or false: 1. An implicit cost usually involves the use of resources owned by the owner of the firm. 2. Costs are money payments for the use of resources. 3. Variable costs depend on how much output is produced. 4. Short run is a period of time that is less than 1 year. ??List the inputs that generate explicit costs and implicit costs • A self-employed automobile mechanic uses his own tools, rents a building, buys replacement parts, and hires a teenager as a helper. • ??opportunity cost • A piece of land is used to raise wheat . If the farmer could make $2000 by growing corn on this land, $1800 by growing peanuts, $1700 by growing soybeans, and $1500 by raising cattle, what is the opportunity cost of the wheat. Which of the following are short-run and which are long-run adjustments? (a) Wendy’s builds a new restaurant; (b) Acme Steel Corporation hires 200 more production workers; (c) A farmer increases the amount of fertilizer used on his corn crop; (d) An Alcoa plant adds a third shift of workers. • The MES (minimum efficient scale) is the smallest level of output needed to attain all economies of scale and minimum long-run ATC. • If long-run ATC drops quickly to its minimum cost which then extends over a long range of output, the industry will likely be composed of both large and small firms. If long-run ATC descends slowly to its minimum cost over a long range of output, the industry will likely be composed of a few large firms. If long-run ATC drops quickly to its minimum point and then rises abruptly, the industry will likely be composed of many small firms. 三.Long-run Cost Curves • • • • 1.Types of LR costs 2.LRAC and SRAC( envelope of SACs) 3.law 4. economy of scale/diseconomies of scale • 5. minimum efficient scale • 6.shift of long run cost curve: learning curve • 7. break even analysis LRAC and SRAC Suppose a firm has only three possible plantsize options represented by the ATC curves. ??What plant size to choose in producing 50, 130,160, and 250 units? Draw the firm’s long-run average-cost curve on the diagram and define this curve. Long-run Average Costs To understand LRAC • LRAC: shows the lowest average total cost at which any output level can be produced after the firm has had time to make all appropriate adjustments in its plant size. ??Why U-shaped LRAC Law--AC • Economies of scale: the reduction in LRAC as the scale of the firm’s output is increased. • Diseconomies of scale: Returns to scale and economies of scale C LAC O q1 q2 Q Elasticity and LRAC 1.Output Elasticity εQ = ∂Q/Q ÷ ∂Xi/Xi If • εQ > 1 →increasing returns. • εQ = 1 →constant returns. • εQ < 1 →decreasing returns. 2.Cost elasticity: εC = ∂C/C ÷ ∂Q/Q. • εC < 1 :falling AC, increasing returns. • εC = 1 : constant AC, constant returns. • εC > 1 rising AC, decreasing returns. 5.Minimum Efficient Scale Definition of MES: output level at the minimum point on the LRAC curve. Competitive Implications of MES: long run average cost C C C LAC LAC LAC O Q (a) O Q (b) O Q (c) 6.Learning Curves • Definition : average cost reduction over time due to production experience. **Learning → shift of LRAC curve **Learning curve advantages≠ economies of scale effects Learning Curve Examplep159 AC2004=$100 AC2005=$90 Learning rate=(1- AC2/AC1) *100% • Strategic Implications of the Learning Curve Concept – When learning results in 20% to 30% cost savings, it becomes a key part of competitive strategy. 7.Cost-volume-profit Analysis • (1).Break even quantity • QBE=TFC/ (P-AVC) • Example (2).Degree of Operating Leverage – DOL is the elasticity of profit with respect to output. **DOL/profit elasticity= %△profit/%△Q DOL=Q(P-AVC)/[Q(P-AVC)-TFC] **DOL=(P-AVC)/P-AC 五.Production costs in the long run 1.Types of costs: TC; ATC; MC (ATC and MC: U shape) 2. Economies of scale and diseconomies of scale ①Economies of scale: when increasing the scale of production lead to a lower cost per unit of output. Q up----LAC down • Reasons: labor and managerial specialization\ ability to purchase and use more efficient capital goods\ other factors such as advertising or other start up costs\ economy of bulk buying. ②Diseconomies of scale: where costs per unit of output increase as the scale of production increases. Q up---LAC down. • Reasons: the growing complexities of managing a larger organization\ distant management, worker alienation and problems with communication and coordination.. ③ Constant return to scale: Q↑or↓→unchanged ATC 3. The relationship between LAC and SAC SR: fixed inputs LR: variable inputs= a firm could choose the size of its factory and once a factory is chosen, the firm must deal with the shortrun costs associated with that plant size. LATC is called the envelope curve of SATCs. 4.Minimum efficient scale and industry structure Minimum efficient scale: MEC the smallest level of output at which a firm can minimize its average costs in the long run.. If the MES is a large percentage of the market, and if the firms are to be large enough to gain the full economies of scale, there will not be room for many firms. If the MES exceeds 50%, there is only room for one firm large to gain full economies of scale. In this case, the industry is said to be a natural monopoly. Transportation Costs and MES – Terminal, line-haul and inventory costs can be important. – High transport costs reduce MES impact. Firm Size and Plant Size • Multi-plant Economies and Diseconomies of Scale – Multi-plant economies are cost advantages from operating several plants. – Multi-plant diseconomies are cost disadvantages from operating several plants. Economics of Multi-plant Operation: an Example • Plant Size and Flexibility Economies of Scope • Economies of Scope Concept – Scope economies are cost advantages that stem from producing multiple outputs. – Big scope economies explain the popularity of multi-product firms. – Without scope economies, firms specialize. • Exploiting Scope Economies – Scope economics often shape