Talk: Investment

advertisement

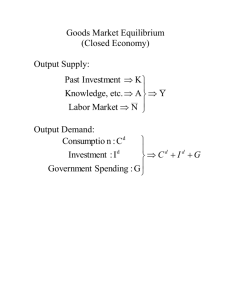

Macroeconomic Analysis 2003 Investment Blanchard 16.2, Mankiw 17; M&S 14 Lecture 13 1 Contents • • • • • • • • • • Why investment is so volatile? Investment Decision: Present value and Cost Marginal productivity theory of investment A Numerical Example of Investment Problem Investment tax credit and optimal capital stock Problem of Manufacturing sector in UK Long term yield and investment Multiplier-Accelerator theory of Investment Marginal productivity, Cost of Capital and Tobin’s Q Exercises Lecture 13 2 Investment is More Volatile than Output: Why? Lecture 13 3 Lecture 13 4 Asset Market Bubbles and Collapse FTSE100 Index 8000.00 7000.00 6000.00 FTSE100 BEAR 4000.00 3000.00 BULL 2000.00 1000.00 0.00 Ja n8 Ja 5 n8 Ja 6 n8 Ja 7 n8 Ja 8 n8 Ja 9 n9 Ja 0 n9 Ja 1 n9 Ja 2 n9 Ja 3 n9 Ja 4 n9 Ja 5 n9 Ja 6 n9 Ja 7 n9 Ja 8 n9 Ja 9 n0 Ja 0 n0 Ja 1 n02 Index 5000.00 Lecture 13 5 Asset Market Bubbles and Collapses 40,000.0 35,000.0 Djones nikkier 8,000.0 6,000.0 30,000.0 25,000.0 20,000.0 15,000.0 10,000.0 4,000.0 2,000.0 5,000.0 0.0 0.0 19 85 19 86 19 8 19 7 8 19 8 89 19 90 19 9 19 1 9 19 2 93 19 94 19 9 19 5 9 19 6 97 19 98 19 99 20 0 20 0 01 20 02 Dow Jones 10,000.0 Lecture 13 6 Nikkie 12,000.0 Why Investment is the Most Volatile Component of the GDP? In advanced economies, where the capital output ratio (K/Y) is around 2.5 on average and share of investment in the GDP is around 20%, the capital stock is 12.5 (=2.5/0.2) times the flow of investment. This means even a one percentage change in the demand for capital stock brings roughly 13 percent change in the demand for investment. As explained by perpetual inventory method on average it takes about 13 years of investment flows to generate the total stock of capital of an economy at a given point of time. Lecture 13 7 Investment Decision Analysis Breaks even point: r K PV Annual income from the project: 18000 The value of this investment project: V= 18000 r Cost of the Project: 100,000 r 0.05 0.1 =0.08 0.15 PV 138461.5 100000 78260.87 Project breaks even at 10% interest rate and makes positive real profit at 5 % interest rate Investment should not be recommended when the interest rate is 15% because the manufacturer will loose almost 22k. Lecture 13 8 Financing of an Investment Project Demand for output Self Finance Bequests Maturity Need for Capital Financing an Investment Project Equity Finance Stock Market (LSE) Bonds: Debt Finance Banks, Building Society, Insurance Instalment Repayment Method Method Lecture 13 No Risk High Risk Risk 9 PK L wL rK K L Low interest rate induces producers to substitute out labour by capital K w L r 1 PK L w 0 L PK 1 L r 0 K o w r Lecture 13 10 Optimal Capital Stock for a Firm MPK Output C = (r+)K Y = f(K) Y MPK=MC Kopt Lecture 13 Capital 11 Impact of Increase in the Interest rate on the Optimal Capital Stock for a Firm MPKb MPKa Output & Cost Yb Ra = (r2+)K Rb = (r1+)K Y = f(K) r2 > r1 Ya Ka Kb Capital Lecture 13 12 Impact of Technological Advancement in the Capital Stock MPK2 MPK1 r-cost 0 K1 Lecture 13 K2 13 Lending is Growing with Lower Interest Rate in Recent Years Growth of Lending to Individuals and the Interest Rate, BOE 20.0 Lending Intrate 15.0 10.0 5.0 0.0 O ct -8 7 O ct -8 8 O ct -8 9 O ct -9 0 O ct -9 1 O ct -9 2 O ct -9 3 O ct -9 4 O ct -9 5 O ct -9 6 O ct -9 7 O ct -9 8 O ct -9 9 O ct -0 0 O ct -0 1 O ct -0 2 Growth Rate and Interest Rate 25.0 Lecture 13 14 Marginal Productivity Theory of Investment -calculations Output and Capital Accumulation Y F K and K t K t 1 1 I t Investment 1 I V e I e t t 1 1 r 1 r t t 1 1 te 1 .... 1 r e t Yt t and Kt Optimal investment MPK r P K Lecture 13 k 1 15 Marginal Productivity and the User Cost of Capital K P 1 F K k 2 K P1 K 1 r 1 r ' F K Pk K 1 r 1 1 P2K 1 r MPK 1 r P1 1 P k or 0 K 2 MPK 1 r 1 1 K K P k 1 , where P2K K K 1 is the capital gain. 0 P1 MPK r P K k 1 Lecture 13 16 Role of Investment Tax Credit in Promoting Investment Why Manufacturers Lobby for a Tax Credit? r K 1 r K 0 MPK K1 K2 Lecture 13 17 What is the optimal capital stock for a car company? which is selling each car at 8 thousands had to pay for capital equipment per car about 2 thousands if the nominal interest rate is 6%, inflation (capital gain) is 3% and the depreciation of capital stock is 3% per year assuming that the production function of this company is given by Y K with 0.75 . Lecture 13 18 Optimal Capital Stock for the Car Company The user cost of capital i K = 6% +3%-3% =6% Marginal product of capital: 1 F ' K1 K 0.75K Optimal Investment condition P.F ' K1 P1k i k 0.751 => 80000.75K 0.751 20006% 3% 3% => 8.0.75K 0.25 26% ; 6K 3 K 0.25 0.06 0.25 K 50 4 = 26% => 6.25 million Lecture 13 19 Problem of the Manufacturing Sector in the UK Input and Output Price Inflation in Manufacturing Sector 20.0 Input Output 15.0 5.0 Jan-02 Jan-01 Jan-00 Jan-99 Jan-98 Jan-97 Jan-96 Jan-95 Jan-94 Jan-93 -5.0 Jan-92 0.0 Jan-91 Percent change 10.0 -10.0 -15.0 Lecture 13 20 Input Prices are Volatile Because of the Volatility of Oil Prices Lecture 13 21 Investment is sensitive to the Long-term Yield than to Short Term Returns Arbitrage condition for two periods 2 e 2t 1t 1,t 1 1 i 1 i 1 i 1 i i i Yield curve for n period bonds 1 e e e int i1t i 2t i 3t ... i nt n Rising short run interest rates gives an upward sloping and 2t 1t 2t 2 falling short run interest give Higher long-run rate and lower downward sloping yield curves short run interest rate is good for investment. e Lecture 13 22 Multiplier Accelerator Theory of Investment 1 Y AK L MPK AK 1 L1 Y Y Y r K where MPK K K or MPK K K represents capital gains. Role of investment tax credit Y K 1 r K where represents the investment tax credit. Lecture 13 23 Essence of the Multiplier-Accelerator Theory of Investment • Change in demand requires change in Capital stock • New Investment meets this requirement • Investment has multiplier effect on income • There is more demand • More demand for capital stock • More investment and more output • This process continues, until the economy reaches turning point • There is a similar downward movement in output, investment and capital stock in the recessionary period. Lecture 13 24 A Simple Illustration of the Multiplier Accelerator Theory of Investment Consumption function: National income identity: Investment Multiplier: Ct c c Yt 0 1 Yt Ct It Y 1 I 1 c 1 Investment is Change in Capital Stock Capital stock is multiple of output: I n,t K td K t 1 0. Yt K t Yt ; I n,t Yt Yt 1 = I n,t Accelerator: I n ,t Yt Y YT Multiplier Acceleration effect on Output: 1 c1 Lecture 13 25 Tobin’s q-theory and Investment Market value of installed capital replacem ent cost of installed capital Tobin’s q is the ratio of market value of Tobin’s q with installation cost: capital stock to its replacement cost and MPK k q P 1 Marginal cost can be stated as: 1 r MPK q Pk 1 r Cost Of Capital And Investment MPK MPK 0 1 Tobin’s q Tobin’s q theory q (I/K) Lecture 13 (I/K) 26 Exercises • Optimal investment with a given production function and user cost of capital • Impact of investment tax credit • Whether to take or not take an investment project with a stream of projected revenues and certain cost • How to deal with uncertainties? Lecture 13 27 Link Between Financial System and the Economy Y= F(K,L) C T S Funds K Profit FA Equity Lecture 13 Treasury Bonds Deposit Banks Pension Funds 28 Three Sources of Financing an Investment Project • Self-financing – Depends on retained earning – Personal savings • Bonds – Banks, Building Societies and Trusts – Various maturities and risks • Stocks – Market signals and equity prices Lecture 13 29 S =100 Savers Households, Corporations and Government Transaction Charges Intermediaries (1-θ)S=0.05*100 = 5 Banks, Insurance Companies, Building Societies, Trusts, Stock and Bonk Markets θS=I =95 Investors Small, Medium and Large Private, Public, Domestic and Foreign Lecture 13 30 T otal equity turnover value as at end September 5,000 4,500UK International 4,383 4,170 4,000 3,588 3,500 2,872 £bn 3,000 2,500 2,482 2,000 1,500 1,000 500 0 1998 1999 2000 Lecture 13 2001 2002 31 Investment Income Distribution and Factor Substitution Yt At Kt Lt 1 rK K L . K Y Y rK wL 1 Y Y 1 K L L wL Y Y K L K L K L K L KL K L 1 w r K L 1 1 AK L AK L wr K L 1 1 AK L AK L Lecture 13 32