WARNING

All rights reserved. No part of the course materials

used in the instruction of this course may be

reproduced in any form or by any

electronic or mechanical means, including the use

of information storage and retrieval systems,

without written approval from the copyright owner.

©2006 Binghamton University

State University of New York

ISE 211

Engineering Economy

Depreciation

Chapter 11

Introduction

While considering the different analysis techniques, we have avoided

income taxes, which are an important element of most economical

analyses.

For capital equipment, depreciation is required to compute income

taxes.

Depreciation is defined as a “decrease in value” – depreciation of assets

is an important component of many after-tax economic analyses, since

depreciation may be deducted from taxable income.

The cost of the asset, less the total depreciation charges made, is know

as the book value – which can also be defined as the remaining

unallocated cost of an asset.

Introduction (cont’d)

Types of Property: the rules for depreciation are linked to the classification

of business property as either tangible or intangible.

Tangible property: can be seen, touched, and felt -- real property (land,

buildings, etc) and personal property (equipment, vehicles, office machinery,

etc).

Intangible property: all property that has value to the owned but cannot

be directly seen or touched (patents, copyright, trademarks, etc)

Many of the properties that wear out, decay, or lose value can be depreciated

as business assets.

Almost all tangible properties (exception: land) can be depreciated.

Depreciation Calculation Fundamentals

Book Value (BV) = Cost – Depreciation charges made to date

General Depreciation

Depreciation Calculation Fundamentals

t

BVt = Cost Basis -

d

i 1

i

Where BVt = Book Value of the depreciated asset at the end of time t

Cost Basis = B = the dollar amount that is being depreciated - - this

includes the asset’s purchase price as well as any other costs necessary to

make the asset ready for use.

t

d

i 1

i

= the sum of depreciation deduction taken from time 0 to time

t, where di is the depreciation deduction in year i.

The above equation shows that year-to-year depreciation charges reduce

an asset’s book value over its life.

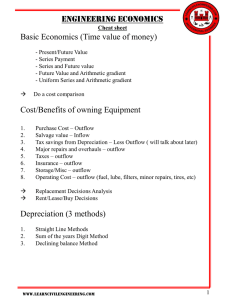

Depreciation Calculation Methods

The six major depreciation methods that will be presented herein are:

1) Straight Line Depreciation (SL)

2) Sum-of-Years Digits Depreciation (SOYD)

3) Declining Balance Depreciation (DB)

4) Composite Declining Balance Depreciation (CDB)

5) Unit of Production Depreciation (UOP)

6) Modified Accelerated Cost Recovery System Depreciation

(MACRS)

Depreciation methods generally result in the same total depreciation

deductions, so it is the timing of the deductions that characterize the

different methods.

Depreciation Calculation Methods (cont’d)

Immediate tax savings are more valuable than tax savings

some years in the future due to the time value of money.

For this reason, a profitable firm prefers to depreciate its

assets as rapidly as possible.

On the other hand, firms which are not profitable would

have a little or no incentive to depreciate their assets rapidly.

1) Straight Line (SL) Depreciation

The most straightforward and best-known of the various depreciation methods is

the straight line approach.

In this method, a constant depreciation charge is made based on the cost of the

asset (B), the salvage value (S), and the useful life in years (N) as follows:

Annual Depreciation Charge = dt = (B-S)/N

where (B-S) represent the total amount to be depreciated.

The depreciation charges (dj) for a specific year j, j=1,2,…, n, may also be

computed based on the book value at the end of the jth year as follows:

The book value at the end of the jth year is:

j

BVj B di B j

i 1

(B S )

N

Example 1

A special type of equipment has a

first cost of $900, a 5 year useful

life, and a $70 salvage value.

Compute the SL depreciation

schedule.

Example 1 Solution (cont’d)

2) Sum-of-Years Digits (SOYD) Depreciation

The Sum-of-Years Digits method results in depreciation charges that

are larger than those of straight line depreciation during the early years

of the useful life of an asset, and necessarily, smaller during the later

years.

The SOYD depreciation charge (dt) for year t is expressed as:

dt

N t 1

(B S )

SOYD

Where : dt = depreciation charge in any year t

N = number of years in depreciable life

SOYD = sum-of-year digits, calculated as: SOYD

B = cost of the asset made ready for use

S = estimated salvage value after depreciable life

N ( N 1)

2

Example 1

A special type of equipment has a

first cost of $900, a 5-year useful

life, and a $70 salvage value.

Compute the SOYD depreciation

schedule.

Example 1 Solution (cont’d)

3) Declining Balance (DB) Depreciation

DB depreciation charge is computed by applying a constant depreciation

rate to the property’s declining book value.

The DB depreciation charge for year t can be found as follows:

dt

r

BV t 1

N

Since the book value equals the cost minus depreciation charge to date, the

above equation can be rewritten as follows:

t 1

r

r

rB

r

dt BVt 1 ( B di )

(1 )t 1

N

N

N

N

i 1

The two rates specified in the Tax Reform Act of 1986 are 150% and 200%

of the SL rate.

Hence r = 2 or 1.5

3) Declining Balance (DB) Depreciation

Therefore, the Double Declining Balance (DDB) is obtained, when r = 2, as

follows:

DDB d t

2B

2

(1 ) t 1

N

N

The Book Value, BVt, can be found by using the following general form:

BVt B (1

r t

)

N

Example 1: A special type of equipment has a first cost of $900, a 5 year useful

life, and a $70 salvage value.

a)

Determine the DDB BV at the end of the third year.

b) Determine the total DDB depreciation charges at the end of the third year.

c)

Compute the DDB depreciation schedule.

d) Compute the 150% DB depreciation schedule.

Example 1 Solution (cont’d)

4) Composite Declining Balance (CDB) Depreciation

Since a DB depreciation schedule is independent of the estimated salvage

value, any of the three situations illustrated below might occur:

First: in Figure (a), the book value of the asset is seen to decline below the

salvage value.

Since the depreciation charges are not permitted to reduce the book value

below the salvage value, the schedule must be modified in accordance with

the IRS regulations.

4) Composite Declining Balance (CDB) Depreciation

Second: the schedule in Figure (b) presents no problem, since the DB depreciation

schedule results in a book value which (coincidentally) corresponds exactly to the

salvage value at the end of the asset’s useful life.

Lastly: Figure (c ) illustrates the situation where the asset is not fully depreciated by

the end of its useful life. This problem may be resolved in either of two approaches:

1)

If the asset is retained in service beyond its estimated useful life, then DB

depreciation will continue to be charged in subsequent years until either the

current estimated salvage value is reached, or until the asset is disposed of.

2)

The second alternative is to use a composite method. With this approach, a

“switch” to another depreciation method (e.g., SL) is made at some point during

the life of the asset. The point (in time) of the switch is selected such that the

book value of the asset is reduced to its salvage value as quickly as possible.

Example 1

Equipment (a special handling device for food

and beverage manufacture) has a first cost of

$14500, a 5-year useful life, and a $1000

salvage value. Determine the Double

Declining Balance depreciation schedule

with conversion to SL at the most desirable

time.

6) Unit of Production (UOP) Depreciation

In rare situations, the recovery of depreciation on a particular asset is

more closely related to use than to time.

Example: if the natural resources will be exhausted before the

machinery wears out.

In these instances, UOP depreciation may be employed and is defined as:

UOP depreciation in any year =

Pr oduction for year

(B S )

Total lifetim e production

This is not considered an acceptable method for general use in

depreciating industrial equipment.

Example 1

A truck for hauling coal has an estimate net

cost of $55,000 and is expected to give service

for 250,000 miles, resulting in a zero salvage

value. Compute the allowed depreciation

amount for the truck usage of 30,000 miles.

Example 2

A piece of equipment that costs $900 has been purchased for use

in a san and gravel pit. The pit will operate for five years, while a

nearby airport is being reconstructed and paved. Then the pit will

be shut down, and the equipment removed and sold for $70.

Compute the UOP depreciation schedule, if the airport

reconstruction schedule calls for 40,000 cubic meters of sand and

gravel as follows:

Year

1

2

3

4

5

Required sand and gravel (m3)

4,000

8,000

16,000

8,000

4,000

5) Modified Accelerated Cost Recovery System (MACRS)

The MACRS was created as part of the TAX Reform Act of 1986.

It is now the principal means for computing depreciation expenses.

Three major advantages of MACRS depreciation are:

1) The computations are made using “property class lives” that are

less than the “actual useful lives”

2) Salvage values are assumed to be zero

3) Tables of the annual percentage simplify computations

5) Modified Accelerated Cost Recovery System (MACRS)

Steps in MACRS depreciation:

1) Determine the property type and class (within a type) of the asset being

depreciated.

There are two types of property: personal and real (estate) property. All

personal property falls into one of the six classes displayed in Table 10-2

(page 378)

Real estate, on the other hand, is categorized as either residential rental or

nonresidential property.

2) After the property class is determined, determine depreciation charges from the

schedules listed in Tables 10-4* and 10-5*., for personal or real property,

respectively.

Example 4

On July 1st, Nancy Silva (Silvia’s mother) paid

$600,000 for a commercial building and an

additional $150,000 for the land on which it

stands. Four years later, she sold the property for

$850,000. Compute the MACRS depreciation

for each of the five calendar years during which

she had the property.

Spreadsheets and Depreciation

Depreciation Technique

Excel Function

Straight Line

SLN(cost, salvage, life)

Declining Balance

DDB(cost, salvage, life, period, factor)

Sum of Years’ Digits

SYD(cost, salvage, life, period)

MACRS

VDB(cost, salvage, life, start-period, endperiod, factor, no-switch)

Spreadsheets and Depreciation (Use of VDB)

1- Salvage = 0, since MACRS assumes no salvage value.

2- Life = recovery period of 3, 5, 7, 10, 15, or 20 years.

3- 1st period runs from 0 to 0.5, 2nd period from 0.5 to 1.5, tth period from t-0.5 to

t-0.5, and last period from life-0.5 to life.

4- factor = 2 for recover periods of 3, 5, 7, or 10 years and =1.5 for recovery

periods of 15 or 20 years.

5- Since MACRS includes a switch to straight line, no-switch can be omitted.

Example I

Consider a 7-year MACRS property asset,

which has $150,000 of office equipment. Use

VDB to compute the depreciation amounts.

Homework # 11 (Chapter # 11)

1

4(a,b)

5(c,d)

8

9

12

17

23

25

27

29

30

31

32

34

Use Spreadsheet Software: