Fair Labor Standards Act

advertisement

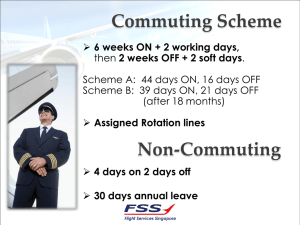

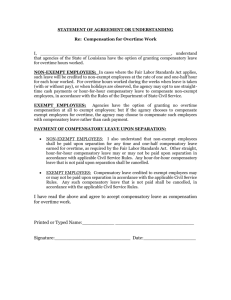

FLSA Fair Labor Standards Act 29 U.S.C., Sec. 201 et seq. Presented by Ramon Vigil Cuddy & McCarthy Law Firm NMASBO Fall Conference September 12, 2012 1 Table of Contents The Law Compliance Record keeping Prevention: 2 Fair Labor Standards Act Enacted in 1938 Minimum Wage/ Overtime/ Child Labor US Dept of Labor Purpose: To prevent abuse of employees by employers 3 OVERTIME More than 40 hours in a work week (7 consecutive 24-hour periods) 1 ½ times hourly rate May give compensatory time off Hours worked – all time employee on duty 4 Work Week & Daily Hours Employer may set Work Week Daily Work Schedule To Avoid Overtime 5 The Law: Exempt Employees Executives Administrators Professionals Non-Exempt Employees Custodial workers Bus drivers Cafeteria workers Secretaries Instructional assistants PAYMENT BY SALARY DOES NOT DETERMINE EXEMPT OR NON-EXEMPT STATUS 6 Test for Exemption Two-Part Test Salary > $455 p/week / $23,660 p/year Duties 7 Exempt Employees Executive Employees Administrative Employees Learned Professional Employees Creative Professional Employees Computer Employees Teachers 8 Examples of Exempt Employees Dept. Supervisors of support staff employees (Food Service Manager, Transportation Supervisor, Office Manager, Custodian and Maintenance Supervisor) Supt., Asst. Supt., Principals, Asst. Prin., Directors, Coordinators Teachers 9 Non-Exempt Employees Secretaries Instructional Assistants Custodial Workers Bus Drivers Maintenance Workers Cafeteria Workers 10 Compensatory Time 29 C.F.R., Sec. 553 1 ½ hours comp time for each hour of OT worker Memorialize agreement before the work is performed Up to 160 OT hours, i.e., 240 comp time hours Reasonable opportunity to take comp time 11 RECORDKEEPING Without GOOD records, you will not be able to pull enough rabbits out of the hat. 12 Record Keeping Employer responsible for record keeping Employee required to follow Employer’s record keeping procedures Time cards / Time sheets District Overtime Policy followed 13 Without GOOD records . . . Employee won’t be paid accurate amount! 14 Good records for ALL employees: Exempt employees: Non-exempt employees: Name All of the data for exempt employees, plus Home address Regular hourly rate for any Date of birth (if under 19) workweek when OT is worked Gender Basis on which wages are Occupation paid Time of day and day of week Amount and nature of that workweek begins compensation that is excluded Basis on which wages are from regular rate paid Hours worked each workday 15 Accurate Employee Files Employees must update information in employees whenever circumstances change (address, phone number, marital status, dependents, etc.) 16 COMPLICATING FACTORS Dual jobs Occasional or sporadic work Volunteers 17 DUAL JOBS Bus driver – instructional assistant Coach – instructional assistant Bus driver – custodian Instructional assistant – gate keeper And the list goes on . . . 18 Occasional or Sporadic Work Must not be performance of work similar to work regularly performed Cannot be a condition of employment Regular part-time jobs do not qualify Examples: Cafeteria worker stays late to assist with an evening banquet Secretary takes up tickets at a ballgame 19 Occasional or Sporadic Work If it becomes routine it is no longer occasional or sporadic work. Employer should find a way to pay OT or rotate the assignment For example: Taking tickets for the basketball season as opposed to taking tickets for the one championship game hosted by your District 20 Volunteers Must be different work from work regularly performed (Parent Volunteer Exception) May not be coerced or condition of employment (Free-Will; Charitable) No expectation of compensation Should qualify under and comply with District’s Volunteer Policy 21 Break Periods Meal periods involving no duties and lasting 30 minutes or more Rest periods of 20 minutes or more 22 Out of Town Travel Non-working hours are generally not compensable Must not require performance of duties or other work If required to be available, employee must be paid! If there is no where to go, and all they can do is sit there, employee must be paid! 23 Permitting/suffering Employer must make employee leave or pay them! 24 Permitting/suffering If the employer “suffers or permits” an employee to work overtime, even after telling employee they cannot, then the employer is responsible for payment. It doesn’t matter if the work is performed at home or at school. Mere promulgation of the rule is not sufficient to avoid overtime liability. 25 Recordkeeping This is everyone’s proof for accurate pay Bad example Good example The best record is a time clock! 26 Report Pay Errors Immediately Review Pay Check for Errors in Pay Report Error to Immediate Supervisor Submit Information About Error in Writing for Correction ASAP DON’T WAIT !!!!! The Sooner Errors are Caught, the Sooner they Can Be FIXED. 27 Strategies For Employer to minimize overtime pay: Employer May Adjust schedules Minimize dual employment Use exempt employees as much as possible Make certain “extra duties” do not lead to overtime Develop, implement and enforce overtime time policies 28 PREVENTION Properly classify employees as exempt and nonexempt The employer and the employee may not agree to waive the employee’s rights to overtime Staff must realize that compliance is not optional and that failure to comply places the District at risk Perform a FLSA audit 29 Computing Overtime OT = 1 ½ Times Hourly Rate over 40 hrs $8.00 p/hr 7 hr/day 35 hr work week Works 3 extra hours during week $8 x 38 = $304 Works 8 extra hours during week ($8 x 40=$320) + ($12 x 3=$36)=$356 30 Computing Comp Time OT=1 ½ hrs for each hr worked over 40 hr $8.00 p/hr 7 hr day 35 hr week Works 5 hrs extra during week (40 hrs) 5 hrs of comp time Works 10 hours extra during week (45 hrs) (5 hrs) + (5 x 1 ½ = 7½) = 12 ½ hr comp time 31 Computing Blended OT Rate Job 1 = $10 p/hr & Job 2 = $ 6 /hr Job 1 worked 40 hrs in work week Job 2 worked 20 hours in work week OT rate = 1 ½ (($10 x 40) + ($6 x 20))/60 1 ½ ($400 + $120)/60 1 ½ ($520)/60 1 ½ ($8.67) = $13.01 32 QUESTIONS & ANSWERS Q&A 33 For additional information or assistance, contact: Ramon Vigil, Jr. The Cuddy & McCarthy Law Firm rvigil@cuddymccarthy.com www.dol.gov 34