Webinar Materials - California Employer Advisor

Advanced Exemption Audits: Evaluate

Your Overtime Classifications Now To

Avoid Costly Trouble Later

Friday, November 19, 2010

Presented by the Employer Resource Institute

© 2010 Employer Resource Institute. All rights reserved. These materials may not be reproduced in part or in whole by any process without written permission.

Disclaimers

• This webinar is designed to provide accurate and authoritative information about the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional services.

• This webinar provides general information only and does not constitute legal advice. No attorney-client relationship has been created. If legal advice or other expert assistance is required, the services of a competent professional should be sought. We recommend that you consult with qualified local counsel familiar with your specific situation before taking any action.

© 2010 Employer Resource Institute. All Rights Reserved

About Today’s Presentation

• This entire webinar is being recorded and all of the accompanying materials are protected by copyright.

• If at any time during today’s event you experience technical issues, please call

(877) 297-2901

to reach an operator.

• Questions or comments about this webinar?

Employer Resource Institute

(800) 695-7178 custserv@employeradvice.com

© 2010 Employer Resource Institute. All Rights Reserved

Recertification Credit

This program, ORG-PROGRAM-

77159

, has been approved for 1.5 recertification credit hours toward PHR® and SPHR® recertification through the Human Resource Certification Institute (HRCI).

Please be sure to note the program ID number on your recertification application form.

For more information about certification or recertification, please visit the HRCI home page at www.hrci.org.

The use of the above seal is not an endorsement by HRCI of the quality of the program.

It means that this program has met HRCI’s criteria to be pre-approved for recertification.

© 2010 Employer Resource Institute. All Rights Reserved

About Our Speaker

Mary Topliff, Esq., founded the Law Offices of Mary L. Topliff in

San Francisco in 1997, after practicing civil and employment litigation for nine years.

The firm specializes in employment law counseling, training and compliance, focusing on practical solutions to avoid costly legal issues. She has advised many organizations regarding a wide variety of fitness for duty and disability accommodation issues, provided training to managers and human resources professionals and has crafted customized policies and procedures to comply with legal requirements.

She is a published author and frequent speaker on legal issues impacting the workplace.

© 2010 Employer Resource Institute. All Rights Reserved

Advanced Overtime Exemption Audit

Strategies

ERI Webinar, 11/19/10

Mary L. Topliff, Esq.

7

Agenda

• Overview of Key Legal Requirements

• Risks of Misclassification

• Meal/Rest Period Issues

• Audit Process --Analysis of Selected Jobs

• Strategies for Communication & Implementation

• What you can do now!

8

Overview of Key Legal Requirements

• Overtime Exemption Laws

• Federal Fair Labor Standards Act (FLSA)

• Law favors payment by the hour

• Presumption that employees are nonexempt

• Burden on employer to prove overtime exempt

• Employees cannot “agree” to be overtime exempt

• California Law

• Labor Code and Wage Orders

• Apply CA law to employees working in CA

• Open legal issue regarding employees working occasionally in

CA

9

Overview of Key Legal Requirements

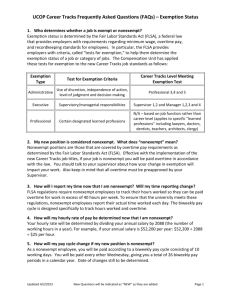

• Overtime Exemption Classifications

• Administrative

• Executive (Manager)

• Professional (Licensed/Learned/Computer/Creative)

• Outside Sales

• Two Components

• Paid on Salary Basis

• Exceptions: Computer professional, outside sales

• Employee’s Regular Duties Qualify for Specific Exemption

10

Overview of Key Legal Requirements

• Salary alone is not determinative

• Salary subject to rules

• Fixed base weekly salary not subject to reduction due to quantity/quality of work

• Deductions from weekly salary in full-day increments

• Okay for employee-requested absences

• Not okay for employer-required absences

• Deductions from weekly salary in partial day increments

• Never okay

• Deductions from Vacation/Sick/PTO banks

• Not the same as deductions from salary

11

Overview of Key Legal Requirements

• California salary requirement: No less than two times State minimum wage based on 2,080 hours worked in year (i.e., full-time employment)

• Currently: $33,280/year

• Salary not prorated for part-time employees

• Tips on inadvertent deductions

• Have policy for employees to raise issues

• Address and fix quickly (specific employee issue + look at broader implications/changes)

• Employee acknowledgment that issue resolved

12

Overview of Key Legal Requirements

• “Duties” Test & 50% Rule

• More than 50% of employee’s actual work involves exempt duties during work week + employer’s realistic expectations and realistic requirements of job

• FLSA focuses on primary duties vs. quantitative analysis

• “Discretion and independent judgment” (DIJ) required for California

Administrative, Professional, Executive Exemptions

• Most commonly misapplied element

13

Overview of Key Legal Requirements

• “Discretion and Independent Judgment” Definition

• Power to make independent choice based on comparison & evaluation of possible courses of action without immediate direction or supervision on matters of consequence

• Skill or knowledge not equivalent

• Decision making regarding management policies/procedures; can deviate from established policies without approval; can negotiate and bind company on significant matters; carries out major assignments; performs work that substantially affects business operations; provides consultation or expert advice to management

14

Overview of Key Legal Requirements

• California Administrative Exemption Summary

• Work directly relates to management policies or general business operations of employer or customers + assists proprietor or specialized work requiring specialized training or special assignments

• Common Misclassification Issues:

• Jobs involve production (product or service of business) or sales

• Jobs do not involve specialized work

• Jobs involve processing reports/data, but lack analytical work and recommendations

15

Overview of Key Legal Requirements

• California Professional Exemption Summary

• Licensed professional (of 8 specified) or learned or artistic profession in advanced field of science/learning after prolonged course of study

• Subset: Computer Professional requiring highly skilled in theoretical & practical application of systems analysis, programming or software engineering

• Common Misclassification Issues:

• Advances in technology have decreased specialized technical aspects of some jobs (i.e. web/graphics designers)

• Coders, testers with lofty job titles

16

Overview of Key Legal Requirements

• California Executive Exemption Summary

• Supervises at least 2 full-time employees with authority to hire/fire &

>50% of time spent in supervisory functions

• Common Misclassification Issues:

• “Working” managers performing same duties as direct reports

• Having handful of direct reports

17

Risks of Misclassification

• Worst case scenario example:

• Employee has worked in same job for 5 years, regularly works 45 hours per week, & paid $40k/year. Employee is very detail-oriented and keeps a calendar of each day’s work hours. If employee’s job is determined to be nonexempt:

• Statute of Limitations: 3 years under California Labor Code; 4 years under California Unfair Business Practices law

• Legal Exposure: $19.23/hr X .5 = $9.62/hr X 5 hrs/week =

$48.08 X 52 weeks X 4 = $9,999

• Plus attorneys’ fees (your own + the plaintiff’s), expenses, downtime

• Even worse case scenario: More than one employee in same job

18

Meal & Rest Period Considerations

(California-Specific)

• Additional risk of misclassification

• California Labor Code provides penalty of one additional hour’s pay for each work day in which meal or rest period is not provided

• Timesheets not typically required for exempt employees, thus no way to prove meal & rest periods provided/taken

• Statute of limitations held to be 3 years

• Brinkley and Brinker cases on appeal to California Supreme Court

19

Impetus for Overtime Exemption Analysis

Jobs

Making

Headlines

Salaried

Worker

Overtime

Gut Feeling about Jobs

OT

Exemption

Review

Regular

Audit

20

Getting Started

• Consider combining Overtime Exemption Analysis Project with another related project

• Example: Total Compensation Review or update of job descriptions or new HRIS systems

• Benefit: Creates efficiencies by addressing multiple issues and provides more context for job changes

21

Getting Started

Announce Project

Educate Managers

Select Jobs to

Evaluate

22

Selecting Jobs to Evaluate

• Jobs that raise “red flags”

• Entry-level or trainee

• Manager title but no direct reports

• Catch-all titles: Analyst

• Sales jobs with non-sales titles

• Jobs that involve processing data, running reports

23

Selecting Jobs to Evaluate

Good

• Start with lowest paid exempt jobs

Better

• Follow job family to obvious cut-off

Best

• Include all exempt jobs below Director

• Analyze gray area exempt positions

• Include “red flag” jobs regardless of pay or grade

• Include catch-all titles like Analyst, Project

Manager

24

Data Collection Alternatives

Interviews

Observation

Questionnaires

Job Descriptions

Job Titles

25

Common Pitfalls to Avoid during Analysis

By-Passing

Direct Manager

• Imperfect information

• Missed opportunity for buy-in

• Surprises = pushback

Relying on Job

Descriptions

• Doesn’t tell % of time spent on each duty

• Is the person really doing that job?

• Court rulings based on actual job performed, not description

26

Information-Gathering Considerations & Tips

• Who should conduct the analysis?

• Internal HR with in-house or outside counsel review

• External specialist – if attorney, opinion is attorney-client privileged

• Need thorough understanding of employee’s duties

• Insufficient to rely on manager’s insistence of importance of job

• Another data point: performance reviews

• Determine percentage of work time spent on specific duties

27

Information-Gathering Considerations & Tips

• How to determine “discretion and independent judgment”?

• Do not ask: “does the employee exercise discretion and independent judgment?”

• Ask definitional questions with specific examples

• Collect data on hours worked by employees in question

• Travel time?

• Eligible for production bonuses?

28

Analysis of Selected Jobs

• Jobs that have been subject of lawsuits:

• Pharmaceutical sales representatives

• Account executives

• Mortgage loan processors

• Insurance claims adjusters

• Variety of computer professionals

29

Implementation Issues

• Logistics of moving nonexempt employees out of exempt salary structure

• Anomalies may result:

• Employees making more than their boss due to overtime

• Same job at different locations may have different exemption classifications

• Treat differently or make the job nonexempt for all locations?

• Determine extent of “back” overtime

• Factors to consider: Has scope of job changed at particular time? Is job changing now?

30

Implementation Issues

Who will make ultimate decision?

• Sign-off by CEO

• Executive Team

Management

Decision-making

Pitfalls

• Advocating for

“pet positions”

• Not addressing back overtime

• Company decides to take

“calculated” risks

31

Implementation Issues

• Release Agreements

• Cannot condition payment of wages owed on release agreement

• HR “Public Relations” problem

• Need to explain why we didn’t get this right the first time

32

Implementation Issues

• Communicating the Results

• Manager Training

• FAQ’s are helpful

• Announcement to Employees

• Meetings or Memo?

• Assuring employees that change in exemption does not mean demotion or that job is not important

• Department meetings – head of functional area explains

• One-on-one meetings – impacted employee and manager discuss

33

Resources

• Industrial Welfare Commission Wage Orders and DLSE Enforcement Manual

( www.dir.ca.gov

)

• Department of Labor ( www.dol.gov

)

• Employer Resource Institute, “Who’s Entitled to Overtime: How to Avoid

Mistakes When Classifying California Employees” (2009)

( www.employeradvice.com

)

34

Thank You!

Mary L. Topliff

Law Offices of Mary L. Topliff

555 Montgomery Street, Suite 1650

San Francisco, CA 94111

415/398-9597 topliff@joblaw.com

www.joblaw.com

Thank You

• Recordings of this webinar and past presentations can be ordered by calling (800) 695-7178

• Or visit www.employeradvice.com for information.

• We hope you’ll join us again soon.

Please be sure to complete and return your program evaluation. An evaluation will be e-mailed to the registered participant shortly after the conference.

QuickTime™ and a

TIF F ( Uncompressed) decompressor are needed to see this picture.

© 2010 Employer Resource Institute. All rights reserved.

SPECIAL TRIAL OFFER

Regular Price: $199

FREE 30-Day Trial!

CLICK HERE for a test drive!

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

Your Guide to California

Wage & Hour Law!

The California Labor Code vs. the federal Fair Labor Standards Act (FLSA)

Who the California wage/hour laws apply to

The Wage Orders that cover your organization

Hours of work —including travel time, make-up time, meal and rest periods, and the definition of "hours worked"

The rules for hourly, salary, and piece-rate pay

Bonuses, profit-sharing plans, and tips

Overtime and double-time wages

Alternative workweeks

Tools and equipment, uniforms, and work-related expenses and losses

Paid time off —vacation, PTO, holidays, and sick leave

Unpaid time off

When and how employees must be paid

Payment of final wages upon termination

Deductions from pay

Recordkeeping requirements

Pay-related discrimination

And much more!

Limited Time

Offer for

Webinar

Attendees

Call (800) 695-7178