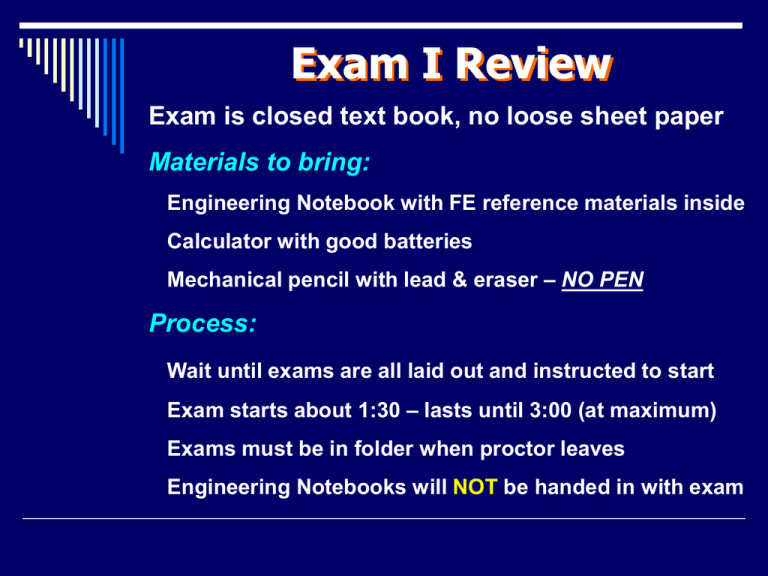

Exam I Review

advertisement

Exam I Review Exam is closed text book, no loose sheet paper Materials to bring: Engineering Notebook with FE reference materials inside Calculator with good batteries Mechanical pencil with lead & eraser – NO PEN Process: Wait until exams are all laid out and instructed to start Exam starts about 1:30 – lasts until 3:00 (at maximum) Exams must be in folder when proctor leaves Engineering Notebooks will NOT be handed in with exam Exam I Coverage Cash Flow Diagrams: Solid arrows are cash flows, dashed are unknown flows Horizontal axis is time, units should be noted for n Arrow direction is important: inflow (up), outflow (down) Time Value of Money: Simple Interest (only if asked … two formulas to know) Compound Interest (for everything else) End of period convention for inter-period payments Table Factors: Write solution equations in table factor form Substitute either table values or closed-form equations Identify solution and units at the end (double lines / box) Exam I Coverage Cash Flow Patterns: Single flow patterns (Present / Future values) Annual flow patterns (equal, periodic values) Gradient flow patterns (Linear / Geometric incr / decrease) Complex Cash Flows: Decompose into P, F, A, G, or g patterns Convert to P or F values to move across time: Combine cash flows only at the same point in time! Convert to other flows from P or F values, if required! Effective Interest Rates: Nominal rate (APR) adjusted for compounding period Must match effective rate to pay period for factors / eqns! Future Given Present P is the present value at Time 0 F is the future value at Time n (n periods in the future) i is the effective interest rate F? 0 1 2 3 P F = P(F/P,i,n) n Present Given Future P is the present value at Time 0 F is the future value at Time n (n periods in the future) i is the effective interest rate for each period F 0 1 2 3 P? P = F(P/F,i,n) n Future Given Annual A is the equal annual value over the time period (time period: Time 0 to Time n, 1st flow at Time 1) F is the future value at Time n (n periods in the future) i is the effective interest rate for each period F? 0 1 2 3 n A F = A(F/A,i,n) Note: cash flow A does not have to be annual, just periodic Annual Given Future A is the equal annual value over the time period (time period: Time 0 to Time n, 1st flow at Time 1) F is the future value at Time n (n periods in the future) i is the effective interest rate for each period F 0 1 2 3 n A? A = F(A/F,i,n) Note: cash flow A does not have to be annual, just periodic Present Given Annual A is an equal annual flow over the time period (time period: Time 0 to Time n, 1st flow at Time 1) P is the present value at Time 0 (n periods in the past) i is the effective interest rate for each period P? 0 1 2 3 n A P = A(P/A,i,n) Note: cash flow A does not have to be annual, just periodic Annual Given Present A is the equivalent annual flow over the time period (time period: Time 0 to Time n, 1st flow at Time 1) P is the present value at Time 0 (n periods in the past) i is the effective interest rate for each period P 0 1 2 3 n A? A = P(A/P,i,n) Note: cash flow A does not have to be annual, just periodic Present Given Gradient (Linear) G is the linear gradient over the time period (time period: Time 0 to Time n, 1st flow at Time 2) P is the present value of the flow at Time 0 (n periods in the past) i is the effective interest rate for each period P? 0 1 2 3 n G = $/yr P = G(P/G,i,n) Note: cash flow is periodic, no flow at Time 1, flow of G at Time 2 Future Given Gradient (Linear) G is the linear gradient over the time period (time period: Time 0 to Time n, 1st flow at Time 2) F is the future value of the flow at Time n (n periods in the future) i is the effective interest rate for each period F? 0 1 2 3 n G = $/yr F = G(F/G,i,n) Note: cash flow is periodic, no flow at Time 1, flow of G at Time 2 Annual Given Gradient (Linear) G is the linear gradient over the time period (time period: Time 0 to Time n, 1st flow at Time 2) A is the annual equivalent of the gradient flow (annual flow starts at Time 1, goes through Time n) i is the effective interest rate for each period A? 0 1 2 3 n G=$/yr A = G(A/G,i,n) Note: cash flow of G starts at Time 2, flow of A starts at Time 1 Present Given Gradient (Geometric) g is the geometric gradient over the time period (time period: Time 0 to Time n, 1st flow at Time 1) P is the present value of the flow at Time 0 (n periods in the past) i is the effective interest rate for each period P? 0 1 A1 2 3 g = %/yr P = A1(P/A,g,i,n) n (1 g ) n 1 ( 1 i ) when i g i g ( P / A, g , i , n ) n when i g (1 i ) Note: cash flow starts with A1 at Time 1, increases by constant g% Table Factors Listed (P/F, i, n) (P/A, i, n) (P/G, i, n) Present given Future Present given Annual Present given Gradient (linear) (F/P, i, n) (F/A, i, n) Future given Present Future given Annual (A/P, i, n) (A/F, i, n) (A/G, i, n) Annual given Present Annual given Future Annual given Gradient Note: There is NO P/g. Present given Geometric Gradient is: (P/A, g, i, n) Complex Cash Flows Complex Cash Flows – Break apart (or separate) complex cash flows into component cash flows in order to use the standard formulas. Remember: You can only combine cash flows if they occur at the same point in time. CRITICAL POINT When using the factors, n and i must always match! Use the effective interest rate formulas to make sure that i matches the period of interest Interest Rate Terms… ● Compounding Period (cp) – the time between points when interest is computed and added to the initial amount. ● Payment Period (pp) – the shortest time between payments. Interest is earned on payment money once per period (cost of money) ● Nominal Rate ( r ) – is a simplified expression of the annual cost of money. It means nothing, unless the compounding period is stated along with it. ● Annual Percentage Rate (APR) – is the nominal interest rate on a yearly basis (credit cards, bank loans, …). It, too, should have a compounding period stated. ● Effective Rate ( i ) – is the rate that is used with the table factors or the closed form equations, and it converts the nominal rate taking into account both the compounding period and the payment period so that the blocks match. Summary of Effective Rates An “APR” or “% per year” statement is a Nominal interest rate – denoted r – unless there is no compounding period stated The Effective Interest rate per period is used with tables & formulas Formulas for Effective Interest Rate: If continuous compounding, use i er ( y ) 1 y is length of pp, expressed in decimal years m If cp < year, and pp = 1 year, use i 1 r 1 a m is # compounding periods per year m If cp < year, and pp = cp, use m is # compounding periods per year i r m m If cp < year, and pp > cp, use me is # cp per payment period r e ie 1 1 m Remember… As the compounding period gets smaller, the effective interest rate will increase. CONTINUOUS COMPOUNDING: i = e( r )(years) – 1 NOTE: In this continuous formula, the r value will be specified as a nominal annual rate (% per year) so you have to use the length of pay period in years, not number of periods, for which you are looking for the effective interest rate. (Note: r and years are expressed as decimals!) IF CP < 1 Year, and PP = CP … EFFECTIVE INTEREST RATE r nominal interest rate i = __ = _________________________________ m # of compounding periods per nominal NOTE: In this formula, the interest rate you want (i ) is for a smaller period than the interest rate that you have (interest rate per compound period). So… (m) is the number of those smaller periods in the larger, nominal period for which you have the nominal interest rate (r). If CP < 1 Year and PP = 1 Year… EFFECTIVE INTEREST RATE ia = ( 1 + interest rate per cp) (# of cp per year) – 1 REMEMBER: In this formula, the interest you want (ia ) is for a larger period than the interest rate that you have (interest rate per compound period). So… the “number of compound periods per year” is the number of those smaller periods in the annual period for which you want to find ia . (And interest rate per cp = r / m !) If CP < 1 Year and PP > CP … EFFECTIVE INTEREST RATE ie = ( 1 + interest rate per cp) (# of cp per pp) – 1 REMEMBER: In this formula, the interest you want (ie ) is also for a larger period than the interest rate that you have (interest rate per compound period). So… the “number of cp per pp” is the number of those smaller compounding periods in the payment period for which you want to find ie . (And interest rate per cp = r / m !) Other Terms to Know… ● Sunk Costs – money that was already spent in the past that has no effect on the financial decision to be made now. ● Equity – financing funds provided by someone with an ownership stake in the project. ● Debt – financing funds provided by someone without an ownership stake in the project. These funds will depend on the owner’s credit worthiness and possibly on collateral assets that may be sold to pay off the remainder owed. ● Loan – Funds provided upfront (at Time 0) to finance a project that will be paid back, with interest, over the life of the project loan (starting one payment period later, and continuing through Time n). ● Lease – Use of an asset over the life of the project lease, provisioned upon periodic payments, with interest, that occur ahead of each period of use. (So the 1st payment begins at Time 0, and continues through Time n – 1) Final Hints … RTDP especially the bold, italic, underlined words Show your work – partial credit helps All point values are shown & the problems are numbered – so they can be done in any order…but do sub-steps (2a, 2b, 2c, …) in order to save time RTDP