Chintain Vaishnav & Sergey Naumov, MIT: Incumbent's Dilemma: Towards Empirical Research

advertisement

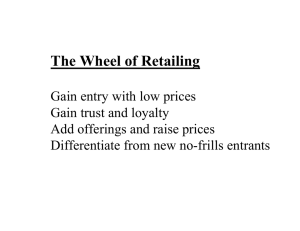

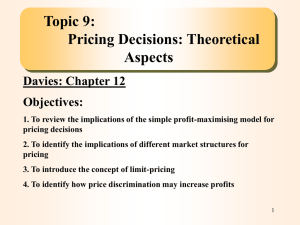

Chintain Vaishnav & Sergey Naumov, MIT: Incumbent's Dilemma: Towards Empirical Research Chintan Vaishnav: “INCUMBENT’S DILEMMA” is a joint work. Good Afternoon. This is last session but it will be very exciting so put away email etc….. ha, ha, ha. Observations: literature has focused on “why large firms fail,” but in the real world there are three distinct outcomes possible: 1. 2. 3. Entrants win. Entrants lose Both entrants and incumbents share the market. We can construct a table to document the intended outcomes (see chart). Horizontally you can understand factors that lead to outcomes. To study this problem we have extensively used and studied a model with both Entrants and Incumbents. Environmental factors lead to decision to buy which leads to decisions on where to focus on structure and focus and this leads back to innovation. What are the structures that become dominant to create the three scenarios? Environmental factors. Consumers value quality ad compatibility over innovation and low price. At product/service level factor are strong network effects. At firm-level incumbents have far superior cost structure. Incumbents use their size to leverage. Disruption: New entrant market share with cost structure driven by the nature of innovation. Attractiveness in price for consumers. At firm-level, superior cost structure (see chart). Incumbent successfully responds with raid innovation Consumers value availability over quality or innovation Product service level: No network effect. Incumbents can affect switching behavior heavily. (See chart) Entrants may innovate to gain market, but struggle to offer quality due to lackj of assets or market power. Altogether we get these theoretical results (see chart). We are beginning case research. To present this research I would like to introduce Sergei. Sergey Naumov: We are trying to build constructions of the model and see results on business cases. What are the limitations? What are real life implementations? The cases we have selected originated in the past. We wanted to have some insight into what actually happened since we now know the outcomes of these cases. We have a challenge to use this model predictively. Desktop operating system Windows XP vs. Linux (see chart): For consumers, the product needs to work out of the box. So the price point is important. We have a new entrant and we have very modular society. For an open source entrant the price to buy is non-existent, but it takes effort to operate. This equals a moderate effect on decision to buy. XP is easily available and is out of box; so it was much better suited. Not much influence on price side because many apps are available. Many applications, so market share of windows computers continues to grow and Linux is almost non-existent. Server Operating System (see chart): The market characteristics are completely different. They need apps, servers and Windows did not have all those features. Prices not much of a factor. Apps are important but many apps are tailored uniquely for large firms. An open source society is attractive and IT people are in favor. Network sensitivity was an important consideration but not as large as the other case. Linux was in a better situation here than in Case 1, but through quality and sensitivity and innovation Windows maintained superiority. Price did not influence. We end up with the case for co-existence in Case 2. The last example is VoIP (see chart). AT&T vs. incumbant (i.e., Skype or Google). People were not sensitive to quality so much. Innovations were important and network sensitivity was very important. They needed people available at all times. Price is not diminished completely, but it is substantially lower. AT&T tried to rely on quality, but that was not what the market required. So they tried innovation, services to backbone. But these were not innovations to the consumer. It seems like it would lead to coexistence. BUT, Skype was able to do accomplish a lot of innovations to bring up quality, thus affecting their influence and THUS increasing their network sensitivity. Skype had increasing market share; so it was basically a case of disruption. (See slide for framework definitions). Slide for Business Cases: Disruption, OLED Displays Linux-Windos server, OS QUESTIONS QUESTION: Do you have suggestions for more cases? Look at why dinosaurs (Motorola and Norte) failed? What makes current companies work well? Where is Cisco, in the middle? What do they need to do? Who failed? Who is succeeding? INTEL? Others? Android vs. iOS Companies like telcos: What is provided in terms of market value that allows them to continue to compete? Innovations are important? Does creativity matter? Basically do you survive because of monopoly? ANSWER: All good questions but very involved. Let’s talk more about it. Open systems would seem to be more attractive as we need more modularity and compatibility—non vertical. QUESTION: You have seen most examples in hindsight. Have you tested models looking at startups, say, taking 10 recent startups, and see if the model predicts accurately? ANSWER: Yes, we can look at recent outcomes and adjust the model. If that is all, we thank you.