How does money affect macroeconomic equilibrium - TMyPF-UNAM

advertisement

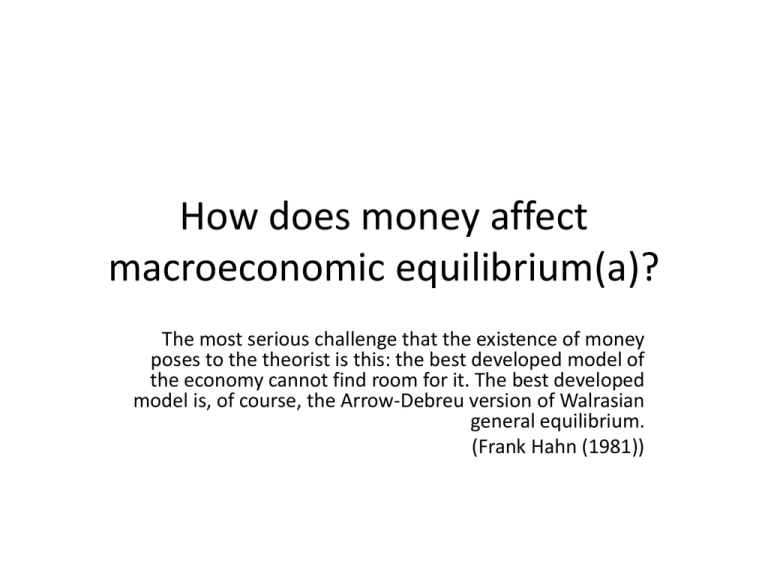

How does money affect macroeconomic equilibrium(a)? The most serious challenge that the existence of money poses to the theorist is this: the best developed model of the economy cannot find room for it. The best developed model is, of course, the Arrow-Debreu version of Walrasian general equilibrium. (Frank Hahn (1981)) How does money affect macroeconomic equilibrium(a)? 1.- Does money largely, or just respond to, developments elsewhere in the economy? Is money “active” (exogenous (to whom?) and determined prior to other variables) or “passive” (endogenous) as in structuralist inflation theory? 2.- Do changes in the money supply mostly affect the volume of activity, or the price level? What are the channels via which money has its impacts on quantities and prices? 3.- Should we concentrate the analysis on changes in “money” (banking system liabilities) or “credit” (banking system assets)? Causal status of money/cred it Endogenous (passive) Exogenous (active) Main effects of money/credit On prices Via Money Via Credit On quantities Via Money Via Credit Hume Thornton Wicksell Schumpeter Malthus Banking School Marx Kaldor Minsky Real Business Cycle School Ricardo Currency School Mill Monetarist “Caps” Keynes “Hats” Law Hats and Caps were the first “structuralist” and “monetarist” position in macro theory (Kindleberger, 1984). They debated in the Sweden Parliament in middle 1700s. The Hats were policy activists, urging credit creation to spur the Baltic Trade. The Caps countered with arguments that excessive spending could lead to inflation, payments deficits, and related ills. Investment could be spurred by low interest rate ensured by usury law or credit creation. The importance of credit was stressed by John Law, who sought to stimulate French growth early in the eighteenth century by setting up development banks. Speculative booms! Mississippi Bubble! Minsky who established that banks actively create credit which can have a strong influence on output via “Keynesian” channels. Instability. Caps, Hats, and Law (1700s) all argued as if money and credit could be controlled by the relevant authorities. Part of the intellectual reaction against mercantilism took the form of making money as well as the trade surplus endogenous in the short run. In Hume’s (1750) model aggregate demand depends on the real money stock (M/P) while output (X) is predetermined. The expansion in the money supply (M^) is given by specie inflow resulting from the trade surplus: B=XD, in this sense money is passive or endogenous. Because money drives the level P via the equation of exchange, money expansion M^ is an inverse function of P and thereby of M itself. An increase in M, produces a increase in prices, so the trade balance worsen and M starts to decrease because, prices go down, exports sell better –the trade deficit declines toward equilibrium. Malthus vs. Ricardo Malthus: A precursor of the “structuralist” Banking School, he thought that the money supply and/or the velocity adjusted endogenously to meet demand, or the “need of trade”. Ricardo: a superb monetary theorist, differed from Malthus in accepting supply-side determination of output, the nineteenth-century version of Say´s Law. He naturally followed the monetarist trail, most notably in 1810 when he attacked “excessive” British note issue to finance the war against Napoleon. His logic was based on the quantity theory and purchasing power parity (PPP) –standard components of all subsequent monetarist model. Ricardo’s main policy recommendation was a Friedmanite rule called the “currency principle,” recommending that the outstanding money stock should be strictly tied to gold reserves. … and its supply should only be allowed to fluctuate in response to movements of gold. The Currency school: Peel´s Charter Act 1844 for the Bank of England: put a limit on the issue of notes against securities. In 1847 there was a run against English banks, the Bank of England acted (correctly) as Walter Bagehot in the 1870s christened a “lender of last resort”. It pumped resources into commercial banks in danger of collapse. “To big to fall” John Stuart Mill codified the doctrine of “loanable found” which underlies much subsequent mainstream thought. Following Henry Thornton Mill thought the interest rate would adjust to erase any difference between aggregate saving and investment. This theory undergirds Say’s Lay by bringing in changes in the interest rate to ensure full employment investment-savings balance. Loanable theory “incorporates” Patinkin´s “dichotomy” in that money can affect only the price (and presumably the wage) level, without any influence on the volume of production. This is the ultimate monetarist position, with echoes in both Irving Fisher’s suggestion that monetary policy should be actively deployed to control prices and Milton Friedman’s argument against active policy. Schumpeter Circular Flow vs. Developing Development only occurs when an entrepreneur makes an innovation and shift production coefficients or the rules of the game. He/she gains a monopoly profit until other people catch on and imitate, and the economy moves to a new circular flow. The key analytical questions about this process refers to both the financial and the real sides of the economy –how does the entrepreneur obtain resources to innovate? An endogenous money supply and redistribution of real income flows are required to support his efforts. Wicksell extended loanable funds theory by proposing that inflation is a “cumulative process” based on the discrepancy between new credit demanded by investors and new deposit supply from desired saving (corresponding to a zero rate of inflation) at a rate of interest fixed by the banks. (!-Inflation Targeting) Suppose that the banks set the interest rate too low. Then the excess of new credits over new deposits leads to money creation; via the equation of exchange at presumed full employment, the consequence is rising prices. Inflation is the outcome of endogenous monetary emission, driven by credit creation. The Banking School. The group is known (Thomas Tooke, John Fullarton, James Wilson, and J. W. Gilbart, among others) for espousing the doctrine of “real bills.” In the early nineteenth century, the banking system devoted most of its efforts to accepting (at a discount) paper issued by merchants in pursuit of trade. The Banking School’s doctrine stated that the banks should discount all solid, nonspeculative commercial paper, that is true or real debts. Adam Smith was an early proponent of the doctrine. The Banking School. “Law of Reflux”: there would be a contraction of the money supply in response to too aggressive attempts to expand it. Financial innovation. Minsky. Kaldor (1982) & Radcliffe Committee: “If… more money comes into existence than the public, (?) at the given or expected level of incomes or expenditures, wishes to hold, the excess will be automatically extinguished-either through debt repayment or its conversion into interest-bearing assets.” Marx. M-C-M’ Exploitation arises as money M is thrown in circulation of commodities C (incorporation labor power and the means of production), which yields a money return M’: surplus value is M’-M. Access to M gives capitalist a leg up in the economy, making their extraction of surplus possible. At a more applied level of abstraction, Marx roughly adhered to Banking School ideas, at times arguing that velocity varies to satisfy the equation of exchange.