OT, Commissions & Hourly Rates: Making Cents of Route Driver Pay

advertisement

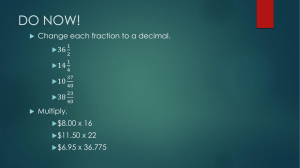

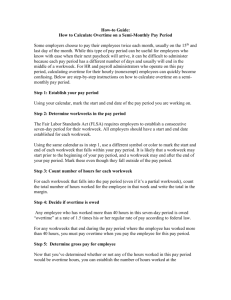

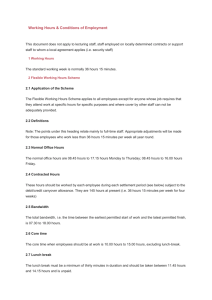

“OT, Commissions & Hourly Rates: Making Cents of Route Driver Pay” Presented by Heather A. Bailey, Esq. SmithAmundsen LLC November 13, 2013 10:30am – Noon NAMA Coffee, Tea & Water Show 2013 Gaylord Opryland Convention Center, Tennessee Ballroom B By the hour? With overtime pay? Commissions only? Salary only? Fluctuating Workweek method? Trucks 10,001+ GVWR; and affecting interstate commerce: ◦ Many of your vending items are shipped from out of state vendors or distributors and do not “come to rest” in warehouse; or ◦ Routes cross state lines S.D. of FLA case – NAMA member fought route driver on MCE & won! M.D. of TN case – NAMA amicus brief in support of industry on MCE Countless DOL audit & employee demand letter fights Alaska California Colorado* DC* Hawaii* Kansas* Maine New Hampshire New Jersey New Mexico* New York Washington You do NOT need to pay your route drivers overtime You may pay them a weekly salary for all hours worked ◦ Be careful of deducting time from salary!! You may pay them based upon a commission only You can still choose to pay OT Agree to pay $X per hour (at least minimum wage) Depending on state, pay time and a ½ for those hours worked over 40 in a week or 8 in a day CANNOT combine weeks to determine or average out Note: some states require double time Agree to pay driver based upon % of commissions Take commissions for the week, ÷ by hours worked to get hourly rate Take ½ that rate x overtime hours For example, a non-exempt driver earned $1,000 in weekly commissions and worked a total of 48 hours in the week. The employee’s hourly rate for that week is $20.83 (1,000 divided by 48). Thus, the operator needs to compensate this employee an additional $83.32 for his overtime hours ($20.83 divided by 2 = $10.415 (the half rate) multiplied by 8 overtime hours). Collect Sales Monthly? One way to compute the driver’s overtime rate would be to take the monthly commissions of $2,000 and multiply that by 12 months in the year ($24,000) and then divide that by 52 weeks in the year to give you the employee’s weekly commissions of $461.54. Thus, if the employee worked 48 hours in one of the weeks that month, his overtime would be calculated as follows: $461.54 divided by 48 hours = $9.62 for a regular rate. Thus, the employee’s additional overtime compensation would be $4.81 multiplied by the 8 overtime hours (the hourly rate $9.62 divided by 2 to get the half time rate = $4.81). Alternative to paying time and a ½ OT Only HALF TIME is paid for OT Much like paying salary but with OT Must give notice and best to have employee agree in writing How do we get away with this? Agree to pay $X per week guaranteed Each week take salary ÷ the number of hours worked to get hourly rate Take ½ the hourly rate x overtime hours If a driver makes a fixed salary of $500 per week and worked 45 hours one week, you divide $500 by 45 hours, which equals $11.11 per hour: the employee’s rate for that week for straight-time. You then divide $11.11 by 2 in order to calculate the half-time for the 5 hours of overtime worked, which equals $5.56. Thus, you would owe the employee an additional $5.56 per hour for the 5 hours of worked overtime because he was already compensated straight-time for those hours with the fixed salary. You can pay drivers with a combination of pay ◦ Salary or hourly plus commission ◦ Commission plus non-discretionary bonuses ◦ Safety awards or like perks Any pay that driver is entitled to receive for his work gets included in these “weekly compensation” for hourly rate determination formulas ◦ Not included: gifts, discretionary/holiday bonuses, and premium payments added to hourly wages Individual Wage Complaint for wages DOL Audit Individual Lawsuit for wages All can turn into Class Actions for all drivers Potential damages: ◦ ◦ ◦ ◦ ◦ ◦ Back pay Interest Penalties Attorney Fees & Costs Criminal consequences Headaches & morale Determine whether MCE applies or not If not, determine which method you want to pay your route drivers OT ◦ If so, determine salary and pay salary each pay period (few exceptions) ◦ Know when you can and cannot deduct for driver not working a full workweek ◦ No matter which method, ensure OT is calculated on a weekly workweek basis and ALL applicable comp is included when determining hourly rate Always ensure driver is paid minimum wage When in doubt, contact L&E counsel ◦ Check payroll system – many have automatic increase Heather A. Bailey, Esq. SmithAmundsen LLC Chicago, IL (312) 894.3266 hbailey@salawus.com FREE BLOG: www.laborandemploy mentlawupdate.com As a NAMA member, you are entitled to 15minutes of free Labor and Employment Advice each quarter! Just call or email me.