Staff Months Presentation

advertisement

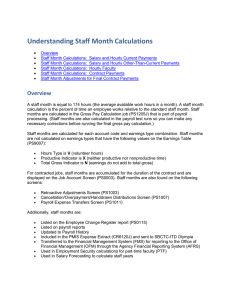

STAFF MONTHS PPMS User Group October 15, 2010 Rita Lauzon Definitions • Staff month: 174 hours (the average available work hours per month) • Staff month calculation: The percent of time an employee works relative to the normal full-time hours available in a month Staff Months Are: • Calculated in Payrolls • Calculated by Account Code and Earn Type • Accumulated for Contracted Jobs Not Calculated on Earnings Where: • Earnings Hours Type is V (Volunteer Hours) • Productive Indicator is X (Neither Productive or Nonproductive Time) • Total Gross Indicator is N (Earnings do not add to Total Gross) Screens Staff Months are on: • Retroactive Adjustment Screen • C/O/H Distributions Screen • Payroll Expense Transfer Screen • Earnings Distribution for a Check • Expense Transfers for an Employee History Uses for Staff Months • Listed on the Employee Change Register • Listed on Payroll Reports • Updated to Payroll History • Included in the PMIS Expense Extract and sent to SBCTC-ITD Olympia Uses for Staff Months (cont.) • Transferred to FMS • Reported to OFM through AFRS • Used in Employment Security Hours Calculations for PTF • Used in Salary Forecasting to Calculate Staff Years Salary and Hourly Current Payments The Pay Rate Code is: • S (Salary Payment) or • H (Hourly Rate) Salary and Hourly Current Payment Calculation Actual Hours ________________________________________ Full Time Pay Period Hours X Standard Pay Period Hours for the Pay Cycle _________________________________________________________ Standard Hours Per Month Examples Salary: 88 / 88 x 87 / 174 = .50 Hourly: 33 / 88 x 87 / 174 = .19 Salary and Hourly Other-Than-Current Payments • Out of Cycle Payments • Retroactive Pay • Additional Pay. Earn type categories of: – A (Additional Pay ) – S (Sick Leave Buyout) – V (Vacation Leave Buyout) Salary and Hourly Other-Than-Current Payment Calculation Actual Hours _____________________ Standard Hours Per Month Example 44 / 174 = .25 Sick Leave Buyout Calculation Actual Hours __________ Standard Hours Per Month Institution X Parameter 401 Example 96 / 174 x .25 = .14 Hourly Faculty • Pay Rate Code is H (Hourly) and • Job Category is: – M (Moonlight Faculty) – P (Part Time Faculty) or – S (Stipend) Hourly Faculty Calculation Actual Hours ______________________ Contract Units or Institution Parameter 1105 Examples Using Contract Units: 21.50 / 112 = .19 Using Institution Parameter 1105: 18 / 60 = .30 Contract Payments Pay Rate Code is C (Contract Payment) Contract Payment Calculation Job Term __________________ Payment Term Transaction Hours X ________________________ Job Hours Example (9 / 19) x (88 / 88) = .47 Job Terms Are Important 1 Quarter = 3.00 2 Quarters = 6.00 3 Quarters = 9.00 4 Quarters = 12.00 Contract Payments Staff Month • Updated to PS0003 • Accumulated • Open field and can be adjusted if necessary • Used in End of Contract Staff Month Adjustments Final Contract Payments Adjustment Job Term X Percent of Full Time 100 Example 3 x (5 / 100) = .15 How Adjustment Is Used • Compared with Cumulative • Difference is adjustment • Charged to the first account • Staff months only assigned up to the result of the above calculation • End of Contract Staff Months Adjustment Report (PS1205B) shows adjustments Cumulative Job Staff Months • Reset to zero if you change the job begin date to a date that is greater than the previous job end date • If you only change the job end date of a job, the cumulative job staff months will continue to cumulate • Will not reset to zero if job dates changed with Mass Data Change Questions?