Slide 1

advertisement

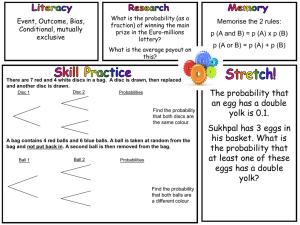

Approximation of heavy models using Radial Basis Functions Graeme Alexander (Deloitte) Jeremy Levesley (Leicester) www.le.ac.uk The problem • Calculate Value at Risk • Need to determine 0.5th percentile of insurer’s net assets in one year • Net assets = f(R1,R2,R3,...Rn) • Many firms have previously calculated the percentiles of univariate distns, and aggregated using correlation matrix / copula approach Moving to Solvency II • For internal model approach, strongly encouraged to calculate the whole distribution of Net Assets, not just the percentile • It is a simple matter to generate 100,000 simulations of (R1,R2,..Rn) • However, evaluating f(r1,r2,..rn) for a single realisation of the risk vector using the “heavy model” can take hours!! • Common approach: Run the heavy models on a small number of points, and interpolate to obtain estimator function fE(r1, r2, ..,rn), known as a “lite model” Splines Linear spline approximation to sin(x) Combination of hat functions Cubic Splines Cubic spline approximation to sin(x) Combination of B-splines Radial basis function approximation t1 < t2 < • A basis function f • Set of points < tn • Approximation n sn (t) = åaif (t - ti ) i=1 More generally sn ( x) x y y y Y Data Y x x y Gaussian ( r ) exp( c r ) 2 2 y How to compute coefficients Interpolation s n ( x ) f ( x ), xY. Linear Equations y1 y1 y 2 y 1 y n y1 y1 y 2 y2 y2 yn y2 y1 y n 1 f ( y1 ) y 2 y n 2 f ( y2 ) y n y n n f ( y n ) An Example - annuity • Difficult to test our interpolation on real-life data due to the length of time it takes to run heavy models • So let’s take a simple product, a single life annuity, £1 payable p.a. • Assume just two risk factors, discount rate and mortality • Assume a constant rate of mortality 1/T in each future year. Thus, the cash flows are: (T-1)/T at the end of year 1, (T-2)/T at end of year 2,1 / T at end of year T-1 T 1 PV 1 t 1 t t (1 disc ) T 1 1 disc 1 1 2 T disc T . disc ( 1 disc ) •Allow T and disc to vary stochastically disc~ N (8%, 2.5%2) T ~ N (20,9) An Example - annuity • We used 10 fitting points. • It turns out that the polynomial function (order 3) performs slightly better than the RBF 99.5th percentile of liability: Actual = 9.27 RBF (Gaussian) estimate = 8.86, error = 4% Polynomial estimate = 9.25, error = 0.19% Annuity – how good was the fit What if there is a discontinuity? Chart shows liabilities against T, for fixed disc=8%: Was fitted using “norm” function. Unlikely to arise in practice, though. However.... Choice of polynomial or RBF • Choice of appropriate polynomial terms is problematic. High degree polynomials are famously unstable (Gibb’s phenomena) • Choice of RBF is related to the “smoothness of the data” – see difference between Gaussian and norm function. This requires some user input, but does not require other experimentation. • RBF is adaptable to the placement of new points near to where error is being observed in approximation. This is not robust with polynomial approximation. With profits • The realistic balance sheet includes a “cost of guarantees” • For example, suppose there is a guaranteed sum assured on the assets, equal to £500. • Crudely, we can model the cost of guarantees as a put option on the asset share. Assume that: Asset Share is £1,000 Strike price (guarantee) is £500 Assets ~ N (1000, 3002), disc~ N (8%, 2.5%2) This time the radial basis function (“norm”) does better: Actual = £83.53 RBF estimate = £74.6, error = 11% Polynomial estimate = £1,735, error = 1978% With profits Polynomial has difficulty coping with the particular behaviour shown Also, the fitting problem is prone to becoming singular RBF (using “norm”) does much better Smoothing splines • If the data is noisy • Minimise l ( ) ( f ( y ) s Y ( y )) l ( s Y ). 2 y Y ( g ) smoothness measure of g • Choice of l is crucial l 0 , least squares l , interpolat ion if enough degrees of freedom Summary • It is worthwhile to explore the use of radial basis functions for approximation. • They are good in high dimensions, and adapt easily to the local shape of the surface. • Polynomials are good where the surface is close to a polynomial in reality • They are also difficult to implement in high dimensions. • There are different RBFs and different approximation processes depending on the nature and reliability of the data.