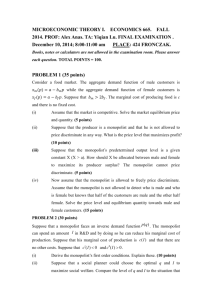

Pricing —multimarket price discrimination

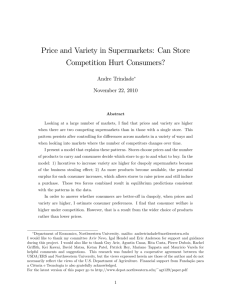

advertisement

Pricing – multimarket price discrimination I Sometimes, di¤erent prices can be charged to di¤erent customers B Based on location – China and North America B Based on observables – discounts for youth and elderly I Actually keeping consumers in separate markets is often di¢ cult – they can "arbitrage" by going to China for DVDs, or the next state over for cigarettes Pricing – multimarket price discrimination practice FinalPracticeP38 A monopolist is selling a good in two markets and has marginal cost MC = 2(Q1 + Q2 ). (Inverse) Demand in the two markets is given by P1 = 100 Q1 P2 = 190 3Q2 If there are di¤erent prices, it is not due to di¤ering costs! I What prices should the monopolist charge in the two markets to maximize pro…ts? Hint: the optimal quantity is sold in each market MC = MR1 and MC = MR2 Pricing – multimarket price discrimination practice A monopolist selling a good in two markets has marginal cost MC = Q1 + Q2 . (Inverse) Demand in the two markets is given by PD1 = 70 Q1 PD2 = 50 Q2 M I What quantities QM 1 and Q2 should the monopolist sell in the two markets? M I What prices PM 1 and P2 should the monopolist set in the two markets? Pricing – multimarket price discrimination practice A monopolist selling a good in two markets has marginal cost MC = 3 (Q1 + Q2 ). (Inverse) Demand in the two markets is given by PD1 = 75 3Q1 PD2 = 65 Q2 M I What quantities QM 1 and Q2 should the monopolist sell in the two markets? M I What prices PM 1 and P2 should the monopolist set in the two markets? Pricing – some cases I The monopolist cannot see which bundle is bought. (For a single good, this means seeing how many units the buyer chooses.) B The monopoly case we studied earlier. B Now: a monopolist serving two markets. I The monopolist sees which bundle is bought, but cannot make a full price menu. B Two-part tarri¤s B Block pricing I The monopolist sees which bundle is bought, and can set di¤erent prices for every bundle. B "Direct price discrimination" – it charges PD (q) for each unit, altogether collecting W B A useful baseline case Pricing – going upmarket or downmarket I Another example Type A B C # 10 10 20 WTP 15 7 5 B What is the optimal price? B What would the optimal price be if there were no type C consumers? I We can think of the monopolist as making a plan for each customer type Pricing – two goods practice Type A B # 100 200 WTP for H 10 6 WTP for L 4 2 Which goods should the monopolist sell, and at what prices PL and PH ? I If selling H to A and L to B, we must make sure that A does not want to switch ...Convince the rich folks not to buy the cheap seats... I What are possible plans? B drop low-value customers B drop low-quality product B sell di¤erent goods to each Pricing – two goods practice Type A B # 100 200 WTP for H 10 4 I We need to consider three options B drop low-value customers B drop low-quality product B sell di¤erent goods to each WTP for L 4 3 Pricing – two goods practice Type A B # 100 600 WTP for H 10 4 WTP for L 4 3 I Which goods should the monopolist sell, and at what prices PL and PH ? Type A B # 100 200 WTP for H 10 3 WTP for L 5 1 Firm behavior for a monopoly (practice later) WB16#1 Setup for the full problem (…nal only) p p p B Tech F (L, K) = LK, MPL = 12 K/L, MPK = 12 L/K B Input prices w = 9, r = 4 B Market (inverse) Demand PD = 66 3Q I Find B B B B B The The The The The monopolist’s monopolist’s monopolist’s monopolist’s monopolist’s total cost function C (Q) optimal quantity QM , given MC = 12 optimal input purchases LM and KM optimal price PM pro…t ΠM = QM PM QM MC