Binomial Tree Option Pricing

advertisement

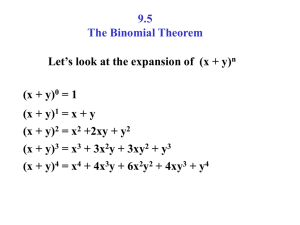

Binomial Tree Option Pricing A Three Step Process: 1) Construct a Stock Price Binomial Tree 2) Value the Option at Time of Expiry 3) Value the Option Through Backward Induction Three Guys, One Method • John Cox, Stephen Ross, and Mark Rubinstein published a paper detailing their method in 1979 • “Option Pricing: A Simplified Approach” • A discrete, numerical alternative to the Black Scholes PDE using relatively simple techniques • No Calculus required! What is a Binomial Tree? • Say we have a stock price at t0, S0. In the Binomial Method, the price can go either up or down. At t1 (after one time interval), the price can either be an “up” price or a “down” price. These prices can each go either up or down over the course of the next time interval. • You can see that the possible prices quickly “branch” out over time, thus the term Binomial “Tree.” • By making the number of time intervals between t0 and time of expiry T very large, we will get many possible stock prices at T and we will have a better approximation of the Brownian Random Walk, which is a time continuous model. The Up and Down Ratios • • • • • • In order to get from S0 to Su, we have to multiply S0 by what’s called the up ratio, labeled u. Similarly, to get from S0 to Sd, we have to multiply S0 by the down ratio, labeled d. These factors are constant throughout the tree. Recombining Feature: If the stock takes an up move followed by a down move, it’ll arrive at the same price had the stock taken a down move followed by an up move. Order does not matter. Consequence: The Stock Price after m up moves and k down moves, regardless of the order they happened, would equal S0umdk u and d depend on two things: volatility of the stock and the length of a time interval. Cox, Ross, and Rubinstein chose the up and down ratios to be these: Because d is the reciprocal of u, u*d = 1. Therefore, if S0 takes an up move followed by a down move or vice versa, the price will return to S0. We will use these formulas for u and d to model a Stock Price Binomial Tree. Transition Probabilities • • • • If the probability of S0 rising to Su is p, then the probability of S0 falling to Sd must be 1-p, since one of those two outcomes must happen in this model. We can say that the expected price at t1 is the probability of the up move happening times the up price plus the probability of the down move happening times the down price. We want the Binomial Method to be risk neutral. A riskless asset should grow by a factor of after delta t, with r as the riskless interest rate. Set the risk neutral expected value of S equal to the binomial expected value of S. • Solving for p yields: • This is the risk-neutral transition probability of an up move. • Remember that u and d only depend on the volatility and the length of the time interval, so this probability only depends on volatility, the length of a time interval, and the riskless interest rate. All of these will remain constant throughout our binomial tree, so this probability will remain constant throughout the tree as well. Step 1: Constructing a Stock Price Tree • Let’s say we want to price a European call option with a strike of $100. The initial stock price is $100, volatility is 30%, time to expiry is one year, and the riskless interest rate is 5%. Let’s build our stock price tree with four time intervals. (where node * is located m up moves and k down moves from S0) T Step 2: Valuing the Option at Time of Expiry • • • While we don’t know the value of the option before time of expiry, we do know the value of the option at the time of expiry: it’s simply the payoff of the option. For our example, the value of the European call at T is ST – K if ST > K and 0 otherwise. We will construct a second binomial tree identical in structure to our Stock Price Tree, which will serve as our Option Value Tree. We can fill in the nodes at t4 = T. How Do I Value the Option at Earlier Nodes? • Let’s build a portfolio that contains delta shares of a stock and a riskless bond that matures to B after one time period. • We want to choose delta and B such that the value of the portfolio is equivalent to the value of an option on that stock, depending on the direction the stock goes. We’re replicating the payout of the option with our portfolio, so we want: • Solving for delta and B, we get: • The portfolio, with these values of delta and B, replicates the value of the option V on stock S. So at t0: Substitute in our values for delta and B : • We finally have a way to find the value of option at earlier nodes. We know S0, the riskless interest rate, the length of the time interval, and the value of the option at later nodes (specifically at T). Further manipulation brings the riskless probability into play: Step 3: Valuing the Option Through Backward Induction • Recall our example of the European call from before. S0 = 100, K = 100, σ = 30%, T = 1 year, n = 4, r = 5% Stock Price Tree Option Value Tree Observe: each sub-piece of the Binomial Tree is its own one-period tree Let’s calculate p, and then we’ll be able to determine “V0.” = e-.05(.25)(.5043*82.21+(1 - .5043)*34.99) = $58.07 Now we can fill in that node on our option value tree. • • We continue the process by filling in the rest of the nodes at t3. Once we’ve done that, the nodes at t3 become the the Vu’s and Vd’s for the “V0’s” at t2. We continue working backwards until we have a value for the option at t0, the actual V0, which is the price of the option and what we’ve been looking for. The rest of the option value tree fills in like this: Compare to Black-Scholes • • • The Binomial Tree Method gave us a price of $13.53 on that European call option. The Black Scholes PDE gave that same option a price of $14.23. Why the discrepancy? Remember, this is a time-discrete approximation to the Black-Scholes method. We only used four time intervals and came within less than a dollar of the Black-Scholes method. Increasing the number of time intervals (and thus making each time interval shorter in length), would increase the method’s accuracy because our model would then be a better approximation of the time continuous model. Pricing an American Option • • • • With the Binomial Method, we can easily adapt a European option to an American option. When using backwards induction to fill in the nodes on the option value tree, compare the value that you get by using the formula from before to the value of early exercise at that respective node. The actual value at that node is the greater of the two. Value of Option at a Node = max (Binomial Value, Exercise Value) Interestingly enough, in our example from before, the exercise value is lower than the binomial value at every node. Therefore, the price of an American option with those same parameters is still $13.53. Here’s an example where the American price will be different than the European price: We want to price an American put option with S0=50, K=52, T=2 years, σ=22.31%, r=5%, and n=2. So Δt= 1 year, u=1.25, d=.8, and p=.5584 Stock Price Tree Value at Node “a” = max ( =$0.84 Value at Node “b” = max ( = $12 Value at Node “c” = V0 = max ( = max(5.49, 2) = $5.49 Option Value Tree , max(K – Sa, 0)) = max(0.84, 0) , max(K – Sb, 0)) = max (9.46, 12) , max(K – Sc, 0)) Modifications to the General Cox-Ross-Rubinstein Method • • Dividends: If a stock pays a dividend as a percent of the stock price at a certain date, that can be reflected in our stock price tree by taking what would be the stock price at that date and multiplying it by the percent of that value not being paid out. We can model our stock price tree to a variety of situations. Flexible Trees: In the Cox-Ross-Rubinstein model, Binomial Trees called “Standard” Trees were used. The biggest difference between Standard Trees and “Flexible” Trees is that the volatility need not be constant in the latter. This allows us to more accurately model our Stock Price Tree because volatility does generally change quite a bit, but it comes at a cost: the values for u, d, and p must be recalculated at every time step. Pros and Cons • • Pros: It uses relatively simple Mathematics. It can be used to price American and Bermudan options. It can be implemented in computer programs. It can be adapted to various kinds of stock features (like dividends) Cons: Being discrete, it does not produce exact answers. By hand, it would take a long time to price an option using a lot of time intervals. At least with the Cox-Ross-Rubinstein Model, it must use a constant volatility, a downside that the Black-Scholes PDE has as well. Sources • Black-Scholes and Beyond: Option Pricing Models by Neil A. Chriss • Introduction to Futures & Options Markets by John C. Hull • The Concepts and Practice of Mathematical Finance by Mark Joshi • Option Pricing: A Simplified Approach • • by John C. Cox, Stephen A. Ross, and Mark Rubinstein Wikipedia page on Binomial Options Pricing Model Special Thanks: Title Slide Picture - Heaven on the Moon by deviantART user GriinFX