Dagens aksjerapport

advertisement

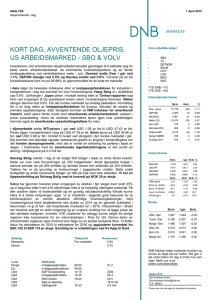

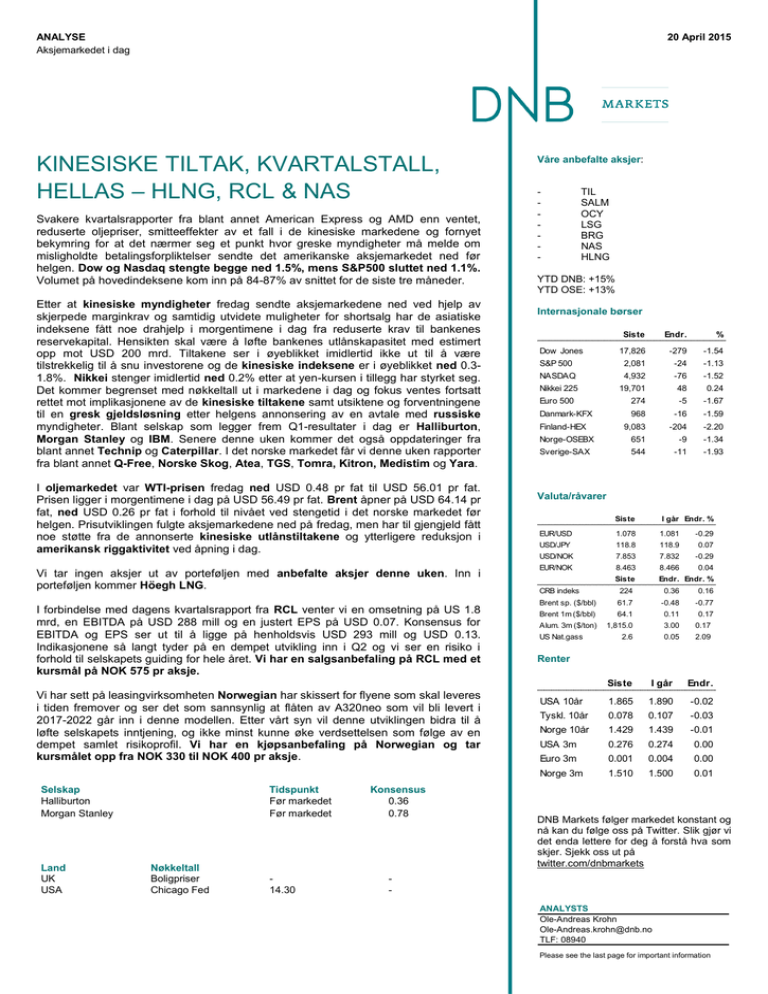

ANALYSE Aksjemarkedet i dag 20 April 2015 KINESISKE TILTAK, KVARTALSTALL, HELLAS – HLNG, RCL & NAS Svakere kvartalsrapporter fra blant annet American Express og AMD enn ventet, reduserte oljepriser, smitteeffekter av et fall i de kinesiske markedene og fornyet bekymring for at det nærmer seg et punkt hvor greske myndigheter må melde om misligholdte betalingsforpliktelser sendte det amerikanske aksjemarkedet ned før helgen. Dow og Nasdaq stengte begge ned 1.5%, mens S&P500 sluttet ned 1.1%. Volumet på hovedindeksene kom inn på 84-87% av snittet for de siste tre måneder. Etter at kinesiske myndigheter fredag sendte aksjemarkedene ned ved hjelp av skjerpede marginkrav og samtidig utvidete muligheter for shortsalg har de asiatiske indeksene fått noe drahjelp i morgentimene i dag fra reduserte krav til bankenes reservekapital. Hensikten skal være å løfte bankenes utlånskapasitet med estimert opp mot USD 200 mrd. Tiltakene ser i øyeblikket imidlertid ikke ut til å være tilstrekkelig til å snu investorene og de kinesiske indeksene er i øyeblikket ned 0.31.8%. Nikkei stenger imidlertid ned 0.2% etter at yen-kursen i tillegg har styrket seg. Det kommer begrenset med nøkkeltall ut i markedene i dag og fokus ventes fortsatt rettet mot implikasjonene av de kinesiske tiltakene samt utsiktene og forventningene til en gresk gjeldsløsning etter helgens annonsering av en avtale med russiske myndigheter. Blant selskap som legger frem Q1-resultater i dag er Halliburton, Morgan Stanley og IBM. Senere denne uken kommer det også oppdateringer fra blant annet Technip og Caterpillar. I det norske markedet får vi denne uken rapporter fra blant annet Q-Free, Norske Skog, Atea, TGS, Tomra, Kitron, Medistim og Yara. I oljemarkedet var WTI-prisen fredag ned USD 0.48 pr fat til USD 56.01 pr fat. Prisen ligger i morgentimene i dag på USD 56.49 pr fat. Brent åpner på USD 64.14 pr fat, ned USD 0.26 pr fat i forhold til nivået ved stengetid i det norske markedet før helgen. Prisutviklingen fulgte aksjemarkedene ned på fredag, men har til gjengjeld fått noe støtte fra de annonserte kinesiske utlånstiltakene og ytterligere reduksjon i amerikansk riggaktivitet ved åpning i dag. Vi tar ingen aksjer ut av porteføljen med anbefalte aksjer denne uken. Inn i porteføljen kommer Höegh LNG. I forbindelse med dagens kvartalsrapport fra RCL venter vi en omsetning på US 1.8 mrd, en EBITDA på USD 288 mill og en justert EPS på USD 0.07. Konsensus for EBITDA og EPS ser ut til å ligge på henholdsvis USD 293 mill og USD 0.13. Indikasjonene så langt tyder på en dempet utvikling inn i Q2 og vi ser en risiko i forhold til selskapets guiding for hele året. Vi har en salgsanbefaling på RCL med et kursmål på NOK 575 pr aksje. Vi har sett på leasingvirksomheten Norwegian har skissert for flyene som skal leveres i tiden fremover og ser det som sannsynlig at flåten av A320neo som vil bli levert i 2017-2022 går inn i denne modellen. Etter vårt syn vil denne utviklingen bidra til å løfte selskapets inntjening, og ikke minst kunne øke verdsettelsen som følge av en dempet samlet risikoprofil. Vi har en kjøpsanbefaling på Norwegian og tar kursmålet opp fra NOK 330 til NOK 400 pr aksje. Selskap Halliburton Morgan Stanley Land UK USA Tidspunkt Før markedet Før markedet Nøkkeltall Boligpriser Chicago Fed 14.30 Konsensus 0.36 0.78 Våre anbefalte aksjer: - TIL SALM OCY LSG BRG NAS HLNG YTD DNB: +15% YTD OSE: +13% Internasjonale børser Siste Endr. % 17,826 -279 -1.54 S&P 500 2,081 -24 -1.13 NASDAQ 4,932 -76 -1.52 Nikkei 225 19,701 48 0.24 274 -5 -1.67 Dow Jones Euro 500 Danmark-KFX 968 -16 -1.59 9,083 -204 -2.20 Norge-OSEBX 651 -9 -1.34 Sverige-SAX 544 -11 -1.93 Finland-HEX Valuta/råvarer Siste I går Endr. % EUR/USD 1.078 1.081 USD/JPY 118.8 118.9 0.07 USD/NOK 7.853 7.832 -0.29 8.463 8.466 0.04 Siste Endr. Endr. % EUR/NOK -0.29 CRB indeks 224 0.36 0.16 Brent sp. ($/bbl) 61.7 -0.48 -0.77 Brent 1m ($/bbl) 64.1 0.11 Alum. 3m ($/ton) 1,815.0 3.00 0.17 2.6 0.05 2.09 US Nat.gass 0.17 Renter Siste I går Endr. USA 10år 1.865 1.890 -0.02 Tyskl. 10år 0.078 0.107 -0.03 Norge 10år 1.429 1.439 -0.01 USA 3m 0.276 0.274 0.00 Euro 3m 0.001 0.004 0.00 Norge 3m 1.510 1.500 0.01 DNB Markets følger markedet konstant og nå kan du følge oss på Twitter. Slik gjør vi det enda lettere for deg å forstå hva som skjer. Sjekk oss ut på twitter.com/dnbmarkets ANALYSTS Ole-Andreas Krohn Ole-Andreas.krohn@dnb.no TLF: 08940 Please see the last page for important information DNB Markets | Sentrale US-INDekser 20 April 2015 SENTRALE US-INDEKSER Endring i poeng -279.47 -23.81 -75.98 -21.04 -4.93 -3.08 -15.09 -2.06 -53.68 -10.00 -2.67 Siste 17,826 2,081 4,932 1,252 776 212 1,423 582 3,730 696 233 Dow Jones Industrial S&P 500 Nasdaq Composite Russel 2000 Amex naturgass-indeks (XNG) Amex Oil Service Indeks Philadelphia-børsens oljeproduksjon-indeks (XOI) Amex farmasi-indeks (DRG) Nasdaq biotech-indeks Philadelphia-børsens halvleder-indeks (SOX) S&P 500 Paper & Forest Index ( PAFO) Endring 1 dag (%) -1.54 -1.13 -1.52 -1.65 -0.63 -1.43 -1.05 -0.35 -1.42 -1.42 -1.13 Endring 1 mnd.(%) -1.66 -1.28 -1.88 -1.15 10.40 12.66 7.06 -0.15 -2.79 -4.76 -2.33 Endring hittil i år(%) 0.02 1.08 4.13 3.91 6.72 0.49 5.55 9.20 17.40 1.34 0.88 Gj.snittlig est. P/E 15.26 18.06 29.32 47.16 18.00 13.95 14.88 25.37 293.89 21.02 0.00 NORDISKE AKSJER I USA Sluttkurs USA Endr.1 dag (USD) (USD) Norge Frontline Royal Caribbean Cruises Questerre (CAD) Statoil Yara Sverige AstraZeneca Finland (EUR) Nokia Danmark Novo Nordisk B Volum USA Sluttkurs USA, hjemlig valuta Sluttkurs Forskjell sluttkurs hjemme USA/hjemlig 2.81 79.03 0.33 19.93 52.84 -0.12 -0.41 -0.03 -0.25 -1.28 2,573,379 2,995,230 36,164 2,160,914 8,052 22.07 620.61 2.09 156.51 414.95 22.20 611.50 2.13 156.30 416.30 -0.13 9.11 -0.04 0.21 -1.35 71.32 -0.71 973,320 617.38 613.00 4.38 7.62 -0.22 89,883,408 7.15 -0.08 54.77 -0.43 964,014 376.90 2.32 7.07 379.22 SAMMENLIGNBARE SELSKAPER (PEERS) BEST -1d% Furniture Brands Internatio #N/A N/A Dell Inc #N/A N/A Overseas Shipholding Grp #N/A N/A Ubs #N/A N/A Exact Holding #N/A N/A Furniture Brands Internatio #N/A N/A Ipsen 1.7 Mitsui Osklines Ltd 1.5 Bp 1.2 Schlumberger Ltd 1.1 Peer SVAKEST EKO KOM FRO DNB Sampo Leonia Oyj Holmen Ab Polycom Industrie Natuzzi Efore Transocean Inc Metro Finnair La Z Boy Chair Co Cap gemini EKO PHO WWI STL PGS -1d% Peer -7.4 -4.6 -4.4 -4.2 -3.8 -3.3 -3.3 -3.1 -2.9 -2.8 STB NSG TAA EKO ELT FOE SCH SASNOK EKO ATEA RÅVARER & SHIPPING CRB indeks GS råvare indeks Oil Brent Spot Brent olje 1m Brent olje 3m WTI olje 1m Flybensin Naturgass US Henry Hub Fyringsolje Metals Aluminium 3m Nikkel Kopper Gull Shipping WS AG - Japan, 250 dwt WS AG - USG, 250 dwt Containerships index Baltic dry index Siste I går 223.9 3,193 223.9 3,193 61.68 64.09 65.56 56.44 604.50 2.64 189.7 61.21 63.45 64.92 55.74 604.50 2.64 188.2 1,815 12,555 6,060 1,203 1,815 12,555 6,060 1,204 63 33 0 597 0 33 0 597 Endr. -1.8 -21.9 0.47 0.64 0.64 0.70 10.00 0.06 1.4 -5 -290 0 -1 0 0 0.0 4.0 %1D 1W 1M 3M YTD 12M 52W H 52W L 0.79 -0.7% 7 133 9.8 214 5.0 267 -6.0 -40 -87.5 -1,883 313.3 5,214 206.8 2,856 0.77 1.01 0.99 1.26 1.68 2.17 0.8 5 6 6 5 39 0 11 8.49 8.77 8.25 10.72 64.50 -0.15 16 16.21 16.10 15.20 10.05 82.25 -0.46 27.0 5.92 6.76 6.37 3.17 31.50 -0.36 5.0 - -48.03 -45.44 -43.10 -47.86 -372.50 -1.93 111.2 115.71 114.44 107.73 45.19 47.68 42.03 0.3 2.3 0.1 50 70 21 4 29 -1,170 275 21 -30 -2,225 345 -92 -38 -2,595 -240 18 3 13 5 0 6 -5 -5 0 -156 5 0 0 -185 0 0 0.0% 0.67 17 307.1 158.9 -50 -5,370 -589 -91 2,120 21,625 7,212 1,345 1,745 12,205 5,340 1,131 25 5 0 -333 0 1,484 0 509 2 DNB Markets | US-INTRADAG REBASERT 20 April 2015 US-INTRADAG REBASERT 104 103 102 101 100 99 98 97 96 95 OSX (O ljeservice ) XOI (Oljep roduksjon) Olje pris (WTI) S&P 500 Olje / Indekser Endring USA close/close Endring US-open/Oslo-close Endring Oslo-close/US-close Endring US-close/this morning WTI Oljeservice Oljeproduksjon -1.43 % -1.05 % 0.73 % -1.12 % -1.36 % -1.44 % -0.52 % 0.10 % 1.26 % . Kilde: Bloomberg/DNB Markets 3 DNB Markets | S&P 500-indekser på bransjenivå 20 April 2015 S&P 500-INDEKSER PÅ BRANSJENIVÅ Fritidsutstyr Bildeler 1 dag 3.0% 0.0% 1 m nd. 9.8% 2.0% 3 m nd. 8.0% 15.4% 1 år hittil i år -12.4% -1.1% 9.4% 7.5% Farmasi Kraft Helseartikler Luftfart Energi og relatert utstyr Matvarer Drikkevarer Datamaskiner og tilbehør Metall Hotell og restaurant Kjemikalier Diversifiserte telekomtjenester Olje og gass Industrielle konglomerater Elektrisk utstyr Bygg og anlegg Elektronisk utstyr og instrumenter Husholdningsartikler Papir- og skogprodukter Programvare Bank Forsikring Maskiner Media Kommunikasjonsutstyr Legemiddelindustri og bioteknologi Internett programvare og -tjenester Bioteknologi -0.2% -0.4% -0.5% -0.5% -0.5% -0.7% -0.8% -0.8% -0.8% -0.8% -0.8% -0.8% -0.9% -0.9% -1.0% -1.0% -1.1% -1.1% -1.1% -1.5% -1.5% -1.5% -1.7% -1.9% -1.9% -1.9% -2.0% -2.1% -1.3% -1.9% -0.9% -9.7% 11.4% 7.1% 0.0% -1.4% 4.7% -2.0% 0.6% -1.9% 5.2% 3.1% 0.5% 4.5% -4.3% -2.1% -2.3% -2.9% -1.7% -1.5% -0.7% -2.7% -2.7% -0.3% -4.6% -6.2% 2.4% -10.6% 4.2% -6.7% 12.2% 3.6% -2.4% 8.8% -0.1% 6.6% 3.4% -1.4% 5.8% 9.0% 2.4% 12.9% 5.3% -7.4% -0.3% -4.3% 7.4% 4.0% 0.6% 5.7% -3.0% 11.8% 4.2% 1.4% 18.9% 4.3% 25.2% 45.4% -18.9% 13.4% 10.7% 47.3% -19.6% 10.2% 6.6% -2.5% -10.4% 7.8% -9.3% -23.3% 12.0% 1.8% 20.6% 9.3% 7.0% 8.7% -5.5% 15.8% 0.1% 39.9% 8.9% 46.9% 5.1% -7.6% 4.2% -8.1% 5.5% 4.9% 1.0% 5.8% -6.4% 4.5% 2.6% 0.3% 1.2% 4.3% -1.8% 1.6% 4.0% -7.1% 0.9% -5.4% -3.5% -1.8% -3.6% 1.2% -4.1% 22.8% 0.5% 7.1% est. P/E 20.0 14.4 18.2 16.0 19.3 7.2 23.8 20.3 21.3 13.7 19.8 23.1 18.1 13.6 34.8 17.3 15.9 13.5 16.9 21.1 14.0 18.4 11.6 11.3 16.7 18.3 13.5 19.5 23.6 18.3 MSCI EUROPA PÅ BRANSJENIVÅ Endring Endring Endring Endring Endring Gj.snittlig 1 dag 1 m nd. 3 m nd. 1 år hittil i år est. P/E Energi -0.8% 6.4% 16.5% 0.4% 16.8% 18.95 Hotell-, underholdnings- og restaurantvirksomhet -0.9% -1.5% 12.3% 43.1% 16.9% 21.35 Forsyningsselskaper -1.1% 0.5% 6.2% 10.5% 6.0% 15.53 Drikkevarer, mat og tobakk -1.2% 1.8% 12.4% 31.5% 19.5% 21.19 Eiendomsselskaper -1.4% -2.1% 8.8% 35.1% 19.4% 23.80 Media -1.5% -0.4% 16.0% 41.7% 22.6% 20.95 Telekommunikasjon og tjenester -1.5% -0.4% 8.6% 26.0% 14.4% 20.45 Husholdningsvarer og personlige produkter -1.5% 0.2% 16.0% 36.9% 23.2% 24.16 Kommersielle tjenester og leveranser -1.6% 0.2% 12.8% 18.9% 18.3% 18.36 Forbruksvarer og klær -1.7% -0.6% 17.2% 20.2% 17.5% 19.75 Biler og komponenter -1.7% -3.4% 19.8% 23.3% 28.4% 11.66 Programvare og tjenester -1.7% 0.0% 18.9% 22.0% 16.0% 19.04 Transport -1.8% 0.5% 12.0% 20.4% 17.5% 16.08 Detaljhandel -1.9% -0.4% 11.2% 25.4% 15.1% 21.73 Teknologisk utstyr -1.9% -1.7% 12.6% 30.8% 16.0% 20.31 Finansieringsselskaper -2.1% 1.7% 25.0% 24.2% 24.1% 13.91 Materialer -2.1% -1.8% 13.7% 11.4% 15.9% 17.65 Mat- og apotekhandel -2.2% -0.4% 14.9% 8.9% 26.6% 18.37 Kapitalvarer -2.2% -1.3% 13.7% 14.2% 18.0% 17.84 Forsikring -2.2% -2.6% 12.5% 31.5% 18.7% 12.14 Banker -2.4% -0.6% 12.7% 8.4% 11.7% 11.96 Helsevern - utstyr og tjenester -2.5% 0.3% 10.0% 43.1% 16.2% 23.79 4 DNB Markets | Indekser 20 April 2015 INDEKSER DOW 30 Kurs Endring Endring Endring siste 1 dag 1 m nd 1 år GENERAL ELECTRIC CO 27.25 -0.1% 7.3% 2.6% JOHNSON & JOHNSON 99.58 -0.2% -2.8% 0.6% PFIZER INC 35.04 -0.4% 2.3% 15.8% COCA-COLA CO/THE 40.30 -0.7% -0.9% -1.0% VERIZON COMMUNICATIONS INC 48.90 -0.8% -1.3% 2.7% MCDONALD'S CORP 94.88 -0.8% -2.2% -5.4% EXXON MOBIL CORP 86.93 -0.9% 2.8% -13.4% CHEVRON CORP 109.11 -1.0% 1.9% -11.8% DU PONT (E.I.) DE NEMOURS 71.55 -1.0% -3.8% 6.8% HOME DEPOT INC 112.10 -1.1% -4.6% 45.4% APPLE INC 124.75 -1.1% -0.9% 66.4% PROCTER & GAMBLE CO/THE 82.53 -1.2% -2.6% 0.9% INTEL CORP 32.47 -1.2% 3.7% 20.1% CATERPILLAR INC 83.28 -1.3% 2.6% -19.0% MICROSOFT CORP 41.62 -1.3% -3.0% 4.0% WALT DISNEY CO/THE 106.69 -1.3% -1.6% 33.4% NIKE INC -CL B 98.55 -1.4% -3.4% 33.1% GOLDMAN SACHS GROUP INC 197.35 -1.4% 2.2% 25.3% INTL BUSINESS MACHINES CORP 160.67 -1.5% -1.4% -15.4% JPMORGAN CHASE & CO 62.84 -1.5% 1.8% 13.8% BOEING CO/THE 149.60 -1.6% -3.2% 16.9% MERCK & CO. INC. 56.88 -1.7% -2.9% 0.7% WAL-MART STORES INC 77.88 -1.7% -6.4% 0.3% VISA INC-CLASS A SHARES 64.52 -1.7% -4.3% 24.1% UNITED TECHNOLOGIES CORP 115.11 -2.0% -3.6% -2.9% UNITEDHEALTH GROUP INC 118.71 -2.4% -0.4% 56.7% CISCO SYSTEMS INC 27.92 -2.4% -1.8% 20.3% 3M CO 161.71 -2.5% -2.9% 17.4% TRAVELERS COS INC/THE 105.40 -3.0% -3.9% 21.6% AMERICAN EXPRESS CO 77.32 -4.4% -6.5% -10.3% S&P 500 - 30 fra toppen S&P 500 - 30 fra bunnen S&P 500 - 30 fra toppen S&P 500 - 30 fra bunnen Kurs Endring Endring Endring siste 1 dag 1 uke 1 år MATTEL INC 26.75 5.8 % 11.4 % -28.6 % MYLAN NV 69.82 4.5 % 10.7 % 48.8 % SOUTHWESTERN ENERGY CO 27.16 2.9 % 20.2 % -44.5 % CSX CORP 33.30 2.7 % -5.3 % 18.3 % SEAGATE TECHNOLOGY 57.43 2.6 % 1.6 % 3.3 % BRISTOL-MYERS SQUIBB CO 65.35 2.6 % -3.6 % 32.1 % HUDSON CITY BANCORP INC 9.50 2.2 % -8.8 % -4.0 % EMC CORP/MA 26.61 2.1 % -0.3 % 0.0 % HOST HOTELS & RESORTS INC 20.60 1.8 % -5.2 % -1.6 % NETFLIX INC 571.55 1.7 % 33.4 % 65.3 % WESTERN DIGITAL CORP 99.44 1.6 % -1.0 % 9.2 % ALTERA CORP 44.02 1.5 % 19.1 % 27.7 % BOSTON SCIENTIFIC CORP 18.40 1.3 % 3.1 % 34.8 % SCHLUMBERGER LTD 92.86 1.1 % 12.7 % -7.1 % TENET HEALTHCARE CORP 51.38 1.0 % 3.5 % 29.4 % P G & E CORP 52.36 0.8 % -3.0 % 16.7 % EASTMAN CHEMICAL CO 75.86 0.7 % 9.2 % -14.4 % GOODYEAR TIRE & RUBBER CO 27.23 0.6 % 6.1 % 0.9 % REYNOLDS AMERICAN INC 74.70 0.6 % 6.9 % 36.1 % TRACTOR SUPPLY COMPANY 87.00 0.6 % -2.2 % 29.4 % JOHNSON CONTROLS INC 50.54 0.6 % 0.3 % 7.9 % KINDER MORGAN INC 43.90 0.5 % 4.2 % 30.0 % MOHAWK INDUSTRIES INC 177.10 0.4 % -2.2 % 31.4 % NORFOLK SOUTHERN CORP 100.65 0.4 % -8.9 % 4.5 % GENWORTH FINANCIAL INC-CL A 8.02 0.4 % 8.7 % -52.5 % HCP INC 43.22 0.4 % 1.8 % 6.6 % PHILIP MORRIS INTERNATIONAL 85.26 0.4 % 7.3 % 2.5 % CHIPOTLE MEXICAN GRILL INC 683.95 0.4 % -0.4 % 31.6 % STRYKER CORP 92.50 0.3% -1.2% 17.4% Kurs Endring Endring Endring siste 1 dag 1 uke 1 år TIME WARNER CABLE 149.61 -5.4 % -5.2 % 10.6 % AMERICAN EXPRESS CO 77.32 -4.4 % -6.5 % -10.3 % TRANSOCEAN LTD 17.98 -3.3 % 19.9 % -55.7 % NOBLE CORP PLC 16.94 -3.1 % 23.5 % -36.1 % LENNAR CORP-A 48.58 -3.1 % -3.3 % 27.1 % GAMESTOP CORP-CLASS A 39.66 -3.1 % -3.1 % -4.4 % SALESFORCE.COM INC 65.81 -3.1 % -2.8 % 17.3 % TRAVELERS COS INC/THE 105.40 -3.0 % -3.9 % 21.6 % VERTEX PHARMACEUTICALS INC125.07 -3.0 % -4.5 % 94.9 % DEAN FOODS CO 17.24 -3.0 % 6.7 % 11.1 % ROSS STORES INC 100.40 -3.0 % -6.6 % 45.5 % YAHOO! INC 44.45 -2.9 % -1.3 % 22.2 % WALGREENS BOOTS ALLIANCE INC 86.96 -2.9 % -1.4 % 30.3 % HELMERICH & PAYNE 73.64 -2.8 % 8.0 % -33.6 % TEXTRON INC 44.81 -2.8 % -0.4 % 13.3 % COGNIZANT TECH SOLUTIONS-A 60.70 -2.8 % -5.2 % 22.5 % RR DONNELLEY & SONS CO 19.52 -2.8 % 1.5 % 9.9 % L BRANDS INC 89.44 -2.8 % -4.2 % 69.4 % GANNETT CO 34.95 -2.8 % -4.0 % 30.1 % AVAGO TECHNOLOGIES LTD 121.85 -2.8 % -8.6 % 100.1 % FRANKLIN RESOURCES INC 51.18 -2.8 % -4.1 % -3.8 % AMAZON.COM INC 375.56 -2.7 % -0.8 % 15.6 % INTERCONTINENTAL EXCHANGE IN 223.67 -2.7 % -5.5 % 12.8 % VERISIGN INC 66.06 -2.7 % 2.0 % 30.4 % ADOBE SYSTEMS INC 73.15 -2.7 % -5.4 % 14.2 % CHESAPEAKE ENERGY CORP 15.45 -2.6 % 13.5 % -42.0 % NORDSTROM INC 76.43 -2.6 % -7.2 % 25.6 % DIAMOND OFFSHORE DRILLING 30.44 -2.6 % 10.0 % -33.9 % URBAN OUTFITTERS INC 42.00 -2.6 % -10.7 % 17.9 % RALPH LAUREN CORP 133.78 -2.6 % 0.5 % -13.3 % 3M CO 161.71 -2.5 % -2.9 % 17.4 % VIACOM INC-CLASS B 69.14 -2.5 % -0.9 % -17.7 % Nasdaq 100 - 30 fra toppen Nasdaq 100 - 30 fra toppen Kurs Endring siste 1 dag SEAGATE TECHNOLOGY 57.43 2.6 % NETFLIX INC 571.55 1.7 % ALTERA CORP 44.02 1.5% TRACTOR SUPPLY COMPANY 87.00 0.6 % BAIDU INC - SPON ADR 207.87 0.5 % SIGMA-ALDRICH 138.39 0.1 % TESLA MOTORS INC 206.79 0.0 % MICRON TECHNOLOGY INC 28.02 0.0 % AMERICAN AIRLINES GROUP INC 48.19 -0.1 % SYMANTEC CORP 24.24 -0.2 % KRAFT FOODS GROUP INC 86.73 -0.4 % INTUITIVE SURGICAL INC 540.70 -0.5 % SBA COMMUNICATIONS CORP-CL119.75 A -0.6 % O'REILLY AUTOMOTIVE INC 214.05 -0.6 % CATAMARAN CORP 59.25 -0.8 % MONSTER BEVERAGE CORP 136.91 -0.8 % DISH NETWORK CORP-A 69.26 -0.8 % AKAMAI TECHNOLOGIES INC 71.90 -0.8 % MONDELEZ INTERNATIONAL INC-A36.97 -0.9 % EXPRESS SCRIPTS HOLDING CO 85.55 -0.9 % ILLUMINA INC 191.16 -1.0 % DIRECTV 86.60 -1.0 % LINEAR TECHNOLOGY CORP 46.17 -1.0 % ANALOG DEVICES INC 63.42 -1.1 % NETAPP INC 35.97 -1.1 % LIBERTY VENTURES - SER A 42.51 -1.1 % MARRIOTT INTERNATIONAL -CL A 77.64 -1.1 % APPLE INC 124.75 -1.1 % VERISK ANALYTICS INC-CLASS A 71.84 -1.1 % DISCOVERY COMMUNICATIONS-A 32.80 -1.1 % Endring 1 uke 1.6 % 33.4 % 19.1% -2.2 % -2.3 % 0.1 % 4.4 % -2.3 % -13.6 % -0.6 % 40.0 % 6.2 % -2.3 % -0.3 % 20.3 % -0.4 % -5.7 % -1.3 % 6.4 % 0.2 % -2.5 % 0.4 % -4.9 % 3.8 % -3.6 % 1.7 % -7.6 % -0.9 % 0.5 % 1.1 % Endring 1 år 3.3 % 65.3 % 27.7% 29.4 % 33.4 % 47.1 % 4.4 % 17.2 % 36.1 % 17.0 % 52.4 % 31.2 % 31.3 % 46.2 % 51.6 % 102.7 % 16.5 % 32.4 % 6.7 % 18.3 % 41.1 % 14.5 % -0.4 % 20.0 % 0.3 % 41.2 % 38.0 % 66.4 % 24.7 % -17.5 % Nasdaq 100 - 30 fra bunnen Nasdaq 100 - 30 fra bunnen Kurs Endring siste 1 dag VIMPELCOM LTD-SPON ADR 5.67 -4.7% CHECK POINT SOFTWARE TECH 81.75 -3.6% ROSS STORES INC 100.40 -3.0% COGNIZANT TECH SOLUTIONS-A 60.70 -2.8% AVAGO TECHNOLOGIES LTD 121.85 -2.8% AMAZON.COM INC 375.56 -2.7% ADOBE SYSTEMS INC 73.15 -2.7% COMCAST CORP-SPECIAL CL A 57.73 -2.6% LIBERTY MEDIA CORP - C 37.90 -2.5% VIACOM INC-CLASS B 69.14 -2.5% STAPLES INC 16.03 -2.5% CELGENE CORP 113.47 -2.5% CISCO SYSTEMS INC 27.92 -2.4% DOLLAR TREE INC 79.14 -2.3% TRIPADVISOR INC 80.71 -2.3% KLA-TENCOR CORP 58.00 -2.3% LIBERTY MEDIA CORP - A 38.08 -2.2% BROADCOM CORP-CL A 43.59 -2.2% EBAY INC 55.79 -2.2% AUTOMATIC DATA PROCESSING 83.53 -2.2% REGENERON PHARMACEUTICALS447.52 -2.2% BIOGEN INC 419.44 -2.1% AUTODESK INC 60.35 -2.1% CITRIX SYSTEMS INC 64.02 -2.1% COMCAST CORP-CLASS A 58.42 -2.1% CA INC 31.20 -2.1% GOOGLE INC-CL A 532.74 -2.0% AMGEN INC 163.58 -2.0% STERICYCLE INC 138.06 -2.0% Endring Endring 1 uke 1 år 6.2% -37.0% -4.0% 22.1% -6.6% 45.5% -5.2% 22.5% -8.6% 100.1% -0.8% 15.6% -5.4% 14.2% -2.4% 18.9% -5.2% #VALUE! -0.9% -17.7% -1.4% 33.3% -11.7% 60.4% -1.8% 20.3% -5.6% 54.9% -6.5% -5.8% -8.7% 9.1% -5.0% 15.6% -5.2% 46.2% -3.7% 1.5% -4.8% 24.8% -8.5% 50.8% -11.9% 44.4% -1.0% 24.5% 0.4% 14.3% -1.7% 19.0% -5.2% 2.6% -5.7% -2.0% -3.8% 41.7% -1.2% 24.2% RENTER & VALUTA Renter Siste I går Endr. 1W 1M 3M YTD 12M Norge - Nibor 3m USA - Libor 3m Euro - Euribor 3m 1.510 0.276 0.001 1.510 0.276 0.001 0.000 0.001 -0.001 0.08 -0.00 -0.011 0.26 0.01 -0.024 0.10 0.02 -0.059 0.03 0.02 -0.077 -0.27 0.05 -0.327 Norge 10 år stat USA 10 år stat Euro 10 år stat Tyskland 10 år stat Japan 10 år stat UK 10 år stat 1.429 1.865 0.078 0.078 0.315 1.584 1.429 1.865 0.078 0.078 0.308 1.584 0.001 0.000 -0.007 -0.007 0.007 -0.023 0.00 -0.06 -0.08 -0.08 -0.03 0.00 -0.17 -0.07 -0.20 -0.20 -0.01 -0.10 0.04 0.08 -0.38 -0.38 0.09 0.05 -0.11 -0.31 -0.46 -0.46 -0.01 -0.17 -1.46 -0.86 -1.44 -1.44 -0.29 -1.08 Valuta Siste I går Endr. 1W 1M 3M YTD 12M 52W H 52W L EUR/USD USD/JPY GBP/USD 1.078 118.8 1.495 1.081 118.9 1.497 -0.003 -0.080 -0.001 0.021 -1.3 0.028 -0.005 -1.2 -0.000 -0.078 0.0 -0.019 -0.132 -0.9 -0.063 -0.302 16.2 -0.184 1.399 122.0 1.719 1.046 100.8 1.457 USD/NOK EUR/NOK GBP/NOK 7.853 8.463 11.745 7.832 8.466 11.719 0.023 -0.003 0.026 -0.245 -0.096 -0.159 -0.173 -0.216 -0.246 0.178 -0.399 0.123 0.407 -0.552 0.136 1.855 0.187 1.676 8.419 9.897 12.441 5.849 8.077 9.918 5 DNB Markets | ETF/ETP 20 April 2015 ETF/ETP ET F E ndring 1 dg. i % E ndring 5 dg. i % E ndring 1 m nd i % E ndring 1 år i % V a lut a 44.1 81.91 12.925 49.06 698.9 207.95 275.76 55.8 156.4699 24.13 45.41 41.47 356.46 37.36 106.01 51.17 46.93 124.43 177.94 23.33 152.31 15.182 42.7 49.72 31.44 34.535 103.87 -0.4 % -0.7 % -0.8 % -0.9 % -0.9 % -1.2 % -1.2 % -1.2 % -1.2 % -1.3 % -1.3 % -1.4 % -1.4 % -1.5 % -1.6 % -1.6 % -1.6 % -1.6 % -1.6 % -1.6 % -1.7 % -1.7 % -1.7 % -1.8 % -2.0 % -2.1% -2.5 % -1.3 % 2.2 % -0.1% -1.1% -1.4 % -1.0 % -1.2 % -2.1% -1.0 % -0.5 % -0.4 % -1.4 % -0.3 % 2.8 % -1.6 % -1.7 % -1.2 % -0.9 % -1.3 % -3.0 % -0.9 % -3.4 % -0.4 % -2.3 % 0.5 % 0.2 % -5.7 % -2.0 % 6.5 % 0.9 % 0.2 % -0.2 % -1.2 % -1.4 % -2.3 % -1.3 % -2.3 % 0.3 % -2.5 % -2.7 % 12.2 % -2.3 % 1.3 % 1.2 % -1.2 % -1.7 % 8.8 % -1.1% -1.9 % 6.5 % -0.7 % 6.3 % 9.5 % -3.1% 4.3 % -11.7 % 15.6 % 12.4 % 5.5 % 11.6 % 12.2 % 5.8 % 11.8 % 10.4 % -6.4 % 15.1% 60.5 % -26.9 % 23.0 % 15.7 % -5.5 % 10.2 % 8.7 % 11.2 % 16.8 % 33.5 % 1.6 % 25.1% -17.5 % -27.3 % 22.4 % USD USD USD USD GB p USD USD USD USD USD USD USD USD USD USD EUR USD USD USD USD USD EUR USD EUR USD USD EUR 8500532 16917429 31145808 5539765 4559755 191113230 1915213 11304081 5360 39857705 986436 10159434 1843521 15272397 46513964 161493 779478 48283498 8683455 5455996 1564224 14958 76687966 6461 420686 18112099 34844 NGA S OILB OILW UGA S CRUD HEA T USO 0.0734 37.57 29.895 32.655 14.13 15.205 19.84 2.2 % 2.1% 1.4 % 1.4 % 1.1% 0.9 % -0.5 % 3.6 % 9.3 % 8.6 % 8.4 % 8.5 % 7.4 % 7.8 % -6.1% 13.7 % 17.8 % 8.9 % 18.1% 10.3 % 20.8 % -49.3 % -47.1% -45.8 % -40.2 % -46.4 % -35.9 % -47.3 % USD USD USD USD USD USD USD 210700 56593 0 0 2360553 0 21790269 SLV B ULL COP A ZINC A LUM COTN 15.56 14.96 28.025 6.815 3.2095 2.124 -0.1% 0.6 % -0.2 % -0.4 % -0.5 % -0.5 % -1.3 % -0.3 % 0.5 % 1.1% 3.5 % -2.6 % -2.8 % 1.5 % -0.3 % 7.8 % 1.5 % 1.0 % -17.6 % -8.6 % -9.9 % 4.4 % -6.9 % -23.7 % USD USD USD USD USD USD 3606794 0 11521 5000 2561 0 HOGS A IGO SOYB CORN COFF SUGA WEA T SOYO 0.7025 17.275 21.83 1.266 1.7245 10.225 0.998 4.285 0.4 % 1.4 % 1.2 % 1.1% 1.0 % 0.8 % 0.6 % 0.5 % -2.2 % 8.5 % 1.8 % 0.6 % 3.3 % 4.1% -5.8 % 3.2 % 2.7 % 13.5 % -1.0 % -1.8 % -2.1% 5.5 % -6.5 % 2.7 % -43.3 % -43.6 % -25.7 % -30.7 % -34.5 % -36.5 % -34.3 % -30.1% USD USD USD USD USD USD USD USD 992 4500 2920 93092 19220 300 182615 0 A IGE A IGA A IGG A IGC A IGP A IGS A IGX A IGL A IGI 5.85 5.735 4.5125 10.3875 16.62 4.435 9.34375 3.503 11.8 1.6 % 1.0 % 0.9 % 0.7 % 0.5 % 0.4 % 0.4 % 0.2 % -0.8 % 7.3 % 0.5 % -0.8 % 2.7 % -0.7 % 2.3 % 0.4 % 0.6 % 1.0 % 8.2 % -1.1% -3.0 % 2.3 % 0.1% 2.4 % -0.3 % 1.8 % -0.1% -44.4 % -29.2 % -30.1% -26.7 % -11.3 % -31.6 % -19.6 % -10.9 % -10.3 % USD USD USD USD USD USD USD USD USD 1703746 115513 0 20033 423232 0 0 0 626696 N avn Kurs V o lum A k s je r / Inde k s e r Fo rsyningstjenester Energi Japan Fo rbruksvarer FTSE 100 S&P 500 S&P M idcap 400 Industri Do w Jo nes To tal market Finansielle tjenester S&P Euro 350 Tekno lo gi USA B io tekno lo gi Oil Service Nasdaq 100 CA C-40 P acific ex-Japan Russell 2000 DJIA Ho ng Ko ng Russell 2000 Gro wth TecDax Emerging M arkets A EX-Nederland Latin-A merica 40 B rasil DA X XLU XLE EWJ XLP ISF SP Y M DY XLI THRK XLF IEV XLK IB B OIH QQQ CA C EP P IWM DIA EWH IWO TDXP EX EEM A EXT ILF EWZ DA XEX O lje / E ne rgi Naturgass B rent-o lje WTI-o lje B ensin Råo lje Fyringso lje WTI-Oil M e t a lle r Sølv Gull Ko bber Sink A luminium B o mull A ndre rå v a re r Svinekjøtt Råo ljer So yabønner M ais Kaffe Sukker Hvete So yao lje R å v a re k urv e r Energi Landbruk Ko rn Råvarer Edle metaller So fts (Sukker, Kakao , B o mull) Ex-Energi B uskap Industrimetaller 6 DNB Markets | ETF/ETP 20 April 2015 DISCLAIMER Denne rapport er utarbeidet av DNB Markets, et forretningsområde i DNB Bank ASA. Rapporten baserer seg på kilder som vurderes som pålitelige, men DNB Markets garanterer ikke at informasjonen er presis eller fullstendig. Uttalelser i rapporten reflekterer DNB Markets’ oppfatning på det tidspunkt rapporten ble utarbeidet, og DNB Markets forbeholder seg retten til å endre oppfatning uten varsel. Rapporten skal ikke oppfattes som et tilbud om å kjøpe eller selge finansielle instrumenter eller som en anbefaling om investeringsstrategi. DNB Markets påtar seg ikke noe ansvar, verken for direkte eller indirekte tap, som følge av at rapporten legges til grunn for investeringsbeslutninger. Regler om konfidensialitet og informasjonshåndtering i DNB Bank og DNB Markets begrenser utveksling av informasjon mellom ulike enheter i DNB Markets og mellom DNB Markets og enheter i DNB-konsernet. Enheter i DNBkonsernet kan ha informasjon som er relevant for de forhold rapporten gjelder, men som ikke har vært tilgjengelig for forfatteren av rapporten. Distribusjon av analyser er i enkelte land regulert ved lov. Personer som mottar denne rapporten plikter å gjøre seg kjent med slike forhold og ikke formidle rapporten videre til personer som er hjemmehørende i land som er gjenstand for slike begrensninger. Om du har behov for ytterligere informasjon vedrørende rapporten, herunder informasjon om eierskap, offentlig kjente corporateoppdrag eller annen relevant informasjon jf lov om verdipapirhandel 2007/06/29 nr 75 og forskrift til verdipapirhandelloven 2007/06/29 nr 876 kan du ta kontakt med DNB Markets på telefon. Informasjon om DNB Markets Alminnelige forretningsvilkår er tilgjengelig på vår hjemmeside www.dnb.no/markets. Denne rapport er kun til bruk for våre kunder og er ikke ment for offentlig distribusjon. DNB Markets, DNB Bank ASA (organisasjonsnummer 984 851 006), er medlem av Norges Fondsmeglerforbund og er underlagt tilsyn av Finanstilsynet i Norge. DNB Markets er også underlagt lokale tilsyn i Singapore, og i noen grad i Storbritannia og Sverige. Detaljer vedrørende omfanget av lokale tilsynsreguleringer utenfor Norge er tilgjengelig på forespørsel. Ytterligere informasjon om DNB Markets og DNB Bank ASA finnes på www.dnb.no. Det ovenstående er et norsk sammendrag av DNB’s standard disclaimer som du finner nedenfor, og kun ment som et supplement til denne. Vi ber lesere av rapporten særlig om å legge merke til avsnittet ”Conflict of Interest”. Vennligst ta kontakt med oss på telefon 08940 (+47 915 08940) dersom du har noen spørsmål. IMPORTANT/DISCLAIMER This note must be read in conjunction with published research notes of DNB Markets.This note (the “Note”) must be seen as marketing material and not as an investment recommendation within the meaning of the Norwegian Securities Trading Act of 2007 paragraph 310 and the Norwegian Securities Trading Regulation 2007/06/29 no. 876. The Note has been prepared by DNB Markets, a division of DNB Bank ASA, a Norwegian bank organized under the laws of the Kingdom of Norway (the “Bank”), for information purposes only. The Note shall not be used for any unlawful or unauthorized purposes. The Bank, its affiliates, and any third-party providers, as well as their directors, officers, shareholders, employees or agents (individually, each a “DNB Party”; collectively, “DNB Parties”) do not guarantee the accuracy, completeness, timeliness or availability of the Note. DNB Parties are not responsible for any errors or omissions, regardless of the cause, nor for the results obtained from the use of the Note, nor for the security or maintenance of any data input by the user. The Note is provided on an “as is” basis. DNB PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE NOTE’S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE NOTE WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall DNB Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the Note, even if advised of the possibility of such damages. Any opinions expressed herein reflect the Bank’s judgment at the time the Note was prepared and DNB Parties assume no obligation to update the Note in any form or format. The Note should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. No DNB Party is acting as fiduciary or investment advisor in connection with the dissemination of the Note. While the Note is based on information obtained from public sources that the Bank believes to be reliable, no DNB Party has performed an audit of, nor accepts any duty of due diligence or independent verification of, any information it receives. Confidentiality rules and internal rules restrict the exchange of information between different parts of the Bank and this may prevent employees of DNB Markets who are preparing the Note from utilizing or being aware of information available in DNB Markets/the Bank which may be relevant to the recipients of the Note. Please contact DNB Markets at + 08940 (+47 915 08940) for further information and inquiries regarding this Note, such as ownership positions and publicly available/commonly known corporate advisory performed by DNB Markets etc, in relation to the Norwegian Securities Trading Act 2007/06/29 no. 75 and the Norwegian Securities Trading Regulation 2007/06/29 no. 876. 7 DNB Markets | ETF/ETP 20 April 2015 The Note is not an offer to buy or sell any security or other financial instrument or to participate in any investment strategy. Distribution of material like the Note is in certain jurisdictions restricted by law. Persons in possession of the Note should seek further guidance regarding such restrictions before distributing the Note. The Note is for clients only, and not for publication, and has been prepared for information purposes only by DNB Markets - a division of DNB Bank ASA registered in Norway with registration number NO 984 851 006 (the Register of Business Enterprises) under supervision of the Financial Supervisory Authority of Norway (Finanstilsynet), The Monetary Authority of Singapore, and on a limited basis by the Financial Conduct Authority and the Prudential Regulation Authority of the UK, and the Financial Supervisory Authority of Sweden. Details about the extent of our regulation by local authorities outside Norway are available from us on request. Information about DNB Markets can be found at dnb.no. Additional information for clients in Singapore The Note has been distributed by the Singapore Branch of DNB Bank ASA. It is intended for general circulation and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser regarding the suitability of any product referred to in the Note, taking into account your specific financial objectives, financial situation or particular needs before making a commitment to purchase any such product. You have received a copy of the Note because you have been classified either as an accredited investor, an expert investor or as an institutional investor, as these terms have been defined under Singapore’s Financial Advisers Act (Cap. 110) (“FAA”) and/or the Financial Advisers Regulations (“FAR”). The Singapore Branch of DNB Bank ASA is a financial adviser exempt from licensing under the FAA but is otherwise subject to the legal requirements of the FAA and of the FAR. By virtue of your status as an accredited investor or as an expert investor, the Singapore Branch of DNB Bank ASA is, in respect of certain of its dealings with you or services rendered to you, exempt from having to comply with certain regulatory requirements of the FAA and FAR, including without limitation, sections 25, 27 and 36 of the FAA. Section 25 of the FAA requires a financial adviser to disclose material information concerning designated investment products which are recommended by the financial adviser to you as the client. Section 27 of the FAA requires a financial adviser to have a reasonable basis for making investment recommendations to you as the client. Section 36 of the FAA requires a financial adviser to include, within any circular or written communications in which he makes recommendations concerning securities, a statement of the nature of any interest which the financial adviser (and any person connected or associated with the financial adviser) might have in the securities. Please contact the Singapore Branch of DNB Bank ASA at +65 6212 0753 in respect of any matters arising from, or in connection with, the Note. The Note is intended for and is to be circulated only to persons who are classified as an accredited investor, an expert investor or an institutional investor. If you are not an accredited investor, an expert investor or an institutional investor, please contact the Singapore Branch of DNB Bank ASA at +65 6212 0753. We, the DNB group, our associates, officers and/or employees may have interests in any products referred to in the Note by acting in various roles including as distributor, holder of principal positions, adviser or lender. We, the DNB group, our associates, officers and/or employees may receive fees, brokerage or commissions for acting in those capacities. In addition, we, the DNB group, our associates, officers and/or employees may buy or sell products as principal or agent and may effect transactions which are not consistent with the information set out in the Note. Additional Information, including for Recipients in the In the United States: The Note does not constitute an offer to sell or buy a security and does not include information, opinions, or recommendations with respect to securities of an issuer or an analysis of a security or an issuer; rather, it is a “market letter,” as the term is defined in NASD Rule 2211. In Brazil If the analyst or any close associates serves as an officer, director or board member, or have a personal relationship with any individual that works for a company which DNB Markets publish a research note, this will be mentioned under the disclaimer in the relevant research note. The analyst or any close associates do neither hold nor do they have any direct/indirect involvement in the acquisition, sale, or intermediation of the securities discussed in each research note. Any financial interests, not mentioned in the relevant research notes, that the analyst or any close associates holds in the issuer discussed in the report is limited to investment funds that do not mainly invest in the issuer or industry discussed in the report and the management of which these persons cannot influence. 8