Investment Attitudes and Behaviors of High Income

advertisement

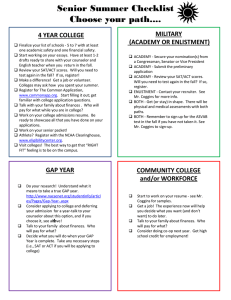

Cultural Difference: Investment Attitudes and Behaviors of High Income Americans Tahira K. Hira – Iowa State University 515.294.2042 tkhira@iastate.edu Caezilia Loibl – Ohio State University Tom Schenk Jr. – Iowa State University *This work was made possible by a generous grant from FINRA Education Foundation. Academy of Financial Services - October, 2007 Introduction • What is the next generation of investors in the United States going to look like • Will the high income diverse investors perceive and behave differently – When investing and – When planning for retirement • What will be the effects of these differences Tahira K. Hira 2 Academy of Financial Services - October, 2007 Objectives • Survey – Focus on high income investors – Includes Whites, Blacks, Hispanics, and Asians • Research Topics – Risk tolerance level – Investor confidence – Retirement confidence Tahira K. Hira 3 Academy of Financial Services - October, 2007 Procedures • National Random Sample – Sample 4,1410 – Targeted geographical areas wit Av. households incomes of $100,000 and – high concentration of minorities - 30% • Data Collection – 911 households agreed to participate – CCSM conducted phone interviews between 0/05 and 2/06 – Average phone interview - 22 minutes – Response rate of 22% Tahira K. Hira 4 Academy of Financial Services - October, 2007 Descriptive Statistics Variable Full-Time Employment White Black Asian Hispanic 74.3% 77.8% 80.0% 78.3% Occup. Professional Bachelor & Masters Married Male Age Household Size Income ($) Debt ($) 51.6% 40.9% 42.9% 31.9% 67.0% 65.3% 75.7% 56.5% 89.6% 84.7% 95.7% 88.4% 66.4% 48.6% 65.7% 65.2% 48.8 47.1 46.1 45.4 3.36 3.65 3.66 3.61 128,900 119,434 138,426 120,746 189,740 110,554 326,343 150,659 Tahira K. Hira 5 Academy of Financial Services - October, 2007 Risk Tolerance: Measure “Are you willing to take --- 1 = substantial financial risks to earn substantial returns 2 = above average risks for above average returns 3 = average risks for average returns 4 = below average risks for below average returns 5 = or no risk at all?” Tahira K. Hira 6 Academy of Financial Services - October, 2007 Risk Tolerance: Results Percentage Responding "Agree" or "Strongly Agree" Risk Threshold White Black Asian Hispanic High Risk 45 42 46 30 Average Risk 46 42 37 52 Low Risk 9 17 17 17 *Chi-square statistic is significant at the 10% level. Tahira K. Hira 7 Academy of Financial Services - October, 2007 Risk Tolerance: Regression Logit Regression of Risk Threshold (High Risk = 1, Low is 0) Selected Demographic Coefficients Variable Coefficient p-value Age -.056 0.108* Household Size 0.15 0.241 Divorced 0.288 0.685 Widowed -0.898 0.286 Single/Never Married -0.926 0.176 Tahira K. Hira 8 Academy of Financial Services - October, 2007 Risk Tolerance: Regression Logit Regression of Risk Threshold (High Risk = 1) Education Coefficients (Less than High School omitted) Variable Coefficient p-value High School Diploma .948 0.516 Some College 1.79 0.202 Bachelors Degree 2.22 0.121 Masters Degree 2.43 0.095 PhD, MD, DDS, etc. 3.42 0.028 Investment Strategy -.332 0.002 Tahira K. Hira 9 Academy of Financial Services - October, 2007 Risk Tolerance: Regression Logit Regression of Risk Threshold (High Risk = 1) Race and Ethnicity Coefficients (White omitted) Variable Coefficient p-value Black -.946 0.062 Asian -1.83 0.000 Hispanic -1.30 0.005 Tahira K. Hira 10 Academy of Financial Services - October, 2007 Risk Tolerance: Regression Logit Regression of Risk Threshold (High Risk = 1) Income Coefficients Variable Coefficient p-value Income Net worth Tahira K. Hira .112 0.014 -.00000006 0.792 11 Academy of Financial Services - October, 2007 Predictors of Risk Tolerance: • Demographics – Age (negative) – Race (white) – Income (positive) – Education (positive) • Follow consistent investment strategy (negative) Tahira K. Hira 12 Academy of Financial Services - October, 2007 Investor Confidence-Measure Tell me “whether you strongly disagree, disagree, agree, or strongly agree with each of statement” • I am confident about my ability to invest • I worry about the outcome of my investments • I am knowledgeable about investing Tahira K. Hira 13 Academy of Financial Services - October, 2007 Investor Confidence: Results Percentage Responding "Agree" or "Strongly Agree" Confidence Indicators White Black Asian Hispanic Knowledgeable About Investing*** 62 66 71 65 Confident About Investment Ability* 62 60 77 68 Worry About Outcome of Investments*** 54 49 60 50 Chi-square test: * indicates 99% confidence; *** indicates 99% confidence Tahira K. Hira 14 Academy of Financial Services - October, 2007 Investor Confidence: Males Percentage Responding "Agree" or "Strongly Agree" (Percentage Male-to-Female Difference) Confidence Indicators White Black Asian Hispanic Knowledgeable About Investing 65 (+3) 76 (+10) 79 (+8) 70 (+5) Confident About Investment Ability 67 (+5) 69 (+9) 78 (+1) 68 (-0) Worry About Outcome of Investments 44 (-10) 59 (+10) 64 (+4) 51 (+1) Tahira K. Hira 15 Academy of Financial Services - October, 2007 Retirement Confidence- Measure “Tell me whether you strongly disagree, disagree, agree, or strongly agree with each of the following statements” • I maximize contributions to my retirement account • I have a clear idea of my financial needs during retirement • I am confident I will be financially secure Tahira K. Hira 16 Academy of Financial Services - October, 2007 Retirement Confidence: Results Percentage Responding "Agree" or "Strongly Agree" Confidence White Black Asian Hispanic I maximize contributions to retirement account*** 75 70 83 75 I have a clear idea of my financial needs during retirement*** 72 73 70 71 I am confident I'll be financially secure*** 81 89 86 86 Chi-square Test: * indicates 99% confidence; *** indicates 99% confidence Tahira K. Hira 17 Academy of Financial Services - October, 2007 Summary: Risk Tolerance • Differences – Minorities (including Asians) tend to be less risk tolerant than whites – Marital status, household size, and gender did not influence risk thresholds • Similarities – Higher income increased risk tolerance. – Age decreased risk tolerance Tahira K. Hira 18 Academy of Financial Services - October, 2007 Summary: Investor Confidence • New Findings – Minorities are generally at least as confident as whites …especially Asians • Similarities – Men claim to be …more knowledgeable about investing …confident …but worry more often (for minorities) • Differences – Gender effects tend to be strongest for whites Tahira K. Hira 19 Academy of Financial Services - October, 2007 Summary: Retirement Confidence • New Findings – Asians are more likely to maximize contributions to their retirement accounts • Differences – Minorities do not exhibit lower retirement confidence levels • Similarities – Overall levels of retirement confidence are high among all ethnic and racial groups Tahira K. Hira 20 Academy of Financial Services - October, 2007 Implications • Minorities being less risk tolerant may imply greater wealth inequalities (in the long run) – “ we should help target groups who are under investing” • Minority females are less confident investors – “we should target education programs to women” • Favorable outlook for the well-being during retirement for high net-worth minorities and whites Tahira K. Hira 21 Academy of Financial Services - October, 2007 Questions and Answers Dr. Tahira K. Hira Iowa State University 515.294.2042 tkhira@iastate.edu www.eng.iastate.edu/tkhira This work was made possible by a generous grant from FINRA Education Foundation Tahira K. Hira 22