Q. 1/2012

advertisement

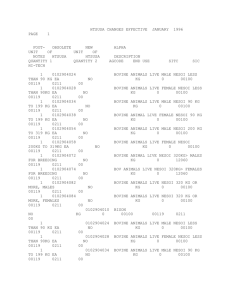

Dynasty Ceramic “We are making the impossible, POSSIBLE.” Contents Road to Success Sales Reports Cost of Production Performance Competitor Analysis Going Forward Q&A 2 Dynasty Ceramic “Road to Success” Timeline Forbes Award − Best Under a Billion 200 Companies in 2002 Registered as PCL on the 4th of March 1994 1st company owned outlet in 1998 Established on the 1st of August 1989 Dynasty Production Process in 2004 2004 32.2 M DCC Timeline Computerized Systems in the middle of 2007 2006 37.4 M Forbes Award − Best Under a Billion 200 Companies in 2010 2008 42.2 M Listing on the SET on the 3rd of January 1992 Forbes Award − Best Under a Billion 200 Companies in 2006 Registered Capital of 408 million Baht in 2000 2010 51.6 M 2009 45.1 M 2005 35.5 M Merged with Tile Top Industry at the end of 1997 SET Outstanding Performance Award 2011 2012 64 M 2011 58.6 M Ranked 17th world’s Largest Ceramic Tile Manufacturer in 2008 Waste Heat Recovery System in 2007 Dynasty Ceramic on 200 Best Public Companies of the years 2010 Magazine 4 Our Growth Forecast 2012 9,000 250 8,000 200 7,000 6,000 150 5,000 Outlet Sales per Outlet Outlet Sales 4,000 100 Revenue Agent Sales 3,000 2,000 50 1,000 - 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 DCC “with” Thai People Dynasty Ceramic “Sales Reports” Sales Volume Sales Value Sales Volume & Sales Value Y2012 SALES VOLUME(M.Sqm.) 1Q 12 %GROWTH 1Q 11 2% 2Q 11 3Q 11 4Q 11 Y 11 SALES VALUE(MB) 1Q 12 1Q 11 4% 2Q 11 3Q 11 4Q 11 Y 11 Sales Volume & Sales Value 1Q2012 SALES VALUE(MB) SALES VOLUME(M.Sqm.) 1Q12 %GROWTH 4Q11 29% 1Q11 2% 1Q12 4Q11 28% 1Q11 4% Outlet Quarterly Sales Performance by Region (MB) Outlet Quarterly Sales Performance by Region (%) (%) (ล้านบาท) Agent 4% Agent 9% Agent 6% Agent 1% Agent 4% Agent 3% Agent 9% Agent 2% Agent 3% Agent 8% Agent 5% Agent 7% Agent 2% Agent 2% Agent 1% Agent 6% Agent 2% Agent6% Agent 4% Agent 5% Agent 2% Agent 3% Agent 3% Agent 1% Agent 2% เปรียบเทียบยอดขายตามช่ องทางจาหน่ าย Y2009 – 2011, 1Q2012 (MB) (ล้านบาท) Sales Comparison by Distribution Channel Y2010 – 2011, 1Q2012(%) (ล้า Sales Comparison by Product Type Y2009 – 2011,1Q2012 (MB) (ล้านบาท) Sales Comparison by Product Type Y2010 – 2011,1Q2012 (%) Dynasty Ceramic “Cost of Production” Cost of Production Y2011 19 Cost of Production 1Q2012 20 Dynasty Ceramic “Performance” Notices 30% Tax (1Q11) DCC adopted new accounting standard (2011) TAS19 - Employees’ Benefit Obligation (1Q11) First 85 Million Baht booked in Liabilities 12-15 Million Baht per year Sales’ promotion and commission fee deducted directly from “Sales” (1Q11) Revising assets and its depreciation (2Q11) 23% Tax (2012) 22 QUARTERLY PERFORMANCE M.฿ M.฿ NET PROFIT(MB)/EARNINGS PER SHARE(BAHT) 1Q2012 NET PROFIT(MB) 1Q12 %GROWTH 47% 4Q11 2% 1Q11 EARNINGS PER SHARE(BAHT) 1Q12 4Q11 1Q11 Performance Revenue (Bt mil) Cost of Goods Sold (Bt mil) Gross Profit (Bt mil) Gross Profit Margin (percent) SG&A (Bt mil) Net Profit (Bt mil) Sales (Bt mil) Sales Volume (Sqm. mil) Average Sales Price (Bt/Sqm.) FY06 FY07 FY08 FY09 FY10 FY11 1Q12 4,460 4,475 5,095 5,905 6,531 7,227 2,096 (2,829) (2,742) (3,130) (3,384) (3,630) (4,143) (1,264) 1,631 1,733 1,965 2,521 2,901 3,084 832 37 39 39 43 44 43 40 (742) (791) (978) (1,079) (1,208) (1,237) (347) 567 543 664 994 1,175 1,243 373 FY06 FY07 FY08 FY09 FY10 FY11 1Q12 4,452 4,458 5,089 5,884 6,511 7,207 2,093 34 35 41 47 51 56 16 125.38 128.62 128.91 128.93 129.31 125.72 124.65 25 Performance FY06 FY07 FY08 FY09 FY10 FY11 1Q12 Gas Cost of COGS (Bt mil) 619.06 549.06 929.76 702.97 946.81 1,314.41 381.31 Natural Gas Price (Bt/MMBTU) 259.39 257.09 354.44 245.54 303.07 371.67 412.03 Transportation Cost (Bt mil) 362.15 345.70 438.51 410.48 517.39 598.06 170.08 Transportaion Cost (Bt/Sqm.) 10.34 9.58 10.69 8.66 9.97 10.58 10.56 Oil Price (Bt/Litre) 25.58 25.50 31.17 23.87 28.50 29.44 31.29 26 Key Financial Ratios FY06 FY07 FY08 FY09 FY10 FY11 1Q12 ROE 27.74 23.86 28.45 39.02 43.80 46.78 13.29 ROA 13.03 13.40 16.72 26.43 31.99 30.99 8.51 EPS (Baht) 1.39 1.33 1.63 2.44 2.88 3.05 0.91 D/E 1.13 0.78 0.59 0.34 0.36 0.62 0.47 2.78 1.78 4.40 9.89 9.41 8.95 P/BV Pay Out Ratio 70% 75% 77% 85% 100% 100% 100% Dividend Per Share 0.97 1.00 1.25 2.08 2.88 3.05 0.91 27 Dynasty Ceramic “Competitor Analysis” Sales Volume (M.Sqm.) 29 Sales Value (MB) 30 Profit (MB) 31 ASP (Baht/Sqm.) 32 Dynasty Ceramic “Going Forward” Risk Factors Natural Gas price is said to increase 5% in 2012 Natural Disaster worse than previous year? Government Policies Production Capacity Expansion Plan 2012 2012 Outlook Targeting 10% growth in revenue Targeting to open 15 outlets Targeting 42% gross margin Increase ASP to 133 Baht Domestic market share up to 50% Increase 5% in production capacity by modifications More than 95% capacity utilization rate Reduce 5% of labor Reduce SG&A Intensive training programs for all employees 36 …and Next? Targeting 10 billion Baht Revenue at the end of 2014 Increase same store growth 350 Outlets in 2021 throughout Thailand Reduce 5% of work force every year for the next 5 years Improve gross profit margin Maintain 100% dividend pay out Looking for market opportunity abroad Research, Research, Research Dynasty Ceramic “Questions?” MARUTH SAENGSASTRA Vice President & C.I.O. Dynasty Ceramic PCL. Tile Top Industry PCL. 37/7 Sutthisarn Rd., Samsennok, Hueykwang BKK.10310 E-mail : maruth@dynastyceramic.co m 39