Deere & Company

advertisement

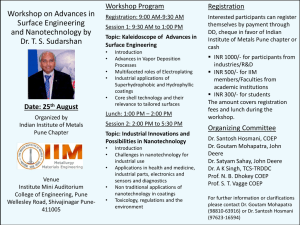

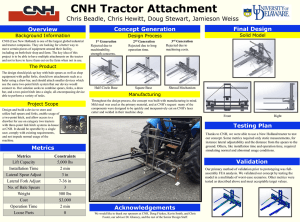

Deere & Company Yen-Hua Huang (Gina) Cheng- Yuan Huang Yu-Te Hung (Ted) Te-Chi Kuo (William) Presented: April 12, 2012 Agenda Overview Macroeconomics Industry Descriptions Company Descriptions Financial analysis and Competitors Financial projection and Models Recommendation Overview: Deere & Company, founded 1837, is an globalized company and provides products and services primarily for agriculture and forestry all over the world . It operates in three major business segments: agriculture/ turf (A&T) , construction/forestry, & financial services. GICS MAP 20106010 Symbol DE Current Price 79.34 (4/12/2012) Forward P/E 12.16 Market Cap. 32.04B Enterprise Value 57.87B ROA 5.99% EPS 6.75 ROE 42.32% Profit Margin 8.63% Source from Deere Mar 2012 presentation for strategy Macroeconomic Tailwinds : •Global population •Global infrastructure needs Macroeconomic Tailwinds : Population growing in size and affluence By 2050, world population will reach 9 billion, up from ~7 billion today, with most of population growth in Asia and Africa More People, More Food Source from Deere Mar 2012 presentation for strategy Source from Deere Mar 2012 presentation for strategy Source from Deere Mar 2012 presentation for strategy Source from Deere Mar 2012 presentation for strategy Sector : Industrial Goods Industry : Farm and Construction Machinery Farm Equipment : Construction Equipment : Source from IBIS world Construction Revenue Drivers : • the value of all non-residential construction • Demand from mining • The value of residential construction Source form IBIS world Farm revenue drivers •Demand from crop production •Agriculture price index •Private spending on home improvements Source form IBIS world Main Competitors: Company's Name Ticker Deere & Company DE 79.34 9.6 6.75 Caterpillar Inc. CAT 105.87 9.35 7.4 CNH Global NV CNH 41.04 8.83 3.91 Kubota Corporation KUB 47.83 14.15 2.59 AGCO Corporation AGCO 45.55 8.61 5.95 Stock Price Forward P/E EPS Relevant Stock Market Prospects Deere & Company’s GICS code is #20106010. Therefore, the firm majorly competes with Caterpillar Inc. (CAT), CNH Global NV( CNH), and AGCO Corporation (AGCO). Relevant Stock Market Prospects: Industry Top 1st Player: Caterpillar Inc. (CAT) accounts for 20.3% of the market share. Top 2nd Player: Deere & Company (DE) accounts for 7.5% of the market share. -Caterpiller provides more comprehensive product lines, including construction & mining equipment and logging machinery -Deere is the world’s leading manufacturer of agricultural equipment -Both of them are Illinois-based Relevant Stock Market Prospects Key statistics regarding Deere and its competitors Source: Yahoo Finance Relevant Stock Market Prospects - Compared with the market index Source: Yahoo Finance A Glance at the Company and Its Business - Basic Description Deere & Company manufactures and services primarily for agriculture and forestry worldwide. Agricultural output will need to double by midcentury to satisfy demand and do so from the essentially same amount of land and with even less water. Deere & Company is consisted of: 1. Agriculture & Turf Segment 2. Construction & Forestry Segment 3. Financial Service Segment A Glance at the Company and Its Business -Basic Description -Agricultural & Turf segment provides utility equipment and related parts Rice Binder Sub-compact Utility Tractor Tractor Model D Wheeled Feller Buncher Cotton Picker Source from Deere website A Glance at the Company and Its Business -Basic Description -Construction & Forestry segment offers utility equipment and related parts Earthmoving contractor and road builder Power Shovel Source from Deere website A Glance at the Company and Its Business - Basic Description - Financial service segment works for worldwide equipment financing, marketing and business development, agricultural financial service, and international lending. - Deere’s interest income will be viewed as the operating assets. - If its debt rating is downgraded, the financial service will not support Deere’s sales as before. A Glance at the Company and Its Business Deere’s Strategy 1. Continue to grow strong at 2nd position in North America 2. Globalize the Business 3. Improve volumes and pricing 4. Grow market share in developing market A Glance at the Company and Its Business A Leading Technology Source: Deere’s website A Glance at the Company and Its Business Revenue by Business Segment A Glance at the Company and Its Business Revenue by Geographic Segment A Glance at the Company and Its Business Business Drivers: - Demand from crop production -Agricultural price index -Private spending on home improvements -Natural disaster index Brief Description of Deere’s Competitors: Caterpillar Inc. : world’s leader of manufacturer of construction and mining equipment. CNH Global NV: important manufacturer of agricultural and construction equipment. Kubota Corporation: Japan’s leader of manufacturer of agricultural and construction equipment AGCO Corporation: Europe-based manufacturer of agricultural equipment CAT CNH KUB AGCO Financial Ratios Company's Name Deere & Company Caterpillar Inc. CNH Global NV Kubota Corporation AGCO Corporation Ticker Stock Price Forward P/E EPS EBIT/TA EBIT/EV DE 79.34 9.6 6.75 13.00% 8.61% CAT 105.87 9.35 7.4 13.78% 7.03% CNH 41.04 8.83 3.91 7.62% 8.91% KUB 47.83 14.15 2.59 8.84% 7.46% AGCO 45.55 8.61 5.95 12.32% 7.33% Multiples DE CAT CNH KUB AGCO Industry Ave. Market Cap 32.88B 68.55B 9.84B 12.01B 4.43B 2.14B Current P/E 12.12 14.31 10.5 18.47 7.66 10.15 12.61 Forward P/E 9.6 9.35 8.83 14.15 8.61 N/A 10.11 Prof. Margin 8.63% 8.19% 4.89% 5.44% 6.65% 7.38% 6.76% P/B 4.82 5.34 1.21 1.55 1.49 2.2 2.88 P/S 1 1.14 0.5 0.99 0.51 0.9 0.83 ROE 5.99% 6.16% 4.17% 4.35% 6.00% 4.65% 5.33% ROA 42.32% 40.29% 12.07% 8.60% 20.57% 14.00% 24.77% Joel Greenblatt (In thousands) EBIT Tangible Assets EV EBIT/TA EBIT/EV SUM DE 4.98 47.08 56.91 13.00% 8.61% 21.61% CAT 7.12 69.99 99.84 13.78% 7.03% 20.81% CNH 1.94 31.01 21.45 7.62% 8.91% 16.53% KUB 1.12 16.37 14.75 8.84% 7.46% 16.3% AGCO 0.59 5.40 5.17 12.32% 7.33% 19.65% (in million) Source: Yahoo. Finance Dupont Analysis Dupont Ratio 2008 2009 2010 2011 Profit Margin 7.96% 4.21% 7.95% 9.53% Total Asset Turnover 66.62% 50.46% 54.48% 61.12% Equity Multiplier 592.50% 852.02% 686.42% 707.38% ROE 31.42% 18.10% 29.73% 41.20% Liabilities Breakdown Assets Breakdown Receivable : Source form Deere 2010 annual report Financial Projections 1. Required return Current Shares Shares Outstanding Current Share Price Capital Beta Equity Value Debt Leverage (Debt/equity ratio) 403390000.0 $79.34 1.41 32,004,962,600 26,589,600,000 83.08% Rate Assumptions Tax Rate Risk Free Rate Market Risk Premium Cost of Debt 34.00% 5.00% 6.00% 2.85% Required Returns Equity Return WACC default risk premium 13.46% 8.21% 3.00% Required Returns 11.21% 2012/4/12 Financial Projections 2. Growth rate 3. Key assumption(A1 and A2 sheet) Application of Valuation Tools DCF Model Base Downside Upside Price 96.67 68.96 126.11 Weight 33% 33% 33% Price 31.9011 22.7568 41.6163 96.2742 Current Price $79.34 (04/12/2012) DCF Price $96.27 Multiple Price $85.12 Target Price $94.04 Recommendation: Buy 100 shares @market price Thank you ! Q&A