Trucking Trends - Louisville Sustainability Council

advertisement

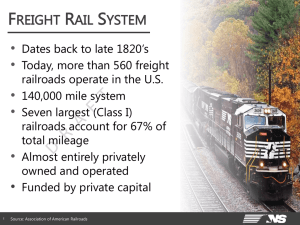

Transportation Trends Money and Tons • Revenue: $681.7 billion in gross freight revenues (primary shipments only) from trucking, representing 81.2% of the nation’s freight bill in 2013. • Tonnage: 9.7 billion tons of freight (primary shipments only) transported by trucks in 2013, representing 69.1% of total domestic tonnage shipped. Taxes-Our Fair Share Taxes: $37.8 billion paid by commercial trucks in federal and state highway-user taxes in 2012. Commercial trucks make up 12.8% of all registered vehicles, and paid $17.6 billion in federal highway-user taxes and $20.3 billion in state highway-user taxes, in 2012. Combined Local, State and Federal Gas Tax in KY 50.90 ranks 13th in the U.S. Kentucky ranks 3rd nationally in highway user fees. Trucking Registration equal 65% of total registration fees in KY 46% of State and Federal Highways fees come from trucking Transportation Funding • Map 21-Kicking The Can Down The Road • Trucking Pays Its Fair Share – – – – – IRP, IFTA, KYU, KIT, UCR KY Ranks 3rd in Highway User Fees 43%-49% of Total Highway User Fees 77% of Registration Fees Only 14% of Miles Traveled • Future Funding Mechanism – – – – – Fuel Tax VMT Tolling Indexing Registration Miles & Miles & More Miles Mileage: 421.3 billion miles logged by all trucks used for business purposes (excluding government and farm) in 2012. 30.6% of all miles traveled by trucks. 14.2% of all motor vehicle miles traveled. 152.4 billion miles logged by all Class 6 - 8 trucks used for business purposes (excluding government and farm) in 2012. Big Time Fuel Users Fuel Consumption: 52.7 billion gallons of fuel consumed by those trucks used for business purposes in 2013. 37.7 billion gallons of diesel fuel. 15.1 billion gallons of gasoline Reducing Trailer Resistance Reducing Tire Resistance There Are A Bunch Of Trucks • Number of Trucks: 32.1 million trucks registered and used for business purposes (excluding government and farm) in 2012, representing 24.4% of all trucks registered. 2.3 million Class 8 trucks used for business purposes (excluding government and farm) in 2012. 11.7 million commercial trailers registered in 2012. 20,000 + IRP vehicles in Kentucky Diesel Price “Spiking” Intensifying! The number of times the week-toweek change in the national retail diesel price exceeded 5 cents (up or down) • 1990s: once in 302 weeks (0.3%) • 2000s: 95 times in 521 weeks (18.2%) • 2010s: 42 times in 186 weeks (22.5%) Trucking Companies Number of Companies: According to the U.S. Department of Transportation, as of September 2013, For-hire carriers 465,697, Private carriers totaled 725,179 Interstate motor carriers totaled 164,723. 90.1% operate 6 or fewer trucks. 97.1% operate fewer than 20 trucks. Transportation Jobs • Employment: 7 million people employed throughout the economy in jobs that relate to trucking activity in 2012, excluding self-employed. 3.2 million truck drivers employed in 2012. 107,000 people employed in trucking-KY Represents 7% of the workforce in KY Average annual trucking wages $42,000 and rising What Factors Will Impact Transportation Mode of the Future? Factors • Normal market conditionsservice, reliability, pricing, competitor missteps • Industry investment in equipment, infrastructure, technology • Government investments • Government regulations • Shifts in population • Shifts in oil and gas production • Panama Canal expansion 25% diversion of freight west to east Panama Canal Expansion How Does Freight Move In Kentucky? • • • • • • • Total Freight Tonnage 169,456,120 Inbound Freight 45% Outbound Freight 55% Trucking 76.53% Rail 10.29% Waterways 10.78% Intermodal .88% Air 1.52% National Highway System 2035 89% of cost concentrated on 12% of Interstate miles Cost of Congestion Los Angeles metro worst with $1.1B in costs Freight Performance Measures 2013 Top Ten Bottlenecks Average Speed 2011 Rank Change 1 Chicago, IL: I-290 at I-90/I-94 30.13 1 0 2 Houston, TX: I-610 at US 290 41.99 14 +12 3 Austin, TX: I-35 35.79 4 +1 4 Fort Lee, NJ: I-95 at SR-4 28.98 2 -2 5 St. Louis, MO: I-70 at I-64 West 41.62 11 +6 6 Louisville, KY: I-65 at I-64/I-71 44.93 3 -3 7 Houston, TX I-45 at US-59 38.55 17 +10 8 Cincinnati, OH: I-71 at I-75 48.12 9 +1 9 Houston, TX: I-10 at I-45 45.63 15 +6 42.44 7 -3 Rank Location 10 Dallas, TX: I-45 at I-30 Cost of Congestion • 2013 cost of $9.2 billion • 141 million lost hours of productivity – Translates to over 51,000 drivers sitting idle for a working year • Overall average of $864 per registered large truck (GVWR 10k+ lbs.) CA and TX each had over $1B in costs Maine had lowest cost ($5.1M) Louisville 2,000 Truck Sample Same 2,000 Trucks After 24 Hours Same 2,000 Trucks After 72 Hours Same 2,000 Trucks After 5 Days Same 2,000 Trucks After 7 Days Trucking Trends • Trucks will continue to dominate the transportation of general commodities • Anticipate truckload carriers will boost their use of railroads • For Hire Carrier tonnage will increase annually by 3.3% • LTL average annual growth expected to be around 3.5% for the next 5 years. • Private carrier volume is slated to expand 2.8% per year for the next 5 years. Rail Intermodal • Rail intermodal tonnage is forecast to expand 6.5% per year on average from 2010 to 2015. • Longer term, growth is pegged at 5.2% per year through 2021. • Rail intermodal revenue rises from an estimated $9.4 billion in 2009 to $15.6 billion in 2015 and $23.6 billion by 2021. • This translates into average annual growth of 11.1% during 2010-2015 and 8.6% per year on average through 2021. Rail Freight Trends • Overall rail share of total tonnage is pegged at 15.2% (carload plus intermodal) • Rail carload traffic is set to grow 1.5% the next 5 years. • Rail intermodal is forecasted to expand 6.2% per year for the next 5 years. Future Challenges • Transportation Funding • Regulatory • Workforce Regulatory-What Does It Mean? • • • • • • • Small Guy Will Struggle Workforce Will See Attrition Increased Costs Safer Highways Length of Haul Will Reduce Potential Need For More Capacity Market Historically Has Adjusted Safe and Efficient Transportation Act 97,000 Pound Trucks? • States Will Still Control • 44 States Already Allow Heavier Trucks • Highway Stress • Safety Concerns • 60 foot 6 inch Walmart Super-Cube Rig In Cab Communications Vehicle to Vehicle & Vehicle to Infrastructure • Collison Avoidance Technology • Platooning • Self Driving Vehicles • Hot Spots • E-Screening Future Workforce? • • • • • • • • Truck Drivers Are Getting Older Transitioning To A Less Experienced Work Force Regulations Will Create Attrition Strong Economy Other Opportunities More Immigrants Qualified Drivers Tough To Find Pay Increases May Not Be Enough Driver Entry Age 23 or Older Technology • Rapidly Improving – In Cab Communication – Communication With Enforcement – Anti Crash/Anti Rollover – Real Time Communication With Home Terminal – Real Time Training – Real Time Billing Contact Information Jamie Fiepke KMTA President/CEO 502-227-0848 jfiepke@kmta.net Trucks Use a Lot of Fuel • In 2013, trucking consumed 52.7 billion gallons of fuel – 37.7 billion gallons of diesel (72%) – 15.1 billion gallons of gasoline (28%) Large On-Highway Diesel Fuel Bill • Annual diesel costs were $87 billion (2009); $109 billion • (2010); $143 billion (2011); $156 billion (2012); $149.5 (2013) • 1¢ diesel increase = $350 - $375 million in added fuel costs to industry Natural Gas Is Natural Gas a Viable Fuel Option for Trucking? Outlook Remains Positive Top 10 Reasons Natural Gas Looks Promising for Trucking • • • • • • • • • • Roughly $1.00 (LNG) - $1.50 (CNG) cheaper per DGE Domestically-produced Vast supplies readily available Future cost projections remain low Fuel surcharges roller-coaster Manufacturers have/will have product lines Fleet requests for natural gas trucks is on the rise Infrastructure build-out continues OEM competition will decrease equipment costs and fleet competition will increase market penetration of equipment Lower emissions Natural Gas Use in Transportation is Not a New Concept First U.S. Well Dug in 1821 William Hart dug the first well specifically to produce natural gas in the U.S. in the Village of Fredonia on the banks of Canadaway Creek in Chautauqua County, NY. It was 27 feet deep, excavated with shovels by hand, and its gas pipeline was hollowedout logs sealed with tar and rags. The 1920’s “Cutting Edge” Car Further Advances in the 1930’s 1980’s Chinese Natural Gas Vehicles To the Present … Issues for States • Fracking bans • Vehicle weight exemptions • State tax incentives and grants • Truck safety concerns • Road degradation • Taxation of natural gas • Note: fracking-associated hauls provide significant economic boon for tank truck industry (≈2000 hauls per fracked well)