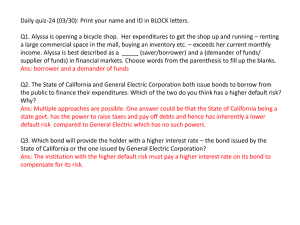

CHAPTER 8

advertisement

CHAPTER 8 Bond Valuation and Risk 1 CHAPTER 8 OVERVIEW This chapter will: A. Explain how debt securities are priced B. Identify the factors that affect bond prices C. Explain how the sensitivity of bond prices to interest rates is dependent on particular bond characteristics D. Explain the benefits of diversifying bonds internationally 2 A. Bond Valuation Process 1. Bond Valuation Pricing formula: C C C par PV ... 1 2 n 1 k 1 k 1 k where C = coupon payment paid in each period Par= par value k = required rate of return n = number of period to maturity 3 A. Bond Valuation Process 2. Impact of the Discount Rate on Bond Valuation a. Critical to accurate bond valuation b. High risk securities have higher discount rates 4 A. Bond Valuation Process 3. Impact of the Timing of Payments on Bond Valuation a. Timing affects the market price of a bond b. Funds received sooner can be reinvested to earn additional returns c. Most bonds have semiannual coupons 5 B. Factors that Affect Bond Prices 1. Bonds selling below par a. If coupon rate is below required rate, present value of the bond is below par b. known as a discount bond 2. Bonds selling at par a. If coupon rate equals the required rate, the price of the bond is equal to par value 3. Bonds selling above par a. If the coupon rate is above the required rate, the price of the bond is above the par b. known as a premium bond 6 B. Factors that Affect Bond Prices 4. Factors That Affect the Risk-Free Rate a. Inflationary Expectations b. Economic Growth c. Money Supply Growth d. Federal Government Budget Deficit 7 B. Factors that Affect Bond Prices 5. Factors That Affect the Credit (Default) Risk Premium a Changes in the Credit Risk Premium over Time b. Changes in Bond Ratings over Time 8 C. Sensitivity of Bond Prices to Interest Rate Movements 1. Bond Price Elasticity a. Influence of Coupon Rate on Bond Price Sensitivity b. Influence of Maturity on Bond Price Sensitivity 9 C. Sensitivity of Bond Prices to Interest Rate Movements 2. Duration a. Duration of a Portfolio b. Modified Duration c. Estimation Errors from Using Modified Duration d. Bond Convexity 10 C. Sensitivity of Bond Prices to Interest Rate Movements 3. Bond Investment Strategies Used by Investors a. Matching Strategy b. Laddered Strategy c. Barbell Strategy d. Interest Rate Strategy 11 D. Return and Risk of International Bonds 1. Influence of Foreign Interest Rate Movements 2. Influence of Credit Risk 3. Influence of Exchange Rate Fluctuations 12 D. Return and Risk of International Bonds 4. International Bond Diversification a. Reduction of Interest Rate Risk b. Reduction of Credit Risk c. Reduction of Exchange Rate Risk 13