Reserve Bank of India India - Macroeconomic Situation Assessment

advertisement

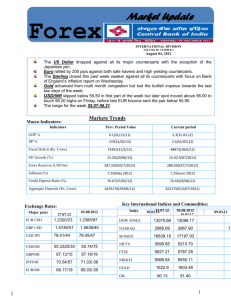

Reserve Bank of India India - Macroeconomic Situation Assessment and Prospects Indian Merchants’ Chamber Mumbai June 19, 2012 Dr. Duvvuri Subbarao Governor Reserve Bank of India 1 India Macroeconomic Situation Cause for Concern? 2 India - Macroeconomic Situation Trends in Growth Rate Long-Term Trend Recent Trend 10.0 10.0 8.7 9.0 9.5 8.0 7.5 9.6 9.0 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 8.5 5.6 8.0 Percent Per cent 6.2 7.5 7.0 6.5 6.5 6.0 5.5 5.0 3 India Growth Story What drove India’s growth in the pre-crisis period and what explains the current moderation? 4 What is the inflation story? Year-on-Year Inflation Rates 11 9 5 3 1 WPI - Headline Apr/12 Jan/12 Oct/11 Jul/11 Apr/11 Jan/11 Oct/10 Jul/10 Apr/10 Jan/10 -2 Oct/09 per cent 7 WPI- Non-food Manufactured Products 5 Moderation in WPI not transmitted to CPI Year-on-Year Inflation Rates 11 9 8 7 WPI - Headline May/12 Apr/12 Mar/12 Feb/12 6 Jan/12 per cent 10 CPI (New)- Combined 6 What is driving Inflation? • Food (structural) • Fiscal deficit • Demand pressures • Commodity prices + depreciation 7 What has RBI done to control inflation? 8 Has RBI succeeded in controlling inflation? 9 Has RBI’s tight monetary policy hurt growth? 10 9 18 4 8 3 6 2 4 1 2 0 0 Growth in Private Fixed Capital Formation (Right Scale) 2011-12 10 2010-11 5 2009-10 12 2008-09 6 2007-08 14 2006-07 7 2005-06 16 2004-05 8 Growthin Private Fixed Capital Formation (Per cent) Real Weighted Average Lending Rate and Growth in Private Fixed Capital Formation 2003-04 Real Weighted Average Lending Rate (Per cent) Is it the high interest rate that is inhibiting investment? Real Weighted Average Lending Rate (Left Scale) 11 If inflation is caused by supply side pressures, is tight monetary policy an appropriate response? 12 What is required to revive growth? 13 How much has the rupee depreciated and why? Month-wise Trend in Rupee-dollar Exchange Rate and REER 6 Currency 30 120 118 116 114 40 45 110 REER 112 108 50 106 104 55 102 May-12 Apr-12 Mar-12 Feb-12 Jan-12 Dec-11 Nov-11 Sep-11 Aug-11 Oct-11 REER 6 Currency (RHS) June 2012 (so far) Rs/US$ Jul-11 Jun-11 100 May-11 60 Apr-11 Rs per US$ Nominal Exchange Rate 35 14 What is causing rupee depreciation? 15 Is the rupee depreciation entirely due to global factors? Depreciation/Appreciation of BRICS Currencies (June 12, 2012 over End-July 2011) . 5.0 1.0 0.0 Per cent -5.0 -10.0 -15.0 -16.2 -20.0 -20.6 -25.0 -20.7 -24.4 -30.0 Brazilian Real South African Rand Chinese Yuan Russian Ruble Indian Rupee 16 What has RBI done to contain the movement in the exchange rate? 17 What is RBI’s policy on exchange rate? 18 What drives the exchange rate? 19 Why 2012 is not 1991? 20 Is there a new normal for inflation? 21 Has India’s potential growth rate declined? 22 What are the risks to the growthinflation outlook? 23 Is the “India Growth Story” still credible? 24