Forecasting-08

advertisement

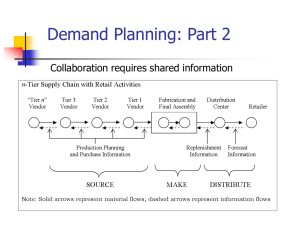

Forecasting of Demand Chapter 7 of Chopra Read: Chap. 7.1-7.4; p207; p212-214 (upto/exclude “Trend-corrected …”); 7.6; 7.7-upto p220 (exclude “Trend-corrected …”); 7.10. 1 Global Sourcing • components take different lead times before reaching the destinations wooden casing: sea, Sweden Cheap peripheral : van, HK microprocessors: air, Malaysia destination: USA screws: train, China (Sichuan) LCD: truck, China microphone: air, Japan Resistors, capacitors, 2 DVD Players A CM/OED 3 About 10 pages Murphy’s Law: If anything can go wrong, it will. 4 When and In What Quantity to “Buy/Make” of Each Parts/Finished Goods? Push/Pull Processes (Chapter 1) • With pull processes, execution is initiated in response to a customer order -reactive Make-to-order, assemble-to-order • With push processes, execution is initiated in anticipation of customer orders -speculative Make-to-stock Suppliers: Parts, … Procurement process Clock’s assembly factory Manufacturing/ Fulfillment Processes Orders 5 Learning Objectives • • • • Describe types of forecasts Describe time series Use time series forecasting methods Explain how to monitor & control forecasts 6 What Is Forecasting? • Process of predicting a future event • “Forecasting is difficult especially when it has to deal with future” -- Mark Twin Sales will be $200 Million! • Underlying basis of all business decisions – Production – Inventory – Facilities, …... 7 Why forecast demand? • We need to know how much to make ahead of time, i.e. our production schedule – How much raw material – How many workers – How much to ship to the warehouse in XXX • We need to know how much production capacity to build 8 Why Forecasting ? • You’re managing merchandises for Park’n Shop. Fruits take 3 wks to arrive from Australia. • You need to commit to a number of containers NOW for the month of March in order for a better price • Coca-Cola Bottling: next quarter’s demand + promotions -> production plan/ orders of concentrates 9 Forecasting is Always Wrong • “I think there is a world mkt for maybe 5 computers” Thomas Watson, Chairman of IBM, 1955 • “There is no reason anyone would want a computer in their home.” - Ken Olson, CEO and Founder of Digital Equipment Corp. , 1977 • “640K should be enough for anybody.” -- Bill Gates, 1981 • “Economists are good at explaining why their forecasts always went wrong” -- Economist, xx, 1998 • “Fore. represents a constant pain for human being” -- some one 10 Coping with Forecast Errors • Better forecasting methods (e.g., new SCM concepts) • Buffer mechanism (e.g., safety stock) • Shorter lead time (i.e., reducing f horizon) • Flexible ops (mass customisation approach) 11 Forecasting v.s. Planning • Forecast: – About what will happen in future • Plan: – About what should happen in future – Forecasts as input • All plans are based upon some fore. explicitly or implicitly 12 Forecasting v.s. Planning • When sales dept. shows sales forecasts, be cautious. They may be goals • Both forecasting and planning are art and science – Quant f methods - educated guessing • must be tempered by judgement bec’s • quant f assumes future is a continuation of the past 13 Types of Forecasts by Time Horizon • Short-range forecast – Up to 1 year; usually < 3 months – Procurement, worker assignments • Medium-range forecast – 3 months to 3 years – Sales & production planning, budgeting • Long-range forecast – 3 + years – Capacity planning, facility location 14 15 Types of Forecasts by Item Forecast • Key forecasts in business: • Future demand for products, Sales • Demand (sales = demand - lost sales) • Future price of various commodities • Lead times • Processing times (learning curves) … 16 Forecasting Steps • • • • • • • • • Define objectives Select items to be forecasted Determine time horizon Select forecasting model(s) Gather data Validate forecasting model Make forecast Implement results Monitor forecast performance 17 Forecasting Approaches Qualitative Methods Quantitative Methods • Used when situation is • Used when situation is vague & little data exist ‘stable’ & historical data – New products exist – New technology 3G – Existing products – Current technology • Involves intuition, experience • Involves mathematical techniques • e.g., forecasting sales on Internet • e.g., forecasting sales of milk, tissue papers, … 18 Quantitative Forecasting Methods Qualitative Simulation Moving Average Quantitative Forecasting Time Series Models Exponential Smoothing 時間序列 Trend & Season Causal Models 因果關係 Regression 19 A future is continuation of the past (short run) ERP: Enterprise Resource Planning Black Box 20 What’s a Time Series? • Set of evenly spaced numerical data – Obtained by observing response variable at regular time periods • Forecast based only on past values – Assumes that factors influencing past, present, & future will continue 21 1st & 2nd Law of Forecasting 1. In forecasting, we assume the future will behave like the past – If behavior changes, our forecasts can be terrible 2. Even given 1, there is a limit to how accurate forecasts can be (or nothing can be predicted with complete accuracy) – The achievable accuracy depends on the magnitude of the noise component 22 Monthly Demand for Sport-3506 Monthly Demand 160 140 De m and 120 100 80 60 40 20 0 0 5 10 15 20 25 30 35 40 Month 23 TS of a Raw Material’s Price Raw Material Price 3.8 3.6 Price ($/Unit) 3.4 3.2 3 Price 2.8 2.6 2.4 2.2 2 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Period 24 Monthly Australian Red Wine Sales Series 3000. 2500. 2000. 1500. 1000. 500. 0 20 40 60 80 100 120 140 25 Monthly new polio cases in the U.S.A., 1970-1983 Series 14. 12. 10. 8. 6. 4. 2. 0. 0 20 40 60 80 100 120 140 160 26 Monthly Traffic Injuries (G.B) beginning in January 1975 Series 2200. 2000. 1800. 1600. 1400. 1200. 1000. 0 20 40 60 80 100 120 27 Daily Dow Jones & HSI Series 2 Series 1 14.00 14.00 13.50 13.50 13.00 13.00 12.50 12.50 12.00 12.00 11.50 11.50 11.00 11.00 10.50 10.50 10.00 10.00 9.50 0 10 20 30 40 50 60 70 0 10 20 30 40 50 60 70 30 Time Series Components Sales Original T.S. Time 31 Time Series Components Trend Cyclical Seasonal Random 32 Trend Component • Persistent, overall upward or downward pattern • Due to population, technology etc. • Several years duration Response Mo., Qtr., Yr. 33 HK Regional Headquarters 34 Cyclical Component • Repeating up & down movements • Due to interactions of factors influencing economy • Usually 2-10 years duration Cycle Response Mo., Qtr., Yr. 35 Electronics & Machinery Output 140.0 120.0 Index 100.0 80.0 Seri 60.0 40.0 20.0 0.0 0 1982 20 1985 40 60 1990 Yr 1995 80 2000 03 100 36 Port Unloading (Annual, 1993-2005) 160 000 140 000 120 000 100 000 80 000 60 000 40 000 20 000 0 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 37 Seasonal Component • Regular pattern of up & down fluctuations • Due to weather, customs etc. • Occurs within 1 year Spring Festives Response Mo., Qtr. 38 Quarterly 39 40 Random Component • Erratic, unsystematic, ‘residual’ fluctuations • Due to random variation or unforeseen events – Union strike – Tornado • Short duration & nonrepeating 41 General Time Series Models • Any observed value in a time series is the product (or sum) of time series components • Multiplicative model Yi = Ti · Si · Ci · Ri (if quarterly or mo. data) • Additive model Yi = Ti + Si + Ci + Ri (if quarterly or mo. data) • Hybrids 42 Time Series Components Sales Original T.S. Time 43 Time Series Components Original T.S. Cycle Seasonal Trend Random 44 Purely Random Error No Recognizable Pattern Demand Demand Sub-summary Common Time Series Patterns Increasing Linear Trend Time Seasonal Pattern Demand Demand Time Time Seasonal Pattern plus Linear Growth Time 45 Underlying model and definitions -Static Method Systematic component = (level + trend) x seasonal factor L = estimate of level for period 0 (de-seasonalised demand) It assumes the estimates of level, T= estimate of trend (increase/decrease demand per trend, and seasonality do notin vary period) as new demand is observed, at St= Estimate of seasonal factor for period t least for a fairly large number of Dt= Actual demand observed for period t periods. Ft= Forecast of demand for period t Ft+k = [ L+ (t+k)T ]St+k Note: pp 207-211 on Static Forecast. – skip 46 HK Regional Headquarters Static You may use 1991-2002 to estimate the “trend line”; after 2003/05, you still use47 this line to project the future – not update it with 2003/05 new observation! Monthly Demand for Sport-3506 Monthly Demand 160 140 De m and 120 100 80 60 40 20 0 0 5 10 15 20 25 30 35 40 Month 48 Adaptive forecasting • The estimates of level, trend and seasonality are updated after each demand observations Lt estimate of level at end of period t (de - seasonalis ed) Tt estimate of trend at end of period t St estimate of seasonal factor for period t Dt actual demand observed for period t Ft forecast of demand for period t (made in period t-1 or earlier) Ft k (Lt kTt )St k 49 Moving Average Lt ( Dt Dt 1 Dt ( N 1) ) / N Lt 1 ( Dt 1 Dt Dt 1 Dt ( N 2 ) ) / N Ft k Lt • • • • • • for all k Assumes no trend and no seasonality => Level estimate is the average demand over most recent N periods Update: add latest demand observation and and drop oldest Forecast for all future periods is the same Each period’s demand equally weighted in the forecast How to choose the value of N? – – N large => N small => 50 Moving Average Example You’re manager of a museum store that sells historical replicas. You want to forecast sales (000) for 1998 using a 3period moving average. 1994 4 1995 6 1996 5 1997 3 1998 7 51 Moving Average Solution Time All of what we need to know is number: 5,Total Demand thisMoving is the forecast for all Di which future (N = 3) periods! 1994 4 1995 6 1996 5 NA Why do we need to calculate the forecasts for the past NA periods? NA Forecasts Moving Avg. ( N = 3) NA NA NA 1997 3 4 + 6 + 5 = 15 15/3 = 5.0 1998 7 6 + 5 + 3 = 14 14/3 = 4.7 1999 NA 5 + 3 + 7 = 15 15/3 = 5.0 Forecast for 1999 52 Moving Average Graph Sales 8 6 4 2 0 94 Actual Forecast 95 96 97 Year 98 99 53 Milk– weekly data / Pet products – monthly data A pet supply product ( 6 varieties) 6000 5000 4000 3000 2000 1000 0 l l l l t v c t v c t v c t v c r r r r r y r y r y r y an eb a p a un Ju ug ep c o e an eb a p a un Ju ug ep c o e an eb a p a un Ju ug ep c o e an eb a p a un Ju ug ep c o e a /2 J /F /M 2/A /M 2/J 2/ /A /S 2/O /N /D 3/J /F /M 3/A /M 3/J 3/ /A /S 3/O /N /D 4/J /F /M 4/A /M 4/J 4/ /A /S 4/O /N /D 5/J /F /M 5/A /M 5/J 5/ /A /S 5/O /N /D 6/J 0 02 02 0 02 0 00 02 02 0 02 02 0 03 03 0 03 0 00 03 03 0 03 03 0 04 04 0 04 0 00 04 04 0 04 04 0 05 05 0 05 0 00 05 05 0 05 05 0 20 20 20 20 20 20 2 20 20 20 20 20 20 20 20 20 20 20 2 20 20 20 20 20 20 20 20 20 20 20 2 20 20 20 20 20 20 20 20 20 20 20 2 20 20 20 20 20 20 2 54 Moving Average Method • Used if little or no trend • Used often for smoothing – Provides overall impression of data over time • Why “moving” not just overall mean? 55 Cereal Sales in HK Quantity (kg) Year 56 Monthly Sales Within a year Month 57 Disadvantages of Moving Averages • Increasing N makes forecast less sensitive to changes • Do not forecast trend well • Require much historical data – N, while exponential only last forecast! 58 Simple Exponential Smoothing (No trend, no seasonality) Lt 1 Dt 1 (1 ) Lt Ft n Lt 1 for all n 1 • Rationale: recent past more indicative of future demand observing Dt+1 for period t+1, we of latest demand • After Update: level estimate is weighted average observation andestimate previous estimate revise the of the level is called the smoothing constant (0 < < 1) (as defined in the textbook) • Forecast for all future Or periods is the same • Assume systematic component of demand is the same for all After observing D for period t, t periods (L) Lt = guess Dt + (1-) Lt-1 • Lt is the best at period t of what the systematic demand level is For all n1, Ft+n = Lt 59 Simple Exponential Smoothing – Example 7-2 Data: 120, 127, 114, 122. L0= 120.75 = 0.1 F1 = L0 =120.75 Alternatively, if you are only Note:interested (120+127+114)/3 be estimated in a D1= 120 in F5, then LL30 =can =120.33 way! Here L subjective 0 E1 = F1 – D1 = 120.75 – 120 = 0.75 =(120+127+114+122)/4 0.1- D4+0.9 L1 = DL1 4+=(1 ) L0 L3 = 12.2+108.2 =120.4 Especially when there is = (0.1)(120) + (0.9)(120.75) = 120.68 => F5 insufficient = 120.4 data. F2 = L1= 120.68, F3 = L2 = 121.31, … F5 = L4= 120.72 => the forecast for period 5 60 Simple Exponential Smoothing – Example: Tables 7-1 & 7-5 L0= 22083 F1 = L0 = 0.1 D1=8000 E1 = F1 – D1 = 22083 – 8000 = 14083 L1 = D1 + (1 - ) L0 = (0.1)(8000) + (0.9)(22083) = 20675 F2 = L1= 20675, F10 = L1 = 20675 Note: this example appears in pp 208-219 61 Simple Exponential Smoothing Lt 1 Lt ( L t Dt 1 ) • • • Et 1 Update: new level estimate is previous estimate adjusted by weighted forecast error How to choose the value of the smoothing constant ? – Large responsive to change, forecast subject to random fluctuations – Small may lag behind demand if trend develops Incorporates more information but keeps less data than moving averages – – Average age of data in exponential smoothing is 1/ Average age of data in moving average is (N+1)/2 If is 0 then … If is 1 then ... 62 Understanding the exponential smoothing formula Lt 1 Dt 1 (1 ) Lt Dt 1 (1 )(Dt (1 ) Lt 1 ) Dt 1 (1 ) Dt (1 ) 2 Lt 1 Dt 1 (1 ) Dt (1 ) 2 Dt 1 (1 ) k Dt k • Demand of k-th previous period carry a weight of hence the name exponential smoothing • Demand of more recent periods carry more weight 63 Forecast Effect of Smoothing Constant () The alpha parameter for exponential smoothing ... Period .10 .30 .50 .70 1 .10 .30 .50 .70 Ft = ·Dt - 1 + 2 .09 .21 .25 .21 ·(1-)·Dt 3 .08 .15 .13 .06 + 4 .07 .10 .06 .02 ·(1- )2·Dt - 3 + 5 .07 .07 .03 .01 ·(1- )3·D t - 4 + ... 6 .06 .05 .02 .00 7 .05 .04 .01 8 .05 .02 .00 64 Exponential Smoothing Example You’re organising a international meeting. You want to forecast attendance for 2000 using exponential smoothing ( = .10). The 1994 forecast was 175. 1994 180 1995 168 1996 159 1997 175 1998 190 65 Exponential Smoothing Solution Lt = Lt-1 + · (Dt - Lt-1) Time Actual Forecast, Ft ( = .10) 1994 180 175.00 (Given) 1995 168 175.00 + .10(180 - 175.00) = 175.50 1996 159 175.50 + .10(168 - 175.50) = 174.75 1997 175 174.75 + .10(159 - 174.75) = 173.18 1998 190 173.18 + .10(175 - 173.18) = 173.36 1999 NA 173.36 + .10(190 - 173.36) = 175.02 66 Trend corrected exponential smoothing (Holt’s model) Update : Lt Dt (1 )( Lt 1 Tt 1 ) Tt ( Lt Lt 1 ) (1 )Tt 1 Forecast : Skipped Ft n Lt nTt is the smoothing constant for trend updating • If is large, there is a tendency for the trend term to “flip-flop” in sign • Typical is 2 67 Holt’s model - Example L0= 12015 T0=1549 = 0.1 0.2 F1 = L0 + T0 = 12015 + 1549 = 13564 , D1=8000 E1 = F1 – D1 = 13564 – 8000 = 5564 L1 = D1 + (1 - )(L0 + T0) = (0.1)(8000) + (0.9)(13564) = 13008 Skipped T1 = (L1 L0) + (1 - )T0 = (0.2)(13008 12015) + (0.8)(1549) = 1438 F2 = L1+T1= 13008+1438 = 14446, F10 = L1 + 9 T1 = 13008 + 9(1438) = 25950 68 Trend and seasonality corrected exponential smoothing (Winter’s model) Update : Dt 1 (1 )( Lt Tt ) Lt 1 St 1 Tt 1 ( Lt 1 Lt ) (1 )Tt Skipped Dt 1 (1 ) St 1 St 1 p Lt 1 Forecast : Ft n ( Lt nTt ) St n 69 Trend- & Seasonality-corrected Exp Smooth. (level +trend ) x seasonal factor (Winter’s Smoothed value Method/Model) for t+1 Need 3 revision eqns ,D, ==Actual smooth. para. St+1 ==Seasonal factor, p? Tt+1 Trend forecast t+1 (1) Lt+1 = (Dt+1 / St+1 )+ (1- ) (Lt + Tt ) (2) Tt+1 = ( Lt+1 – Lt ) + (1- ) Tt Skipped (3) St+p+1 = (Dt+1 / Lt+1 ) + (1- ) St+1 Tt = Forecast for t+n Forecast of t+n: Ft+n = (Lt + nTt ) St+n , n >1 70 Winter’s model - Example L0= 18439 T0=524 S1 = 0.47, S2 =0.68, S3 =1.17, S4 =1.67, = 0.1, 0.2, = 0.1, F1 = (L0 + T0) S1 = (18439 + 524)(0.47) = 8913 D1=8000, E1 = F1 – D1 = 8913 – 8000 = 913 L1 = (D1/S1) + (1 - )(L0 + T0) = T1 = (L1 L0) + (1 - )T0 = (0.2)(18769 18439) + (0.8)(524) = 485 S5 = (D1/L1) + (1 - )S1 = (0.1)(8000/18769) + (0.9)(0.47) = 0.465 Skipped F2 = (L1+T1)S2 = F11 = (L1 + 10 T1)S11 = 71 Winter’s ES • Why Dt+1 /St+1? • How to initialize the forecast? • How to choose alpha, beta and gamma values? Skipped • Winter’s method is an extension of Holt’s 72 Special Forecasting Difficulties for Supply Chains • New products and service introductions – – – – • No past history Use qualitative methods until sufficient data collected Examine correlation with similar products Use a large exponential smoothing constant Lumpy derived demand – – – • Not required Large but infrequent orders Random variations “swamps” trend and seasonality Identify reason for lumpiness and modify forecasts Spatial variations in demand – Separate forecast vs. allocation of total forecasts 78 A Lumpy Demand Example 140 120 100 80 Skipped Series1 60 40 20 0 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 79 Analysing Forecast Errors • • Choose a forecast model Monitor if current forecasting method/model accurate – – • Understand magnitude of forecast error – • Consistently under-predicting? Over-predicting? When should we adjust forecasting procedures? In order to make appropriate contingency plans Assume we have data for n historical periods Et Ft Dt forecast error in period t At Et absolute deviation for period t 80 Measures of Forecast Error • Mean Square Error (MSE) 1 n 2 MSEn Et – Estimate of variance (s ) of random component n i 1 Mean Absolute Deviation 1 n (MAD) MAD A n t – If random component n i 1 normally distributed, s1.25 MAD 100 n Et Mean Absolute Percent MAPE n Error (MAPE) n i 1 Dt 2 • • 81 Further Error Equations • What does it mean when MFE 0 ? • What does it mean when MFE = MAD? • What does it mean when MSE < MAD? • Why do we need MAPE? 82 Guidelines for Selecting Forecasting Model • No pattern or direction in forecast error – Error = (Fore. -Actual ) – Seen in plots of errors over time • Smallest forecast error – Mean square error (MSE) – Mean absolute deviation (MAD) 83 Pattern of Forecast Error Trend Not Fully Accounted for Desired Pattern Error Error 0 0 Time (Years) Examples? Time (Years) 84 Forecasting Steps • • • • • • • • • Define objectives Select items to be forecasted Determine time horizon Select forecasting model(s) Gather data Validate forecasting model Make forecast Implement results Monitor forecast performance 85 Tracking Errors You have been using one! • Errors due to: – – • • Random component Bias (wrong trend, shifting seasonality, etc.) n biasn Et i 1 Monitor quality of forecast with a tracking signal Alert if signal value exceeds threshold – biast TSt Indicates underlying environment MADt changed and model becomes inappropriate 86 Monitoring: Tracking Signal • Tracking signal -- Checks for consistent bias over many periods • Measures how well forecast is predicting actual values • Ratio of running sum of forecast errors (RSFE) to mean absolute deviation (MAD) – Good tracking signal has low values 87 TS = RSFE / MAD RSFE(t)=RSFE(t-1)+E(t) = Bias MAD = sum of | forecast errors| over time/ n If TS is greater than some maximum value then report a problem. 88 Tracking Signal Equation RSFE TS MAD n (Fi Di ) i 1 MAD (Forecast Errors ) MAD 89 Tracking Signal Computation* Mo Forc Act Error RSFE Abs Cum MAD Error Error 1 100 90 10 10 10 2 100 95 5 15 5 3 100 115 -15 0 4 100 90 10 5 100 115 6 100 130 TS 10 10.0 1 15 7.5 2 15 30 10.0 0 10 10 40 10.0 1 -15 -5 15 55 11.0 -.5 -30 -35 30 85 14.2 -2.5 90 Tracking Signal Plot 3 2 1 TS 0 -1 -2 -3 1 2 3 4 5 6 Time 91 Tracking Signal • Limits used for tracking signal ratio usually between (-3/6, 3/6) 6 0 Time -6 • Used for monitoring Re-evaluate the model 92 Tracking Signal • Cautious! – Is it always good to have TS=0? – TS: the smaller the better? – Can TS be used for comparing models? 93 Summary so far • Importance of forecasting in a supply chain • Forecasting models and methods • Exponential smoothing – Stationary model – Trend – Seasonality • Measures of forecast errors • Tracking signals 94 A Remark • Adaptive method Observed Dt-1: Ft = f(Dt-1, …), observed Dt: Ft+1 = f(Dt , …), … • Static method (Section 7.5) – it assumes the estimates of level,. trend, and seasonality do not vary as new demand is observed: Observed Dt-1: Ft = f(Dt-1, …), observed Dt: Ft+1 = f(Dt-1 , …), … 95 • Forget all beyond this slide 96 Part 1 of As# 1 Chapter 7 in 3rd edition • Discussion questions All are posted as downloadable – Q4, Q9 • Exercises – Q1, Q 2 & Q3. • The deadline: hand in the class before ?. Part 2 will be released later. 97 Reading List (Chap. 7) • Adaptive Forecasting, up to “Trend- and Seasonality- … Winter’s Model)”. • Section 7.6. Measures of Forecast Errors. • Section 7.7, up-to “Trend- and Seasonality- … Winter’s Model)”. 98 Moving Average Method • MA is a series of arithmetic means • Used if little or no trend • Used often for smoothing – Provides overall impression of data over time • Equation Lt Demand in Previous N Periods N 99 Adaptive Forecasting Moving Average Method Systematic component of demand = Level Chopra: p. 82 100 Trend-corrected Exp Smooth. Systematic component = level +trend Dt = a t + b + Random (Holt’s Model) Need two revision eqns (1) Level component New forecast = Old forecast+ correction = Lt-1 + Tt-1 + correction Error = Dt – (Lt-1 + Tt-1 ) Lt = Lt-1 + Tt-1 + (Dt – (Lt-1 + Tt-1 ) ) = Dt + (1- ) (Lt-1 + Tt-1 ) 101 Trend-corrected Exp Smooth. (2) Trend component Tt = ( Lt -Lt-1) + (1- ) Tt (3) Forecasting Ft+1 = Lt + Tt , Ft+n = Lt + n Tt Correction: Chopra, p84 under eqn 4.14: Should be “After observing demand for period t+1”. 102 Trend- & Seasonality-corrected Exp Smooth. Systematic component = (level +trend ) x seasonal factor, with periodicity p. Dt = (a t + b) s + Random (Winter’s Model) Need 3 revision eqns (1) Lt = (Dt / St )+ (1- ) (Lt-1 + Tt-1 ) (2) Tt = ( Lt -Lt-1) + (1- ) Tt-1 (3) St+p = (Dt/ Lt ) + (1- ) St , t+p and t are the same “season”, and St is the latest estimate of seasonal factor which was made t-p periods ago (for period t). 103 Forecast: Tt+n = (Lt + nTt ) St+n Static Methods • It assumes that the estimates of level, trend and seasonality do not vary as new demand is observed – no need to update Systematic component = (Level+ trend)x seasonal factor Ft+n = [L+ (t+n ) T] St+n 104 Visual Inspection or Systematic Diagnosing 105 Equations fh 106 Forecast Error Equations • Mean Square Error (MSE) • Mean Absolute Deviation (MAD) 107 Selecting Forecasting Model Example You’re an analyst for Hasbro Toys. You’ve forecast sales with Holt’s model & expo. smoothing. Which model do you use? Actual Holt’s Model Expo Smooth Year Sales Forecast Forecast 1992 1 0.6 1.0 1993 1 1.3 1.0 1994 2 2.0 1.9 1995 2 2.7 2.0 1996 4 3.4 3.8 108 Holt’s Model Evaluation Year 1992 1993 1994 1995 1996 Total MSE = MAD = Di 1 1 2 2 4 Fi 0.6 1.3 2.0 2.7 3.4 Error Error2 |Error| 0.4 0.16 0.4 -0.3 0.09 0.3 0.0 0.00 0.0 -0.7 0.49 0.7 0.6 0.36 0.6 0.0 1.10 2.0 Error2 / n = 1.10 / 5 = .220 |Error| / n = 2.0 / 5 = .400 109 Exponential Smoothing Model Evaluation Year 1992 1993 1994 1995 1996 Total Di 1 1 2 2 4 Fi 1.0 1.0 1.9 2.0 3.8 Error Error2 |Error| 0.0 0.00 0.0 0.0 0.00 0.0 0.1 0.01 0.1 0.0 0.00 0.0 0.2 0.04 0.2 0.3 0.05 0.3 MSE = Error2 / n = 0.05 / 5 = 0.01 MAD = |Error| / n = 0.3 / 5 = 0.06 110 Further Error Equations • Mean absolute percentage error MAPE = i=1 | Ei / Di| x100/n • Bias (Mean forecast error = MFE) Bias = i=1 Ei 111 Further Error Equations • What does it mean when MFE 0 ? • What does it mean when MFE = MAD? • What does it mean when MSE < MAD? • Why do we need MAPE? 112 Tracking Signal Plot 113 Tracking Signal • Limits used for tracking signal ratio usually between (-6, 6) 6 0 Time -6 • Used for monitoring Re-evaluate the model 114 Tracking Signal • Cautious! – Is it always good to have TS=0? – TS: the smaller the better? – Can TS be used for comparing models? 115 An Example CLP Power has been collecting data on demand for electric power in a recently developed residential area for only the past 2 years. 1. What are weaknesses of the standard fore. methods as applied to this set of data? 2. Propose your own approach to forecasting. 3. Forecast demand for each month of next year using your model. 116