Chapter 5 Terms & Notes

advertisement

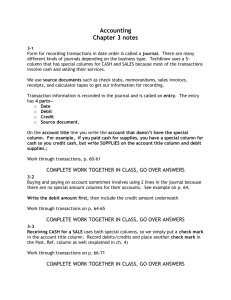

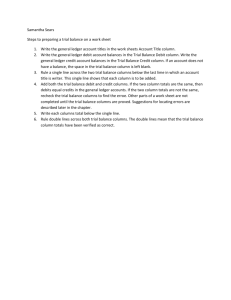

Chapter 5 Journalizing Transactions Definitions: – Journal-A form for recording transactions in chronological order.(A book of original entry) – Journalizing-Recording transactions in a journal. – Special Amount Columns-A journal amount column headed with an account title. Definitions Continued – General Amount Column-A journal amount column that is not headed with an account title. – Entry-Information for each transaction recorded in a journal. – Double-Entry Accounting-The recording of debit and credit parts of a transaction. – Source Document-A business paper from which information is obtained for a journal entry. Definitions Continued – Check-A business form ordering a bank to pay cash from a bank account. – Receipt-A business form giving written acknowledgment for cash received. – Memorandum-A form on which a brief message is written describing a transaction. – Proving Cash-Determining that the amount of cash agrees with the accounting records. Chapter Highlights Four parts of an entry – Date – Debit – Credit – Source Document – Before a transaction is recorded in a journal, it must be analyzed into its debit and credit parts. The terms Debit and Credit are abbreviated at dr and cr. These are derived from Latin and Italian words debere and credere. Ledgers with debit and credit sides became popular in the 17th century in Europe Proving a Journal Page Proving is showing that total debits = total credits. Proving has 3 steps – 1.Add each of the amount columns. – 2.Add the debit column totals, and then ad the credit column totals. – 3.Verify that debits = credits Ruling Rule a single line across all amount columns directly below the last entry to indicate that the columns are to be added. On the next line write the date in the date column. Write words carried forward if bringing totals to the top of the next page if final totals enter the word “totals”. Also place a check mark in the post reference column(PR) Rulings Continued On the top of the new page if not final totals write Brought Forward in the Account Title Column and place a check mark in the PR column. Write each column total below the single ruled line. Rule double lines blow the column totals across all amount columns. The double lines mean that the totals have been verified. Prove Cash 1-Cash Balance on 3-Subtract cash paid hand at beginning of fiscal period 2Add the cash received during the fiscal period(This is usually the cash debit total) out during the fiscal period(Usually the cash credit total) 4-Equal the cash on hand at the end of the fiscal period. 5-Verify that the cash balance = the checkbook balance. General Accounting Practices Errors are corrected in a way that does not cause doubts about whether the information is correct. Draw a neat line through an error and write the correction above the cancelled item. Words in accounting record are written in full when space permits. All items need to be legible. Only abbreviate when space is limited. Practices Continued Dollars and cents signs and decimal points are not used when writing amount on ruled account paper. Two zeros are written in the cents column when an amount is in even dollars otherwise doubts may arise as to amounts. Practices Continued A single ruled line indicates addition or subtraction. A double ruled line indicates totals are verified and correct. Neatness is important and rulers should be used to make rulings.