Exercises of computational methods in finance

advertisement

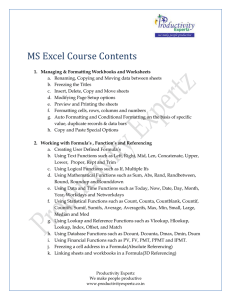

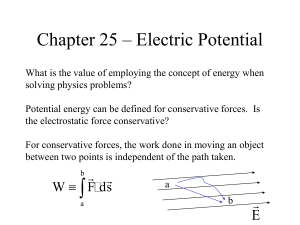

Exercises of computational methods in finance Nikos Skantzos 1. Decompose the following strategies into simple Call and Put positions (short or long). Discuss advantages and disadvantages of each of the strategies • Left: Call(K1) + Put(K2): Strangle •Advantages: protection against volatility (profit for low spots, profit for high spots) •Disadvantages: Expensive • Middle: ½Call(K1) + ½ Put(K2)-Call(K)-Put(K): Butterfly •Advantages: cheap •Disadvantages: profit limited with the two strikes • Right: Call(K1) - Put(K2): Risk reversal •Advantages: cheaper than vanilla •Disadvantages: gives risk for losses if spots is low Integrate numerically the function exp(-x²/2) between –4 and +4, using an interval of dx=0.01. Differentiate numerically and analytically the function exp(-x²/2). Write a program in VBA that calculates the functions min(a,b) and max(a,b) using the min / max of two numbers. Write a program in VBA to generate a brownian motion W(t). The input parameters are: the number of time steps, the final time. As an output, the function should return the simulated trajectory. Use the function of exercise 4 to calculate the variance of the final value of a brownian trajectory with dt=0.01, on the basis of 1000 realisations. Change the time-increment to dt=0.5 and explain why the variance increases. Write a programe in VBA to compute a Black-Scholes price (analytic formula) for a Call option: Call(S, K, s, r, q, T). Compare the price of a simple call option to the price call with a barrier where the barrier level H increases. What is the value of a 3m call on EUR/USD, rEUR = 4%, rUSD = 5% vol=25%, K=1.3 for different values of the spot. For each point of the curve calculate the Delta using finite differences and the analytic formula. If S=1.27, what is the cost of an option on 1,000,000 EUR notional? And on an option on 1,000,000 USD notional? Write a VBA program that generates variables of a normal distribution of mean μ and variance σ using the VBA uniform random number generator. Calculate the mean and the variance of the samples. Write an Excel method that calculates the cumulative function of a normal density function e-x*x/2/√(2π) Using Excel calculate Black-Scholes spotladder (price of a call option for various spot levels) for different values of (i) volatility, (ii) maturity, (iii) rates. What is the impact of each of these on the price of the option? Calculate with Monte Carlo the value of an Asian put option and compare with the value of the corresponding vanilla put. How do you explain the difference in the prices? Programm a VBA function allowing the pricing of a Call with Monte-Carlo: Call(S, K, s, r, q, T, Nsimu). Compare with the exact solution from Black-Scholes formula Calculate the number p using a Monte-Carlo method Write a VBA program that calculates the value of a digital option with Monte Carlo simulations. Compare with the analytic result. Calculate the price of a knock-out option using Monte Carlo and the formula for the surviving probabilities Price a call option using the explicit PDE method and compare the result to the Black-Scholes formula. Write a VBA program that generates variables of a normal distribution of mean μ and variance σ using the VBA uniform random number generator. Calculate the mean and the variance of the samples. Write an Excel method that calculates the cumulative function of a normal density function e-x*x/2/√(2π)