Mergers and Restructuring

advertisement

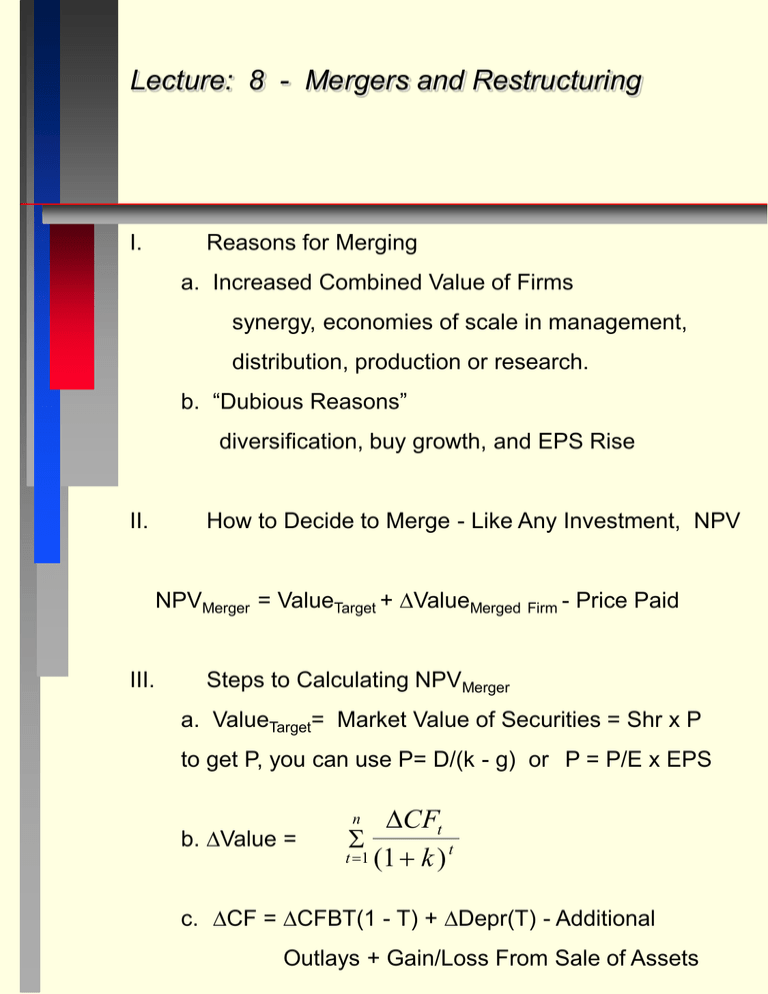

Lecture: 8 - Mergers and Restructuring I. Reasons for Merging a. Increased Combined Value of Firms synergy, economies of scale in management, distribution, production or research. b. “Dubious Reasons” diversification, buy growth, and EPS Rise II. How to Decide to Merge - Like Any Investment, NPV NPVMerger = ValueTarget + ValueMerged Firm - Price Paid III. Steps to Calculating NPVMerger a. ValueTarget= Market Value of Securities = Shr x P to get P, you can use P= D/(k - g) or P = P/E x EPS b. Value = CFt t t 1 (1 k ) n c. CF = CFBT(1 - T) + Depr(T) - Additional Outlays + Gain/Loss From Sale of Assets Lecture: 8 - Mergers and Restructuring III. Steps to Calculating NPVMerger - Continued d. Get k Commensurate with Risk e. Get Costs Which are Clear for Cash Offers f. Cost for Stock Offers - Calculate % of Bidding Firm Owned by Target Shareholders After Merger W = Shares Held by Target in Merged Firm Total Shares in Merged Firm ValueMerged firm = ValueTarget + ValueAcquirer + ValueMerged Firm Cost = W x (Value of Merged Firm) g. If DCF’s have Infinite Life Then Use Constant Growth Model or Infinite Annuity Lecture: 8 - Mergers and Restructuring Example: Consider the following incremental cash flows, depreciation and investments from a merger. Year CFBT Depr Investment 0 0 0 1 200,000 400,000 1,200,000 2 400,000 500,000 300,000 3 500,000 200,000 200,000 4- 800,000 50,000 200,000 100,000 If the corporate tax rate is .35, the cost of capital is 20%, the present market value of the target is $1,000,000 and the bidder’s market value is $4,500,000, should the target be acquired if the bidder will have to give the target shareholders 25% of the combined firm’s shares as payment to complete the acquisition? Lecture: 8 - Mergers and Restructuring Year CFBT 0 + Depr 0 - Investment 0 CF = 100,000 -100,000 1 200,000(.65) 400,000(.35) 1,200,000 -930,000 2 400,000(.65) 500,000(.35) 300,000 135,000 3 500,000(.65) 200,000(.35) 200,000 195,000 4 - 800,000(.65) 50,000(.35) 200,000 337,500 PV at time 3 of CF’s for year 4 and after = 337,500/.20 = 1,687,500 ValueMerged Firm = -100,000 - 930,000[PV.20,1] + 135,000 [PV.20,2] + 195,000 [PV.20,3] + 1,687,500 [PV.20,3] = 308,159 ValueMerged Firm = 4,500,000 + 1,000,000 + 308,159 = 5,808,159 Cost of purchase = .25(5,808,159) = 1,452,040 NPV = 1,000,000 + 308,159 - 1,452,040 = -143,881 Lecture: 8 - Mergers and Restructuring IV. Market Value Exchange Ratio Market Value of Cash and Securities Offered by Acquiring Firm/Market Value of Target’s Stock Guideline: Usually 125 - 150% V. EPS (Earnings Per Share) “Illusion” - Continued c. For Cash Payment -> EPS = E/Nx d. For Shares Payment -> Post Merger EPS = E/[Nx + PyNy/Px] where, E = Total Earnings of Combined Firm Nx = # Old Shares of Acquiring Firm X Ny = # of Shares of Target Firm Y VI. Px = Share Price of Acquiring Company Py = Share Price Offered for Target Who Benefits From Mergers a. Target Usually Benefits b. Acquirer Usually Loses or Gains Very Little c. Investment Bankers Make a Fortune Lecture: 8 - Mergers and Restructuring VIII. Tax Implications of a Merger - Tax Free if: a. Consolidation - No Tax Motivations and Continuity of Organization b. Acquisition of Whole Firm - Uses Voting Stock & Acquires at least 80% of Target’s Stock c. Acquisition of Assets - Target Shareholders Must be Shareholders in Combined Firm IX. Accounting Treatment of a Merger X. Balance Sheet Effects of a Merger XI. Income Sheet Effects of a Merger XII. Successful Mergers Focus on Fixed Assets XIII. Financing Alternatives of a Merger a. Junk Bonds b. Bonds Used for LBOs (Leveraged Buyouts) c. Divestiture of Parts of Firm to Pay for LBO d. Finance Through ESOP (Employee Stock Ownership Plan) Lecture: 8 - Mergers and Restructuring XIV. Terminology a. Greenmail or Repurchase Standstill Agreements b. Golden Parachutes c. Golden Handcuffs XV. Defensive Tactics a. Staggered Board of Directors b. Super Majority c. Super Common Stock d. Poison Pills e. Scorched Earth f. Leverage g. Restructure h. White Squire i. White Knight j. Pac Man k. Nancy Reagan - Just Say No! l. Bear Hug Lecture: 8 - Mergers and Restructuring XVI. Divestiture a. Difficult Decision for Business Managers b. Sell Off Assets Worth More to Others c. Focus on Assets Best Managed by Present Managers XVII.Steps to Decide on Divestiture - getting Merger NPV a. Estimate Operating CFs of the Division b. Get the After Tax Discount Rate k for the Division c. Calculate PV of CFs d. Subtract Liabilities Associated with Division NPV = CFt - Market Value of Liabilities t t 1 (1 + k) n This assumes that the acquirer assumes the target’s liabilities (e.g., you own a $120,000 home with a $100,000 mortgage - sell for $20,000 or more if buyer assumes the mortgage.) e. Compare NPV with Net After Tax Proceeds if After Tax Proceeds > NPV then sell. Lecture: 8 - Mergers and Restructuring XVII.Steps to Decide on Divestiture - Continued f. If Acquirer Does Not Accept Liabilities, Adjust Offer Downward by Liabilities Value Note: Process is exactly the reverse of the decision to merge process. XVIII. Abandonment a. Check NPV Periodically b. Salvage Value After Tax > PV of Remaining CFs => Abandon Project, Else, Keep Example: SIV Products can sell a product line for $50,000 after tax or it can keep the product line which will earn $17,500 each year for the next 4 years. If its cost of capital is 14 percent, should SIV divest the product line? How about if the product line has $3000 in liabilities that will be assumed by the purchaser? a.NPVkeep = 17,500[PVA.14,4] - 50,000 = 990 Keep, do not divest. b. NPVkeep = 17,500[PVA.14,4] - 50,000 - $3000 = -2010 Now you should divest. Lecture: 8 - Mergers and Restructuring XIX. Financial Distress a. Out of Court Options 1. Extensions 2. Composition 3. Assignment b. In Court Options /Bankruptcy Reform Act 1978 1. Debtor Files - Voluntary 2. Creditor Files - Involuntary 3. Chapter 7 - Liquidation XX. Reorganization a. Trustee can Reorganize or Run it Himself b. Creditors Vote to Accept/Reject Trustee’s Plan for Reorganization XXI. Decision to Liquidate or Reorganize Calculation of: NPVliq. > NPVreorg. => Liquidate NPVreorg. > NPVliq. => Reorganize