x - Dalton State College

advertisement

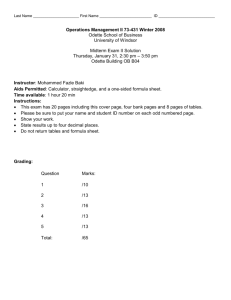

INTRODUCTION TO OPERATIONS RESEARCH Linear Programming LINEAR PROGRAMMING REVIEW Linear Programming provides methods for allocating limited resources among competing activities in an optimal way. Any problem whose model fits the format for the linear programming model is a linear programming problem. Wyndor Glass Co. example Two variables – Graphical method Maximize profit RADIATION THERAPY EXAMPLE Mary diagnosed with cancer of the bladder → needs radiation therapy Radiation therapy Involves using an external beam to pass radiation through the patient’s body Damages both cancerous and healthy tissue Goal of therapy design is to select the number, direction and intensity of beams to generate best possible dose distribution Doctors have already selected the number (2) and direction of the beams to be used Goal: Optimize intensity (measured in kilorads) referred to as the dose RADIATION THERAPY Area Healthy Anatomy Critical Tissues Tumor Region Tumor Center Fraction of Entry Dose Absorbed by Area (Average) Beam1 Beam2 0.4 0.5 0.3 0.1 0.5 0.5 0.6 0.4 Restriction on Total Average Dosage, Kilorads minimize ≤ 2.7 = 6.0 ≥ 6.0 RADIATION THERAPY Graph the equations to determine relationships Minimize Z = 0.4x1 + 0.5x2 Subject to: 0.3x1 + 0.1x2 ≤ 2.7 0.5x1 + 0.5x2 = 6 0.6x1 + 0.4x2 ≥ 18 x1 ≥ 0, x2 ≥ 0 MIXTURE PROBLEM In order to ensure optimal health (and thus accurate test results), a lab technician needs to feed the rabbits a daily diet containing a minimum of 24 grams (g) of fat, 36 g of carbohydrates, and 4 g of protein. But the rabbits should be fed no more than five ounces of food a day. Rather than order rabbit food that is custom-blended, it is cheaper to order Food X and Food Y, and blend them for an optimal mix. Food X contains 8 g of fat, 12 g of carbohydrates, and 2 g of protein per ounce, and costs $0.20 per ounce. Food Y contains 12 g of fat, 12 g of carbohydrates, and 1 g of protein per ounce, at a cost of $0.30 per ounce. What is the optimal blend? MIXTURE PROBLEM Daily Amount Fat Carbohydrates Protein Food Type X Y 8 12 12 12 2 1 maximum weight of the food is five ounces: X+Y≤5 Daily Requirements (grams) ≥ 24 ≥ 36 ≥4 Minimize the cost: Z = 0.2X + 0.3Y MIXTURE PROBLEM Graph the equations to determine relationships Minimize Z = 0.2x + 0.3y Subject to: fat: 8x + 12y ≥ 24 carbs: 12x + 12y ≥ 36 protein: 2x + 1y ≥ 4 weight: x+y≤5 x ≥ 0, y ≥ 0 MIXTURE PROBLEM When you test the corners at: (0, 4), (0, 5), (3, 0), (5, 0), and (1, 2) you get a minimum cost of sixty cents per daily serving, using three ounces of Food X only. Only need to buy Food X INVESTMENT EXAMPLE You have $12,000 to invest, and three different funds from which to choose. Municipal bond: CDs: High-risk acct: 7% return 8% return 12% return (expected) To minimize risk, you decide not to invest any more than $2,000 in the high-risk account. For tax reasons, you need to invest at least three times as much in the municipal bonds as in the bank CDs. Assuming the year-end yields are as expected, what are the optimal investment amounts? INVESTMENT EXAMPLE Bonds (in thousands): CDs (in thousands): High Risk: x y z Um... now what? I have three variables for a two-dimensional linear plot Use the "how much is left" concept Since $12,000 is invested, then the high risk account can be represented as z = 12 – x – y INVESTMENT EXAMPLE Constraints: Amounts are non-negative: x≥0 y≥0 z≥0 Z = 0.07x + 0.08y + 0.12z 12 – x – y ≥ 0 y ≤ –x + 12 High risk has upper limit z≤2 12 – x – y ≤ 2 y ≤ –x + 10 Taxes: 3y ≤ x Objective to maximize the return: y ≤ 1/3 x Z = 1.44 - 0.05x – 0.04y INVESTMENT EXAMPLE When you test the corner points at (9, 3), (12, 0), (10, 0), and (7.5, 2.5), you should get an optimal return of $965 when you invest $7,500 in municipal bonds, $2,500 in CDs, and the remaining $2,000 in the high-risk account. MANUFACTURING EXAMPLE Machine data Machine \ Product A B C D Total processing time Product data Unit processing times (min) P Q 20 10 12 28 15 6 10 15 57 59 Revenue per unit Material cost per unit Profit per unit Maximum sales Availability (min) R 10 16 16 0 42 2400 2400 2400 2400 P Q R $90 $45 $45 100 100 $40 $60 40 $70 $20 $50 60 PRODUCT STRUCTURE Machines A,B,C,D Available t ime: 2400 min/week Operating expenses: $6000/week P urchased part : $5/unit P Revenue: $90/unit Max sales: 100 units/week Q Revenue: $100/unit Max sales: 40 units/week D 15 min/unit D 10 min/unit R Revenue: $70/unit Max sales: 60 units/week C 16 min/unit C 9 min/unit C 6 min/unit B 16 min/unit A 20 min/unit B 12 min/unit A 10 min/unit RM1 $20/unit RM2 $20/unit RM3 $20/unit Component 1 Component 2 Component 3 LP FORMULATION max s.t. 45 xP 20 xP 12 xP 15 xP 10 xP + + + + + 60 xQ 10 xQ 28 xQ 6 xQ 15 xQ Objective Function 1800 1440 2040 2400 xP 100, xQ 40 Are we done? xP ≥ 0, xQ ≥ 0 Structural constraints demand nonnegativity Are the LP assumptions valid for this problem? = 81.82 Optimal solution x * P x *Q = 16.36 FEASIBLE REGION P 240 Max Q 200 D 160 120 Max P 80 A 40 0 B 0 40 C 80 120 160 200 240 280 320 360 Q OPTIMAL SOLUTION P Optimal solut ion = (16.36, 81.82) 120 Max Q 100 80 A 60 40 Z = $4664 20 Z = $3600 B 0 0 10 20 30 40 50 60 Q DISCUSSION OF RESULTS Optimal objective value is $4664 but when we subtract the weekly operating expenses of $3000 we obtain a weekly profit of $1664. Machines A & B are being used at maximum level and are bottlenecks. There is slack production capacity in Machines C & D.