PowerPoint Presentation - Financial Accounting and Accounting

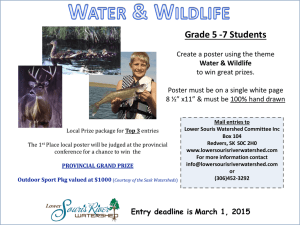

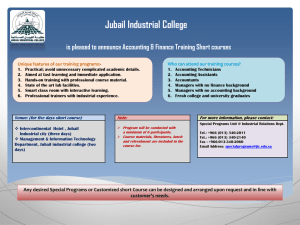

advertisement

Impact of Adjusted Entries by Group 1 Fernando Casco-Downing, Katie Fleming, Michael Kubik, Emily Stone, Fei Wang Chapter 3-1 Introduction Accounting Equation (A= L + SE) Accounting Cycle Accounting Concepts Chapter 3-2 Revenue Expense Revenue Recognition Matching Principle Types of Adjusted Entries Examples of Adjusted Entries Impact without entries The Accounting Equation Relationship among the assets, liabilities and stockholders’ equity of a business: Illustration 3-3 The equation must be in balance after every transaction. For every Debit there must be a Credit. Chapter 3-3 The Accounting Cycle Illustration 3-6 Transactions 9. Reversing entries 1. Journalization 8. Post-closing trail balance 2. Posting 7. Closing entries 3. Trial balance 6. Financial Statements Work Sheet 5. Adjusted trial balance Chapter 3-4 4. Adjustments Adjusting Entries Revenues - recorded in the period in which they are earned. Expenses - recognized in the period in which they are incurred. Adjusting entries - needed to ensure that the revenue recognition and matching principles are followed. Chapter 3-5 Types of Adjusting Entries Illustration 3-20 Prepayments Accruals 1. Prepaid Expenses. Expenses paid in cash and recorded as assets before they are used or consumed. 3. Accrued Revenues. Revenues earned but not yet received in cash or recorded. 2. Unearned Revenues. Revenues received in cash and recorded as liabilities before they are earned. 4. Accrued Expenses. Expenses incurred but not yet paid in cash or recorded. Chapter 3-6 Expedient Recording Method Expedient Records an expense upon payment of cash before goods or services are consumed Records revenue upon receipt of cash before goods or services are provided Chapter 3-7 Expedient General Entries Q1 : On December 1, 2011, Johnson received a $45,000 payment for services to be rendered equally over a four-month period. Service revenue was credited. Dec. 1 Cash 45,000 Service revenue 45,000 Service Revenue Debit Credit 45,000 45,000 Chapter 3-8 Cash Debit 45,000 45,000 Credit Adjusting Entries for “Unearned Revenues” Q1 : On December 1, 2011, Johnson received a $45,000 payment for services to be rendered equally over a four-month period. Service revenue was credited. Dec. 31 Service revenue 33,750 Unearned service revenue Service Revenue Debit 33,750 Credit 45,000 11,250 Chapter 3-9 (=45,000-45,000/4) 33,750 Unearned Service Revenue Debit Credit 33,750 33,750 Impact Without Adjusted Entries Q1 : On December 1, 2011, Johnson received a $45,000 payment for services to be rendered equally over a four-month period. Service revenue was credited. Dec. 31 Service revenue (SE) 33,750 Unearned service revenue (L) Total Assets None Chapter 3-10 (=45,000-45,000/4) 33,750 Total Liab. Stk. Equity Net Income Retained Earning Understate 33750 Overstate 33750 Overstate 33750 Overstate 33750 Standard Recording Method Standard Asset upon payment of cash Liability upon receipt of cash before goods or services are provided Chapter 3-11 Standard General Entries Q1 : On December 1, 2011, Johnson received a $45,000 payment for services to be rendered equally over a four-month period. Dec. 1 Cash 45,000 Unearned service revenue Unearned Service Revenue Debit Credit 45,000 45,000 Chapter 3-12 45,000 Cash Debit 45,000 45,000 Credit Adjusting Entries for “Unearned Revenues” Q1 : On December 1, 2011, Johnson received a $45,000 payment for services to be rendered equally over a four-month period. Dec. 31 Unearned service revenue 11,250 Service revenue Service Revenue Debit Credit 11,250 11,250 Chapter 3-13 11,250 Unearned Service Revenue Debit 11,250 Credit 45,000 33,750 Expedient Vs. General Expedient Service Revenue Debit 33,750 Unearned Service Revenue Credit Debit 45,000 Credit 33,750 11,250 33,750 General Service Revenue Debit Credit 11,250 11,250 Chapter 3-14 Unearned Service Revenue Debit 11,250 Credit 45,000 33,750 Adjusting Entries for “Prepaid Expenses” Q2. On December 31, 2011, the company paid a local radio station $16,000 for 40 radio ads that were to be aired, 20 per month, throughout January and February of 2012. Prepaid advertising was debited. Dec. 31 Prepaid Advertising 16,000 Cash 16,000 Prepaid Advertising Debit 16,000 16,000 Chapter 3-15 Credit Cash Debit Credit 16,000 Adjusting Entries for “Accrued Expenses” Q3. Employee salaries for the month of December 2011 totaling $8,400 will be paid on January 5, 2012. Dec. 31 Salaries expense 8,400 Salaries payable Salaries Expense Debit 8,400 8,400 Chapter 3-16 Credit 8,400 Salaries Payable Debit Credit 8,400 Adjusting Entries for “Accrued Expenses” Q3. Employee salaries for the month of December 2011 totaling $8,400 will be paid on January 5, 2012. Dec. 31 Salaries expense(SE) 8,400 Salaries payable(L) Chapter 3-17 8,400 Total Assets Total Liab. Stk. Equity Net Income Retained Earning None Understate 8400 Overstate 8400 Overstate 8400 Overstate 8400 Adjusting Entries for “Accrued Expenses” Q4. On September 31, 2011, Johnson Corp. borrowed $60,000 from a local bank. A note was signed with principal and 6% interest to be paid on September 1, 2012. (Interest = 60,000 * 6% /12 *3) Dec. 31 Interest expense 900 Interest payable Interest Expense Debit 900 Chapter 3-18 Credit 900 Interest Payable Debit Credit 900 Adjusting Entries for “Accrued Expenses” Q4. On September 31, 2011, Johnson Corp. borrowed $60,000 from a local bank. A note was signed with principal and 6% interest to be paid on September 1, 2012. (Interest = 60,000 * 6% /12 *3) Dec. 31 Interest expense(SE) 900 Interest payable(L) Chapter 3-19 900 Total Assets Total Liab. Stk. Equity Net Income Retained Earning None Understate 900 Overstate 900 Overstate 900 Overstate 900 Adjusting Entries for “Accrued Expenses” Q5. On December 31, 2011, it was determined that $8,000 of the recorded Accounts receivable would prove to be uncollectible. Dec. 31 Bad Debt Expense 8,000 Allowance for Doubtful Accounts Bad Debt Expense Debit 8,000 Chapter 3-20 Credit 8,000 Allowance for Doubtful Accounts Debit Credit 8,000 Impact Without Adjusted Entries Q5. On December 31, 2011, it was determined that $8,000 of the recorded Accounts receivable would prove to be uncollectible. Dec. 31 Bad Debt Expense (SE) 8,000 Allowance for Doubtful Account (A) Total Assets Overstated 8000 Chapter 3-21 8,000 Total Liab. Stk. Equity Net Income Retained Earning None Overstated 8000 Overstated 8000 Overstated 8000 Impact Without Adjusted Entries Total Assets Net Income Retained Earning Overstate 33750 Overstate 33750 None None None Understate Overstate 8400 8400 Overstate 8400 Overstate 8400 Q4 None Understate Overstate 900 900 Overstate 900 Overstate 900 Q5 Overstated 8000 Overstated 8000 Overstated 8000 Overstated 8000 Overstate Understate Overstate Total 8000 43050 51050 Overstate 51050 Overstate 51050 Q1 None Q2 None Q3 Chapter 3-22 Total Liab. Stk. Equity Understate Overstate 33750 33750 None None None Conclusion Accounting Concepts Standard Vs. Expedient Recording Method Types of Adjusted Entries Prepayments : Prepaid Expense and Unearned Revenue Accruals: Accrued Rev. and Accrued Exp. Impact without adjusted entries Chapter 3-23 Revenue and Expense Revenue Recognition and Matching Principle Overstated A, L, SE, NI, RE Understated A, L, SE, NI, RE Questions Chapter 3-24