Concentrated

advertisement

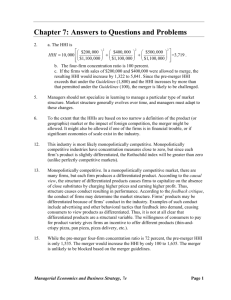

The Nature of Industry Chapter 7 1 Concentration Ratios Measures of how concentrated an industry is. 1. Four Firm Concentration Ratio percentage of an industry’s revenue accounted for by the 4 largest firms 2. Herfindahl index or Herfindahl-Hirshman Index (HI or HHI) sum of the squared market share values (S1)2+ (S2)2+ (S3)2+...+ (Sn)2 2 Calculate market share Tire Sales Makers Top, Inc. 270 ABC, Inc. 225 Big, Inc. 180 XYZ, Inc 90 Cheap, Inc 81 Tiny, Inc. 54 Total 900 Market Share 30% ? 20% 10% 9% 6% 100% 3 Calculate market share Tire Makers Top, Inc. ABC, Inc. Sales Big, Inc. XYZ, Inc Cheap, Inc Tiny, Inc. Total 180 90 81 54 900 270 225 Market Share 30% 225/900 *100 20% 10% 9% 6% 100% 4 Calculate market share Tire Sales Makers Top, Inc. 270 ABC, Inc. 225 Big, Inc. 180 XYZ, Inc 90 Cheap, Inc 81 Tiny, Inc. 54 Total 900 Market Share 30% 25% 20% 10% 9% 6% 100% 5 4-firm concentration ratio Add market share of top 4 firms 4-firm CR =? 30+25+20 +10 = 85 Tire Sales Makers Top, Inc. 270 ABC, Inc. 225 Big, Inc. 180 XYZ, Inc 90 Cheap, Inc 81 Tiny, Inc. 54 Total 900 Market Share 30% 25% 20% 10% 9% 6% 100% 6 Another example of 4-firm concentration ratio Add market share of top 4 firms 4-firm CR =? 79+2+2+ 2 = 85 Industry X Sales Market Share Firm A 790 79% Firm B 20 2% Firm C 20 2% Firm D 20 2% 15 other 10 1% firms each with: Total 1000 100% 7 Disadvantage of 4-firm concentration ratio: Doesn’t give extra weight to especially large firms 8 Herfindahl Index Tire Sales Market (S1 (S2 Makers Share (S3)2+...+ (Sn)2 270 30% (30)2+(25)2+(20)2 Top, Inc. 225 25% +(10)2+ (9)2+(6)2 ABC, Inc. Big, Inc. 180 20% = XYZ, Inc 90 10% 900+625+400 Cheap, Inc 81 9% +100+81+36= Tiny, Inc. 54 6% 2142 Total 900 100% ) 2+ )2+ 9 Herfindahl Index HI = 6268 Industry X Sales Market Share Firm A 790 79% Firm B 20 2% Firm C 20 2% Firm D 20 2% 15 other 10 1% firms each with: Total 1000 100% 10 Herfindahl Index Increases if the number of firms decrease Gives extra weight to especially large firms 11 Concentration Measures by SIC/NAICS Code Department of Census http://www.census.gov/epcd/www/concentration.html http://factfinder.census.gov/servlet/EconSectorServlet?caller=dataset&sv_name=*&_SectorId=31&ds_name=EC0700A 1&_lang=en&_ts=314058002437 Retail Bakery (311811) 2002 4- firm CR = 4.0, HI=8.0 2007 4- firm CR = 3.7, HI=7.3 Soft Drink Manufacturing (312111) 2002 4- firm CR = 46, HI=709 2007 4- firm CR = 58, HI=1,095 12 Anti-trust Enforcement Department of Justice /Federal Trade Commission Enforcement FTC Horizontal Merger Guidelines http://www.usdoj.gov/atr/public/guidelines/horiz_book/hmg1.html FTC Competition Enforcement Reports http://www.ftc.gov/bc/caselist/index.shtml 13 DOJ/FTC Horizontal Merger Guidelines The Guidelines describe the analytical process that the Agency will employ in determining whether to challenge a horizontal merger. First, the Agency assesses whether the merger would significantly increase concentration and result in a concentrated market, properly defined and measured. Second, the Agency assesses whether the merger, in light of market concentration and other factors that characterize the market, raises concern about potential adverse competitive effects. Third, the Agency assesses whether entry would be timely, likely and sufficient either to deter or to counteract the competitive effects of concern. Fourth, the Agency assesses any efficiency gains that reasonably cannot be achieved by the parties through other means. Finally the Agency assesses whether, but for the merger, either party to the transaction would be likely to fail, causing its assets to exit the market. The process of assessing market concentration, potential adverse competitive effects, entry, efficiency and failure is a tool that allows the Agency to answer the ultimate inquiry in merger analysis: whether the merger is likely to create or enhance market power or to facilitate its exercise. 14 The general standards for horizontal mergers are as follows: a) Post-Merger HHI Below 1000. The Agency regards markets in this region to be unconcentrated. Mergers resulting in unconcentrated markets are unlikely to have adverse competitive effects and ordinarily require no further analysis. b) Post-Merger HHI Between 1000 and 1800. The Agency regards markets in this region to be moderately concentrated. Mergers producing an increase in the HHI of less than 100 points in moderately concentrated markets post-merger are unlikely to have adverse competitive consequences and ordinarily require no further analysis. Mergers producing an increase in the HHI of more than 100 points in moderately concentrated markets post-merger potentially raise significant competitive concerns depending on the factors set forth in Sections 2-5 of the Guidelines. 15 c) Post-Merger HHI Above 1800. The Agency regards markets in this region to be highly concentrated. Mergers producing an increase in the HHI of less than 50 points, even in highly concentrated markets postmerger, are unlikely to have adverse competitive consequences and ordinarily require no further analysis. Mergers producing an increase in the HHI of more than 50 points in highly concentrated markets postmerger potentially raise significant competitive concerns, depending on the factors set forth in Sections 2-5 of the Guidelines. Where the postmerger HHI exceeds 1800, it will be presumed that mergers producing an increase in the HHI of more than 100 points are likely to create or enhance market power or facilitate its exercise. The presumption may be overcome by a showing that factors set forth in Sections 2-5 of the Guidelines make itunlikely that the merger will create or enhance market power or facilitate its exercise, in light of market concentration and market shares. 16 Case Study February 20, 1986: Coca Cola announced intentions to purchase Dr Pepper Pepsi announced intentions to buy SevenUp The FTC (Federal Trade Commission) announced decision to oppose Pepsi withdrew; Coca Cola persisted 17 Problems with using only CR and HI to proxy for level of competition i) Often difficult to Define Relevant Market FTC Argues relevant market is Carbonated Soft Drink (CSD) and local This market is highly concentrated already and would increase with merger 18 FTC’s Ranking of Competitiveness: Concentrated Case Study Producers in 1985 Coca-Cola PepsiCo Philip Morris (7-up) Dr. Pepper Co R.J. Reynolds (Sunkist, Canada Dry) Royal Crown Cola Proctor and Gamble (Orange Crush, Hines) Others (supermarket brands) Herfindahl no merger 37.42+28.92+5.72+4.62+3.02… = 2324 Share 37.4% 28.9 5.7 4.6 3.0 2.9 1.8 15.7 19 Case Study Producers in 1985 Coca-Cola + Dr. Pepper PepsiCo Philip Morris (7-up) R.J. Reynolds (Sunkist, Canada Dry) Royal Crown Cola Proctor and Gamble (Orange Crush, Hines) Others (supermarket brands) Herfindahl with merger 422+28.92+5.72+3.02… = 2668 Share 37.4+4.6= 42.0 28.9 5.7 3.0 2.9 1.8 15.7 20 Defense (Coca Cola) Case Market definition: all potable beverages (HHI only 739 in all beverage consumption) USE CROSS-PRICE ELASTICITIES TO HELP DETERMINE RELEVANT MARKET 21 Problems with using only CR and HI to proxy for level of competition ii) Does not take into account Entry Barriers FTC Argues that there are significant entry barriers Access to bottlers; economies of scale; entry risky due to high sunk costs; limited number of buttons and spigots Coca-Cola argues that there are few entry barriers No specialized resources or talents; Kraft, Beatrice and Borden potential entrants 22 Types of Barriers to Entry 1. 2. Economies of Scale/ Economies of Scope Legal Barriers 3. Patents, Copyrights and Franchises Inability of potential entrants to gain access to distribution network or resource (ex. Alcoa and Bauxite) 23 Problems with using only CR and HI to proxy for level of competition iii) Cannot necessarily equate more concentration with less competition FTC notes that the Return on Stockholder’s Equity for the major CSD producers is relatively high (problem with this argument is that it does not pertain to the consequences of the proposed merger) Coca-Cola notes that the real price of CSDs has declined in the last two decades 24 Problems with using only CR and HI to proxy for level of competition iii) Cannot necessarily equate more concentration with less competition Coca-Cola argues that due to the many different product types and the inability to monitor secret price cutting, it is difficult to collude in the CSD industry. FTC argues that many different product types and promotions would not inhibit the ability to raise the price of CSD concentrate. 25 Problems with using only CR and HI to proxy for level of competition (and use this to argue against a merger) iv) Merger may increase efficiency Coca-Cola argues that the merger will reduce costs due primarily to economies of scale. These cost savings could result in lower prices to the consumer. 26 Major Changes in CSD Industry Post-1985 1. 2. 3. 4. 7-Up and Dr. Pepper merged in late 1986 and Cadbury-Schweppes purchased them in 1995. Cadbury-Schweppes also acquired a number of other brands including Canada-Dry, Sunkist, A&W, Crush and Hires. Technological change results in greater economies of scale associated with bottling. Coca-Cola and Pepsi vertically integrate by acquiring a number of their bottling companies. Diet CSDs’ market share has increased (from 25.9% in 1999 to 30.2% in 2004). 27 28 29 30 31 32