CCIL

advertisement

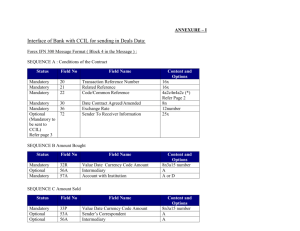

Counter-party Credit Risk Management S Roy, CCIL 6th April 2013 1 Outline Introduction Bilateral Margining & CSA Role of CCIL in Indian OTC Market Trade Repository At CCIL Alternate Risk Management Options Conclusion 2 Introduction Counterparty Risks from OTC Derivative Market Exposures - significant, increasing steadily & can change fast Approach to manage this risk Bilateral Margining CCP Clearing Complexities due to new Regulatory Approach Mandatory CCP Clearing of trades in Certain Products Mandatory Bilateral Margining for other OTC Derivative trades 3 Bilateral Margining & CSA In practice, Bilateral Margining is effected through CSA Seeks to keep exposures in terms of MTM value under control Operationalisation requires: (a) Portfolio Reconciliation (b) Valuation to be in sync (c) Transferred amount – preferably in cash; else availability of collateral re-hypothecation option Structure does not allow Margin collection towards Potential Future Exposures 4 Bilateral Margining & CSA(Cont.) Does CSA create unmanageable operational difficulty? How does one get so many CSAs executed & keep upto date? Often problems faced when one needs protection - at the time of stress when counter-party looks vulnerable Trade Portfolio Reconciliation fails Valuations are disputed Collaterals are not transferred in time by counterparty Refund of collaterals placed earlier becomes doubtful Revaluation on fortnight basis leaves huge risk uncovered Across border flows become extremely uncertain 5 Bilateral Margining & CSA(Cont.) Bigger problem is however under normal market condition In a market with 80 active players having outstanding trades with each other can have upto (80*79/2) flows after each revaluation period Effecting & Tracking these flows increases costs & huge operations risk Sample Analysis in Inter-bank Forward Foreign Exchange market in India shows 2506 connections for 79 participants & Gross MTM placement requirement of Rs 8800 Crores (net placement would be only Rs 3100 Crores) 6 Role of CCIL in Indian OTC Market Pioneer in CCP clearing of OTC market products Securities Settlement – Started in April 2002 - Market size increased from average Rs 5000 Crs per day to Rs 46000 Crs per day Rupee/USD Foreign Exchange – Started in Nov 2002 - Market Size increased from average USD 2 bn per day to USD 21 bn per day Collateralised Borrowing & Lending Obligation (CBLO) – Started in Jan 2003 - Market Size increased from nil to average Rs 42000 Crs per day Forward Foreign Exchange Started in Dec 2009 - CCP Cleared Market Size increased from USD 14 bn to USD 134 bn Rupee Interest Rate Swaps – likely to start soon 7 Trade Repository At CCIL Institutional Trades Interest Rate Swaps Credit Default swaps Forward Foreign exchange (including Cross Currency) Currency Options (including Cross Currency) Currency Swaps Interest Rate Options Client Trades TR will have trade data for most of the OTC derivative trades of the Banks & Institutions Question : Can we leverage the data in TR for Counterparty Exposure Management? 8 Alternate Risk Management Options TR automatically ensures Trade Portfolio reconciliation Valuation of Trades & PFE computation possible with TR data Bilateral margin requirement can be computed Member-wise net payable & receivable amounts can be arrived at Each member can deposit or withdraw the amounts payable or receivable by it by next day pre-specified time The deposit can be in cash or in securities If deposit is in securities, there will have to be additional processes to share any loss from realisation in case of a member default – process for realisation also to be agreed upon. 9 Alternate Risk Management Options (contd.) Benefits from this approach Non-replenishment by a member is known in a very short time & will be known to all its counterparties – will guard against risk of contagion Valuation related discrepancies will not hinder the process Single flow of amount at netted level per day will allow the process to achieve the objective MTM values can be recomputed everyday & hence PFE can be with 1 day Margin Period of Risk – less collateral per entity shortage of collateral in the market can be avoided to a large extent Counterparty Risk Coverage is at maximum efficiency Documentation requirement minimum 10 Alternate Risk Management Options (contd.) Downside - ??? How to make it work? Valuation for trades to be standardised for this purpose Altogether new approach - Regulatory approval to be obtained Legal documentation to be created 11 Do we find the approach attractive enough to work for this? 12 Thank you 13 Securities Settlement Average Daily volume – Rs. 46,692 Crs. Total number of members : 184 (All Institutional Members- Regulated entities) 30,000 27,932 25,000 Volume (Rs. cr.) 21,308 18,760 20,000 13,523 15,000 5,000 3,623 1,577 5,803 5,335 5,303 4,187 3,884 3,215 3,208 12,243 13,943 14,656 12,934 11,623 9,192 8,755 10,000 14,266 6,696 0 2002-03 2003-04 2004-05 2005-06 2006-07 2007-08 S Roy, CCIL 6th April 2013 Outright 2008-09 2009-10 2010-11 2011-12 2012-13 (upto 29.03.13) Repo Back 14 Forex Settlement Average Daily volume – USD 20.82 billion Total number of members - 80 All Authorised Dealers in Forex) 25,000 20,185 Volume (USD mm) 20,000 17,463 16,414 15,000 13,167 10,000 20,823 12,996 7,466 3,813 5,000 1,496 5,020 2,161 0 2002-03 S Roy, CCIL 6th April 2013 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 (upto 29.03.13) Back 15 Collateralised Borrowing & Lending Obligation (CBLO) Average Daily volume – Rs. 41,700 Crs. Total number of members - 232 CBLO Settlement Volume (Daily Average) 60,000 54,531 Volume (Rs. Cr.) 50,000 41,700 41,700 38,335 40,000 30,748 27,588 30,000 20,000 16,096 10,045 10,000 3,345 16 262 0 2002-03 S Roy, CCIL 6th April 2013 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 (upto 29.03.13) Back 16