oligopoly (new window)

advertisement

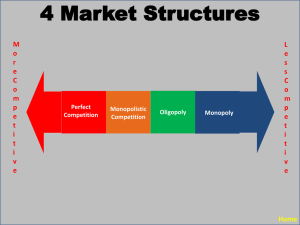

MONOPOLISTIC COMPETITION AND OLIGOPOLY ECO 2023 Principles of Microeconomics Dr. McCaleb Monopolistic Competition and Oligopoly 1 TOPIC OUTLINE I. Monopolistic Competition II. Oligopoly III. Cartels IV. Making Markets Competitive Monopolistic Competition and Oligopoly 2 Monopolistic Competition Monopolistic Competition and Oligopoly 3 MONOPOLISTIC COMPETITION Characteristics of Monopolistic Competition Definition A market in which there are many sellers, each selling a differentiated product, with unrestricted or low-cost long-run entry and exit of resources. Key characteristics • Many buyers and sellers (same as perfect competition) • Product differentiation • Unrestricted entry and exit (same as perfect competition) Monopolistic Competition and Oligopoly 4 MONOPOLISTIC COMPETITION Characteristics of Monopolistic Competition Product differentiation Supplying a good that is slightly different from the goods of competing suppliers. Consumers view each supplier’s product as a close, but not a perfect, substitute for any other supplier’s product. Monopolistic Competition and Oligopoly 5 MONOPOLISTIC COMPETITION Characteristics of Monopolistic Competition Examples of product differentiation • Design (for example, Macintosh computers compared with PC’s). • Reliability (for example, warranties or brand names). • Location (for example, gasoline marketers near interstate highways). • Costly information (for example, the same good sold in different stores at different prices). Monopolistic Competition and Oligopoly 6 The bookstore market portrayed in the video clip is monopolistically competitive and not perfectly competitive because 1. there are many bookstores. 2. each bookstore offers a slightly different set of products and services 3. there are no significant barriers to entry into the bookstore market Monopolistic Competition and Oligopoly 7 MONOPOLISTIC COMPETITION Characteristics of Monopolistic Competition Demand and marginal revenue are negatively-sloped Because of imperfect substitutability, suppliers in a monopolistically competitive market have some market power. Consumer demand for each supplier’s output is negatively-sloped. Negatively-sloped demand curvemarginal revenue is less than price at each quantity. Marginal revenue curve is negatively-sloped and lies below the demand curve. Monopolistic Competition and Oligopoly 8 MONOPOLISTIC COMPETITION Long Run Equilibrium Sellers earn zero long-run economic profit Short-run economic profits induce entry Same as perfect competition. Short-run economic profits provide an incentive for new resources to enter the market in the long run. Entry of new competitors reduces each seller’s market share. Demand for each individual seller’s product decreases and price falls until economic profit is competed away. Long-run equilibrium: Sellers earn zero economic profit (or a normal accounting profit). Monopolistic Competition and Oligopoly 9 MONOPOLISTIC COMPETITION Long Run Equilibrium Short-run economic losses induce exit Same as perfect competition. Short-run economic losses create incentives for existing competitors to leave the market in the long run. Exit of existing sellers increases each remaining seller’s market share. Demand for each remaining seller’s product increases and price rises until economic losses are eliminated. Long-run equilibrium: Sellers earn zero economic profit (or a normal accounting profit). Monopolistic Competition and Oligopoly 10 MONOPOLISTIC COMPETITION Short-Run Equilibrium The profit-maximizing quantity where marginal revenue equals marginal cost . . . is 150 pairs of jeans per day. The maximum price consumers are willing to pay for 150 pairs is $70 per pair. The average total cost to produce 150 pairs is $20 per pair, . . . so economic profit is $50 per pair or $7,500 a day. Monopolistic Competition and Oligopoly 11 MONOPOLISTIC COMPETITION Adjustment from Short Run to Long Run Short-run economic profit creates an incentive for entry of new resources. With increased competition, demand decreases to D' and marginal revenue decreases to MR'. Monopolistic Competition and Oligopoly 12 MONOPOLISTIC COMPETITION Long-Run Equilibrium Profit-maximizing quantity is 50 pairs of jeans a day. The price consumers are willing to pay for 50 pairs is $30 per pair. Average total cost is also $30 per pair so economic profit is zero. Monopolistic Competition and Oligopoly 13 In monopolistic competition 1. the demand curve facing each supplier is (vertical, horizontal, negatively-sloped, positively-sloped). 2. marginal revenue is (greater than, equal to, less than) price and the marginal revenue curve is (below, the same as, above) the demand curve. 3. equilibrium quantity is where (total revenue, price, marginal revenue) is (greater than, equal to, less than) (total cost, average total cost, marginal cost). 4. equilibrium price is shown by (demand, marginal revenue, marginal cost, average total cost) curve. Monopolistic Competition and Oligopoly 14 In monopolistic competition 5. profit is a. b. c. positive if (price, marginal revenue) is (greater than, equal to, less than) (average total cost, marginal cost). zero if (price, marginal revenue) is (greater than, equal to, less than) (average total cost, marginal cost). negative if (price, marginal revenue) is (greater than, equal to, less than) (average total cost, marginal cost). 6. long-run economic profit is (positive, negative, zero, either positive or zero). Monopolistic Competition and Oligopoly 15 In monopolistic competition, equilibrium quantity is where _____ and equilibrium price is shown by the _____ curve. 1. MR=MC; MR 2. MR=MC; demand 3. P=ATC; ATC 4. MC=ATC; MC Monopolistic Competition and Oligopoly 16 In monopolistic competition, suppliers earn _____ profit in the long run. 1. positive 2. zero 3. negative 4. positive or zero Monopolistic Competition and Oligopoly 17 Oligopoly Monopolistic Competition and Oligopoly 18 OLIGOPOLY Characteristics of Oligopoly Definition A small number of suppliers in a market with substantial barriers to entry by potential competitors. Key characteristics • Market dominated by a few large suppliers • High cost entry into the market because of natural (economic) or legal barriers to entry Monopolistic Competition and Oligopoly 19 OLIGOPOLY Characteristics of Oligopoly Examples Do sellers in these markets behave competitively or monopolistically? • Beverages (soft drinks) • Music (CD’s) • Tobacco • Automobiles Monopolistic Competition and Oligopoly 20 OLIGOPOLY Characteristics of Oligopoly U.S. Market Share of Largest Sellers in Market Beverages Seller Share Music Seller Share Tobacco Seller Share Cars Seller Share Coke 44.5% Polygram 24.5% PM 49.4% GM 29.3% Pepsi 31.4% Warner 24.0% Ford 24.9% Cadbury 14.4% Sony Total 18.2% RJR 16.6% B&W 15.0% Chrysler EMI 12.9% BMG 12.2% 90.3% Total 84.4% Total 88.4% Total 16.1% 70.3% Each of these industries is an oligopoly even though the sellers often behave competitively. Monopolistic Competition and Oligopoly 21 OLIGOPOLY Equilibrium in an Oligopoly Range of possible oligopoly equilibria Suppliers in some oligopolistic markets may behave as if they were competitive. Suppliers in other oligopolistic markets may behave as if they were monopolists. Equilibrium in an oligopoly market can lie anywhere along the continuum from perfect competition to pure monopoly. Monopolistic Competition and Oligopoly 22 OLIGOPOLY Equilibrium in an Oligopoly Competitive equilibrium If the market behaves competitively, the marginal cost curve is the market supply curve. Equilibrium occurs where quantity demanded equals quantity supplied with P=MC. Economic profit in equilibrium is zero. Monopolistic Competition and Oligopoly 23 OLIGOPOLY Example: Competitive Equilibrium Monopolistic Competition and Oligopoly 24 OLIGOPOLY Equilibrium in an Oligopoly Monopolistic equilibrium If the market behaves monopolistically, the suppliers cooperate to choose the price and quantity that maximizes total profit. The monopolistic equilibrium quantity is where MR=MC. Economic profit is positive. Monopolistic Competition and Oligopoly 25 OLIGOPOLY Example: Monopolistic Equilibrium Monopolistic Competition and Oligopoly 26 OLIGOPOLY Equilibrium in an Oligopoly Range of possible equilibria Oligopoly equilibrium price is equal to or less than monopoly equilibrium price but greater than or equal to competitive equilibrium price. Oligopoly equilibrium quantity is equal to or greater than monopoly equilibrium quantity but less than or equal to competitive equilibrium quantity. Economic profit is positive unless oligopolists behave exactly as perfect competitors in which case economic profit is zero. Monopolistic Competition and Oligopoly 27 OLIGOPOLY Example: Range of Possible Equilibria Monopolistic Competition and Oligopoly 28 The equilibrium quantity in an oligopoly market is 1. always the same as the perfectly competitive equilibrium quantity. 2. always the same as the monopoly equilibrium quantity. 3. always the same as the monopolistically competitive equilibrium quantity. 4. equal to or greater than the monopoly equilibrium quantity but less than or equal to the perfectly competitive equilibrium quantity. 5. less than the monopoly equilibrium quantity or greater than the perfectly competitive equilibrium quantity. Monopolistic Competition and Oligopoly 29 Cartels Monopolistic Competition and Oligopoly 30 CARTELS Cartels Definition A group of suppliers acting together to limit output, raise price, and increase economic profit. Suppliers in a cartel attempt to act as if they were a monopolist so as to maximize their joint profits. Monopolistic Competition and Oligopoly 31 CARTELS Cartels The short, unhappy life of a cartel Every cartel faces three problems: • Reaching agreement • Detecting and preventing cheating • Enforcing the agreement Monopolistic Competition and Oligopoly 32 CARTELS Cartels Reaching agreement A profit-maximizing cartel must limit the market quantity to raise price to the monopoly level. Cartel must reach agreement about how to allocate the resulting monopoly profits among all the suppliers in the cartel. But each supplier’s share of the monopoly profits depends on its share of the market quantity so each supplier wants a larger quantity for itself but a smaller quantity for all the other suppliers. Monopolistic Competition and Oligopoly 33 CARTELS Cartels Too many or too few? Trade-off between including enough sellers to effectively limit market quantity and including so many sellers that high negotiation costs and small individual gains prevent reaching an agreement. More suppliers means greater control over the market but • higher negotiation costs because each supplier has incentive to hold out for larger share of profits • smaller gains to each supplier relative to going it alone. Monopolistic Competition and Oligopoly 34 CARTELS Cartels Stability of demand and supply Frequent changes in demand or supply require frequent renegotiation which is costly. Possibility that each renegotiation will be unsuccessful and agreement will fall apart. Cartels more likely to be successful in markets characterized by longrun stability in demand and supply. Monopolistic Competition and Oligopoly 35 CARTELS Cartels Detecting and preventing cheating Each cartel supplier has an incentive to expand its share of the market by reducing price below the cartel’s monopoly price or by engaging in other activities to gain a competitive advantage. If all cartel suppliers engage in competitive behavior to expand market share, the cartel disintegrates into a competitive market. Trade-off again—The larger the number of sellers, the more difficult it is to detect cheating and to identify the cheaters. Monopolistic Competition and Oligopoly 36 CARTELS Cartels Enforcing the agreement If cheating is detected, cartel must be able to take credible action to punish the cheaters. Trade-off again—More suppliers make it harder to take action against each one. Most successful cartels are either government-sanctioned with legal enforcement of the agreement or they are engaged in criminal activities and use extra-legal or illegal enforcement. Monopolistic Competition and Oligopoly 37 CARTELS Example: Duopoly in the airframe industry Suppliers are interdependent Two major airframe manufacturers worldwide, Boeing (U.S.) and Airbus (European)—a form of oligopoly called duopoly (a market with two suppliers). The market price of airplanes depends on how many airplanes are produced. Market demand is negatively-sloped. Each manufacturer’s profits depend on how many airplanes it supplies and on how many airplanes its competitor supplies. Monopolistic Competition and Oligopoly 38 CARTELS Example: Duopoly in the airframe industry Range of equilibria Competitive equilibrium: Q=12, P=$1 m. Total industry revenues are $12 m. and economic profits are zero. Monopoly equilibrium: If Boeing and Airbus agree to limit quantity to the monopoly level, they maximize total industry profits. They produce 6 planes at a price of $13 m. each, and the industry generates $72 m. in economic profits. Monopolistic Competition and Oligopoly 39 CARTELS Example: Duopoly in the airframe industry Reaching agreement If Boeing supplies 4 of the 6 planes, its share of the $72 m. profit is $48 m. and Airbus’s share is $24 m. If Airbus supplies 4, its share is $48 m. and Boeing’s share is $24 m. Boeing and Airbus must agree on some allocation of the joint profits, and more profits for one means less for the other. Failure to reach an agreement means the attempt to form a cartel fails. Monopolistic Competition and Oligopoly 40 CARTELS Example: Duopoly in the airframe industry Detecting and preventing cheating Suppose they reach an agreement to split the market. Each supplies 3 planes and earns $36 m. in economic profits. If Boeing increases production to 4 planes, its profits increase to $40 m. even though industry profit decreases to $70 m. Boeing’s increased profits come at Airbus’s expense. Each supplier has an incentive to expand its market share at the expense of the other. Monopolistic Competition and Oligopoly 41 CARTELS Example: Duopoly in the airframe industry Enforcing the agreement If Boeing expands its production to 4 planes per week in violation of the cartel agreement, what can Airbus do? Without legal or extra-legal enforcement, Airbus can only retaliate. If Airbus retaliates by increasing its production to 4 planes per week, its profits increase to $32 m. but industry profits fall again to $64 m. Both suppliers now have the same incentive to continue expanding production, and the cartel disintegrates into a competitive market, moving down the demand curve toward the competitive equilibrium. Monopolistic Competition and Oligopoly 42 According to the video clip, a key to DeBeers’s success as a cartel was 1. Economies of scale 2. Technological superiority 3. Government limits on entry into the diamond market 4. Inelasticity of demand because consumers perceive there are no close substitutes for diamonds Monopolistic Competition and Oligopoly 43 CARTELS Anatomy of a Cartel: OPEC In the 1970’s, OPEC succeeded in limiting the supply of crude oil produced by member countries so as to increase the price. After 1980, however, the market imploded. Price fell almost as much as it had risen. What happened? Why was the cartel’s success so short-lived? Monopolistic Competition and Oligopoly 44 CARTELS Anatomy of a Cartel: OPEC Reaching agreement OPEC reached an agreement to limit quantity and to allocate market share among its members. But, the agreement disintegrated as OPEC’s share of the world oil market declined and demand fell because of . . . Monopolistic Competition and Oligopoly 45 CARTELS Anatomy of a Cartel: OPEC New sources of supply In the 1980’s OPEC faced new sources of supply from non-OPEC countries who expanded their market share at OPEC’s expense: • North Sea (Great Britain and Norway) • Russia and former Soviet republics • Technology made Alberta tar sands and deep ocean drilling profitable Monopolistic Competition and Oligopoly 46 CARTELS Anatomy of a Cartel: OPEC Greater energy efficiency and consumer substitution The high price of oil in the 1970’s and early 1980’s created incentives for greater energy efficiency. Instead of remaining stable, world oil demand became quite volatile. Worldwide consumption fell and did not return to its 1980 level for 15 years. The short-run elasticity of demand for oil and petroleum products is low, but the long-run elasticity is much higher as consumers adopt alternative energy sources and substitute more non-oil-intensive activities for oil-intensive activities. Monopolistic Competition and Oligopoly 47 CARTELS Anatomy of a Cartel: OPEC Detecting and preventing cheating Because crude oil is a relatively homogeneous product and the oil market is worldwide, it is difficult for OPEC to verify that each of its members is abiding by the agreed-upon production quotas. By the 1980’s, member states with smaller market shares were clearly exceeding their production quotas. In particular, the 8-year Iran-Iraq war drove each country to maximize its own production to finance the war. Monopolistic Competition and Oligopoly 48 CARTELS Anatomy of a Cartel: OPEC Enforcing the agreement Short of going to war, OPEC lacks any mechanism to punish the cheaters, even if it could determine who they are. Monopolistic Competition and Oligopoly 49 Is each of the following true or false: To be successful, a cartel must 1. be able to engage in price discrimination. 2. include enough sellers to effectively limit quantity but not so many sellers that high negotiation costs and small individual gains prevent reaching an agreement. 3. be able to detect cheating 4. be able to enforce the cartel agreement against cheaters. 5. have few or no close substitutes for its product. Monopolistic Competition and Oligopoly 50 Making Markets Competitive Monopolistic Competition and Oligopoly 51 MAKING MARKETS COMPETITIVE Benefits of Competitive Markets Competitive markets, efficiency, profits and losses The possibility of earning short-run economic profits and the threat of economic losses provide incentives for suppliers in competitive markets to • use resources to satisfy consumer demand • adopt the most efficient, least-cost operating methods • be innovative. Monopolistic Competition and Oligopoly 52 MAKING MARKETS COMPETITIVE Benefits of Competitive Markets Benefits and costs accrue to consumers In the long run, entry into and exit from competitive markets drive prices up or down to equal costs so that suppliers earn only a normal accounting profit (zero economic profit). Changes in demand or in cost are passed on to consumers through changes in prices and quantities. Suppliers gain or lose in the short run, but in the long run both the benefits and the costs are passed on to consumers. Monopolistic Competition and Oligopoly 53 MAKING MARKETS COMPETITIVE Public Policy and Competition Unrestricted entry and exit is the key What makes a market competitive? Unrestricted entry and exit of resources As long as there are no barriers to the entry of new resources or the exit of existing resources, suppliers will behave competitively—the market will be competitive. Lack of competition in a market arises from barriers to entry and exit—from limitations, often imposed by government, on the entry of new competitors or the expansion of existing competitors. Monopolistic Competition and Oligopoly 54 MAKING MARKETS COMPETITIVE Public Policy and Competition Government policy is schizophrenic Some government policies—the antitrust laws, for example— prohibit sellers from engaging in certain business practices if those practices have the effect of limiting competition or creating monopoly. At the same time, most true monopolies are created or sanctioned by government—public franchises, government licenses, patents, and copyrights, for example—and many government regulations limit competition in the marketplace. Monopolistic Competition and Oligopoly 55 MAKING MARKETS COMPETITIVE Public Policy and Competition Lessons for public policy It is not the number of sellers or their size that makes markets competitive. It is the freedom of competitors and potential competitors to reallocate resources efficiently in response to the profit and loss signals of the market. Whether the market is perfectly competitive, monopolistically competitive, or oligopolistic is irrelevant. In fact,even a monopolist behaves competitively if there is sufficient threat of competition from outside its market. The key to improved competitiveness is the elimination of restrictions on the ability of resources to enter or exit a market in response to short-run economic profit or loss. Monopolistic Competition and Oligopoly 56 True (T) or false (F): In any market where a few large sellers dominate the market, the sellers will act as if they were monopolists. Monopolistic Competition and Oligopoly 57 The key to ensuring competitive behavior in any market is the absence of 1. price discrimination. 2. a few large sellers. 3. product differentiation. 4. barriers to entry into the market in the long run. 5. strategic behavior. Monopolistic Competition and Oligopoly 58