Principles of Economics

advertisement

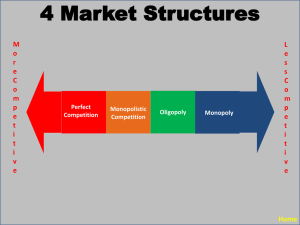

Principles of Economics Imperfect competition: Monopoly, Oligopoly and Monopolistic competition Perfect competition on a product market Perfect competition Imperfect competition Demand Horizontal (p = constant) Downward sloping (p(q)) Product Homogeneous Heterogeneous Information Perfect Imperfect Profit Zero profit Extra profit Number of sellers Many One or few Price formation Price takers Price makers Disadvantages: •Smaller total surplus of the economy •Smaller quantity on the market Advantages: •Technological progress (Schumpeter says innovations overpower negative effect of smaller total surplus – SCHUMPETER HYPOTHESIS) •Economies of scale Market power • Market power is analyzed using several indicators: 1. Share of 4 biggest companies on the market 2. Share of 8 biggest companies on the market 3. Herfindahl-Hirschmann index: HHI S S ... S S n 2 1 2 2 2 n 2 i i 1 0 HHI 10000 Where S is a percentage share of each company on the market. In monopoly HHI = 10000, in perfect competition 0. Dead weight loss • Imperfect competition causes total surplus decline – DEAD WEIGHT LOSS – it is a difference between total surplus in perfect competition (p = MC) and imperfect equilibrium (MR = MC) Monopoly Properties: • 1 seller, no substitutes. • Monopolist can change price. • There are barriers for entry (patents, copyright, large starting investment) • In perfect competition demand is horizontal (p = MR), in monopoly demand is falling (MR < p) • Monopolist maximizes profit: MC = MR < p (in real life p = AC + margin P MC M AC DWL MR 0 P = AR Q • • • • Total revenue (TR) and marginal revenue (MR) TR = p×q AR = p×q/q = p MR = ΔTR/ Δq When demand is falling TR has bell-like form • TR reaches its maximum when │Ed│ = 1 • Note that MR and demand are not the same curve as in perfect competition P │Ed │ = 1 TR MR 0 │Ed │ > 1 elastic p = AR │Ed │ < 1 inelastic Q Exercise 1 • Total cost function of a company is TC=40+2Q and demand function is P=10-0,1Q. If TC=120, what is the monopolist’s profit? • • • • • • TC=40+2Q 120=40+2Q Q=40 P=10-0,1Q=10-0,1*40=6 Π=TR-TC=P*Q-TC=240-(40+2*40) Π=240-120=120 Zadatak 2: • Demand function is Q=200-10P. Marginal revenue is MR=20-0.2Q, average costs are AC=0,05Q+5+225/Q and marginal costs MC=5+0,1Q. Find optimum price, production and profit of this monopolist. • MR=MC • 20-0,2Q=5+0,1Q • Q=50 • Q=200-10P • P=15 • Π=TR-TC=P*Q-AC*Q=15*50(0,05*50+5+225/50)*50=750-600=150 Exercise 3 • Demand is p = 32 – 2q. Find total revenue function. When it reaches its maximum? • Answer: • TR = (32 – 2q)q = -2q2 +32q • TR is at its maximum when Ed = -1, which is exactly at the half-point of a linear demand: 32 – 2q = 0 Q = 16, half-point: q = 8 TR(8) = -128 + 256 = 128 Oligopoly • Oligopoly is a market structure where there are only few sellers and many buyers. • Demand is falling • Sellers can affect price, but les than monopolist. This interaction is analyzed using game theory • Oligopolist used to compete with prices, today with promotion and differentiation • Pure oligopolies (homogeneous product) and differentiated oligopolies • Duopoly: the simplest oligopoly (only two players) • Price is greater than in perfect competition, smaller than monopolistic price Game theory • • • • Players choose between options Depending on decision of others they have different outcomes (profits) John Nash won a Nobel prize for analysis of game theory Nash Equilibrium: nobody can improve its position without change in the opponents decision • Dominant strategy: a company chooses 1 option no matter what the other does • Maximin strategy: traditional (risk averse) strategy • Simultaneous or sequential games Company B Cheap product Company A Cheap product Quality product Quality product 100 100 350 300 320 400 50 50 Maximin strategy: (100, 100) Nash equilibria: blue No dominant strategy If A has advantage: (400, 100) If B has advantage: (300, 350) Cooperative strategy: (300, 350) Exercise 4 • Air transport compaines’ shares in the USA in 1986 are given with the following table: Company United American Delta Eastern Northwest TWA Pan Am Other Market share 17 14 12 12 9 8 7 21 a) Find C4 concentration ratio. b) Find HHI indeks (be careful – “the others” should not be put into the index) a) • C4 = P1+P2+P3+P4 • Shares should be sorted from biggest to smallest! • C4 = 17 + 14 + 12 + 12 • C4 = 55% • Four major air transport companies account for 55% of the American airlines market. b) • HHI = P12 + P22 + … Pn2 • HHI = 172+152+122+122+92+82+72 • HHI = 967 out of 10000 => Low concentration Monopolistic competition • Many sellers, no barriers for entry • Differentiated product • In the short run companies behave like monopolists and earn extra profit • In the long run newcomers offer substitutes => demand declines, profits fall to zero (p = AC) Short run equilibrium in monopolistic competition P • Equilibrium similar to monopolistic (MR = MC) • Extra profit (grey). MC M AC DWL MR 0 P = AR Q Long run equilibrium in monopolistic competition P • In the long run demand becomes more elastic because of the new companies • MR = MC, P = AC (no profit) MC AC DWL MR 0 P = AR Q Exercise 5 • Monopolistically competitive company maximizes profit at TR=40 Its marginal revenue is MR=10 and MC=6+0.5Q. If it maximizes profit, what is the optimal price, quantity and MC? If it is a long-run equilibrium what is the value of total cost? (note: TC = TR in the long run in monopolistic competition) • • • • • • • MR=MC 10=6+0,5Q Q=8 TR=P*Q 40=P*8 P=5 TC = 40 since in the long run profits are zero Risk and uncertainty • Speculation is the activity of moving goods from places and times of abundancy to places and times of scarcity • Speculation improves alocation and brings markets to equilibrium • Arbitrage is the activity of simulatenous purchase on one market and sale on the other (riskless speculation) • Hedging is a process of risk neutralization • Person is RISK AVERSE if loss displeasure is stronger than gain pleasure • Person is RISK FRIENDLY if gain pleasure is stronger than loss displeasure • Person is RISK NEUTRAL if it regards gains as positive as losses negative. • Insurance spreads risk among many insurance contractees (moral hazard – insurance fraud) Exercise 6 Discuss individuals’ position towards risk: • Agatha would pay 1000$ for the insurance from loss of 10000$ that occurs in 5% of the cases. • Ben would pay no more than 1000$ for the insurance from loss of 10000$ that occurs in 20% of the cases. • Max would pay 1000$ for the insurance from loss of 10000$ that occurs in 10% of the cases. • Agatha: averse, Ben: friendly, Max: neutral