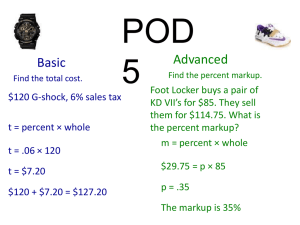

Tax

advertisement

Making Capital Investment Decisions What finance functions add the most to firm value? 2 What do we discount General Rules to follow: Only cash flows matter 2. Only examine incremental cash flow 3. Be consistent in treatment of inflation 4. Deduct taxes before discounting 1. 3 Cash Flow are what matter Cash flow = Dollars receive – Dollars paid Earnings are NOT cash flow Earnings are an ACCOUNTING NUMBER Accountants start with cash flow, but then adjusts for timing, accruals, non-cash items etc. Much of the work in evaluating a project lies in taking accounting numbers and generating cash flows You never write a check for “depreciation” 4 Incremental Cash Flows These are cash flows that the firm only incurs if it takes the project Need to consider all incremental cash flows that can be attributed to the project Examples: Project Interactions, Opportunity Costs, Overhead, Depreciation, Taxes (including cap gains tax), and Salvage Values 5 Interactions (Side Effects) Affects that the investment has on the cash flows of the firm’s other projects Erosion or Cannibalism (Bad) The new product causes existing customers to demand less of the company’s current products 6 Erosion in Action Denon is planning on introducing a Blu-Ray player, which will likely hurt the sales of their DVD players. Are all of the sales/profits of the Blu-Ray project incremental? C0 C1 C2 CD Sales No DVD 800 1000 CD Sales With DVD DVD Sales 500 400 400 800 -200 DVD Incremental CF 7 Working Capital Money the firm has on hand that is necessary for running the business Think of the cash in a register, how effective is the register without the cash in the drawer If a project requires changes in working capital, we need to account for this in our calculations Why??? 8 Opportunity Costs Cash flows that can be realized from putting the assets to use in different projects. What could we be making? Example: When Price Club considers stocking a new product, what is the opportunity costs that it should be considering? 9 Overhead The ongoing administrative expenses a business incurs, which cannot be attributed to any specific business activity, but are necessary to run the firm. Examples: rent, utilities, and insurance. Accountants allocate overhead across projects Are we concerned about the amount of overhead the account’s will assign to our project? 10 Example A firm has only one division A, with assets of $100m and overhead of $20m. It is planning to add another division B. Division B will have another $50m in assets. Due to the addition of this division, overhead is expected to increase to $27m. The firm allocates overheads for the two divisions based on their assets. What are the allocated overhead expenses? What is the relevant cash flow as far as the decision to add division B? 11 Depreciation Allocates the cost of an asset over its expected life, for accounting and tax purposes Accounts for the decline in asset value because of wear and tear or obsolescence Depreciation is based on the asset’s expected life, not on the life of the project LAND DOES NOT DEPRECIATE 12 Why do we care about Depreciation Depreciation is a non-cash expense, an accounting number, so why do we care about it? 13 The Two Depreciations Book (Accounting) Depreciation is what appears on financial statements Ex. Straight line depreciation Tax Depreciation is used to determine the firms tax bill This determines the Tax Shield 14 The Two EBT’s EBDT -Tax Dep EBT (Tax) Tax Rate Taxes Paid -Book Dep EBT (Book) -Taxes Paid Net Income = Book EBT – Taxes Paid 15 Book Depreciation This type of depreciation is used to calculate a company’s Net Income Straight line Depreciation: (Investment – Salvage Value) / Expected life Investment: Salvage Value: 16 Tax Depreciation Tax Depreciation is calculated using the Modified Accelerated Cost Recovery System Tax depreciation ignores salvage value MACRS allows for more depreciation early How will this affect the PV of the tax shield? Tax Shield = (Tax Depreciation * tax rate) What is the Tax Shield? 17 Tax Depreciation Schedules by Recovery-Period Class Year(s) 1 2 3 4 5 6 7 8 9 10 11 3-Year 5-Year 7-Year 10-Year 33.33 44.45 14.81 7.41 20.00 32.00 19.20 11.52 11.52 5.76 14.29 24.49 17.49 12.49 8.93 8.93 8.93 4.45 10.00 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.55 6.55 3.29 18 Acct & Tax Dep. Example Purchase an asset costing $1m, which has a 5 year expected life. After 5 years you can sell it for scrap, $100k. What is the yearly accounting (straight line) and tax depreciation? Year 1 Year 2 Year 3 Year 4 Year 5 Accting Tax 19 Proceeds from Sale and Capital Gains Tax When a company sells an asset, if the price is above the tax book value, it is subject to capital gains Capital Gains Tax Obligation = (Price- Tax Book Value) * Capital Gains Tax Rate 20 Capital Gains Tax Example You purchase a machine that will cost your company $1.5m, that has a life of 5 years. You plan to use the project for 3 years and then sell the machine for $600k, at the end of 5 years the machine is worth $50k. The capital gains rate is 20%. What is the tax obligation resulting from the sale? 21 Inflation and Capital Budgeting Inflation: general increase in the price of good Alternative: the general decline in the purchasing power of money Hershey Nickel Bar: In 1930 bar was 2 oz In 1968 bar was ¾ oz Inflation is an important fact of economic life and must be considered in capital budgeting. 22 Dealing with Inflation KEY: Keep everything in either real or nominal terms Cash Flows → Real Discount Rate Nominal Cash Flows → Nominal Discount Rate Real As long as we are consistent in our treatment of inflation we will get the same NPV 23 Real vs. Nominal Nominal dollars: Real dollars: Nominal rate: Real rate: 24 Inflation and Discount rate The relationship between interest rates and inflation is known as the Fisher Equation (1 + Nominal Rate) = (1 + Real Rate) × (1 + Inflation Rate) 25 Real vs. Nominal Rate Example 1 If you invest $10,000 at a nominal rate of 12% APR, how much will you have in 30 years? How much will you have in real terms if the rate of inflation is 4% per year? 26 Real vs. Nominal Rate Example 2 Nominal Rate is 15%, inflation is 10% Year Real CF Nominal CF 0 -10 -10 1 10 2 11 3 12 What is the real discount rate? What are the nominal cash flows? 27 Depreciation & Inflation Depreciation is always given in nominal terms So, if using real cash flow and discount rates you will need to convert nominal depreciation into real depreciation Generally it’s simpler to use nominal cash flows and the nominal discount rate 28 Costs we Do NOT Care About Sunk Costs: are expenses that have already been paid Already paid so NOT INCREMENTAL to project Ex: Feasibility study, R&D expenses, test marketing, etc. Each of theses is an independent projects, subject to NPV Just because “we have come this far” does not mean that we should continue to throw good money after bad. 29 Cost Categories When determining whether a cost is relevant in NPV analysis, you need to classify it Incremental costs, We care about these Opportunity costs, We care about these Sunk costs, We do NOT care about these 30 Estimating Cash Flows Cash Flow from Operations Recall that: OCF = EBIT – Taxes + Depreciation 31 Other Methods for Computing OCF Bottom-Up Approach Works only when there is no interest expense OCF = NI + depreciation Top-Down Approach = Sales – Costs – Taxes Do not subtract non-cash deductions OCF Tax Shield Approach OCF = (Sales – Costs)(1 – τ) + Depreciation* τ 32 Interest Expense For now, assume that debt is independent of the project Interest expense is not influenced by the project Later we will deal with the impact that debt has on firm value 33 Big Example 1 Denon is planning to introduce a DVD player. It seeks your advice on whether this project should be taken up. The details are given below: The initial investment in plant and machinery is 5 million. The project also requires an initial Net Working Capital of 1 million which will be recouped entirely when the project is sold off at the end of year 3. The revenues from the DVD player is expected to be 9, 10 and 11 million in the first three years. Variable cost are expected to be 60% of sales. Fixed costs are expected to be 1 million each year. For simplicity, assume all assets have a life of 5 years, and assets have no salvage value. The firm expects to sell off the assets after 3 years for $2m. DVD player sales are expected to cannibalize $1million from CD player sales Corporate tax rate is 35%. Capital gains tax rate is 20%. Discount rate = 10% 34 Big Example 1: Investment Denon is planning to introduce a DVD player. It seeks your advice on whether this project should be taken up. The details are given below: The initial investment in plant and machinery is 5 million. The project also requires an initial Net Working Capital of 1 million which will be recouped entirely when the project is sold off at the end of year 3. Year 0 Year 1 Year 2 Year 3 1.00 1.00 0.00 Total Investment Plant & Machinery 5.00 Net Working Capital 1.00 35 Big Example 1: Operations Denon is planning to introduce a DVD player. It seeks your advice on whether this project should be taken up. The details are given below: The revenues from the DVD player is expected to be 9, 10 and 11 million in the first three years. Variable cost are expected to be 60% of sales. Fixed costs are expected to be 1 million each year. For simplicity, assume all assets have a life of 5 years, and assets have no salvage value. Year 0 Year 1 Year 2 Year 3 Sales 9.00 10.00 11.00 Variable Costs (60% Sale) 5.40 6.00 6.60 Fixed Costs 1.00 1.00 1.00 EBDT 2.60 3.00 3.40 Book Dep 1.00 1.00 1.00 EBT 1.60 2.00 2.40 Profit / Loss Accounts 36 Big Example 1: Corp Taxes Denon is planning to introduce a DVD player. It seeks your advice on whether this project should be taken up. The details are given below: For simplicity, assume all assets have a life of 5 years, and assets have no salvage value. Corporate tax rate is 35%. Capital gains tax rate is 20%. Discount rate = 10% Year 0 Year 1 Year 2 Year 3 2.60 3.00 3.40 20.0% 32.0% 19.2% Tax Dep 1.00 1.60 0.96 EBT (Tax) 1.6 1.40 2.44 Tax (35%) 0.56 0.49 0.85 Corp Tax EBDT Tax Dep % 37 Big Example 1: Capital Gains Denon is planning to introduce a DVD player. It seeks your advice on whether this project should be taken up. The details are given below: The firm expects to sell off the assets after 3 years for $2m The assets has a life of 5 years, and assets have no salvage value. Corporate tax rate is 35%. Capital gains tax rate is 20%. Discount rate = 10% Year 0 Year 1 Year 2 Year 3 Capital Gains Tax Proceeds from sale 2.00 Tax Dep BV of asset 5.00 1.00 1.60 0.96 4.00 2.40 1.44 Profit 0.56 Capital Gains Tax (20%) 0.11 38 Big Example 1: Op 2, Net Income Denon is planning to introduce a DVD player. It seeks your advice on whether this project should be taken up. The details are given below: Year 0 Year 1 Year 2 Year 3 Sales 9.00 10.00 11.00 Variable Costs (60% Sale) 5.40 6.00 6.60 Fixed Costs 1.00 1.00 1.00 EBDT 2.60 3.00 3.40 Book Dep 1.00 1.00 1.00 EBT 1.60 2.00 2.40 Tax 0.56 0.49 0.85 Net Income 1.04 1.51 1.55 Profit / Loss Accounts 39 Big Example 1: C F Summary Year 0 Year 1 Year 2 Year 3 0.00 0.00 1.00 Net Income 1.04 1.51 1.55 Book Dep 1.00 1.00 1.00 Investments (5.00) Change in Working Capital (1.00) Sale Proceeds 2.00 Capital Gains (0.11) Lost CD Sales Net Cash Flow (6.00) NPV (0.47) (1.00) (1.00) (1.00) 1.04 1.51 4.44 40 Big Example 2: (In-Class 1, Given) Your R&D department has come up with a innovative product. Your firm had spent $2m as R&D expenses for this project. You are now wondering whether this product introduction will increase shareholder wealth? Investment of $6.0m is required immediately and another $4.0m is required at the end of year 1. The factory can start manufacturing only after this second investment is made. Assume all assets have a life of 5 years, and depreciation starts after manufacturing begins. You expect to sell 1m units in the first year of production, 1.5m units in the next four years. You plan to sell the factory after that and you expect it to fetch $1m. Selling price is expected to be $10/unit in the first year of goods sold and is expected to increase at 5% p.a. Cost of goods sold is $6/unit in the first year of production and is expected to increase at 4% p.a. Assume the level of net working capital to be $1.0m in the first year of production. Afterwards, it will increase by $1.0m each year. In the last year, the firm will be able to liquidate its entire NWC without loss in value. Assume corporate income tax rate to be 35% and capital gains tax rate of 20%. This project requires a nominal discount rate of 10%. 41 Other Tricks with NPV Optimal Timing of a Project Choosing between equipment with different lives Replacing an Existing Machine Cost of Excess Capacity 42 Optimal Timing NPV can be used to determine the optimal time to undertake a project Ex: You have a teak farm and you have to decide when to harvest. The longer you wait, the bigger the trees, and hence higher the value. However, after the initial growth phase, the trees grow slower and slower. The opportunity cost of capital is 10% 43 Teak Farm Example Year 0 1 2 3 4 5 6 7 Value 100 120 140 160 180 200 220 240 20% 16.7% 14.3% 12.5% 11.1% 10% 9.1% $109.10 $115.70 $120.21 $122.94 $124.18 $124.18 $123.16 Yr % PV When do we harvest the trees? Why 44 Investments of Unequal Lives There are times when application of the NPV rule can lead to the wrong decision. Consider a factory that must have an air cleaner that is mandated by law. Discount rate is 10% There are two choices: The “Cadillac cleaner” costs $4,000 today, has annual operating costs of $100, and lasts 10 years. The “Cheapskate cleaner” costs $1,000 today, has annual operating costs of $500, and lasts 5 years. 45 Comparing Investments with Different Expected Lives 1. Replacement Chain Repeat projects until they begin and end at the same time. Compute NPV for the “repeated projects.” 2. The Equivalent Annual Cost Method 46 Replacement Chain Approach The Cadillac last 10 years The Cheapskate last 5 years What is the minimum time span over, which we can fairly compare these two? 47 Replacement Chain Approach The Cadillac cleaner time line of cash flows: 0 1 2 3 4 5 6 7 8 9 10 The Cheapskate cleaner time line of cash flows over ten years: 0 1 2 3 4 5 6 7 8 9 10 48 Equivalent Annual Cost (EAC) Spread the cost of buying and maintaining a machine over its expect life, while accounting for time value of money The payments that an annuity with the same PV and life Used when the only difference is the costs Pick the machine with the lower EAC Pick the machine with the lower EAC The EAC for the Cadillac is ($4,614.46)? The EAC for the Cheapskate is ($2,895.39)? 49 Different Lives Example (Given) There are two machines, A and B. Both machines have the same capacity and produce identical goods. However, while machine A has a life of 5 years, machine B has a life of 3 years. The initial investments are $20m and $15m respectively. There is no salvage value for either machine. The operating costs are $4m and $5m per year respectively. Assume that the discount rate is 10%. Which one should you choose? Find the Present Value of each machines total costs (A) N = 5, I/Y = 10, PV=???, PMT = 4, FV=0:: Op PV=15.16 (A) Total PV = 15.16 + 20 = $35.16 (B) N = 3, I/Y = 10, PV=???, PMT = 5, FV=0 :: Op PV=12.43 (B) Total PV = 12.43 + 15 = $27.4 50 EAC Solution (Given) PVA EACA EACA EACA EACA EACA |-----------|----------|----------|----------|----------| 0 1 2 3 4 5 PVB EACB EACB EACB |-----------|----------|----------| 0 1 2 3 PVA = 35.16; EACA = N = 5, I/Y = 10, PV=35.16, PMT = ???, FV=0:: PMT = $9.28 PVB = 27.43; EACB = N = 3, I/Y = 10, PV=27.43, PMT = ???, FV=0:: PMT = $11.03 Choose Machine A (9.28 < 11.03) 51 Replacement Chain Machine A (Given) How often will machine A be replaced? 2 In year 5, and again in year 10 PVA (Investment)=20 +20/(1.15)+20/(1.110) = 40.13 PVA (Operating Costs) = N=15, I/Y=10, PV=???, PMT=4m, FV=0::PV= $30.42m PVA = 40.13 +30.42 = $70.55m 52 Replacement Chain Machine B (Given) How often will machine B be replaced? 4 In PVB (Investment) = 15+15/(1.13)+15/(1.16)+15/(1.19)+15/(1.112) = 45.88 PVB (Operating Costs) = N years 3, 6, 9, 12 = 15, I/Y=10, PV=???, PMT=5m,FV=0::PV= $38.03m PVB = 45.88+38.03 = $83.91m 53 Replacement Chain Pick One (Given) So which machine do we invest in? A $70.55, or B $ 83.91 Choose A Does it matter if we use EAC or Equal Horizons? It does not matter whether we use the replacement chain or the EAC 54 Twist Now, if the machines also vary in the revenue that they will produce (possible because of quality variations) how will we modify our methods? 55 Equivalent Annual Revenue (EAR) The EAR is the payment of an annuity with the same PV and life as the investment Used when the different projects produce different revenue streams Spreads the machines revenue evenly over it’s life Get the EAR just like the EAC, but now we are using revenue so we want to pick the machine with the higher EAR 56 Replacing an Existing Machine The existing machine will last for 2 years. It will produce a cash inflow of $4,000 in year 1 and $4,000 in year 2. You can replace this with a new machine that costs $15,000 but will produce cash inflows of $8,000 a year for three years. Do you go for the new machine or stay with the old one? Assume a 6% discount rate. 57 Machines EAR NPVnew = NPVold = EARnew = EARold = Do we replace the machine? Why? 58 Quick Quiz How do we determine if cash flows are relevant to the capital budgeting decision? What are the different methods for computing operating cash flow, and when are they important? How should cash flows and discount rates be matched when inflation is present? What is equivalent annual cost, and when should it be used? 59