RGM - AC Bonus Guide - Total Performance Management

advertisement

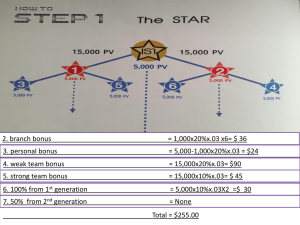

RGM / AC Bonus Guide Purpose and Report Contents Serve as an educational resource for HR and Finance within YRI BMUs Outline design parameters for the implementation of the Yum RGM / AC Bonus Provide detailed design steps and techniques for modeling the Yum RGM / AC Bonus Provide support for a YRI Q1 2005 implementation As such, this document includes the following sections Bonus design and implementation process Data to be collected as “pre-work” to modeling the bonus Outline of principles and objectives of the bonus to assist in communication and education within the BMU Steps for modeling the bonus including an outline of design parameters for each bonus component The examples and methodologies outlined in this presentation and Bonus Modeling Tool are intended as a starting point for modeling; each BMU must consider what makes sense for restaurant performance and objectives within the BMU 2 Bonus Design and Implementation Process Bonus Design and Implementation Process Q2 Q3 Q4 Q1 Mar - May Jun - Aug Sept - Nov Day 1 Pd 1 Engage Finance & Operations Work with Finance & Operations to validate design Execute Communication and training plan Model the bonus Tools RGM / AC Bonus Guide Bonus design tool Outcome Proposed design Test design within TPM tool Become familiar with TPM tool capabilities Experiment with design & data Experiment with reports Tools TPM tool Report templates Outcome Preliminary understanding of how the bonus will be administered through TPM Identification of issues/barriers Go Live Test design & revisions within TPM tool Finalize design and develop communication plan Gain BMU Approval Develop Fieldready bonus & training materials Tools US templates Outcomes Bonus communication materials Training materials 4 Pre-Work Pre-Work Collect a full year of data for the following key Yum! performance measures Sales and Profit (RCP) data Plan for 2004 Plan and Actual results for 2003 Flow-Thru Results for 2003 Target for 2004 CHAMPSCheck Results for 2003 Target for 2004 Results from Strategic Initiative measure e.g., Team Member turnover results for 2003 and target for 2004 To ensure you have a full year of data, you could collect current YTD data and estimate the balance of the year (e.g., using plan data) Collect the data for each restaurant including restaurant number and area number 6 Pre-Work Tips “Clean” the data The Strategic Component should be determined by the BMU. For this example, we have assumed Team Member Turnover is the strategic component. Use annual data for design work Remove partial store periods and use “Full Store Periods” only Remove extreme data points For example, sort the data by sales and delete extremely high or low sales figures…repeat for RCP and other data points The modeling technique outlined in this document uses full-year data, when validating the design you may want to consider what the bonus will payout for each quarter Actual (2003) and Plan (2004) Data Area Store Count ID ID 1 2 3... 199 200 2003 Sales Plan 2003 Sales Actual 2004 Sales Plan 2003 RCP Plan 2003 RCP Actual 2004 RCP Plan 2003 2003 Flow- 2003 Flow 2003 Team Thru Thru to # of 100% Member Results RCP CHAMPS Turnover 001 001 1,000 1,002 1,010,000 730,000 1,085,511 752,000 1,097,861 790,617 280,000 201,663 308,000 205,000 327,000 223,733 319,088 210,156 103.6 102.5 9 7 78 127 025 025 1,396 1,398 765,000 930,000 751,000 925,000 781,830 950,460 221,434 261,934 228,077 269,792 255,826 305,527 237,200 264,397 104.0 98.0 14 9 42 120 7 Bonus Design Principles and Objectives Bonus Design Principles Motivate RGMs and ACs to meet and exceed performance target Aligned with other programs (e.g., BSC, PA) and across Operations & BMU Achieve a balanced emphasis on Customer, Sales, Profits & Strategic Sales & Profit Make Plan Matrix and Flow-Thru Customer 100% CHAMPSCheck Strategic Strategic Initiative (e.g., Turnover) Drive operating Blue Chips Building people capability Driving customer mania through 100% CHAMPS Grow profitable sales Improve RCP & margins “Beat Year Ago” 9 Bonus Design Objectives Design Objective Design Element to Achieve Objective Engage employees through short-term incentives Quarterly payout Higher volume restaurant = Higher value to Yum! and higher rewards for RGM/AC Volume-based financial rewards Fixed $ payout based on satisfying customers 100% each time (RGM only) Customer Mania focus Flexibility to focus on strategic initiative Business Unit focus Performance-based Competitive payout for on-target performance Increased payout for exceeding target Limited payout for below target performance Leveraged to encourage higher performance 10 Aligned F/T P&L Reports RGM Bonus Balanced Scorecard Performance Appraisal Customer Customer Customer 100% CHAMPSCheck 100% CHAMPSCheck Speed of Service BSC + Process (CER, 1-800) People BSC + Leadership/Culture (Safety, Staffing, Team Development) People Strategic Focus e.g., Team Member Turnover Sales “Make Plan” Matrix Profit Turnover Core Training Retention Sales Net Sales to Plan Flow-Thru Profit People Sales BSC + Leadership/Culture/Process Profit BSC + Leadership/Culture/Process Profit to Plan Flow-Thru Examples: Long Term Incentive Period: CHAMPS Cards Quarter: Team Celebrations Yearly: Champions Club Trip & Prizes 11 Balanced emphasis on People, Customer, Sales & Profits BMUs will adjust weights based on overall strategy 30 % Profit PA (60% for RGM & AC) 20 % 20 % 30 % 30 % 30 % BSC Sales it of Pr 30 % s le Sa & r me o t s Cu gic te ra t S 30 % 20 % 20 % 20 % 20 % Bonus will reward results and carries heavier weightings on financials compared to the BSC to minimize funding risk Strategic Customer Bonus Long term Short term Process-oriented Focused on business results 12 RGM Bonus Modeling the Bonus RGM Bonus Steps in Modeling the Bonus Step 1 Determine the target payout for each performance measure Step 2 Calculate Sales growth Step 3 Calculate average RCP and RCP growth Step 4 Develop the Sales & RCP “Make Plan” Matrix Step 5 Develop the Flow-Thru Chart Step 6 Develop 100% CHAMPSCheck Chart Step 7 Develop Chart for the Strategic Component 14 RGM Bonus Step 1 - Target Payouts The following are the performance measures and weight parameters BMUs should determine the appropriate strategic measure initiative and adjust weights based on overall BMU strategy A bonus can be earned for achieving targets on each measure, separately Weight Parameters 1 Sales & RCP Make Plan Matrix 30% - 40% 2 Flow-Thru 20% - 30% 3 100% Perfect CHAMPSCheck 20% - 30% 4 Strategic Initiative 15% - 30% *Note: In markets that do not have Flow-thru, the Flow-thru component may be omitted from the bonus design. The weight from the Flow-thru component should be redistributed to the other components. 15 RGM Bonus Step 1 - Target Payout Use market data to establish the overall bonus target amount Market pricing – target Total Cash at the 50th percentile base salary and 75th percentile bonus taking into consideration the following: Appropriate “mix” of base pay and variable pay Financial ability to pay at the desired market level Tips and Advice • Avoid major target changes from year to year Comparison of Yum! Total Cash to Market Total Cash Annual Dollars (000) $50.0 $40.0 $42.4 $44.3 $3.9 $5.8 $38.5 $38.5 $47.4 $46.0 $8.9 $6.0 $38.5 $40.0 In this example, Yum Total Cash should be between $44.3 and $47.4 $30.0 $20.0 Example Data $10.0 0 25th Percentile 50th Percentile 75th Percentile Market Data - Restaurant/Unit Manager Base Pay Yum! RGM Average Target Bonus Amount 16 RGM Bonus Step 1 - Target Payout Worksheet Tab in the Bonus Modeling Tool 1_TargetBonus Calculate the target payout for each bonus component using the weight parameters From Market Assessment Overall Bonus Target Category $6,000 Target by Category Weight Parameters 1 Change to reflect your bonus weightings. Weight for Example $ Target Sales & RCP Make Plan Matrix 30% - 40% 30% $1,800 Flow-Thru 20%-30% 20% $1,200 100% Perfect CHAMPSCheck 20% - 30% 30% $1,800 Calculate a bonus target amount for each component. Strategic Initiative 15%-30% 20% $1,200 6,000 x .30 = $1,800 100% $6,000 Overall 2 17 3 RGM Bonus Step 2 - Sales Planning Worksheet Tab in the Bonus Modeling Tool 2_SalesPlan 3 2 Calculate 2004 Sales Growth Calculate sums: 2003 Sales Actual 2004 Sales Plan 1 Collect Sales Plan data for the upcoming year (245,314,938 - 239,100,390) 239,100,390 = 2.6% Make sure this number aligns to the BMU goal! 2 Calculations: 2004 Sales Growth 2 239,100,390 245,314,938 3 2.6% Sales Data - 2003 Actual and Plan; 2004 Plan Count 1 2 3... 199 200 Area Store ID ID 2003 Sales Plan 2003 Sales Actual 2003 Sales vs Plan 1 2004 Sales Plan 2004 Sales Growth 001 001 1,000 1,002 1,010,000 730,000 1,085,511 752,000 107.5% 103.0% 1,097,861 790,617 1.1% 5.1% 025 025 1,396 1,398 765,000 930,000 751,000 925,000 98.2% 99.5% 781,830 950,460 4.1% 2.8% 2004 Sales Growth will be used to set the minimum value at which a bonus will be paid (“threshold”) for Sales vs. Plan on the Make Plan matrix 18 RGM Bonus Step 3 - Profit (RCP) Planning Worksheet Tab in the Bonus Modeling Tool 3_ProfitPlan RCP Data - 2003 Actual and Plan; 2004 Plan 1 Collect RCP data for the upcoming year Area Count ID Store ID 1 2 Calculate averages: 2003 RCP Actual 2004 RCP Plan 2003 RCP Plan 2003 RCP Actual 2003 RCP vs. Plan 2004 RCP 1 Plan 2004 RCP Growth 001 1,000 280,000 308,000 110.0% 327,000 6.2% 001 3... 198 025 1,002 201,663 205,000 101.7% 223,733 9.1% 1,394 464,785 478,728 103.0% 526,647 10.0% 199 025 1,396 221,434 228,077 103.0% 255,826 12.2% 200 025 1,398 261,934 269,792 103.0% 305,527 13.2% 356,713 2 384,436 107.8% 2 410,420 2 Averages 6.8% Tips and Advice Average 2004 RCP Plan will be used as a basis for modeling on the Make Plan matrix and FlowThru chart • Work with Finance to ensure that the overall RCP growth percentage is aligned to the BMU goal. 19 RGM Bonus Step 4 - Develop the Make Plan Matrix Objective Design Parameters • Fuel “Beat Year Ago” mentality • Sales vs. Plan is the Fair Pay measure Plan assumes growth over prior year Plan normalizes prior year peaks/valleys and addresses quarterly anomalies • Based on actual RCP results (volume-based) • Bonus increases with increase in profitable sales • Quarterly calculation (i.e. payout based on quarterly results) • Weight of component can vary between 30% – 40% Targets and Thresholds • Business Unit establishes thresholds • The lowest point for bonus payment (e.g., payout 50% for “nearly hitting plan”) should be set such that performance exceeds prior year on a national basis • Payouts will vary by BMU to fit strategy and financial planning • % RCP pool figure will vary based on component weight and average RCP for the BMU • 100% factor within the matrix should correspond to 100% Sales to Plan and 100% RCP to Plan • 300% factor within the matrix is the maximum upside potential and should typically reward 5-10% of performers 20 RGM Bonus Step 4 - Develop the Make Plan Matrix (continued) Basic steps Calculate the Make Plan bonus target as % of the average 2004 RCP Plan This number will tell you the percentage of profit that should be paid for achieving RCP and Sales plans Set up the spreadsheet to model the matrix Establish thresholds (the minimum level of performance for which a bonus will be paid) and maximums on the matrix Adjust Sales and RCP scales to determine the cost of the bonus The modeling tool will calculate the average payout that the matrix will provide compared to the bonus target that you are trying to achieve based on prior year’s performance Adjust matrix payouts to ensure bonus is affordable Make sure to include your Operations and Finance partners to tailor your design to the BMU. The information on the following pages is intended as guidelines to assist you in decision making around the Make Plan matrix. Judgment is required to focus appropriate behavior within the BMU. 21 RGM Bonus Step 4 - Develop the Make Plan Matrix Worksheet Tab in the Bonus Modeling Tool 4a_MakePlanMatrix Calculate Make Plan bonus target as % of the average 2004 RCP Plan From Step 1 Calculation of Make Plan Target as a % of RCP Sales & RCP Make Plan Bonus Target Average 2004 RCP Plan Make Plan Bonus Target as % of RCP Plan 1,800 From Step 3 410,420 0.44% (1,800 410,420) x 100 = .44% Make Plan Target as % of RCP Plan is the percentage of profit that RGMs would be paid for achieving sales and profit plans. The number will be used as the basis for calculating the payout on the Make Plan Matrix. 22 RGM Bonus Step 4 - Develop the Make Plan Matrix (continued) Set up the spreadsheet to model the matrix Worksheet Tab in the Bonus Modeling Tool 4b_MakePlanMatrix 2 1 In the bonus modeling tool, include your prior year Sales and RCP data as well as current year RCP Plan 4 3 Calculate estimated 2004 RCP Actual based on last year’s result 1.1 x 327,000 = 359,700 Calculate .44% of 2004 RCP Actual for each restaurant .0044 x 359,700 = 1,578 5 Identify the appropriate matrix multiplier from the Make Plan matrix using 2003 Sales vs. Plan and 2003 RCP vs. Plan 2 3 Count Store ID 2003 Sales vs. Plan 1 1,000 107.5% 110.0% 327,000 359,700 1,578 2 1,002 103.0% 101.7% 223,733 227,435 12 1,022 102.2% 90.6% 372,887 199 1,396 98.2% 103.0% 255,826 1,398 99.5% 2004 RCP Plan 2004 RCP Actual .44% of RCP Matrix Multiplier 305,527 Pay-Outs 4 2003 RCP vs. Plan 103.0% 1,578 x 2.0 = 3,156 Estimated Pay-out if Last Year's Performance 1 200 Calculate payouts by multiplying .44% of RCP by the Matrix Multiplier 5 All Receivers 200% 3,155 3,155 997 125% 1,247 1,247 337,806 1,482 0% 0 6 263,501 1,156 60% 693 693 828 828 Create a column for 314,693 1,380 “Receivers” and for those 60% RGMs who earned $0 bonus, leave the cell blank. 23 RGM Bonus Step 4 - Develop the Make Plan Matrix (continued) Calculate averages Worksheet Tab in the Bonus Modeling Tool 4b_MakePlanMatrix There are two averages that should be calculated: “All” is the average of bonuses paid to all RGMs, even those who received $0. This number would be used to gauge the overall cost of the bonus. “Receivers” is the average of the bonus paid for only those RGMs who received a bonus (e.g., excludes those who received $0). This number would be used to assess how competitive the bonus is relative to the labor market. 1 Calculate the average payout for “All”, including payouts of $0. Average Payout for "All" 1 2,130 Average Payout for "Receivers" 2 3,183 Estimated Pay-out if Last Year's Performance 2 Pay-Outs Calculate the average payout for “Receivers”, excluding payouts of $0. Count Store ID 2003 Sales vs. Plan 2003 RCP vs. Plan 2004 RCP Plan 2004 RCP Actual .58% of RCP Matrix Multiplier All Receivers 1 1,000 107.5% 110.0% 327,000 359,700 1,578 200% 3,155 3,155 2 1,002 103.0% 101.7% 223,733 227,435 997 125% 1,247 1,247 12 1,022 102.2% 90.6% 372,887 337,806 1,482 0% 0 24 RGM Bonus Step 4 - Develop the Make Plan Matrix (continued) Guidelines - Setting Sales and RCP Scales For setting both Sales and RCP scales, you may want to consider aligning the scales to the Balance Scorecard targets. Set Sales minimum for payout – To ensure “Beat Year Ago” is achieved, the minimum should be set such that achieving the minimum level of performance will result in improvement over the prior year. In this example, sales growth is targeted to be 2.6% (from Step 2) so payment should be made only when that level of performance is achieved (98% of plan). Set RCP minimum level of payout – Work with Finance to determine the expected level of RCP if 98% of Sales is achieved. A rule of thumb used in the US is to assume that RCP will be 33% of Sales. This number will vary based on the country's margins. For example… Formulas: 2004 Sales Plan x .98 X .33 = Expected 2004 RCP Expected 2004 RCP 2004 RCP Plan = Threshold The first increment is typically from the threshold amount (i.e., 98%) to 99.9%. Model the scales using the bonus modeling tool (see next slide) Net Sales vs. Plan 0.44% % of RCP Times RCP vs Plan Example of an average store 1,226,575 x .98 X .33 = 396,674 396,674 410,420 = 96.6% 98 --99.99 100 --101.99 102 --104.99 105 --107.99 108 --109 110 --- 96 --- 99.99 40% 50% 50% 50% 50% 50% 100 --- 101.99 50% 100% 125% 135% 145% 150% 102 --- 103.99 60% 100% 135% 150% 175% 200% 104 --- 109.99 60% 100% 145% 175% 200% 225% 110 --- 114.99 60% 100% 155% 200% 250% 275% 115 --- 60% 100% 165% 225% 275% 300% 25 RGM Bonus Step 4 - Develop the Make Plan Matrix (continued) 2 Average Payout for “All” would be the number used for accrual Net Sales vs. Plan RCP vs Plan 0.44% % of RCP Times 98 --99.99 100 --101.99 102 --104.99 96 --- 99.99 40% 50% 50% 100 --- 101.99 60% 100% 125% 105 --107.99 1 50% 150% 108 --109 110 --- 50% 50% 102 --- 103.99 Actual Sales150% vs Plan 100% 60% 175%Est. 2004175% 1,800 175% Actual RCP vs Plan 102.4% 200% 102.4% 200% 107.8% 107.8% 104 --- 109.99 60% 100% 150% 200% Average Payout for "All" 1 200% 200% 2 2,124 110 --- 114.99 60% Average Payout for "Receivers" 100% 150% 200% 3 225% 3,173 225% 115 --- 60% 100% % of RGMs Receiving a Bonus 150% Average Payout for “Receivers” would be the number to gauge how you are paying for performance. $1,800 should be the payment for achieving plans. The matrix is paying $3,183 for exceeding plans. 2003 Make Plan Target 1 3 200% 225% 67% 250% Estimated Pay-out if Last Year's Performance Pay-Outs 1 Adjust scales to determine what total spending would be and if the program would be affordable Worksheet Tabs 4b_MakePlanMatrix 2003 Sales vs. Plan 2003 RCP vs. Plan 2004 RCP Plan 2004 RCP Actual .44% of RCP Matrix Multiplier Count Area ID Store ID All Receivers 1 001 1,000 107.5% 110.0% 327,000 359,700 1,578 200% 3,155 3,155 2 001 1,002 103.0% 101.7% 223,733 227,435 997 125% 1,247 1,247 199 025 1,396 98.2% 103.0% 255,826 263,501 1,156 60% 693 693 200 025 1,398 99.5% 103.0% 305,527 314,693 1,380 60% 828 828 102.6% 107.8% 410,420 445,374 2,124 3,173 Averages 4c_MakePlanMatrix 26 RGM Bonus Step 4 - Develop the Make Plan Matrix (continued) If the bonus is not affordable using the current matrix percentages, consider changing the matrix percentages Again, the following are guidelines to assist you in decision making; judgment is required to focus appropriate behavior within your BMU See Next Slide for Matrix Graphic Guidelines Pay 100% target at 100% of RCP Plan and Sales Plan If you must reduce cost, adjust from 300% down to 250% (adjust other matrix cells accordingly) Pay a percentage of target for nearly achieving plan. To reduce cost, consider holding payment flat for increasing sales but not achieving profit plan Encourage both growth in sales and growth in profit To avoid negative behaviors, consider maintaining a flat percentage for not increasing sales but increasing profit. Encourage sales growth Consider making the increase between these increments larger to reflect the fact that it is more difficult to achieve these levels of performance. Reduce the matrix payouts below this level. 27 RGM Bonus Step 4 - Develop the Make Plan Matrix (continued) Net Sales vs. Plan RCP vs Plan 0.44% % of RCP Times 98 --99.99 100 --101.99 102 --104.99 105 --107.99 108 --109 110 --- 50% 50% 50% 50% 50% 100% 125% 135% 145% 150% 96 --- 99.99 40% 100 --- 101.99 50% 102 --- 103.99 60% 100% 135% 150% 175% 200% 104 --- 109.99 60% 100% 145% 175% 200% 225% 110 --- 114.99 60% 100% 155% 200% 250% 275% 115 --- 60% 100% 165% 225% 275% 300% 28 RGM Bonus Step 5 - Develop the Flow-Thru Chart Objective Design Parameters • Focus RGMs on maximizing profitability by focusing on costs that they control • Based on actual RCP results (volume-based) • Flow-Thru reflects bottom-line controls by adjusting for sales plan attainment • Bonus increases with increase in profitable sales • Quarterly calculation (i.e. payout based on quarterly results) • Weight of component can vary between 20% – 30% Targets and Thresholds • % RCP pool figure will vary based on component weight and average RCP for the BMU • 100% factor on the Flow-Thru chart should correspond to at least 100% RCP to Flow-Thru index • All other percentages on the chart can vary based on BMU discretion • BMU establishes thresholds • Establish thresholds that ensure good long-term cost control decisions are made 29 RGM Bonus Step 5 - Develop the Flow-Thru Chart BMUs may have a different Flow-Thru calculation than the one outlined in the following example Consult with your Finance partner on how Flow-Thru works for the BMU 30 RGM Bonus Step 5 - Develop the Flow-Thru Chart Worksheet Tab in the Bonus Modeling Tool 5a_FlowThru Calculate Flow-Thru Bonus Target as a % of the average 2004 RCP Plan From Step 1 Calculation of Make Plan Target as a % of RCP Flow-Thru Bonus Target 1,200 Average 2004 RCP Plan 410,420 Flow-Thru Payout as % of RCP Plan 0.29% From Step 3 Calculate the Flow-Thru Bonus Target as a % of Average 2004 RCP Plan (1,200 410,420) x 100 = .29% Flow-Thru Payout as % of RCP Plan is the percentage of actual RCP that RGMs would receive for achieving Flow-Thru targets. The number will be used as the basis for calculating the payout on the Flow-Thru chart. 31 RGM Bonus Step 5 - Develop the Flow-Thru Chart Set up the spreadsheet to model the matrix Worksheet Tab in the Bonus Modeling Tool 5c_FlowThru 1 2 3 Include estimated 2004 RCP data from “Make Plan” Matrix modeling Assume that 2004 FlowThru will equal 2003 FlowThru for each restaurant Flow-Thru Bonus Target 1,200 Average 2004 RCP Plan 410,420 Calculate payouts by multiplying .29% of RCP by the chart multiplier .0029 x 359,700 x 1.5 = 1,565 0.29% Flow-Thru Target as % of RCP Plan Estimated Average Pay-out 4 Identify the appropriate multiplier from the Flow-Thru chart (next slide) using estimated 2004 Flow-Thru 1,362 1 2 Count 1 2 Area ID 001 001 Store ID 1,000 1,002 2003 Flow Thru 103.6 102.5 Estimated 2004 Flow Thru 103.6 102.5 Estimated 2004 Actual RCP 359,700 227,435 199 200 025 025 1,396 1,398 104.0 98.0 104.0 98.0 255,826 305,527 3 4 Estimated Estimated RCP % (from Bonus chart) Payout 150.0% 1,565 125.0% 824 200.0% 50.0% 1,484 443 32 RGM Bonus Step 5 - Develop Flow-Thru Chart Worksheet Tab in the Bonus Modeling Tool 5b_FlowThru 0.29% (.0029) of actual RCP x quarterly multiplier RCP versus Flow-Thru % Set 100% payout at 100% RCP vs. Flow-Thru %; Set at bonus target for the component ($1,200) Allow for threshold payment for achieving within 2-3% of the goal. Work with Finance to determine the appropriate RCP vs. Flow-Thru %. 104 Quarterly Multiplier Payout 200% 2,400 103 - 103.9 150% 102 - 102.9 125% 1,500 101 - 101.9 110% 1,320 100 - 100.9 100% 1,200 98 - 99.9 50% 600 97.9 0% 0 Set the maximum based on your performance distribution and what the BMU can afford (see next slide) 1,800 Based on the performance distribution, create a logical progression for payment (see next slide). As a starting point, you may want to align to Balanced Scorecard targets. 33 RGM Bonus Step 5 - Develop the Flow-Thru Chart 0.29% Use the modeling tool to determine the appropriate breakpoints based on what the BMU can afford (.0029) of actual RCP x quarterly multiplier RCP Versus Flow-thru % 3 Adjust scales to determine what total spending would be and if the program would be affordable Quarterly Multiplier 104 200% 103 - 103.9 102 - 102.9 101 - 101.9 110% 100 - 100.9 100% 98 - 50% Flow-Thru Bonus Target 3 1,200 Assuming Actual Flow-thru of . . . 100.3 150% 99.9 97.9 125% 0% Set the maximum at around the 90th percentile (e.g., only 5-10% of RGMs should achieve this level of payment) Worksheet Tabs Assuming Actual RCP of . . . 107.8% Estimated Average Pay-out 2003 Count Store ID Flow Thru 3 1,373 Estimated 2004 Flow Thru Estimated 2004 Actual RCP Estimated RCP % (from chart) Estimated Bonus Payout 1 1,000 103.6 103.6 359,700 150.0% 1,578 2 1,002 102.5 102.5 227,435 125.0% 831 199 1,396 104.0 104.0 255,826 200.0% 1,496 200 1,398 98.0 98.0 305,527 50.0% 447 100.3 100.3 100% 1,373 5b_FlowThru Averages 5c_FlowThru 90th Percentile 104.6 34 RGM Bonus Step 6 - Develop 100% CHAMPSCheck Chart Objective • 100% CHAMPS = Satisfied Customers Design Parameters • Every CHAMPSCheck score of 100% is rewarded • Every customer provides RGM with opportunity to generate more sales and bonus • Fixed $ payout assumes similar level of complexity in delivering 100% CHAMPS, regardless of volume • Period calculation (i.e. payout based on period results) • Weight of component can vary between 20% – 30% Targets and Thresholds • Targets should be set to motivate improvement over prior year • Work closely with your CHAMPS team to ensure that you have a good prediction of 100% CHAMPSCheck in the base year and the year for which you are planning • BMU establishes threshold for payment • Payouts vary by BMU to fit strategy 35 RGM Bonus Step 6 - Develop 100% CHAMPSCheck Chart Worksheet Tab in the Bonus Modeling Tool 6_CHAMPSPlanning From Step 1 CHAMPSCheck Data - 2003 Actual and Estimated 2004 2003 Actual CHAMPSCheck Bonus Target Average Number of CHAMPSCheck per Year % of Total CHAMPSCHECKS at 100% Average Number of 100% CHAMPSChecks Bonus Payout per 100% CHAMPSCheck 1 16 53.8% 9 2004 Estimated 1,800 1 16 2 62.8% 3 10 1 Enter the average number of CHAMPSChecks per year 2 Enter the 2004 CHAMPSCheck target 3 180.00 4 Calculate the average number of CHAMPSChecks needed to achieve the goal 16 * .628 = 10 4 Calculate the bonus payout per 100% CHAMPSCheck score 1,800 10 = 180 36 RGM Bonus Step 7 - Calculate Strategic Component Chart Objective Design Parameters • Align to BMU strategic objectives • Must be measured on Balanced Scorecard Summary or Balanced Scorecard Detail reports • Business Unit can change strategic measure each year although we recommend balancing “year of initiative” with consistency • Example - BMU could use People Measure (e.g. TM Turnover to drive people capability mindset) to balance Financial Measures • Calculation timeframe can be period or quarterly (we recommend that you pay quarterly) • Fixed $ or volume-based • Should be a recognized strategic focus for BMU and YRI AOP • Weight of component can vary between 15% – 30% 37 RGM Bonus Step 7 - Calculate Strategic Component Chart Worksheet Tab in the Bonus Modeling Tool The Strategic Component should be determined by the BMU. We recommend a People or Customer measure to balance the Financial measures. 7a_StrategicPlanning Example: Team Member Turnover data Team Member Turnover - 2003 Target and Estimated 2004 2003 2004 TM Turnover Target Pay-out 1 Calculate the Average TM Turnover for the prior year 1,200 Average TM Turnover Target 117% 1 Improvement 100% 15% 2 2 3 Enter the Target for 2004 3 Calculate % of improvement Count Area ID Store ID 2003 Team Member Turnover 1 2 3... 199 200 001 001 1,000 1,002 78 127 025 025 1,396 1,398 42 120 2004Team Member Turnover 67 4 108 36 102 (1.14-1.00)/1.14 * 100 = 12.3 4 Use % of improvement to calculate the estimated 2004 TM Turnover by restaurant 78 * (1-.123) = 68 38 RGM Bonus Step 7 - Develop Strategic Component Chart Leverage Projected Annualized Turnover Payout Multiple 0 - 54.9 Set the maximum at around the 10th percentile (e.g., only 5-10% of RGMs should achieve this level of payment). Payment can be up to 300% depending on what the BMU can afford. Calculate the estimated bonus for each RGM using 2004 Team Member Turnover. For example, 69 falls into the 55-74.9 category yielding a bonus of $2,400. 3,000 250% 55 - 74.9 2,400 200% 75 - 99.9 1,500 125% 100 - 114.9 1,200 100% TM Turnover Target Pay-out 115 - 129.9 900 75% Estimated Average Pay-out 0 0% 130 + Adjust scales to determine what total spending would be and if the program would be affordable. As a starting point, you may want to align to Balanced Scorecard targets. Calculate the overall average payout. 1,200 1,338 2003 Team 2004Team Member Member Turnover Turnover Count Area ID Store ID 1 2 001 001 1,000 1,002 78 127 67 108 199 200 025 025 1,396 1,398 42 120 36 102 Estimated Cost 2,400 1,200 3,000 1,200 Worksheet Tabs 7_StrategicPlanning 7_StrategicPayouts 39 Putting it all together... 1 2 Sales & RCP Make Plan Matrix Flow-Thru 0.29% Net Sales vs. Plan RCP vs Plan 0.44% % of RCP Times 98 --99.99 100 --101.99 102 --104.99 105 --107.99 108 --109 110 --- 96 --- 99.99 40% 50% 50% 50% 50% 50% 100 --- 101.99 50% 100% 125% 135% 145% 150% 102 --- 103.99 60% 100% 135% 150% 175% 200% 104 --- 109.99 60% 100% 145% 175% 200% 110 --- 114.99 60% 100% 155% 200% 115 --- 60% 100% 165% 225% 3 100% Perfect CHAMPSCheck $180 payout per 100% CHAMPSCheck (.0029) of actual RCP x quarterly multiplier RCP Versus Flow-thru % Quarterly Multiplier 104 200% 103 - 103.9 150% 102 - 102.9 125% 101 - 101.9 110% 225% 100 - 100.9 100% 250% 275% 98 - 99.9 50% 275% 300% 97.9 0% 4 Strategic Initiative Projected Annualized Turnover Payout 0 --- 54.9 3,000 55 --- 74.9 2,400 75 --- 99.9 1,500 100 --- 114.9 1,200 115 --- 129.9 900 130 --- 0 40 Validation To validate the bonus design, the following should be taken into consideration On an average basis, consider how the plan is paying out for the level of performance that is achieved Is the overall cost of the bonus affordable for the BMU Average Average Payout Payout "ALL" "Receivers" Total Projected Cost Category Target Sales & RCP Make Plan Matrix $1,800 $2,124 $3,173 $424,717 Flow-Thru $1,200 $1,362 $1,702 $272,353 100% Perfect CHAMPSCheck $1,800 $1,809 $1,809 $361,728 Strategic Initiative $1,200 $1,338 $1,565 $267,600 Overall $6,000 $6,632 $8,249 $1,326,398 41 Validation (continued) When calculating the projected cost of the bonus, the following should be taken into consideration: This bonus modeling technique is modeled on annual data. To validate the bonus, you may want to model the cost of the bonus for each quarter of data to ensure that you are not under or over funding the plan. The model assumes that all stores will be open for a full year. Work with Finance to determine the appropriate assumptions to apply to the total cost figure. The model assumes that no RGMs will forfeit the bonus by terminating employment. Work with Finance to determine the appropriate assumptions to apply to the total cost figure. The model assumes that restaurants will perform at the same level to plan as they did in the prior year. 42 Validation (continued) To test the bonus, calculate bonus payouts for different performance levels and restaurant volumes Does the payout level appropriately reflect performance? Category Sales and RCP Make Plan Matrix Restaurant 200 • Almost achieved Sales Plan • Achieved RCP Plan • Almost achieves Flow-Thru target • 10 of 16 100% CHAMPSChecks • Achieves TM Turnover Target Restaurant 13 • Achieved Sales Plan • Achieved RCP Plan • Exceeds Flow-Thru target • 8 of 16 100% CHAMPSChecks • Achieves TM Turnover Target Restaurant 161 • Exceeds Sales Plan • Exceeds RCP Plan • Achieves Flow-Thru target • 6 of 16 100% CHAMPSChecks • Achieves TM Turnover Target Receives 73% of bonus target Receives 118% of bonus target Receives 215% of bonus target Restaurant 200 Restaurant 13 Payout Sales vs. Plan RCP vs. Plan Estimated Actual RCP Matrix Multiplier Flow-Thru Estimated 2004 Flow-Thru Flow-Thru Multiplier 100% Perfect CHAMPSCheck Number of 100% CHAMPSChecks Strategic Initiative Estimated Team Member Turnover Estimated Bonus Payout Target Bonus % of Total Payout Restaurant 161 Payout Payout 99% 103% 314,693 60% $828 100% 103% 426,447 100% $1,870 116% 112% 627,982 250% $6,885 98.0 50% $443 105.6 200% $2,473 104.0 200% $3,642 10 $1,880 8 $1,520 6 $1,160 102 $1,200 $4,351 $6,000 73% 106 $1,200 $7,063 $6,000 118% 104 $1,200 $12,887 $6,000 215% 43