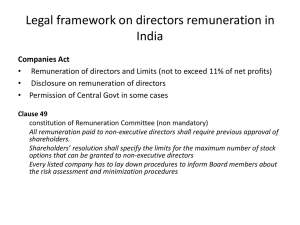

Executive directors` remuneration

advertisement

GO European Focus Fund Governance for Owners’ shareholder proposals for the Viscofan 2012 AGM on 23 May Gavin Morris Pedro Yágüez Rebeca Coriat London, 2nd May 2012 1 Contents Governance for Owners and Viscofan 1st Resolution: progressive dividend policy 2nd Resolution: board tenure 3rd Resolution: non-executive remuneration 4th Resolution: shareholder directors’ remuneration 5th Resolution: executive remuneration Annex 2 Governance for Owners Governance for Owners (“GO”) is an investment manager with c.€1bn under management and the GO European Focus Fund is its flagship product The GO European Focus Fund aims to add significant long-term value for clients by acting as a catalyst for corporate change with an agenda based on: – Strategic issues – Financial issues – Governance issues 3 Governance for Owners and Viscofan GO owns 5.045% of the share capital of Viscofan – one of the top three shareholders in the company What we like about Viscofan: • • • • Leading position in an attractive industry with pricing power, generating cash. Considerable operational improvements and on-going operational excellence. Diversified risk profile in terms of products and geographies. Performed well, but still more potential. But there is still potential for Viscofan to be more highly rated: • • • • • Make balance sheet more efficient. Increase shareholder remuneration. Improve overall governance and disclosure. Improve board independence. Implement best practice in executive incentivisation. Viscofan has already responded to a number of GO’s proposals • • • Disclosed detailed board remuneration for first time 4/2012. Proposed NED with China experience 4/2012. Will be appointing advisers on board remuneration to report at 2013 AGM. 4 GO’s proposed resolutions for Viscofan 2012 AGM on 23 May 1st. Introduction of a progressive dividend policy (payout ratio: 55% in 2013; 65% in 2014). 2nd. Maximum board tenure of 12 years for independent directors (consistent with Recommendation 29 of Unified Code of Corporate Governance). 3rd. Non-executive directors’ remuneration to be fixed and not performance-based (consistent with Recommendation 36 Unified Code of Corporate Governance). 4th. Shareholder directors (dominicales) not be remunerated. 5th. Better shareholder alignment in the remuneration scheme for Executive Directors (consistent with Recommendation 35 of Unified Code of Corporate Governance). 5 1st Resolution: Introduction of a progressive dividend policy While Viscofan has increased its dividend in absolute terms in recent years, the pay-out policy has remained unchanged: in EUR 2007 2008 2009 2010 2011 Interim dividend 0.19 0.21 0.26 0.30 0.36 Share premium refund 0.25 0.29 0.36 0.29 0.20 0.63 AGM attendance 0.005 0.005 0.005 0.006 0.006 Total DPS (EUR) 0.45 0.50 0.62 0.80 1.00 Pay-out ratio, % 45% 45% 45% 46% 46% Complemetary dividend … which, coupled with strong cash generation, has resulted in decreasing net debt and sub-optimal leverage 2007 2008 2009 2010 2011 Net debt (m EUR) -95 -122 -91 -60 -61 Net debt/EBITDA 1.0x 1.2x 0.7x 0.4x 0.4x 6 1st Resolution: Introduction of a progressive dividend policy (2) Such is Viscofan’s cash generation that we estimate it will be cash positive in 2014, despite elevated capex in the meanwhile: 2007 2008 2009 2010 2011 2012 E 2013E 2014 E Capex -34 -45 -46 -47 -65 -75 -68 -63 Capex as % of sales -6% -8% -8% -7% -11% -10% -9% -8% Net debt (m EUR) -95 -122 -91 -60 -61 -57 -33 3 …which will further depress leverage AND result in a declining return on equity Net debt/EBITDA ROE 2007 2008 2009 2010 2011 2012 E 2013E 2014 E 1.0x 1.2x 0.7x 0.4x 0.4x 0.3x 0.2x -0.0x 16.4% 17.2% 19.8% 21.6% 23.7% 21.5% 20.2% 19.4% 7 1st Resolution: Introduction of a progressive dividend policy (3) We have discussed the inefficiency of balance sheet with the management on a number of occasions and their response has been that it is ‘conservative’. We believe there is ample scope for the company to introduce a progressive dividend policy and still remain conservative: 2012 E 2013E 2014 E 2012 E 2013E 2014 E Pay-out ratio, % 46.0% 46.0% 46.0% Pay-out ratio, % 46.0% 55.0% 65.0% Total DPS (EUR) 1.01 1.07 1.14 Total DPS (EUR) 1.01 1.27 1.60 yoy, % 1.4% 5.2% 6.5% yoy, % 1.4% 25.7% 25.9% Dividend yield 3.0% 3.1% 3.3% Dividend yield 3.0% 3.7% 4.7% ROE, % 21.5% 20.2% 19.4% ROE, % 21.5% 20.4% 20.1% 0.3x 0.2x -0.0x Net debt/EBITDA 0.3x 0.2x 0.1x 47 50 53 47 59 75 1.1x 1.5x 1.7x FCFE / Dividend 1.1x 1.2x 1.2x Peers' m edian div.yield 3.1% 3.4% 3.8% Net debt/EBITDA Dividend paid (m EUR) FCFE / Dividend Dividend paid (m EUR) … this will contribute to reducing balance sheet inefficiency, while leaving the company with sufficient headroom to raise additional debt if needed: EBITDA 2012 (mEUR) Re-leveraging to Headroom (m EUR) 180 1.5x 2.0x 212 302 8 2nd Resolution: Board tenure CATEGORISATION OF EXTERNAL DIRECTORS (from the Spanish Unified Code) Independent: No former employment with the company; no personal, business or financial relationship between the directors and the company, its key executives or significant shareholders; maximum tenure length of 12 years Affiliated: Non-executive directors that do not fulfil the CNMV independence criteria, as they are related to a substantial shareholder or have served on the board for more than 12 years Name Tenure GO’s Classification José Domingo de Ampuero y Osma Néstor Basterra Larroudé Ágatha Echevarría Canales Alejandro Legarda Zaragüeta Gregorio Marañón Bertrán de Lis José Cruz Perez Lapazarán Ignacio Marco Gardoqui Ibañez Laura González Molero n/a Executive 15 Affiliated 14 Affiliated 6 Independent 13 Affiliated 14 Affiliated 3 Independent 2 Independent Long tenures are problematic: the supervisory role of the board may be weakened if it is gets too close to management 9 2nd Resolution: Board tenure (2) Four so-called independent non-executive directors have served on the board for over 12 years. The Code recommends (article 29): “independent directors should not stay on as such for a continuous period of more than 12 years”. Governance for Owners believes that long tenures are problematic. The supervisory role of the board may be weakened if it gets too close to management. GO’s resolution proposes: that independent non-executive directors do not hold such a position for more than 12 years. Governance for Owners defers to the Appointments and Remuneration Committee the responsibility for implementing this. 10 3rd Resolution: NED Remuneration • • • Non-executive directors currently receive performance-related remuneration (“board fees”). Non-executive directors who are members of the executive committee, receive additional performance-related remuneration. The Code (recommendation 36) states: “remuneration comprising (…) payments linked to the company’s performance should be confined to executive directors”. GO’s resolution proposes: that the performance-related remuneration element be removed from the NEDs’ fees and that non-executive remuneration should comprise: fixed fees, fixed attendance fees, fixed Committee membership fees, and fixed Chairmanship fees. 11 3rd Resolution: NED Remuneration (2) (see annex) CURRENT BOARD FEES** PROPOSED BOARD FEES ITEM TYPE FY 2011 ITEM TYPE QUANTUM* Performancerelated Board fees VARIABLE 1.5% Net Profit Before Tax/ 8 Fees for NEDs FIXED Maximum of 0.15% of Net Profit Before Tax Per Director Board meetings attendance fees FIXED EUR 1,000/meeting Board meetings attendance fees FIXED Audit Cttee. fees FIXED EUR 16,000 Audit Cttee. fees FIXED Executive Cttee. fees VARIABLE 1.5% Profit Before Tax/3 Appointments and Remuneration Cttee. fees FIXED Chairmanship fees FIXED Executive committee fees Falls under Exec Rem *A cap has been included as Spanish law requires it to be specified in the resolution. Governance for Owners defers to the Appointments and Remuneration Committee the implementation of these provisions. **SEE ANNEX ON PAGE 17 12 4th Resolution: Non-remuneration of shareholder directors (“dominicales”) • • • Governance for Owners understands that two of the so-called independent directors are connected to the founding families of Viscofan. Therefore, we believe that they do not qualify as independent directors. These two board members are also Executive Committee members. GO’ resolution proposes: that the Bylaws of Viscofan be amended such that shareholder directors are not compensated. 13 5th Resolution: Executive directors’ remuneration DISCLOSURE AND CURRENT STRUCTURE Viscofan has, for the first time in 2011, disclosed board members’ remuneration, as requested by GO at the last two AGMs. Executive director’s (Chairman’s) remuneration comprises*: • Board attendance fees • Other boards within the Group • Board fee (1/8 of 1.5% of Net PBT) • Executive Committee fee (1/3 of 1.5% of Net PBT) (EUR) 11,000 292,449 102,058 299,487 (TOTAL) : 705,449 There is no short-term or long-term variable compensation, with appropriate targets to align his remuneration to shareholders’ objectives. *SEE ANNEX ON PAGE 17 14 5th Resolution: Executive directors’ remuneration (2) The Code recommends (article 35): “remuneration schemes with a variable component linked to the company’s net profit should attract and retain the right kind of person”. Governance for Owners believes that executive remuneration should be structured so as to attract and retain the most outstanding professionals and align their objectives with those of shareholders. GO’s resolution proposes: that executive remuneration for (executive) board members be comprised of three elements: Fixed salary Annual bonus LTIP type scheme The annual bonus and LTIP would have appropriate targets to ensure alignment with shareholders’ objectives. 15 Viscofan: the case for change • Viscofan is a significant international company and a potential constituent of the Ibex 35. • The adoption of a progressive dividend policy should help improve the efficiency of its balance sheet and would be well received by shareholders. • The company’s governance structures are currently not commensurate with its size and status. • We believe that better governance structures would: – Strengthen the board – Better align executives’ and shareholders’ objectives – Increase the company’s appeal to international institutional shareholders. 16 ANNEX. Directors’ remuneration - 2011 Director Role José D. Ampuero Osma Exec Chairman Nestor Basterra Larroudé NED Agatha Echevarria Canales NED José C Pérez Lapazarán Board membership 102,058 Attendance fees Audit Cttee. Fees - Other Viscofan Boards 292,904 TOTAL (EUR) 11,000 Executive Cttee. fees 299,904 102,058 11,000 299,487 - 146,452 558,997 102,058 11,000 299,487 16,000 - 428,545 NED A*, A&R 102,058 10,000 - 16,000 - 128,058 Gregorio Marañón Bertrán de Lis NED A 102,058 10,000 - 16,000 - 128,058 Alejandro Legarda Zaragüeta NED A 102,058 10,000 - 16,000 - 128,058 Ignacio MarcoGardoqui NED 102,058 10,000 - - - 112,058 Laura González Molero NED 102,058 9,000 - - - 111,058 TOTAL (EUR) 816,464 82,000 898,461 64,000 439,356 2,300,281 705,449 E*, A&R* E E, A, A&R E – Executive Committee Member; A – Audit Committee Member; A&R – Appointment and Remunerations Committee Member; * - Chairman. BACK TO NED REMUNERATION - PAGE 12; BACK TO EXECUTIVE REMUNERATION - PAGE 14 17 Viscofan: the case for change We look forward to your support! Please do not hesitate to contact us should you have any questions: Gavin Morris: g.morris@g4owners.com Pedro Yágüez: p.yaguez@g4owners.com Rebeca Coriat: r.coriat@g4owners.com +44 (0) 20 7614 4750 18 Please read this important notice This communication is only for Intermediate Customers or Market Counterparties as defined by the Financial Services and Markets Act 2000. Any investment or investment activity to which this presentation relates should not be relied on by those persons properly receiving it. This presentation is issued and approved for the purposes of Section 21 of the Financial Services and Markets Act 2000 by Governance for Owners LLP (“GO”). The registered office is Baker Tilly, Marlborough House, Victoria Road South, Chelmsford, Essex CM1 1LN. GO is Authorised and Regulated by the Financial Services Authority (“FSA”). It should be noted that the FSA does not generally regulate any activities referred to in this document which are not regulated activities under the Regulated Activities Order 2000. This document has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. This document is produced solely for purposes of information and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Prospective investors must rely on their own examination of the legal, taxation, financial and other consequences of an investment in the funds, including the merits of investing and the risks involved. They should not treat the contents of this document as advice relating to legal, taxation or investment matters. Before entering into an agreement in respect of an investment referred to in this document, the reader should consult their own professional and/or investment advisors as to its suitability and should understand that statements regarding future prospects may not be realised. No action should be taken or omitted to be taken in reliance upon information in this document. Figures unless otherwise indicated are sourced from GO. This document may include a list of GO clients. Please note that inclusion on this list should not be construed as an endorsement by them of GO services. Should you wish to contact a client for reference purposes please let GO know in advance. . 19