Employment Allowance Example

advertisement

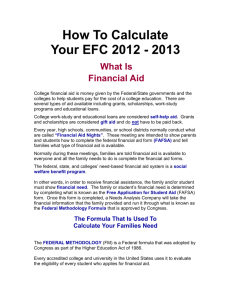

Chuck Moore, CCFC, CAMC, CAFC Louisville, Kentucky 502-721-8646 ▪ tuition2@insightbb.com www.collegeliteracyacademy.com www.gearuped.com How To Complete The FAFSA How The EFC Is Calculated FAFSA Formula Similar To Tax Formula • Income Protection Allowance • Asset Protection Allowance • Employment Allowance • Deductions For Certain Taxes Paid Income Protection Allowance Family size Number in college 1 2 2 $17,100 $14,170 3 21,290 18,380 15,450 4 26,290 23,370 20,460 17,530 5 31,020 28,100 25,190 22,260 19,350 6 36,290 33,360 30,450 27,530 24,620 3 4 Parents of Dependent Students 5 Income Protection Allowance Example Number In Household 4 Number In College 1 AGI: $85,000 Income Protection Allowance $26,290 Available Income $58,710 Asset Protection Allowance Asset Protection Allowance Example Oldest Parent 46 Allowance $37,100 Exposed Assets $50,000 Asset Protection Allowance Example Oldest Parent 46 Exposed Assets $50,000 Allowance (minus) $37,100 $12,900 $12,900 X 5.65% Adjusted Available Assets $729 ($729 Is Added Into Your Adjusted Available Income) Employment Allowance Example Number Of Parents Working 2 Lowest Earner Amount $26,000 Employment Allowance % 35% Maximum Allowance $3,500 (Single Wage Earners Do Not Get An Employment Allowance) Employment Allowance Example Number Of Parents Working 2 Lowest Earner Amount $26,000 Employment Allowance % X 35% $9,100 Maximum Allowance $3,500 (Single Wage Earners Do Not Get An Employment Allowance) Employment Allowance Example Number Of Parents Working 2 Lowest Earner Amount $7,000 Employment Allowance % X 35% $2,450 Maximum Allowance $2,450 (Single Wage Earners Do Not Get An Employment Allowance) Tax Allowance Example Federal Taxes $ 5,250 Social Security Taxes $ 6,120 State Taxes 4% $ 3,200 Total Tax Allowance $14,570 Total Allowance Income Allowance $26,290 Asset Allowance $ Employment Allowance $ 3,500 Tax Allowance $14,570 Total Allowances $45,089 729 Adjusted Available Income Of Parents Total Income $85,000 Total Allowances -$45,089 Adjusted Available Income $39,911 Adjusted Available Income Of Parents If AAI is— Then the contribution is— Less than −$3,409 −$750 ($3,409) to $15,300 22% of AAI $15,301 to $19,200 $3,366 + 25% of AAI over $15,300 $19,201 to $23,100 $4,341 + 29% of AAI over $19,200 $23,101 to $27,000 $5,472 + 34% of AAI over $23,100 $27,001 to $30,900 $6,798 + 40% of AAI over $27,000 $30,901 or more $8,358 + 47% of AAI over $30,900 Adjusted Available Income Of Parents Available Income $39,911 Adjustment Factor - 30,901 Adjustment Factor Left $ 9,010 Adjusted Available Income Of Parents First $30,901 Assessed $8,358 Second $9,010 Assessed 47% +4,235 EFC Of Parents $12,593 Student’s EFC First $6,130 - $0 (50% thereafter minus taxes) Assets 20% (No Asset Protection Allowance) Student’s EFC Student’s Income $ 3,850 Student’s Assets $10,000 Student’s EFC Student’s Assessment From Income $3,850 - $6,130 = $0 Student’s Assets $10,000 X 20% = $2,000 Students EFC = $2,000 Total Family’s EFC Parents’ EFC $12,593 Student’s EFC + 2,000 Family’s EFC $14,593 Student’s Financial Need Total Cost Of Attending $18,000 EFC Of Family - 14,593 Financial Need $ 3,407 Student’s Attends Private University Total Cost Of Attending $38,000 EFC Of Family - 14,593 Financial Need $23,407 BIG PROBLEM How Is This Family Going To Pay Their Expected Family Contribution Of $14,593 This is 14% of Gross Income or; 17% of Net Income After Taxes Chuck Moore, CCFC, CAMC, CAFC Louisville, Kentucky 502-721-8646 ▪ tuition2@insightbb.com www.collegeliteracyacademy.com www.gearuped.com