IX. Explaining Relative Prices

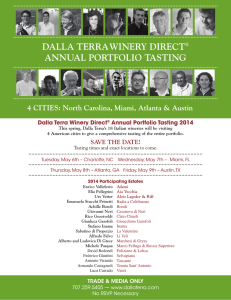

advertisement

IX. Explaining Relative Prices 1 Explaining Relative Prices 1. CAPM – Capital Asset Pricing Model 2. Non Standard Forms of the CAPM 3. APT – Arbitrage Pricing Theory 2 Assumptions behind the CAPM 1. 2. 3. 4. 5. No transaction costs Assets are infinitely divisible No personal taxes Price Takers Investors look only at expected return and variances of their portfolio 6. Unlimited short sales 7. Unlimited lending and borrowing at the riskless Rate 8. Homogenous Expectations about time horizon 9. Homogenous expectations of expected return, variance, and covariance 10. All assets are marketable 3 Sharpe – Lintner – Mossine (CAPM) Two Approaches to deriving 1. Economic intuition 2. Rigorous analysis 4 5 6 A more rigorous proof RP RF Max P Lintner Equation 2 N Rk RF X k k X i ik i 1 ik Rk RF E X R k k Rk Rk Rk N X i 1 ik i R R R R k k i i 7 Rk RF E Rk Rk X i Ri Ri N i 1 Homogenous Expectations Rk RF kM 8 Rk RF kM Must hold for all securities and portfolios RM RF 2 M RM R F 2 M kM Rk RF 2 RM RF M Rk RF k RM RF 9 Non standard forms of the CAPM If the CAPM does a good job of explaining return why bother 1. May do a better job 2. Even if the CAPM explains return; macro behavior might not explain micro behavior – e.g., everybody does not hold market portfolio 3. If we don’t include influences in the model, e.g., taxes we can’t study the impact of their influences on the model 10 Modification of assumptions 1. Short sales 2. Riskless lending and borrowing 3. Personal taxes 4. Non marketable assets 5. Heterogeneous expectations 6. Non price taking behavior 7. Multi period analysis 8. Consumption CAPM Rolls critique 11 Short Sales Since under the standard CAPM nobody short sells in equilibrium 12 13 14 RF Is a rate – such that if we could lend or borrow at it we would hold the market portfolio Lintner Equation Rk RF k RM RF But for zero beta RZ RF so 15 16 RZ RM by convexity of efficient frontier Prof that Rz RG return on global minimum variance portfolio 2 C 2 d C dX Z XZ 2 2 X Z Z 1 X Z 2 2 X Z Z 2 2 2 M 2 M 0 2 2 X Z M 0 2 M 2 2 M Z 17 XZ is greater than 0 and smaller than 1 Global minimum variance involves positive investment in market and zero beta portfolios and therefore, expected return must be in between. 18 19 20 21 22 23 Non Marketable Assets CAPM i covRi Rm 2 m Ri RF Rm RF 2 m covRi Rm With nonmarketable assets (H) Rm RF H Ri RF covRi Rm covRi RH m 2 H m covRm RH m Price of risk * amount of risk 24 Test of Equilibrium Models Ri RF i RM RF Expectations (1) Test with realizations – expectations are an average and on the whole correct Market Model Rit i i Rmt eit Ri i i Rm Ri Ri i Rmt Rm eit Substitution Rit RF i Rmt RF eit 25 26 27 Rit RZ 1 i i RMt eit Rit i RF 1 i i RMt eit i RZ RF 1 i 28 29 30 Fama and Mac Beth 2 Rit 0t 1t t 2t i 1. E 3t 0 2. E 2t 0 3. 3t Sei it E 1t 0 Auto correlation of , 0t , and 1t , 0 0 RF 1 RM RF 31 32 33 34 Rolls Critique Mathematically can show for any efficient portfolio Rk RZP kP RP RZP “Unfortunately it has never been subject to an unambiguous empirical test. There is considerable doubt…that it will be.” 35 POST TAX CAPM R R i F i R M R T d R F M F T d R i F Ri RF 0 1i 2 di RF Ri RF 0.0063 0.04211 0.236(di RF ) t Ti t gi (2.631) (1.86) t di t gi 1 t gi (8.62) .236 1 t di 2 t di .382 t gi .19 36