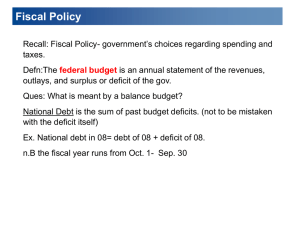

Chapter 15: Fiscal Policy

advertisement

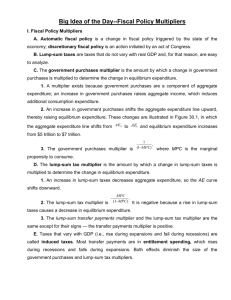

Fiscal Policy Changes in federal taxes and purchases Where does the government spend its money? Federal Government Spending, 2010 Fiscal Policy An Overview of Government Spending and Taxes The Federal Government’s Share of Total Government Expenditures, 1929–2009 Fiscal Policy An Overview of Government Spending and Taxes Federal Purchases and Federal Expenditures as a Percentage of GDP, 1950–2010 Where does the government get its money? Federal Government Revenue, 2010 Government revenue Laffer Curve (not in the book): there is optimal amount of taxation Tax Government spending/taxes and aggregate demand The Effects of Fiscal Policy on Real GDP and the Price Level Expansionary and Contractionary Fiscal Policy: An Initial Look Using Fiscal Policy to Influence Aggregate Demand: A More Complete Account An Expansionary Fiscal Policy Using Fiscal Policy to Influence Aggregate Demand: A More Complete Account A Contractionary Fiscal Policy A Summary of How Fiscal Policy Affects Aggregate Demand Countercyclical Fiscal Policy ACTIONS BY CONGRESS AND THE PRESIDENT RESULT PROBLEM TYPE OF POLICY Recession Expansionary Increase government spending or cut taxes Real GDP and the price level rise. Rising Inflation Contractionary Decrease government spending or raise taxes Real GDP and the price level fall. Don’t Let This Happen to YOU! Don’t Confuse Fiscal Policy and Monetary Policy Multiplier (again) The Government Purchases and Aggregate Demand The Multiplier Effect and Aggregate Demand Taking into Account the Effects of Aggregate Supply The Multiplier Effect and Aggregate Supply The Government Purchases and Tax Multipliers The Multiplier Effect of an Increase in Government Purchases The Government Purchases and Tax Multipliers The ratio of the change in equilibrium real GDP to the initial change in government purchases is known as the government purchases multiplier: Government purchases multiplier Change in equilibrium real GDP Change in government purchases The expression for the tax multiplier is: Tax multiplier Change in equilibrium real GDP Change in taxes A cut in tax rates affects equilibrium real GDP through two channels: (1) A cut in tax rates increases the disposable income of households, which leads them to increase their consumption spending, and (2) a cut in tax rates increases the size of the multiplier effect. The Multipliers Work in Both Directions Decrease and increases in government expenditure are multiplied Decrease and increase in taxes are multiplied Solved Problem Fiscal Policy Multipliers Briefly explain whether you agree or disagree with the following statement: “Real GDP is currently $12.2 trillion, and potential real GDP is $12.5 trillion. If Congress and the president would increase government purchases by $300 billion or cut taxes by $300 billion, the economy could be brought to equilibrium at potential GDP.” Government purchases multiplier Change in equilibrium real GDP Change in government purchases Crowding out A decline in private expenditures as a result of an increase in government purchases. Crowding out limits Fiscal Policy in the short run. Crowding Out in the Money Market An Expansionary Fiscal Policy Increases Interest Rates Crowding Out in the Aggregate Demand and Aggregate Supply Diagram In the long run, the economy returns to potential GDP. Budget Deficit Budget deficit The situation in which the government’s expenditures are greater than its tax revenue. Budget surplus The situation in which the government’s expenditures are less than its tax revenue. Deficits, Surpluses, and Federal Government Debt The Federal Budget Deficit, 1901–2009 Solved Problem The Effect of Economic Fluctuations on the Budget Deficit The federal government’s budget deficit was $207.8 billion in 1983 and $185.4 billion in 1984. A student comments, “The government must have acted during 1984 to raise taxes or cut spending or both.” Do you agree? Briefly explain. Deficits, Surpluses, and Federal Government Debt How the Federal Budget Can Serve as an Automatic Stabilizer Cyclically adjusted budget deficit or surplus: The deficit or surplus in the federal government’s budget if the economy were at potential GDP. Deficits, Surpluses, and Federal Government Debt Is Government Debt a Problem? Debt can be a problem for a government for the same reasons that debt can be a problem for a household or a business. Deficits, Surpluses, and Federal Government Debt Should the Federal Budget Always Be Balanced? Although many economists believe that it is a good idea for the federal government to have a balanced budget when the economy is at potential GDP, few economists believe that the federal government should attempt to balance its budget every year. Making the Connection •Did Fiscal Policy Fail during the Great Depression? FEDERAL GOVERNMENT EXPENDITURES (BILLIONS OF DOLLARS Although government spending increased during the Great Depression, the cyclically adjusted budget was in surplus most years. ACTUALFEDERAL BUDGET DEFICIT OR SURPLUS (BILLIONS OF DOLLARS) CYCLICALLY ADJUSTED BUDGET DEFICIT OR SURPLUS (BILLIONS OF DOLLARS) CYCLICALLY ADJUSTED BUDGET DEFICIT OR SURPLUS AS A PERCENTAGE OF GDP 1929 $2.6 $1.0 $1.24 1.20% 1930 2.7 0.2 0.81 0.89 1931 4.0 -2.1 -0.41 -0.54 1932 3.0 -1.3 0.50 0.85 1933 3.4 -0.9 1.06 1.88 1934 5.5 -2.2 0.09 0.14 1935 5.6 -1.9 0.54 0.74 1936 7.8 -3.2 0.47 0.56 1937 6.4 0.2 2.55 2.77 1938 7.3 -1.3 2.47 2.87 1939 8.4 -2.1 2.00 2.17 The Effects of Fiscal Policy in the Long Run The Long-Run Effects of Tax Policy Tax wedge The difference between the pretax and posttax return to an economic activity. We can look briefly at the effects on aggregate supply of cutting each of the following taxes: • Individual income tax. • Corporate income tax. • Taxes on dividends and capital gains. Tax Simplification In addition to the potential gains from cutting individual taxes, there are also gains from tax simplification. The Effects of Fiscal Policy in the Long Run The Economic Effect of Tax Reform The Supply-Side Effects of a Tax Change The Effects of Fiscal Policy in the Long Run How Large Are Supply-Side Effects? Most economists would agree that there are supply-side effects to reducing taxes: Decreasing marginal income tax rates will increase the quantity of labor supplied, cutting the corporate income tax will increase investment spending, and so on. The magnitude of the effects is subject to considerable debate, however.