Fiscal policy - Mr. Zittle`s Classroom

advertisement

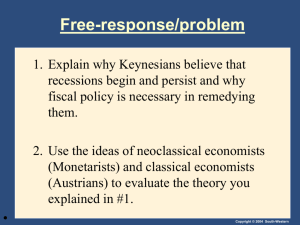

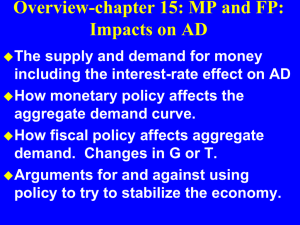

Fiscal Policy How much spending does it take? Introduction • http://www.youtube.com/watch?v=1qhJPqyJR o8&feature=plcp&context=C49f6c9cVDvjVQa1 PpcFMdkWSNt1EsUKtB5fYByDq14YICcdVaANI %3D What is FISCAL Policy? Fiscal Policy Spending – where does it all go? • http://www.nytimes.com/interactive/2012/ 02/13/us/politics/2013-budget-proposalgraphic.html HOW FISCAL POLICY INFLUENCES AGGREGATE DEMAND • Fiscal policy – taxing, spending, and borrowing • influences saving, investment, and growth in the long run. • In the short run, fiscal policy primarily affects the aggregate demand. • What are challenges to fiscal policy implementation? Changes in Government Purchases • There are two macroeconomic effects from the change in government purchases: – The multiplier effect – The crowding-out effect http://www.youtube.com/watch?v=H3nyc8XHrQc The Multiplier Effect • Government purchases are said to have a multiplier effect on aggregate demand. – Each dollar spent by the government can raise the aggregate demand for goods and services by more than a dollar. Price Level Figure 4 The Multiplier Effect 2. . . . but the multiplier effect can amplify the shift in aggregate demand. $20 billion AD3 AD2 Aggregate demand, 0 1. An increase in government purchases of $20 billion initially increases aggregate demand by $20 billion . . . AD1 Quantity of Output A Formula for the Spending Multiplier • The formula for the multiplier is: – Multiplier = 1/(1 – MPC) – An important number in this formula is the marginal propensity to consume (MPC). • It is the fraction of extra income that a household consumes rather than saves. A Formula for the Spending Multiplier • If the MPC = 3/4, then the multiplier will be: Multiplier = 1/(1 – 3/4) = 4 • In this case, a $20 billion increase in government spending generates $80 billion of increased demand for goods and services. The Crowding-Out Effect • Fiscal policy may not affect the economy as strongly as predicted by the multiplier. • An increase in government purchases causes the interest rate to rise. • What are the consequences of a higer interest rate? The Crowding-Out Effect • This reduction in demand that results when a fiscal expansion raises the interest rate is called the crowding-out effect. • The crowding-out effect tends to dampen the effects of fiscal policy on aggregate demand. Figure 5 The Crowding-Out Effect (a) The Money Market Interest Rate (b) The Shift in Aggregate Demand Price Level Money supply 2. . . . the increase in spending increases money demand . . . $20 billion 4. . . . which in turn partly offsets the initial increase in aggregate demand. r2 3. . . . which increases the equilibrium interest rate . . . AD2 r AD3 MD2 Money demand, 0 Quantity fixed by the Fed Aggregate demand, AD1 MD Quantity of Money 0 1. When an increase in government purchases increases aggregate demand . . . http://www.youtube.com/watch?v=RGlt0nEQdRI&feature=plc p&context=C48ec1e6VDvjVQa1PpcFMdkWSNt1EsUByRZ_JiwO oaMf6ZO6WVkJM%3D Quantity of Output Changes in Taxes • When the government cuts personal income taxes, it increases households’ take-home pay. • Households save some of this additional income. • Households also spend some of it on consumer goods. • Increased household spending shifts the aggregate-demand curve to the right. Changes in Taxes • The size of the shift in aggregate demand resulting from a tax change is affected by the multiplier and crowding-out effects. • It is also determined by the households’ perceptions about the permanency of the tax change. What are the Types of Taxes? • Proportional Taxes • A tax with a constant % paid regardless of income • Flat tax • Progressive Taxes • A tax where the % paid in taxes increases as income increases • U.S. Personal Income Tax • Regressive Taxes • The lower your income the higher % you pay in taxes • Sales Tax Proportional, regressive, or progressive? USING POLICY TO STABILIZE THE ECONOMY • Economic stabilization has been an explicit goal of U.S. policy since the Employment Act of 1946, which states that: – “it is the continuing policy and responsibility of the federal government to…promote full employment and production.” The Case for Active Stabilization Policy • The Employment Act has two implications: – The government should avoid being the cause of economic fluctuations. – The government should respond to changes in the private economy in order to stabilize aggregate demand. – What economic school of thought does this follow? Who would be against active stablization? The Case against Active Stabilization Policy • Some economists argue that monetary and fiscal policy destabilizes the economy. • Monetary and fiscal policy affect the economy with a substantial lag – rational expectations!!! • They suggest the economy should be left to deal with the short-run fluctuations on its own. Automatic Stabilizers • Automatic stabilizers are changes in fiscal policy that stimulate aggregate demand when the economy goes into a recession without policymakers having to take any deliberate action. • Automatic stabilizers include the tax system and some forms of government spending.