FORECASTING

advertisement

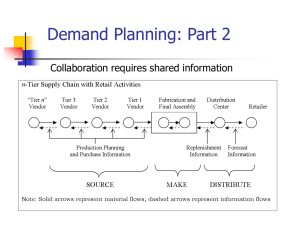

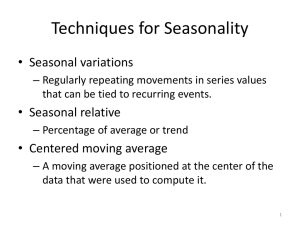

Demand Management and FORECASTING Operations Management Dr. Ron Lembke Demand Management • Coordinate sources of demand for supply chain to run efficiently, deliver on time • Independent Demand ▫ Things demanded by end users • Dependent Demand ▫ Demand known, once demand for end items is known Affecting Demand • Increasing demand ▫ Marketing campaigns ▫ Sales force efforts, cut prices • Changing Timing of demand ▫ Incentives for earlier or later delivery ▫ At capacity, don’t actively pursue more Predicting the Future We know the forecast will be wrong. Try to make the best forecast we can, ▫ Given the time we want to invest ▫ Given the available data • The “Rules” of Forecasting: 1. The forecast will always be wrong 2. The farther out you are, the worse your forecast is likely to be. 3. Aggregate forecasts are more likely to accurate than individual item ones Time Horizons Different decisions require projections about different time periods: • Short-range: who works when, what to make each day (weeks to months) • Medium-range: when to hire, lay off (months to years) • Long-range: where to build plants, enter new markets, products (years to decades) Forecast Impact Finance & Accounting: budget planning Human Resources: hiring, training, laying off employees Capacity: not enough, customers go away angry, too much, costs are too high Supply-Chain Management: bringing in new vendors takes time, and rushing it can lead to quality problems later Qualitative Methods • Sales force composite / Grass Roots • Market Research / Consumer market surveys & interviews • Jury of Executive Opinion / Panel Consensus • Delphi Method • Historical Analogy - DVDs like VCRs • Naïve approach Quantitative Methods Time Series Methods 0. All-Time Average 1. Simple Moving Average 2. Weighted Moving Average 3. Exponential Smoothing 4. Exponential smoothing with trend 5. Linear regression Causal Methods Linear Regression Time Series Forecasting Assume patterns in data will continue, including: Trend (T) Seasonality (S) Cycles (C) Random Variations All-Time Average To forecast next period, take the average of all previous periods Advantages: Simple to use Disadvantages: Ends up with a lot of data Gives equal importance to very old data 4/7/2009 2009 Farm Angels: Ty: 1.000, Jacob 0.833, Noah 0.667 (6 at bats) End of 2008 season Moving Average Compute forecast using n most recent periods Jan Feb Mar Apr May Jun Jul 3 month Moving Avg: June forecast: FJun = (AMar + AApr + AMay)/3 If no seasonality, freedom to choose n If seasonality is N periods, must use N, 2N, 3N etc. number of periods Moving Average Advantages: ▫ ▫ ▫ Ignores data that is “too” old Requires less data than simple average More responsive than simple average Disadvantages: ▫ ▫ ▫ Still lacks behind trend like simple average, (though not as badly) The larger n is, more smoothing, but the more it will lag The smaller n is, the more over-reaction Simple and Moving Averages Period Demand All-Time 10 1 10 12 2 11.0 14 3 12.0 15 4 12.8 16 5 13.4 17 6 14.0 19 7 14.7 21 8 15.5 23 9 16.3 10 3MA 12.0 13.7 15.0 16.0 17.3 19.0 21.0 Centered MA • CMA smoothes out variability • Plot the average of 5 periods: 2 previous, the current, and the next two • Obviously, this is only in hindsight • FRB Dalls graphs Stability vs. Responsiveness • Responsive ▫ Real-time accuracy ▫ Market conditions • Stable ▫ Forecasts being used throughout the company ▫ Long-term decisions based on forecasts ▫ Don’t whipsaw those folks Old Data Comparison of simple, moving averages clearly shows that getting rid of old data makes forecast respond to trends faster Moving average still lags the trend, but it suggests to us we give newer data more weight, older data less weight. Weighted Moving Average FJun = (AMar + AApr + AMay)/3 = (3AMar + 3AApr + 3AMay)/9 Why not consider: FJun = (2AMar + 3AApr + 4AMay)/9 FJun = 2/9 AMar + 3/9 AApr + 4/9 AMay Ft = w1At-3 + w2At-2 + w3At-1 Complicated: • Have to decide number of periods, and weights for each • Weights have to add up to 1.0 • Most recent probably most relevant, gets most weight • Carry around n periods of data to make new forecast Weighted Moving Average Period Demand 3WMA 1 10 2 12 3 14 4 15 12.6 5 16 14.1 6 17 15.3 7 19 16.3 8 21 17.8 9 23 19.6 10 21.6 Wts = 0.5, 0.3, 0.2 Setting Parameters • Weighted Moving Average ▫ Number of Periods ▫ Individual weights • Trial and Error ▫ Evaluate performance of forecast based on some metric Exponential Smoothing Ft Ft 1 At 1 Ft 1 F10 = F9 + 0.2 (A9 - F9) Ft 1 Ft 1 At 1 F10 = 0.8 F9 + 0.2 (A9 - F9) At-1 Actual demand in period t-1 Ft-1 Forecast for period t-1 Smoothing constant >0, <1 Forecast is old forecast plus a portion of the error of the last forecast. Formulas are equivalent, give same answer Exponential Smoothing • Smoothing Constant between 0.1-0.3 • Easier to compute than moving average • Most widely used forecasting method, because of its easy use • F1 = 1,050, = 0.05, A1 = 1,000 • F2 = F1 + (A1 - F1) • = 1,050 + 0.05(1,000 – 1,050) • = 1,050 + 0.05(-50) = 1,047.5 units • BTW, we have to make a starting forecast to get started. Often, use actual A1 Exponential Smoothing Period Demand 1 10 2 12 3 14 4 15 5 16 6 17 7 19 8 21 9 23 10 Alpha = 0.3 ES 10.0 10.0 10.6 11.6 12.6 13.6 14.7 16.0 17.5 19.1 Exponential Smoothing Period Demand 1 10 2 12 3 14 4 15 5 16 6 17 7 19 8 21 9 23 10 Alpha = 0.5 ES 10.0 10.0 11.0 12.5 13.8 14.9 15.9 17.5 19.2 21.1 Exponential Smoothing F12 A11 1 F11 We take: And substitute in to get: F11 A10 1 F10 F12 A11 1 A10 1 F10 2 and if we continue doing this, we get: F12 A11 1 A10 1 A9 1 A8 1 A7 ... 2 3 Older demands get exponentially less weight 4 Choosing • Low : if demand is stable, we don’t want to get thrown into a wild-goose chase, over-reacting to “trends” that are really just short-term variation • High : If demand really is changing rapidly, we want to react as quickly as possible Averaging Methods • • • • Simple Average Moving Average Weighted Moving Average Exponentially Weighted Moving Average (Exponential Smoothing) • They ALL take an average of the past ▫ With a trend, all do badly ▫ Average must be in-between 30 20 10 Trend-Adjusted Ex. Smoothing St exp.smoothedLevel,forecastas of t Tt exp.smoothedT rend 1. St TAFt At TAFt (1 )TAFt At 2. T t T t 1 TAFt TAFt 1 Tt 1 3. TAFt 1 St Tt where and are smoothingconstants Trend-Adjusted Ex. Smoothing S1 100 T1 10 TAF1 100 0.20 0.30 Trend-Adjusted Forecast for period 2 was TAF2 S1 T 1 100 10 110 Suppose actual demand is 115, A2=115 1. S2 TAF2 A2 TAF2 110 0.2 *(115 110) 110 1 111.0 2. T 2 T 1 TAF2 TAF1 T1 10 0.30* (110 100 10) 10 0.3 * 0 10 3. TAF3 S2 T 2 111 10 121 Trend-Adjusted Ex. Smoothing S 2 100 T2 10 TAF3 121 0.20 0.30 Suppose actual demand is 120, A3=120 1. S3 TAF3 A3 TAF3 121 0.2 *(120 121) 121 0.2 120.8 2. T 3 T 2 TAF3 TAF2 T2 10 0.30* (121 110 10) 10 0.3 *1 10.3 3. TAF3 S2 T 2 120.8 10.3 131.1 TAF6=S5+T5 A5 S5 F6 Selecting and β • You could: ▫ Try an initial value for each parameter. ▫ Try lots of combinations and see what looks best. ▫ But how do we decide “what looks best?” • Let’s measure the amount of forecast error. • Then, try lots of combinations of parameters in a methodical way. ▫ Let = 0 to 1, increasing by 0.1 For each value, try = 0 to 1, increasing by 0.1 Evaluating Forecasts How far off is the forecast? Forecasts Demands What do we do with this information? Measuring the Errors Period A-F Method 1 A-F Method 2 1 100 10 2 -100 10 3 100 10 4 -100 10 5 100 10 6 -100 10 7 100 10 8 -100 10 9 100 10 10 -100 10 RSFE 0 100 • Method 1 forecasts are low, high, etc. • Method 2 forecasts always too low. • Running Sum of Forecast Errors, RSFE ▫ Sum of all periods ▫ Also known as the Bias n RSFE At Ft t 1 Evaluating Forecasts n Mean Absolute MAD (1 / n) At Ft Deviation t 1 Mean Squared Error n MSE (1 / n) At Ft 2 t 1 Mean Absolute MAPE (1 / n) Percent Error n t 1 At Ft At 100 MAD of examples Period |A-F| Method 1 |A-F| Method 2 1 100 10 2 100 10 3 100 10 4 100 10 5 100 10 6 100 10 7 100 10 8 100 10 9 100 10 10 100 10 MAD 100 10 • MAD shows that method 1 is off by a larger amount • Method 2 was biased • However, overall, Method 2 seems preferable n MAD (1 / n) At Ft t 1 Tracking Signal • To monitor, compute tracking signal RSFE Tracking Signal MAD n RSFE At Ft t 1 • If >4 or <-4 something is wrong • Top should sum to 0 over time. If not, forecast is biased. Monitoring Forecast Accuracy Forecast Error • Monitor forecast error each period, to see if it becomes too great 4 Upper Limit 0 -4 Forecast Period Lower Limit Techniques for Trend • Determine how demand increases as a function of time yt a bt t = periods since beginning of data b = Slope of the line a = Value of yt at t = 0 Computing Values xy n x y b x nx y b x a y bx 2 2 n S yx n ( y Y ) i i i 1 n2 2 Linear Regression • Four methods 1. Type in formulas for trend, intercept 2. Tools | Data Analysis | Regression 3. Graph, and R click on data, add a trendline, and display the equation. 4. Use intercept(Y,X), slope(Y,X) and RSQ(Y,X) commands • Fits a trend and intercept to the data. • R2 measures the percentage of change in y that can be explained by changes in x. • Gives all data equal weight. • Exp. smoothing with a trend gives more weight to recent, less to old. Causal Forecasting • Linear regression seeks a linear relationship between the input variable and the output quantity. yc a bx • For example, furniture sales correlates to housing sales • Not easy, multiple sources of error: ▫ Understand and quantify relationship ▫ Someone else has to forecast the x values for you Video sales of Shrek 2? • Shrek did $500m at the box office, and sold almost 50 million DVDs & videos • Shrek2 did $920m at the box office Box Office $ Millions 1000 900 800 700 600 500 400 300 200 100 0 Shrek Shrek2 Video sales of Shrek 2? • Assume 1-1 ratio: • • • • ▫ 920/500 = 1.84 ▫ 1.84 * 50 million = 92 million videos? ▫ Fortunately, not that dumb. January 3, 2005: 37 million sold! March analyst call: 40m by end Q1 March SEC filing: 33.7 million sold. Oops. May 10 Announcement: ▫ In 2nd public Q, missed earnings targets by 25%. ▫ May 9, word started leaking ▫ Stock dropped 16.7% Lessons Learned • Flooded market with DVDs • Guaranteed Sales ▫ Promised the retailer they would sell them, or else the retailer could return them ▫ Didn’t know how many would come back • 5 years ago ▫ Typical movie 30% of sales in first week ▫ Animated movies even lower than that • 2004/5 50-70% in first week ▫ Shrek 2: 12.1m in first 3 days ▫ American Idol ending, had to vote in first week The Human Element • Colbert says you have more nerve endings in your gut than in your brain • Limited ability to include factors ▫ Can’t include everything • If it feels really wrong to your gut, maybe your gut is right Washoe Gaming Win, 1993-96 300 What did they mean when they said it was down three quarters in a row? 280 260 240 220 200 180 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1993 1994 1995 1996 Seasonality • Seasonality is regular up or down movements in the data • Can be hourly, daily, weekly, yearly • Naïve method ▫ N1: Assume January sales will be same as December ▫ N2: Assume this Friday’s ticket sales will be same as last Seasonal Relatives • Seasonal relative for May is 1.20, means May sales are typically 20% above the average • Factor for July is 0.90, meaning July sales are typically 10% below the average Seasonality & No Trend Spring Summer Fall Winter Sales 200 350 300 150 Relative 200/250 = 0.8 350/250 = 1.4 300/250 = 1.2 150/250 = 0.6 Total Avg 1,000 1,000/4=250 Seasonality & No Trend If we expected total demand for the next year to be 1,100, the average per quarter would be 1,100/4=275 Forecast Spring 275 * 0.8 = 220 Summer 275 * 1.4 = 385 Fall 275 * 1.2 = 330 Winter 275 * 0.6 = 165 Total 1,100 Trend & Seasonality • Deseasonalize to find the trend 1. Calculate seasonal relatives 2. Deseasonalize the demand 3. Find trend of deseasonalized line • Project trend into the future 4. Project trend line into future 5. Multiply trend line by seasonal relatives. Washoe Gaming Win, 1993-96 300 Looks like a downhill slide -Silver Legacy opened 95Q3 -Otherwise, upward trend 280 260 240 220 200 180 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1993 1994 1995 1996 Source: Comstock Bank, Survey of Nevada Business & Economics Washoe Win 1989-1996 290000 270000 250000 230000 210000 190000 170000 150000 1989 1990 1991 1992 1993 1994 1995 1996 Definitely a general upward trend, slowed 93-94 1989-2007 1989-2007 1998-2007 Cache Creek 9/11 Thunder CC Valley Expands 2003-2010 350,000,000 300,000,000 250,000,000 200,000,000 150,000,000 Washoe Win Deseas 100,000,000 50,000,000 2003 2004 2005 2006 2007 2008 2009 2010 2003-2011 350,000,000 300,000,000 250,000,000 200,000,000 150,000,000 100,000,000 50,000,000 Washoe Win R² = 0.5807 Deseas R² = 0.7377 2003 2004 2005 2006 2007 2008 2009 2010 2011 2011 Forecast using 2003-10 SR 350,000,000 300,000,000 250,000,000 200,000,000 150,000,000 Washoe Win 100,000,000 Data for LR Linear Forecast 50,000,000 2003 2004 2005 2006 2007 2008 2009 2010 2011 Seasonal Relatives calculated using 2003-10 data How Good Was It? 350,000,000 300,000,000 250,000,000 200,000,000 150,000,000 Washoe Win 100,000,000 Linear Forecast 50,000,000 2003 2004 2005 2006 2007 2008 2009 2010 2011 350,000,000 2003 300,000,000 1.Compute Seasonal Relatives 2004 250,000,000 2005 200,000,000 2006 150,000,000 2007 100,000,000 2008 50,000,000 2009 1 Q1 avg SR Q2 Q3 2 240,114,703 259,349,602 279,784,440 246,068,018 2004 231,607,546 259,849,383 297,401,507 259,617,607 2005 245,793,646 269,238,341 294,810,396 257,014,585 2006 245,775,176 269,670,481 294,839,349 257,155,338 2007 244,648,019 273,460,685 284,733,890 246,352,794 2008 227,915,101 237,045,466 258,990,669 206,203,166 2009 190,098,500 211,913,667 217,227,445 185,971,111 2010 187,016,132 198,330,968 209,608,491 175,601,589 2011 174,138,905 192,122,889 203,912,214 175,510,911 220,789,748 241,220,165 260,145,378 223,277,235 1.021 1.101 4 2010 Q4 2003 0.934 3 0.945 236,358,131 2.Deseasonalize Year Quarter Gaming Win Seasonal Deseas 2003 2004 1 240,114,703 0.934 257,045,733 2 259,349,602 1.021 254,122,152 3 279,784,440 1.101 254,201,431 4 246,068,018 0.945 260,484,132 1 231,607,546 0.934 247,938,717 2 259,849,383 1.021 254,611,859 3 297,401,507 1.101 270,207,624 4 259,617,607 0.945 274,827,536 3.LR on Deseasonalized data 2008 Q4-2011Q4 Period 1 2 3 4 5 6 7 8 9 10 11 12 13 Deseasonalized 218,283,762 203,502,775 207,642,335 197,364,541 196,866,394 200,203,062 194,333,409 190,442,251 185,889,365 186,417,833 188,250,460 185,266,831 185,793,374 250,000,000 200,000,000 150,000,000 Deseasonalized 100,000,000 Linear 50,000,000 2009 2010 2011 Intercept = 211,875,992 Slope = -2,352,992 R-squared = 0.83 4.Project trend line into future 300,000,000 250,000,000 200,000,000 150,000,000 Deseasonalized 100,000,000 Straight Line 50,000,000 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 Period Number Intercept = 211,875,992 Slope = -2,352,992 5.Multiply by Seasonal Relatives Linear Trend Period Q Line Seasonal Seasonalized Relative Forecast 37 1 178,933,394 0.934 167,147,450 38 2 176,580,402 1.021 180,212,770 39 3 174,227,410 1.101 191,761,778 40 4 171,874,418 0.945 162,362,279 350000000 300000000 250000000 200000000 150000000 100000000 Gaming Win Deseasonalized 50000000 Straight Line Seasonal Forecast 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 Summary 1. Calculate seasonal relatives 2. Deseasonalize 1. Divide actual demands by seasonal relatives 3. Do a LR 4. Project the LR into the future 5. Seasonalize 1. Multiply straight-line forecast by relatives