Workers’ Compensation Rates

An understanding of basic rates & controls

1

Copyright ERNWest all rights reserved 2012

L&I is expected to

announce “proposed”

base rates for 2013 on

September 17, and they

should be published by

the end of the month.

Copyright ERNWest all rights reserved 2012

2

Rates Overview

• Your rates are determined by two things:

– The “base” rate assigned business activities you

perform

– The extent of the losses you have

• One you can control, one you can’t

Key Concepts

•

•

•

•

•

•

Experience Modification Factor

“Special” Factor

Calculation Limits

Base Rate

Financial Impact of High Rates

Best Ways to Control Rates

What your company pays in premium is a

result of four things:

Type of Work

Performed

Frequency of

Claims

Severity of

Claims

Labor Hours

(exposure)

Workers’

Compensation

Rates

Overly Simplified Premium Calculation

Labor hours x (Experience Mod x (base rate))

6

Risk Class Base Rate

Stay at Work

+

Supplemental

Pension

+

Medical Aid

+

Accident

Fund

Labor hours x (Experience Mod x (base rate))

7

The Department of Labor and Industries uses past injury data

to determine the cost to employers for base or “composite”

rates that are developed by “risk classification”.

2012 Hourly Rates By Business Type

& Risk Classification Code

Class *Examples of Businesses within the Class

AGRICULTURE

4803 Orchards

4805 Nurseries and Shellfish Farms

FOOD PROCESSING AND MANUFACTURING

2104 Fruit and Vegetable Packing - Fresh

3304 Meat, Fish and Poultry Dealers - Wholesale

3702 Breweries, Wineries and Beverage Bottling

3902 Fruit/Vegetable Canneries/Food Product Mfg, NOC

3906 Bakeries and Confectionaries- Wholesale, NOC

4302 Custom Meat Cutting

TRANSPORTATION AND WAREHOUSING

2102 Warehouses, NOC, Grocery Dist. & Recycle Centers

2105 Beer, Wine, and Soft Drink Distributors

STORES

3303 Meat, Fish and Poultry Dealers - Retail

6309 Hardware, Auto Parts and Sporting Good Stores

6402 Supermarkets

6403 Convenience Grocery Stores - No Gas

6404 Florists

6406 Retail Stores, NOC

TEMPORARY HELP

7107 Temp. Help - Food Services

7108 Temp. Help - Warehousing Services

2012

$

$

0.7263

0.7499

$

$

$

$

$

$

0.7790

1.2006

1.0650

1.0976

1.0845

1.6407

$

$

1.3933

1.3069

$

$

$

$

$

$

1.0628

0.5617

0.7028

0.4574

0.6694

0.3699

$

$

0.6193

0.5470

RC

6402

Accident

SAW

$0.3556 $0.0074

Medical

$0.2466

S. Pension

$0.0932

Composite

$0.7028

Deduction

$0.1736

Experience Modification Factor

An EMF is a multiplier used to adjust an industry-based

risk classification base rate up or down based on

common ownership experience.

Good Experience Modifier

Average Experience Modifier

1.50

1.00

Less

1.50

Claim Costs

Expected Loss

.50

1.00

.50

Poor Experience Modifier

More

1.50

1.00

.50

9

Labor hours x (Experience Mod x (base rate))

Experience Modification (EMF)

Exposure

- Labor Hours

- Risk Class

Claim Severity

- How much claims cost

Claim Frequency

- How often claims occur

10

When Does A Claim Effect An EMF?

An employer’s experience period is simply the period

of time during which labor hours and claim costs are

captured to calculation one’s EMF

11

Claims with a

date of injury

between

will impact rates

for calendar

years

but will

“drop out” of

experience on

7/1/09 - 6/30/10

7/1/10 - 6/30/11

7/1/11 - 6/30/12

7/1/12 - 6/30/13

2012, 2013, 2014

2013, 2014, 2015

2014, 2015, 2016

2015, 2016, 2017

June 1st, 2013

June 1st, 2014

June 1st, 2015

June 1st, 2016

Labor hours x (Experience Mod x (base rate))

Experience Period

An employer’s experience period is simply the period

of time during which labor hours and claim costs are

captured to calculation one’s EMF

12

Rates for the

calendar year...

Are determined by claims within

the experience period of

2012

2013

2014

7/1/07 - 6/30/10

7/1/08 - 6/30/11

7/1/09 - 6/30/12

Labor hours x (Experience Mod x (base rate))

Labor hours x (Experience Mod x (base rate))

13

The “Special Rate”

Claims with a

date of injury

between

7/1/06 - 6/30/07

7/1/07 - 6/30/08

7/1/08 - 6/30/09

7/1/09 - 6/30/10

If an employer is able to prevent any time loss or permanent

partial disability payments for the duration of their experience

period, they can achieve a “special” rate that will decrease

fairly dramatically.

14

Labor hours x (Experience Mod x (base rate))

Other “Special” Considerations

• The most your EMF can increase in one year is 25% IN

MOST CASES

• Despite only being in your EMF for three years, if a claim

causes your EMF to increase its maximum amount, your

total rate increase will be 95% and it will take five years

to work out of your factor, not three.

• Exceptions to the rule

– Rule of “one”

• Above 1.33 and calculated to be below 1.00

• Below 0.67 and calculated to be above 1.00

– If you have the “special rate” your 25% increase starts at your

prior year’s “calculated rate

15

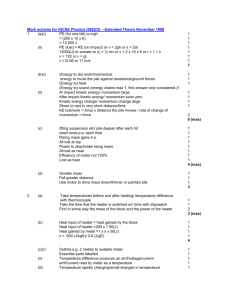

Impact of High Rates

Employer’s Incremental Cost of EMF Increase

Supermarkets - 6402

EMF/FTE

25

50

75

100

300

500

0.5 $

(15,657) $ (31,314) $

(46,972) $

(62,629) $

(187,886) $

(313,144)

0.6 $

(12,526) $ (25,052) $

(37,577) $

(50,103) $

(150,309) $

(250,515)

0.7 $

(9,394) $ (18,789) $

(28,183) $

(37,577) $

(112,732) $

(187,886)

0.8 $

(6,263) $ (12,526) $

(18,789) $

(25,052) $

(75,155) $

(125,258)

0.9 $

(3,131) $

(9,394) $

(12,526) $

(37,577) $

(62,629)

1 $

(6,263) $

-

$

-

$

-

$

-

$

-

$

-

1.1 $

3,131

$

6,263

$

9,394

$

12,526

$

37,577

$

62,629

1.2 $

6,263

$

12,526

$

18,789

$

25,052

$

75,155

$

125,258

1.3 $

9,394

$

18,789

$

28,183

$

37,577

$

112,732

$

187,886

1.4 $

12,526

$

25,052

$

37,577

$

50,103

$

150,309

$

250,515

1.5 $

15,657

$

31,314

$

46,972

$

62,629

$

187,886

$

313,144

•

In the example above the 25 FTE company with a 3% profit margin and

EMF of 1.30 must find $313,334 more in annual revenue than an average

company to cover their WC cost.

•

Same example with the 500 FTE company with a 3% profit margin and

EMF of 1.30 must find an additional $6,262,866 in annual revenue.

16

Controlling Rates

• Safety, Safety, Safety

– If you have no claims you need not worry about your rates

• Kept On Salary

– Impacts “Special” discount, keeps claims medical,

maintains control over claim, avoids reserves

• Modified Duty on a “reasonably continuous basis”

– Avoids voc, avoids reserves, maintains control over claim

• Immediate Investigation & Reporting

– Report the incident to ERNWest within two business days

and we can start applying our resources to help you, the

faster and better reporting we get reduces the time and

hassle you have on complex claims

17

Which is easier?

• Driving millions of dollars in ADDITIONAL

sales

or…….

• Paying attention to your workers’

compensation claims?

19

Contact Information

Group Manager

Curran Bower cbower@ernwest.com

(800) 433-7601 ext. 823

Group Director

John Meier jmeier@ernwest.com

(800) 433-7601 ext. 827

20

21

A Premium Payment Calculation

Risk Class Hours/Units Exp Mod

Accident Fund Medical Fund Stay at Work Pension Composite Payment

4904

12,619

0.9100

$0.0336

$0.0223

$0.0007 $0.0932

$0.1448

$1,827

6402

309,347

0.9100

$0.3556

$0.2466

$0.0074 $0.0932

$0.6486

$200,643

6406

20,092

0.9100

$0.1556

$0.1179

$0.0032 $0.0932

$0.3453

$6,937

$209,407

Labor Hours *(Exp Mod *(AF + MA) + SAW + SPF)

309,347*(.9100 *($0.3556 + $0.2466) + $0.0074 + $0.0932)

=

$200,643