Belgium Toys market

perspectives

Key Stats & Thoughts

Europe & BELGIUM

YTD AUGUST 2014

Copyright 2012. The NPD Group, Inc. All Rights Reserved. This presentation is Proprietary

and Confidential and may not be disclosed in any manner, in whole or in part, to any third

party without the express written consent of NPD.

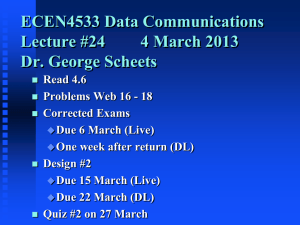

TOYS : Good start for 2014 so far

Total Toy Industry Growth / Decline by Country (YTD July 2014)

US

4

6

5

UK

France

Germany

2

1

Australia

1

Italy

Spain

-1

5

Belgium

5

Poland

Source: The NPD Group | Retail Tracking Service

U.S. Normalised trend (Jan13 *0.8)

International Toy Review

2

1st semester 2014 : growth mainly through occasion

NPD Consumer Panel

Evol % Sales by Occasion Trend Total G5

YTD Q2 – 2014 vs 13

5%

1%

G5 occasion

The NPD Group, Inc. | Proprietary and Confidential

G5 No Occasion

Source: NPD Group | Consumer Panel Service

3

1st semester 2014 : Requested Toys share remains

stable

Consumer Panel

% Of Requested Sales – G5

YTD Q2 – 2014 vs 13

YTD Q2 - 2014

+1%

49%

51%

Requested

No requested

+2 pts

The NPD Group, Inc. | Proprietary and Confidential

Source: NPD Group | Consumer Panel Service

4

AUTOMOTIVE

BEAUTY

COMMERCIAL TECHNOLOGY

CONSUMER TECHNOLOGY

ENTERTAINMENT

FASHION

FOOD & BEVERAGE

FOODSERVICE

HOME

OFFICE SUPPLIES

SOFTWARE

Toys & Games Market

YTD AUG 2014

SPORTS

TOYS

January - August

WIRELESS

5

Total Belgium Market registered a solid growth for this Prefall 2014

mainly boosted up by Volumes

Total Be Traditional Toy Sales

Value (m) & Units (m) – YTD August 2014 / 2013

Toys Value: p 5%

165,4

Toys Units: p 13%

173,3

15,1

13,3

YTD 2013

YTD 2014

The NPD Group, Inc. | Proprietary and Confidential

YTD 2013

Source: NPD EPoS Retail Tracking

YTD 2014

Belgium

6

Except in February and March, Volume registered double digit growth !

Monthly Traditional Toy Sales

Units (m) From January 2013 to August 2014

Monthly Units

5

2013

2014

3

3

2

2

2

1

1

JAN

1

1

FEB

M AR

2

2

2

2

1

1

APR

M AY

2

1

JUN

JUL

AUG

16

17

1

SEP

2

OCT

NOV

DEC

51

Yr/Yr

36

16

3

-4

-24

The NPD Group, Inc. | Proprietary and Confidential

Source: NPD EPoS Retail Tracking

Belgium

7

TOP 5 SUPER CATEGORIES EVOLUTION

YTD 14 vs 13

Belgium market growth came from A&C, Building sets and All Other

toys

Top 5 Most Dynamic Supercategories 2014 vs 13

(in M€)

Supercategories €%

7.8 €

Grand Total

YTD AUG 13

5.7 €

Arts & Crafts

3.1 €

Building Sets

All Other Toys

1.4 €

YTD AUG 14

4,5

7,6

11,9

13,1

3,7

4,4

Outdoor & Sports Toys

0.4 €

22,9

22,1

Plush

0.3 €

2,6

2,6

Source: NPD EPoS Retail Tracking

8

Licenses (€%) Total Belgium vs G6

YTD AUG 12 – 13 – 14

€%

License growth contributed to the market.

Licenses Weigth €% vs

Total Market

26.3

22.2

20.3

24.5

24.4

20.9

YTD 12

YTD 13

YTD 14

Belgium

Licenses Evol (%)

Total G6

8.1

13 vs 12

4.9

14 vs 13

-6.1

Source: NPD EPoS Retail Tracking

-6.8

9

Price Brackets

YTD AUG 12 – 13 – 14

€% / VOL %

All Prices brackets have been dynamic or flat.

VAL%

Grand Total

Between 0 - 5

Between 5 - 10

Between 10 - 15

Between 15 - 20

Between 20 - 30

Between 30 - 50

Others

€

€

€

€

€

€

€

YTD AUG 12 YTD AUG 13 YTD AUG 14 13 vs 12(%) 14 vs 13 (%)

100

100

100

2,6

4,7

8,5

8,1

9,2

-1,8

18,6

16,3

15,4

16,0

-3,3

9,0

15,7

15,0

14,3

-1,6

-0,3

11,4

11,7

12,0

5,6

7,4

16,9

17,0

16,1

3,3

-0,8

14,5

14,7

14,4

3,9

2,9

16,7

18,0

17,9

10,6

4,0

Source: NPD EPoS Retail Tracking

10

Top 5 Items VALUE

YTD August 2014

#1

Hasbro - Furby #1

#2

#3

Panini – Blister 50

Vtech – Storio 2

#4

Mattel– Cars 2

#5

Simba – Friend House

Source: NPD EPoS Retail Tracking

11

Thank You

Industries

Automotive

Beauty

Entertainment

Fashion

Food / Foodservice

Home

Office Supplies

Sports

Technology

Toys

Video Games

Wireless

Keep up with what’s new at The NPD Group.

Subscribe to our newsletter and other communications

by visiting npd.com and clicking “Subscribe.”

The NPD Group, Inc. | Proprietary and Confidential

Countries

Australia

Austria

Belgium

Brazil

Canada

China

France

Germany

Italy

Japan

Mexico

Netherlands

New Zealand

Poland

Portugal

Russia

Spain

Sweden

United Kingdom

United States

12