Taxation in Hong Kong

advertisement

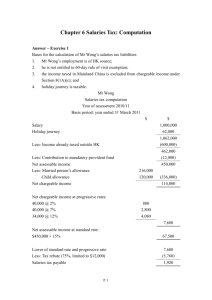

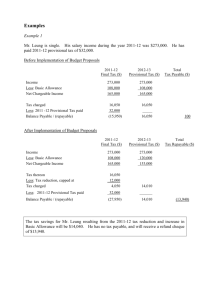

TAXATION IN HONG KONG Mr. Leung Wing Chung TAXES COLLECTED BY INLAND REVENUE DEPARTMENT (稅務局) (2010-11) Type of tax Chinese Salaries tax Profits tax Property tax Personal assessment 薪俸稅 利得稅 物業稅 個人入息課稅 (combination of the three taxes above) Estate duty 遺產稅 Stamp duty 遺產稅 Betting duty 博彩稅 Business registration fees 商業登記費 TAXES COLLECTED BY RATING AND VALUATION DEPARTMENT (差餉及物業估價處) (2010-11) Type of tax Chinese Rates 差餉 Government rent 地租/地稅 Taxes / duties are also collected by the Customs and Excise Department (海關) and Transport Department (運輸署). TAXES COLLECTED BY INLAND REVENUE DEPARTMENT (2010-11) RATES AND GOVERNMENT RENT Payable by : Owners of property (pay per quarter) Ratable value of a property = estimated annual rent of the property Rates = 5% of ratable value Government rent = 3% of ratable value (only applicable to some properties) RATES (EXAMPLES AND CLASS WORK) Question The ratable value of a flat is $80 000. If the rates are charged at 5% p.a., find the rates payable per quarter. Solution Rates payable per quarter 1 = $80 000 × 5% × 4 = $1000 quarter Annual Rates Class Work: RATES (EXAMPLES AND CLASS WORK ) Q.P. 2.20 and Question Betty pays $1200 per quarter for the rates of her flat. If the rates are charged at 5% p.a., what is the ratable value of her flat? Solution Q.P. 2.21 Let $𝑟 be the ratable value. 1 𝑟 × 5% × = 1200 4 1 𝑟 = 1200 ÷ 5% ÷ 4 = 96 000 ∴ The ratable value of the flat is $96 000. PROPERTY TAX Payable by : Owners of property (if rented out) Tax amount = annual rental income × 80% × property tax rate Property tax rate = 15% (in year 2012/13) Note: annual rental income = actual income − rates the remaining 20% is deducted for the allowance for “repair and outgoings”. Work: PROPERTY TAXClass (EXAMPLES AND CLASS WORK) Question Q.P. 2.22 and Q.P. 2.23 The owner of a flat pays a property tax of $7200 for a year. If the property tax is 15%, what is the monthly rental income of the flat? Solution Let $𝑟 be the monthly rental income of the flat. 𝑟 × 12 × 80% × 15% = 7200 𝑟 = 7200 ÷ 12 ÷ 80% ÷ 15% = 5000 ∴ The monthly rental income of the flat is $5000. SALARIES TAX Progressive tax : more income → higher tax rate (%) net chargeable income = annual income − allowances Note: the annual income includes all income, including commissions (佣金), bonuses (花紅), leave pay (代替假期的工資) and end of contract gratuities (約滿酬金) allowances (津貼), perquisites (額外賞賜) and fringe benefits (附帶利益), etc… SALARIES TAX RATES (2012-2013) Progressive rates: Net chargeable income On the First $40 000 On the Next $40 000 On the Next $40 000 Remainder Tax rate 2% 7% 12% 17% Tax ($) 800 2800 4800 Standard rates: • Salary tax = annual income × 15% (no allowance for standard rates) Final result: the minimum of the two results. SALARIES TAX ALLOWANCES (2012-13) SALARIES TAX ALLOWANCES (2012-13) PROGRESSIVE RATES OR STANDARD RATES ??? 500,000 450,000 Salaries Tax ($) 400,000 350,000 300,000 250,000 Allowance: $134500 200,000 Allowance: $298500 150,000 Standard Rates 100,000 50,000 0 0 1,000,000 2,000,000 Annual Income ($) 3,000,000 EXAMPLES AND CLASS WORK