Smart EOFY year strategies 2013/14 presentation

Smart EOFY Strategies

For 30 June 2014

< Insert Adviser logo>

Disclaimer

This information has been prepared by MLC Limited (ABN 90 000 000 402)

105-153 Miller Street, North Sydney NSW 2060, a member of the National Australia Bank group of companies. This information was produced as an information service and without assuming a duty of care. This information is for adviser use only. It contains general information only. It does not constitute financial advice and should not be relied upon as a substitute for financial or professional advice.

In preparing this information, MLC Limited did not take into account the investment objectives, financial situation or particular needs of any particular person. Before making an investment decision, a person needs to consider (with or without the advice or assistance of an adviser) whether this information is appropriate to their needs, objectives and circumstances.

The information in this presentation is based on our interpretation of relevant laws as at 20 March 2014 and is subject to change. No responsibility is taken for persons acting on the information provided.

Persons doing so, do so at their own risk.

MLC is not a registered tax agent. If you wish to rely on this information to determine your personal tax obligations you should seek advice from a Registered Tax Agent.

2

SMART EOFY STRATEGIES | 2014

Agenda

•

Why invest via Super?

•

Super strategies

• Insurance

• Other tax-effective year-end opportunities

• How I can help

SMART EOFY STRATEGIES | 2014

3

Why invest via Super?

Tax concessions every step of the way

1. When you contribute to super

• Make contributions from pre-tax salary

• Claim contributions as a tax deduction

• Get a Government co-contribution of up to $500

• Get a tax offset of up to $540

Now Retirement

1 Includes a Medicare levy of 1.5%.

SMART EOFY STRATEGIES | 2014

4

Why invest via Super?

Tax concessions every step of the way

Now Retirement

2. While build up super

• Earnings in fund taxed at maximum of 15%

• Earnings from investments in own name taxed at up to 46.5%

1 Includes a Medicare levy of 1.5%.

SMART EOFY STRATEGIES | 2014

5

Why invest via Super?

Tax concessions every step of the way

1 Includes a Medicare levy of 1.5%.

SMART EOFY STRATEGIES | 2014

Now Retirement

3. When using super to pay pension

• No tax on investment earnings

• Tax offset between 55 and 59

• Tax-free income at 60+

6

Super EOFY strategies

For middle to higher income earners under 55

Get more from your salary or bonus

If you… • are an employee

You may want to… • salary sacrifice

• contribute pre-tax salary or bonus into super

So you can… • benefit from contribution taxed at max. 15%, (or

30% for people whose earnings and contributions are more than $300k+ p.a.) not marginal rate which is up to 46.5%

• grow retirement savings

• reduce tax payable on salary or bonus by up to

31.5%

You can only sacrifice prospective salary or a bonus into super

(i.e. income to which you are not already entitled) and need to make an effective salary sacrifice agreement with your employer.

SMART EOFY STRATEGIES | 2014

1 Includes a Medicare levy of 1.5%.

7

Salary sacrifice case study

William is aged 45

• About to receive a $5,000 pa salary increase

•

Will bring his total salary to

$100,000 pa

• Considering salary sacrificing this additional $5,000 into super

SMART EOFY STRATEGIES | 2014

8

Salary sacrifice case study

Per annum

Pre-tax pay rise

Less income tax at

38.5% 1

Sacrifice pay rise into super

$5,000

(N/A)

Less tax on super contribution

($750)

Net amount invested $4,250

Tax paid on earnings 15%

Receive pay rise as after-tax salary

$5,000

($1,925)

(N/A)

$3,075

38.5%

1 Includes a Medicare levy of 1.5%.

SMART EOFY STRATEGIES | 2014

9

Results (after 20 years)

$200,000

$160,000

$120,000

$80,000

$40,000

$0

$119,485

$189,371

+ $69,886

Receive pay rise as after-tax salary and invest outside super

Salary sacrifice pay rise into super

Assumptions: . A 20 year comparison based on $5,000 pa of pre-tax salary. Both the super and non-super investments earn a total pre-tax return of 7.7% pa (split 3.3% income and 4.4% growth). Investment income is franked at 30%. All values are after income tax (at 15% in super and 38.5% outside super) and CGT (including discounting). Medicare Levy is 1.5% (this projection does not allow for the increase to 2% that occurs on 1 July 2014).

Note: No lump sum tax is payable on the super investment as William will be 65 at the end of the investment period.

SMART EOFY STRATEGIES | 2014

10

Super EOFY strategies

Make tax deductible super contributions

If you… • are self-employed or not employed

You may want to… • make personal super contributions

So you can… • claim some (or all) of contribution tax deduction

• grow retirement savings

• use deduction to reduce taxable income and income tax payable

To be able to claim a portion of your personal super contributions as a tax deduction, you need to complete a valid ‘notice of intent’ form and give it to your super fund within specific timeframes.

You also need to get an acknowledgement back from your super fund that the notice has been received and accepted by them.

If you don’t you may not be able to claim a deduction. (You also need to be eligible to make a contribution).

SMART EOFY STRATEGIES | 2014

11

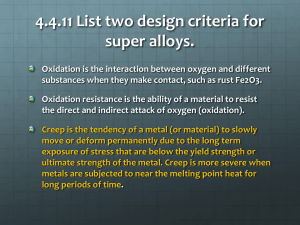

Consider contribution caps

• Salary sacrifice and personal deductible contributions count, along with other amounts, to ‘concessional’ contribution (CC) cap

•

The concessional cap is $25,000 in 2013-14*

• The caps are annual amount and you can’t carry forward any unused amount to another financial year

• It’s really important you make the most of the cap each year, particularly if you are approaching retirement

• Opportunity to make larger ‘last minute’ concessionally taxed contributions no longer available

• People who earn in excess of $300K pay an additional 15% tax on concessional superannuation made over the $300K threshold and within the cap

*

For people aged 58 or under on 30/6/13 and $35,000 for people aged 59 or over on 30/6/13. From 1 July 2014, the general concessional cap will be increased to $30,000. For people aged 49 and over on 30/6/14, their concessional cap will be $35,000 from 1 July 2014.

12

SMART EOFY STRATEGIES | 2014

Cap implications

• Excess concessional contributions for the 2013-14 financial year and beyond are generally returned to the member and taxed at their maximum tax rate

(MTR). An “Excess Concessional Contributions Charge” will also be applied by the ATO.

• Review this year’s contributions and remember that a range of other items count towards this cap, including:

– super guarantee contributions, including those from more than one employer

– concessional contributions made to fund insurance in super

• Review your contributions from 1 July 2013, particularly if you are an employee as the superannuation guarantee rate has increased from 9% to

9.25%*.

*

The SG rate is planned to increase to 9.5% on 1 July 2014 however legislation is currently before parliament to defer the increase. If enacted this will mean that the rate will remain at 9.25% for the 2014/15 year.

13

SMART EOFY STRATEGIES | 2014

Super EOFY strategies

Get a super top up from the Government

If you… • earn at least 10% of income from employment or self-employment

• earn a total income of $48,516 or less

You may want to… • make personal after-tax contributions

So you can… • get up to $500 in free super from Government

• spouse may qualify for co-contributions if you earn too much

14

SMART EOFY STRATEGIES | 2014

Co-contribution case study

Ryan is aged 40

• Employed on salary of $37,000 pa

• Wants to invest $1,000 in after tax salary each year until he retires at 60

SMART EOFY STRATEGIES | 2014

15

Co-contribution case study

In 2012/13 Invest outside super

Amount invested

Co-contribution

$1,000

$0

Total investment $1,000

Tax paid on earnings 34%

Make personal super contribution

$1,000

$331

$1,331

15%

1 Includes a Medicare levy of 1.5%.

SMART EOFY STRATEGIES | 2014

16

Results (after 20 years)

$100,000

$80,000

$60,000

$40,000

$20,000

$0

$39,965

$60,893

+ $20,928

$1,000 pa invested outside super

(no co-contribution)

$1,000 pa invested inside super

(includes co-contribution)

Assumptions: . A 20 year comparison based on an after-tax investment of $1,000 pa. Both the super and non-super investments earn a total pre-tax return of 7.7% pa (split 3.3% income and 4.4% growth). Investment income is franked at 30%. All values are after income tax (at 15% in super and 34% outside super) and CGT (including discounting). Medicare Levy is 1.5% (this projection does not allow for the increase to 2% that occurs on 1 July 2014).

Note: No lump sum tax is payable on the super investment as Ryan will be 60 at the end of the investment period.

SMART EOFY STRATEGIES | 2014

17

Super EOFY strategies

Boost partner’s super and reduce your tax

• For people who have a spouse who earns less than $13,800 pa

• Make after-tax super contribution on their behalf

• Get tax offset of up to $540

• Grow spouse’s super and reduce your tax

SMART EOFY STRATEGIES | 2014

18

Other super EOFY strategies

Make insurance more affordable

Buy life and total and permanent disability insurance in super

Self-employed Claim super contributions as tax deduction

Buy insurance in super with pre-tax dollars Employee

Eligible for co-contribution

Use co-contribution to help pay for future insurance

Concessions can:

• Make it cheaper to insure through super, or

• Enable you to purchase a higher level of cover

SMART EOFY STRATEGIES | 2014

19

Other smart EOFY opportunities

Pre-pay expenses

If you want to bring forward tax deductions and pay less tax this financial year you could:

• Pre-pay annual premiums for an income protection policy held in your own name

• Pre-pay up to 12 months interest on an investment loan

(usually only available with fixed rate facilities)

SMART EOFY STRATEGIES | 2014

20

Other super EOFY strategies

Investment earnings

Pay less on investment earnings

• Cash out non-super investment

• Make personal super contribution

•

Earnings in super fund taxed at max. rate of 15%

• Earnings from investment in own name taxed at up to

46.5% 1

• Reduce tax on investment earnings by up to 31.5%

• Consider capital gains tax payable when selling asset

1 Includes a Medicare levy of 1.5%.

SMART EOFY STRATEGIES | 2014

21

Other smart EOFY strategies

Manage CGT

If you make a capital gain on asset sales this financial year, consider:

• triggering a capital loss by selling another investment that no longer suits your needs , or

• making a super contribution and claiming amount as tax deduction

(if eligible)

Both strategies could be used to offset capital gain and save tax

SMART EOFY STRATEGIES | 2014

22

Strategy wrap-up

Before June 30

Super strategies

• Salary sacrifice contributions

•

Personal deductible contributions

• Co-contributions

• Spouse contributions

Insurance strategies

• Buy insurance in super

• Pre-pay expenses

Other smart opportunities

• Invest non-super money in super

• Manage CGT

After June 30

Key issues to consider

• Review concessional contributions

• Review TTR strategy

• Make the most of your tax refund

Start planning for EOFY 2013/14 now

SMART EOFY STRATEGIES | 2014

23

How I can help

Optional slide(s)- insert relevant content regarding your advice services and how people can make an appointment

SMART EOFY STRATEGIES | 2014

24

SMART EOFY STRATEGIES | 2014

Questions?

25

Insert disclaimer here

Thank you

Contact details line 1

Contact details line 2