Mankiw 5/e Chapter 1: The Science of Macroeconomics

Macroeconomics of

Business Cycles

Percent change from 4 quarters earlier

10

8

6

Average growth rate

4

2

Growth rates of real GDP, consumption

Real GDP growth rate

Consumption growth rate

0

-2

-4

1970 1975 1980 1985 1990 1995 2000 2005 2010

Growth rates of real GDP, consumption, investment

Percent change from 4 quarters earlier

40

30

Investment growth rate

20

Real GDP growth rate

10

0

-10

-20

Consumption growth rate

-30

1970 1975 1980 1985 1990 1995 2000 2005 2010

Unemployment

Percent of labor force

12

10

8

6

4

2

0

1970 1975 1980 1985 1990 1995 2000 2005 2010

Percentage

10 change in real GDP 8

1951

1984

6

Okun’s Law

1966

4

2

1987

Y

Y

3

2

u

2003

1971

2008

0

-2

-4

-3

2001

1991 1982

-2 -1 0 1

Change in unemployment rate

2 3

1975

4

Facts about the business cycle

GDP growth averages about 3 percent per year over the long run with large fluctuations in the short run.

Consumption and investment fluctuate with GDP, but consumption tends to be less volatile and investment more volatile than GDP.

Unemployment rises during recessions and falls during expansions.

Okun’s Law : the negative relationship between

GDP and unemployment.

Index of Leading Economic Indicators

Published monthly by the Conference Board.

Aims to forecast changes in economic activity 6-9 months into the future.

Used in planning by businesses and govt, despite not being a perfect predictor.

Components of the LEI index

Average workweek in manufacturing

Initial weekly claims for unemployment insurance

New orders for consumer goods and materials

New orders, nondefense capital goods

Vendor performance

New building permits issued

Index of stock prices

M2

Yield spread (10-year minus 3-month) on Treasuries

Index of consumer expectations

Index of Leading Economic Indicators

120

110

100

90

80

70

60

50

40

Source:

30

Conference

1970 1975 1980 1985 1990 1995 2000 2005 2010

Board

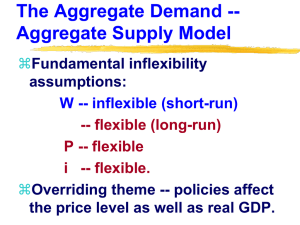

Time horizons in macroeconomics

Long run

Prices are flexible, respond to changes in supply or demand.

Short run

Many prices are “sticky” at a predetermined level.

The economy behaves much differently when prices are sticky.

AD/AS Model

The paradigm most mainstream economists and policymakers use to think about economic fluctuations and policies to stabilize the economy

Shows how the price level and aggregate output are determined

Shows how the economy’s behavior is different in the short run and long run

Aggregate demand

We use a simple theory of AD based on the quantity theory of money.

Recall the quantity equation

M V = P Y

For given values of M and V , this equation implies an inverse relationship between P and Y :

Y = (M V) / P

The downward-sloping AD curve

An increase in the price level causes a fall in real money balances ( M/P ), causing a decrease in the demand for goods & services.

P

AD

Y

Shifting the AD curve

P

An increase in the money supply shifts the

AD curve to the right.

AD

1

AD

2

Y

Aggregate supply in the long run

Recall from Chapter 3:

In the long run, output is determined by factor supplies and technology

Y F K L )

Y is the full-employment or natural level of output, at which the economy’s resources are fully employed.

“Full employment” means that unemployment equals its natural rate (not zero).

The long-run aggregate supply curve

P LRAS

Y so does not depend on

LRAS vertical. is

P ,

Y

Y

, )

Long-run effects of an increase in M

P LRAS

An increase in M

AD to the right. shifts

In the long run, this raises the price level…

P

2

P

1

…but leaves output the same.

Y

AD

1

AD

2

Y

The short-run aggregate supply curve

P

The SRAS curve is horizontal:

The price level is fixed at a predetermined level, and firms sell as much as buyers demand.

P

SRAS

Y

Short-run effects of an increase in M

P

In the short run when prices are sticky,…

…an increase in aggregate demand…

…causes output to rise.

P

Y

1

Y

2

SRAS

AD

2

AD

1

Y

From the short run to the long run

Over time, prices gradually become “unstuck.”

When they do, will they rise or fall?

In the short-run equilibrium, if

Y Y

Y Y

Y Y then over time,

P will… rise fall remain constant

The adjustment of prices is what moves the economy to its long-run equilibrium.

The SR & LR effects of

M > 0

A = initial equilibrium

P LRAS

B = new shortrun eq’m after Fed increases M

C = long-run equilibrium

P

2

P

A

Y

C

B

Y

2

SRAS

AD

2

AD

1

Y

The effects of a negative demand shock

AD shifts left, depressing output and employment in the short run.

P LRAS

B A SRAS

Over time, prices fall and the economy moves down its demand curve toward fullemployment.

P

P

2

Y

2

Y

C

AD

2

AD

1

Y

Supply shocks

A supply shock alters production costs, affects the prices that firms charge (also called price shocks )

Examples of adverse supply shocks:

– Bad weather reduces crop yields, pushing up food prices

– Workers unionize, negotiate wage increases

– New environmental regulations require firms to reduce emissions

Favorable supply shocks lower costs and prices

CASE STUDY:

The 1970s oil shocks

Early 1970s: OPEC coordinates a reduction in the supply of oil

Oil prices rose

11% in 1973

68% in 1974

16% in 1975

CASE STUDY:

The 1970s oil shocks

The oil price shock shifts SRAS up, causing output and employment to fall.

P LRAS

B

In absence of further price shocks, prices will fall over time and economy moves back toward full employment.

P

2

P

1

Y

2

Y

SRAS

2

AD

SRAS

1

Y

Predicted effects of the oil shock:

• inflation

• output

• unemployment

…and then a gradual recovery.

CASE STUDY:

The 1970s oil shocks

70%

60%

50%

40%

30%

20%

10%

0%

1973 1974 1975 1976

Change in oil prices (left scale)

Inflation rate-CPI (right scale)

Unemployment rate (right scale)

12%

10%

8%

6%

1977

4%

Late 1970s:

As economy was recovering, oil prices shot up again, causing another huge supply shock!!!

CASE STUDY:

The 1970s oil shocks

60%

50%

40%

30%

20%

10%

0%

1977 1978 1979 1980

Change in oil prices (left scale)

Inflation rate-CPI (right scale)

Unemployment rate (right scale)

14%

12%

10%

8%

6%

1981

4%

1980s:

A favorable supply shock-a significant fall in oil prices.

As the model predicts, inflation and unemployment fell:

CASE STUDY:

The 1980s oil shocks

40%

30%

20%

10%

8%

10%

6%

0%

-10%

4%

-20%

-30%

2%

-40%

-50%

1982 1983 1984 1985 1986 1987

0%

Change in oil prices (left scale)

Inflation rate-CPI (right scale)

Unemployment rate (right scale)

Stabilization policy

def: policy actions aimed at reducing the severity of short-run economic fluctuations.

Example: Using monetary policy to combat the effects of adverse supply shocks…

The adverse supply shock moves the economy to point B.

Stabilizing output with monetary policy

P LRAS

P

2

P

1

B

A

SRAS

2

AD

1

SRAS

1

Y

Y

2

Y

Stabilizing output with monetary policy

P LRAS But the Fed accommodates the shock by raising agg. demand.

B C results:

P is permanently higher, but Y remains at its fullemployment level.

P

2

P

1

Y

2

Y

A

SRAS

2

AD

1

AD

2

Y

Aggregate Demand I:

The IS-LM Model

The IS LM model determines income and the interest rate in the short run when P is fixed

Keynesian

Cross

Theory of

Liquidity

Preference

The Big Picture

IS curve

LM curve

IS-LM model

Agg. demand curve

Agg. supply curve

Model of

Agg.

Demand and Agg.

Supply

Explanation of short-run fluctuations

The Keynesian Cross

A simple closed economy model in which income is determined by expenditure.

Notation:

I = planned investment

PE = C + I + G = planned expenditure

Y = real GDP = actual expenditure

Difference between actual & planned expenditure = unplanned inventory investment

Elements of the Keynesian Cross

consumption function: govt policy variables:

)

G G , T T for now, planned investment is exogenous: planned expenditure:

I I

PE C Y T ) I G equilibrium condition: actual expenditure = planned expenditure

Y PE

The equilibrium value of income

PE planned expenditure

PE = Y

PE = C + I + G

Equilibrium income income, output,

Y

An increase in government purchases

PE

At

Y

1

, there is now an unplanned drop in inventory…

PE = C + I + G

2

PE = C + I + G

1

G

…so firms increase output, and income rises toward a new equilibrium.

PE

1

= Y

1

Y

PE

2

= Y

2

Y

Solving for

Y

Y C I G

Y C I G

C G

MPC

Y G equilibrium condition in changes because

I exogenous because

C =

MPC

Y

Collect terms with

Y on the left side of the equals sign:

(1

MPC)

Y G

Solve for

Y :

Y

1

1

MPC

G

The government purchases multiplier

Definition: the increase in income resulting from a $1 increase in G .

In this model, the govt purchases multiplier equals

Y

G

1

1

MPC

Example: If MPC = 0.8, then

Y

G

1

1

0.8

5

An increase in G causes income to increase 5 times as much!

Why the multiplier is greater than 1

Initially, the increase in G causes an equal increase in Y: Y = G .

But Y C

further Y

further C

further Y

So the final impact on income is much bigger than the initial G .

An increase in taxes

PE

Initially, the tax increase reduces consumption, and therefore PE :

PE = C

1

+ I + G

PE = C

2

+ I + G

C = MPC T At

Y

1

, there is now an unplanned inventory buildup…

…so firms reduce output, and income falls toward a new equilibrium

PE

2

= Y

2

Y

PE

1

= Y

1

Y

Solving for

Y

Y C I G

C

MPC

Y T eq’m condition in changes

I and

G exogenous

Solving for

Y : (1

MPC)

Y

MPC

T

Final result: Y

MPC

1

MPC

T

The tax multiplier

def: the change in income resulting from a $1 increase in T :

Y

T

MPC

1

MPC

If MPC = 0.8, then the tax multiplier equals

Y

T

0.8

1

0.8

0.8

0.2

4

The IS curve

def: a graph of all combinations of r and

Y that result in goods market equilibrium i.e.

actual output = planned expenditure

The equation for the IS curve is:

Y C Y T ) I r G

J.R. Hicks

r I

PE

Y

Deriving the IS curve

PE

PE = Y

PE = C + I ( r

2

)+ G

PE = C + I ( r

1

)+ G

I

Y

1

Y

2

Y r r

1 r

2

Y

1

Y

2

IS

Y

Shifting the IS curve:

G

At any value of r ,

G PE Y

…so the IS curve shifts to the right.

PE

PE = Y

PE = C + I ( r

1

)+ G

2

PE = C + I ( r

1

)+ G

1

The horizontal distance of the

IS shift equals r r

1

Y

1

Y

2

Y

1

G

Y

1

Y

Y

2

IS

1

IS

Y

2

The Theory of Liquidity Preference

Due to John Maynard Keynes

A simple theory in which the interest rate is determined by money supply and money demand

Money supply

The supply of real money balances is fixed:

M P s

M P interest rate r

M P s

M P

M/P real money balances

Demand for real money balances:

M P d

Money demand

interest rate r

M P s

M P

L ( r )

M/P real money balances

The interest rate adjusts to equate the supply and demand for money:

M P L r

Equilibrium

interest rate r

M P s r

1

M P

L ( r )

M/P real money balances

How the Fed raises the interest rate

To increase r ,

Fed reduces M interest rate r r

2 r

1

M

2

P

M

1

P

L ( r )

M/P real money balances

The LM curve

Now let’s put function:

Y back into the money demand

M P d

L r Y

The LM curve is a graph of all combinations of r and Y that equate the supply and demand for real money balances.

The equation for the LM curve is:

M P L r Y

r

2 r

1

Deriving the LM curve

r

(a) The market for real money balances

M

1

P

L ( r , Y

2

)

L ( r , Y

1

)

M/P r

2 r

(b) The LM curve

LM r

1

Y

1

Y

2

Y

r

2 r

1

How

M shifts the LM curve

r

(a) The market for real money balances

M

2

P

M

1

P

L ( r , Y

1

)

M/P r

2 r

(b) The LM curve

LM

2

LM

1 r

1

Y

1

Y

The short-run equilibrium

The short-run equilibrium is the combination of r and Y that simultaneously satisfies the equilibrium conditions in the goods & money markets:

Y C Y T ) I r G

M P L r Y

Equilibrium interest rate r

LM

IS

Y

Equilibrium level of income

Policy analysis with the IS -LM model

Y C Y T ) I r G

M P L r Y

We can use the effects of

IS-LM model to analyze the

• fiscal policy: G and/or T

• monetary policy: M r

1 r

Y

1

LM

IS

Y

An increase in government purchases

1. IS curve shifts right

1 by

G causing output & income to rise.

2. This raises money demand, causing the interest rate to rise…

3. …which reduces investment, so the final increase in Y

1 is smaller than

G r

2

2.

r

1 r

LM

Y

1

3.

Y

2

1.

IS

1

IS

2

Y

A tax cut

Consumers save

(1

MPC ) of the tax cut, so the initial boost in spending is smaller for

T than for an equal

G … and the IS curve shifts by

1.

MPC

T

2.

r

2 r

1 r

2.

…so the effects on r and Y are smaller for

T than for an equal

G .

LM

Y

1

Y

2

2.

1.

IS

1

IS

2

Y

Monetary policy: An increase in M

1. M the

> 0 shifts

LM curve down

(or to the right) r

LM

1

LM

2 r

1 r

2

2.

…causing the interest rate to fall

3.

…which increases investment, causing output & income to rise.

Y

1

Y

2

IS

Y

The Fed’s response to

G > 0

Suppose Congress increases G .

Possible Fed responses:

1.

2.

3.

hold M constant hold r constant hold Y constant

In each case, the effects of the G are different…

Response 1: Hold M constant

If Congress raises G , the IS curve shifts right.

If Fed holds M constant, then LM curve doesn’t shift.

Results:

Y Y

2

Y

1 r r

2

r

1 r

2 r

1 r

LM

1

Y

1

Y

2

IS

IS

1

2

Y

Response 2: Hold r constant r

If Congress raises G , the IS curve shifts right.

To keep r constant,

Fed increases M to shift LM curve right.

Results:

Y Y

3

Y

1

0 r

2 r

1

LM

1

LM

2

Y

1

Y

2

Y

3

IS

IS

1

2

Y

Response 3: Hold Y constant r

If Congress raises G , the IS curve shifts right.

To keep Y constant,

Fed reduces M to shift LM curve left.

Results:

Y 0 r r

3

r

1 r

3 r

2 r

1

LM

2

LM

1

Y

1

Y

2

IS

IS

1

2

Y

Estimates of fiscal policy multipliers

from the DRI macroeconometric model

Assumption about monetary policy

Estimated value of

Y /

G

Estimated value of

Y /

T

Fed holds money supply constant

Fed holds nominal interest rate constant

Romer & Bernstein (2009)

Barro & Redlick (2010)

0.60

1.93

1.55

0.90

0.26

1.19

0.90

1.10

Shocks in the IS -LM model

IS shocks : exogenous changes in the demand for goods & services.

Examples:

– stock market boom or crash

change in households’ wealth

C

– change in business or consumer confidence or expectations

I and/or C

Shocks in the IS -LM model

LM shocks : exogenous changes in the demand for money.

Examples:

– a wave of credit card fraud increases demand for money.

– more ATMs or the Internet reduce money demand.

CASE STUDY:

The U.S. recession of 2001

During 2001,

– 2.1 million jobs lost, unemployment rose from 3.9% to 5.8%.

– GDP growth slowed to 0.8%

(compared to 3.9% average annual growth during 1994-2000).

CASE STUDY:

The U.S. recession of 2001

Causes: 1) Stock market decline C

1500

1200

S&P 500

900

600

300

1995 1996 1997 1998 1999 2000 2001 2002 2003

CASE STUDY:

The U.S. recession of 2001

Causes: 2) 9/11

–

–

– increased uncertainty fall in consumer & business confidence result: lower spending, left

IS curve shifted

Causes: 3) Corporate accounting scandals

– Enron, WorldCom, etc .

– reduced stock prices, discouraged investment

CASE STUDY:

The U.S. recession of 2001

Fiscal policy response: shifted IS curve right

–

– tax cuts in 2001 and 2003 spending increases

• airline industry bailout

• NYC reconstruction

• Afghanistan war

CASE STUDY:

The U.S. recession of 2001

Monetary policy response: shifted LM curve right

7

6

5

4

3

2

1

0

Three-month

T-Bill Rate

Deriving the AD curve

Intuition for slope of AD curve:

P

( M/P )

LM shifts left

r

I

Y

P

P

2

P

1 r r

2 r

1

Y

2

Y

2

LM( P

2

)

LM( P

1

)

Y

1

Y

1

IS

Y

AD

Y

Monetary policy and the AD curve

The Fed can increase aggregate demand:

M

LM shifts right

r

I

Y at each value of P r r

1 r

2

P

P

1

Y

1

LM(M

1

/P

1

)

LM( M

2

/P

1

)

Y

2

IS

Y

Y

1

Y

2

AD

2

AD

1

Y

Fiscal policy and the AD curve

Expansionary fiscal policy (

G and/or

T ) increases agg. demand:

T

C

IS shifts right

Y at each value of P r r

2 r

1

P

P

1

Y

1

LM

Y

2

IS

1

IS

2

Y

Y

1

Y

2

AD

2

AD

1

Y

IS-LM and AD-AS in the short run & long run

Recall from Chapter 9 : The force that moves the economy from the short run to the long run is the gradual adjustment of prices.

In the short-run equilibrium, if

Y Y

Y Y

Y Y then over time, the price level will rise fall remain constant

The SR and LR effects of an IS shock r

LRAS

LM ( P

1

)

A negative shock shifts and AD causing

IS

IS left,

Y to fall.

P

P

1

IS

1

Y

LRAS

IS

2

Y

SRAS

1

Y

AD

1

AD

Y

2

The SR and LR effects of an IS shock r

LRAS

LM ( P

1

)

In the new short-run equilibrium,

P

P

1

IS

1

Y

LRAS

IS

2

Y

SRAS

1

Y

AD

1

AD

Y

2

The SR and LR effects of an IS shock r

LRAS

LM ( P

1

)

In the new short-run equilibrium,

Over time, P gradually falls, causing

•

SRAS to move down

•

M/P to increase, which causes LM to move down

P

P

1

IS

1

Y

LRAS

IS

2

Y

SRAS

1

Y

AD

1

AD

Y

2

The SR and LR effects of an IS shock r

LRAS

LM ( P

1

)

LM ( P

2

)

Over time, P gradually falls, causing

•

SRAS to move down

•

M/P to increase, which causes LM to move down

P

P

1

P

2

IS

1

Y

LRAS

IS

2

Y

Y

SRAS

1

SRAS

2

AD

1

AD

2

Y

The SR and LR effects of an IS shock r

LRAS

LM ( P

1

)

LM ( P

2

)

This process continues until economy reaches a long-run equilibrium with

P

P

1

P

2

IS

1

Y

LRAS

IS

2

Y

Y

SRAS

1

SRAS

2

AD

1

AD

2

Y

NOW YOU TRY:

Analyze SR & LR effects

of

M a.

Draw the IS-LM and AD-AS diagrams as shown here. r

LRAS

LM (

M

1

/ P

1

) b.

Suppose Fed increases M .

Show the short-run effects on your graphs.

IS c.

Show what happens in the transition from the short run to the long run.

P

Y

LRAS

Y d.

How do the new long-run equilibrium values of the endogenous variables compare to their initial values?

P

1

Y

SRAS

1

AD

1

Y

The Great Depression

240 30

220

200

Unemployment

(right scale) 25

20

180 15

160

140

Real GNP

(left scale)

120

1929 1931 1933 1935 1937 1939

10

5

0

THE SPENDING HYPOTHESIS:

Shocks to the IS curve

asserts that the Depression was largely due to an exogenous fall in the demand for goods

& services – a leftward shift of the IS curve.

evidence: output and interest rates both fell, which is what a leftward IS shift would cause.

THE SPENDING HYPOTHESIS:

Reasons for the IS shift

Stock market crash exogenous C

– Oct-Dec 1929: S&P 500 fell 17%

– Oct 1929-Dec 1933: S&P 500 fell 71%

Drop in investment

–

–

“correction” after overbuilding in the 1920s widespread bank failures made it harder to obtain financing for investment

Contractionary fiscal policy

– Politicians raised tax rates and cut spending to combat increasing deficits.

THE MONEY HYPOTHESIS:

A shock to the LM curve

asserts that the Depression was largely due to huge fall in the money supply.

evidence:

M 1 fell 25% during 1929-33.

But, two problems with this hypothesis:

–

–

P fell even more, so M / P actually rose slightly during 1929-31. nominal interest rates fell, which is the opposite of what a leftward cause.

LM shift would

THE MONEY HYPOTHESIS AGAIN:

The effects of falling prices

asserts that the severity of the Depression was due to a huge deflation:

P fell 25% during 1929-33.

This deflation was probably caused by the fall in M , so perhaps money played an important role after all.

In what ways does a deflation affect the economy?

THE MONEY HYPOTHESIS AGAIN:

The effects of falling prices

The stabilizing effects of deflation:

P ( M/P ) LM shifts right Y

Pigou effect :

P ( M/P )

consumers’ wealth

C

IS shifts right

Y

THE MONEY HYPOTHESIS AGAIN:

The effects of falling prices

The destabilizing effects of expected deflation:

E

r for each value of i

I because I = I ( r )

planned expenditure & agg. demand

income & output

THE MONEY HYPOTHESIS AGAIN:

The effects of falling prices

The destabilizing effects of unexpected deflation: debt-deflation theory

P (if unexpected)

transfers purchasing power from borrowers to lenders

borrowers spend less, lenders spend more

if borrowers’ propensity to spend is larger than lenders’, then aggregate spending falls, the IS curve shifts left, and Y falls

Why another Depression is unlikely

Policymakers (or their advisors) now know much more about macroeconomics

Federal deposit insurance makes widespread bank failures very unlikely.

Automatic stabilizers make fiscal policy expansionary during an economic downturn.

The Great Recession

2008-2009

NBER: December 2007 to June 2009

– Real GDP fell by 4%, u-rate hit 10.6%

Important factors in the crisis:

7

6

5

4

3

9

8

2

1

0

2000

Interest rates and house prices

Federal Funds rate

30-year mortgage rate

2001 2002 2003 2004

170

150

130

110

90

70

2005

50

Change in U.S. house price index and rate of new foreclosures, 1999-2009

14%

12%

US house price index

New foreclosures

1,4

10% 1,2

8%

6%

1,0

0,8

4%

2%

0%

0,6

0,4

-2%

-4%

0,2

-6%

1999 2001 2003 2005 2007 2009

0,0

House price change and new foreclosures, 2006:Q3 – 2009Q1

20%

18%

16%

14%

12%

10%

8%

6%

4%

2%

0%

-40%

Nevada

California

Florida

Arizona

Rhode Island

New Jersey

Michigan

Hawaii

Illinois

Oregon

Ohio

Alaska

Georgia

Colorado

N. Dakota

-30% -20% -10% 0% 10%

Cumulative change in house price index

Texas

S. Dakota

Wyoming

20%

U.S. bank failures by year, 2000-2010

180

160

140

120

100

80

60

40

20

0

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

140%

120%

100%

80%

60%

40%

20%

0%

-20%

-40%

-60%

-80%

Major U.S. stock indexes

(% change from 52 weeks earlier)

DJIA

S&P 500

NASDAQ

Consumer sentiment and growth in consumer durables and investment spending

20%

15%

10%

5%

0%

-5%

110

100

90

80

-10%

70

-15%

Durables

-20%

Investment

UM Consumer Sentiment Index

-25%

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

60

50

Real GDP growth and Unemployment

10% 10

8%

Real GDP growth rate (left scale)

Unemployment rate (right scale)

9

8

6%

7

6

4%

2%

0%

-2%

-4%

1995 1997 1999 2001 2003 2005 2007 2009

3

2

1

0

5

4

The Great Recession

2008-2009

NBER: December 2007 to June 2009

– Real GDP fell by 4%, u-rate hit 10.6%

Important factors in the crisis:

–

–

– early 2000s Federal Reserve interest rate policy sub-prime mortgage crisis bursting of house price bubble, rising foreclosure rates

–

–

– falling stock prices failing financial institutions declining consumer confidence, drop in spending on consumer durables and investment goods

Policy Responses to

Great Recession

Fiscal Policy

– Economic Stimulus Act of 2008

–

–

–

–

TARP (2008)

American Recovery and Reinvestment Act of 2009

Cash for Clunkers (2009)

Additional UI

Monetary Policy

– Quantitative Easing I, II

– New Credit Facilities

Financial Regulation

– Stress tests

– Dodd-Frank (2010)

International Trade Policy

Clicker Review

Over the business cycle, investment spending

______ consumption spending.

a) is inversely correlated with b) is more volatile than c) has about the same volatility as d) is less volatile than

Most economists believe that prices are: a) flexible in the short run but many are sticky in the long run.

b) flexible in the long run but many are sticky in the short run.

c) sticky in both the short and long runs.

d) flexible in both the short and long runs.

The vertical long-run aggregate supply curve satisfies the classical dichotomy because the natural rate of output does NOT depend on: a) the labor supply.

b) the supply of capital.

c) the money supply.

d) technology.

If the short-run aggregate supply curve is horizontal, then a change in the money supply will change ______ in the short run and change ______ in the long run.

a) only output; only prices b) only prices; only output c) both prices and output; only prices d) both prices and output; both prices and output

Assume that the economy is initially at point A with aggregate demand given by AD

2

. A shift in the aggregate demand curve to

AD

0 could be the result of either a(n) ______ in the money supply or a(n) ______ in velocity.

a) increase; increase b) increase; decrease c) decrease; increase d) decrease; decrease

In the IS-LM model, which two variables are influenced by the interest rate?

a) supply of nominal money balances and demand for real balances b) demand for real balances and government purchases c) supply of nominal money balances and investment spending d) demand for real money balances and investment spending

The equilibrium condition in the Keynesiancross analysis in a closed economy is: a) income equals consumption plus investment plus government spending.

b) planned expenditure equals consumption plus planned investment plus government spending.

c) actual expenditure equals planned expenditure.

d) actual saving equals actual investment.

In the Keynesian-cross model with a given MPC, the government-expenditure multiplier ______ the tax multiplier.

a) is larger than b) equals c) is smaller than d) is the inverse of the

An increase in taxes shifts the IS curve, drawn with income along the horizontal axis and the interest rate along the vertical axis: a) downward and to the left.

b) upward and to the right.

c) upward and to the left.

d) downward and to the right.

A decrease in the price level, holding nominal money supply constant, will shift the LM curve: a) upward and to the right.

b) downward and to the right.

c) downward and to the left.

d) upward and to the left.

In the Keynesian-cross analysis, if the consumption function is given by C = 100 + 0.6(Y – T), and planned investment is 100, G is 100, and T is 100, then equilibrium

Y is: a) 350 b) 400 c) 600 d) 750

Based on the graph, starting from equilibrium at interest rate r

1 and income Y

1

, a tax cut would generate the new equilibrium combination of interest rate and income: a) r

2

, Y

2 b) r

3

, Y

2 c) r

2

, Y

3 d) r

3

, Y

3

Based on the graph, starting from equilibrium at interest rate r

3

, income Y

2

, IS

1

, and LM

1

, if there is an increase in government spending that shifts the IS curve to IS

2

, then in order to keep the interest rate constant the Federal Reserve should _____ the money supply shifting to _____.

a) increase; LM

2 b) decrease; LM

2 c) increase; LM

3 d) decrease; LM

3

Based on the graph, if the economy starts from a shortterm equilibrium at A, then the long-run equilibrium will be at ____ with a _____ price level.

a) B; higher b) B; lower c) C; higher d) C; lower

A tax cut combined with tight money, as was the case in the United States in the early 1980s, should lead to a: a) rise in the real interest rate and a fall in investment.

b) fall in the real interest rate and a rise in investment.

c) rise in both the real interest rate and investment.

d) fall in both the real interest rate and investment.