IS-LM analysis

advertisement

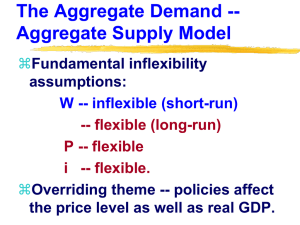

IS-LM analysis: deriving the IS curve Extension Class Presentation Ruth Tarrant Consumption (C) Consumption functions 45⁰ line Income = consumption C = a + bY a = y-intercept = autonomous consumption (i.e. the level of consumption when income is zero) b = slope of the line = marginal propensity to consume Yo Income (Y) At Yo, we say there is equilibrium, as consumption = income Transferring this to Aggregate Demand AD 45⁰ line AD 1. At Yo, the goods market in the economy is in equilibrium: AD = Y 2. In equilibrium, injections = withdrawals 3. So, we can assume that Savings = Investment Yo Income Developing the IS curve • An IS (Investments = Savings) curve shows the different combinations of income (Y) and interest rates (r) at which the goods market is in equilibrium Aggregate Demand 45⁰ line AD1 Income Interest Rate Y0 Assume that the rate of interest in the economy is r0. At this rate of interest, aggregate demand is shown as AD1. So, when the rate of interest is r0, the goods market of the economy is in equilibrium at y0 . r0 We can now plot a point on the bottom diagram, at the intersection of r0 and y0. At this point we know that the goods market in the economy is in equilibrium Y0 Income Aggregate Demand 45⁰ line AD2 AD1 Now suppose that interest rates are lowered, to r1. Lower interest rates boost consumer spending and investment, and so AD rises. We draw a new AD curve at AD2. At this higher level of AD, the economy’s goods market equilibrium is achieved at Y1. Y1 Income Interest Rate Y0 Now we plot a point at the intersection of Y1 and r1 to indicate the point at which the goods market is in equilibrium. r0 r1 Y0 Y1 Income Aggregate Demand 45⁰ line AD2 AD1 Y0 Y1 Income We can repeat this process for all interest rates, and then plot all of the relevant points on the bottom diagram. Interest Rate If we join the dots, we create an IS curve. r0 r1 IS Y0 Y1 Income The slope of the IS curve • Why might the IS curve be steep? Shallow? • The slope of the IS curve depends on the sensitivity of AD to interest rate changes – If changes in interest rates only lead to a small change in AD, the IS curve will be steep – If changes in interest rates lead to a large change in AD, the IS curve will be shallow Shifts in the IS curve • Remember, the IS curve shows the effect of interest rates in shifting AD and the resultant level of income • If anything else changes, the IS curve will shift Shifts in the IS curve • What would happen to the IS curve if: – Government spending increased? – Consumer confidence fell? – Business optimism about future profits improved?