PowerPoint

advertisement

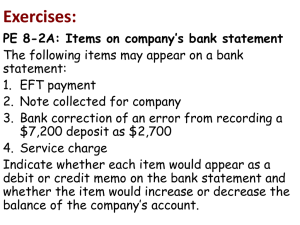

COLLEGE ACCOUNTING HEINTZ & PARRY 19th EDITION COPYRIGHT © 2008 Thomson South-Western, a part of The Thomson Corporation. Thomson, the Star logo, and South-Western are trademarks used herein under license. 7-1 CHAPTER 7 ACCOUNTING FOR CASH 7-2 CASH Includes: Currency, coins, and checking accounts Checks received from customers Money orders Bank cashier’s checks Because cash plays such a central role in operating a business, it must be carefully managed and controlled 7-3 INTERNAL CONTROL A set of procedures designed to ensure proper accounting for transactions Good internal control for cash transactions: All cash received should be deposited DAILY in a bank All disbursements, except for payments from petty cash, should be made by CHECK 7-4 MAKING DEPOSITS A deposit ticket is a form showing a detailed listing of items being deposited Currency, coins, and checks are listed separately Each check should be identified by its ABA (American Bankers Association) number – Found in upper right-hand corner of each check – Also shown in magnetic ink character recognition (MICR) code on the lower left side of the front of each check – The code is used to sort and route checks 7-5 AUTOMATED TELLER MACHINES Each depositor has a plastic card and a personal identification number (PIN) Most automated teller machines (ATMs) are on a system that allows noncustomers to use their ATMs It is important for the depositor to keep an accounting record of ATM withdrawals and deposits 7-6 WRITING CHECKS A check is a document ordering a bank to pay cash from a depositor’s account There are three parties to every check: Drawer—the depositor who orders the bank to pay the cash Drawee—the bank on which the check is drawn Payee—the person being paid the cash Business checks often have a check stub 7-7 BANK STATEMENT The statement shows: The balance at the BEGINNING of the period Deposits and other amounts ADDED during the period Checks and other amounts SUBTRACTED during the period The balance at the END of the period 7-8 BANK STATEMENT Sent with bank statement Canceled checks, “imaged” sheets of check faces, or a listing of checks Any other forms representing items added to or subtracted from the account 7-9 LEARNING OBJECTIVE 2 PREPARE A BANK RECONCILIATION AND RELATED JOURNAL ENTRIES. 7-10 BANK RECONCILIATION EXAMPLE Bank statement shows a balance of $1,748.09. But the general ledger account has a balance of $2,393.23. We need to prepare a BANK RECONCILIATION. 7-11 Maple Consulting Bank Reconciliation November 21, 20-- Heading includes: Name of Company Bank Reconciliation Date 7-12 Maple Consulting Bank Reconciliation November 21, 20-Bank statement balance, November 21 Add: $1,748.09 Deduct: Adjusted bank balance Once all reconciling items are listed, the adjusted bank balance is computed. 7-13 Maple Consulting Bank Reconciliation November 21, 20-Bank statement balance, November 21 Add: $1,748.09 Deduct: Adjusted bank balance Book balance, November 21 Add: Deduct: $2,393.23 The adjusted book balance is computed. Adjusted book balance 7-14 Maple Consulting Bank Reconciliation November 21, 20-Bank statement balance, November 21 Add: Deduct: $1,748.09 We say it is “reconciled” when the adjusted BANK and adjusted BOOK balances agree. Adjusted bank balance Book balance, November 21 Add: $2,393.23 Deduct: Adjusted book balance 7-15 REASONS FOR DIFFERENCES BETWEEN BANK AND BOOK BALANCES Deposits in transit Deposits that have not reached the bank or been recorded by the bank before the statement is prepared Outstanding checks Checks that have not been presented to the bank for payment before the statement is prepared Service charges Bank charges for services such as check printing and processing 7-16 REASONS FOR DIFFERENCES BETWEEN BANK AND BOOK BALANCES (CONT.) Collections Collections of promissory notes or charge accounts made by the bank on behalf of the depositor Not sufficient funds (NSF) checks Checks deposited but not paid because the drawer did not have sufficient funds Errors Errors made by the bank or by the depositor in recording cash transactions 7-17 Maple Consulting Bank Reconciliation November 21, 20-Bank statement balance, November 21 Add deposit in transit Deduct outstanding checks: No. 219 No. 224 No. 227 Adjusted bank balance Book balance, November 21 Add error on check no. 214 Deduct: Unrecorded ATM withdrawal NSF check Bank service charge Adjusted book balance $1,748.09 637.02 $2,385.11 $200.00 25.00 67.78 $100.00 200.00 1.80 292.78 $2,092.33 $2,393.23 0.90 $2,394.13 301.80 $2,092.33 7-18 EXAMPLE We now know that the actual amount of cash is $2,092.33, but the general ledger cash account still shows $2,393.23. JOURNAL ENTRIES ARE NEEDED 7-19 BANK RECONCILIATION JOURNAL ENTRIES Only two kinds of items appearing on a bank reconciliation require journal entries: Errors in the depositor’s books Bank additions and deductions that do not already appear in the books ALL items in the book balance section of the reconciliation require a journal entry 7-20 Maple Consulting Bank Reconciliation November 21, 20-Bank statement balance, November 21 Add deposit in transit Deduct outstanding checks: No. 219 No. 224 No. 227 Adjusted bank balance Book balance, November 21 Add error on check no. 214 Deduct: Unrecorded ATM withdrawal NSF check Bank service charge Adjusted book balance $1,748.09 637.02 $2,385.11 $200.00 25.00 67.78 $100.00 200.00 1.80 292.78 $2,092.33 $2,393.23 0.90 $2,394.13 301.80 $2,092.33 7-21 BANK RECONCILIATION JOURNAL ENTRIES 1 2 3 4 5 6 7 8 DATE DESCRIPTION 20-Nov. 21 Cash PR DEBIT CREDIT 0 90 When check no. 214 was written, the cash account was credited for $0.90 more than the check amount of $46.25. This entry puts $0.90 back in the Cash account. 9 10 11 7-22 BANK RECONCILIATION JOURNAL ENTRIES 1 2 3 DATE DESCRIPTION 20-Nov. 21 Cash PR DEBIT CREDIT 0 90 Accounts Payable 0 90 Error in recording check 4 5 6 7 8 9 10 11 Add error on check Accounts Payable was originally debited for $19.88. This was $0.90 more than the actual telephone bill of $18.98. This entry removes the extra $0.90. 7-23 BANK RECONCILIATION JOURNAL ENTRIES 1 2 3 DATE DESCRIPTION 20-Nov. 21 Accounts Payable PR DEBIT CREDIT 0 90 Cash 0 90 Error in recording check 4 5 6 7 8 Deduct error on check 9 10 11 7-24 Maple Consulting Bank Reconciliation November 21, 20-Bank statement balance, November 21 Add deposit in transit Deduct outstanding checks: No. 219 No. 224 No. 227 Adjusted bank balance Book balance, November 21 Add error on check no. 214 Deduct: Unrecorded ATM withdrawal NSF check Bank service charge Adjusted book balance $1,748.09 637.02 $2,385.11 $200.00 25.00 67.78 $100.00 200.00 1.80 292.78 $2,092.33 $2,393.23 0.90 $2,394.13 301.80 $2,092.33 7-25 BANK RECONCILIATION JOURNAL ENTRIES DATE DESCRIPTION PR DEBIT CREDIT 20-0 90 1 Nov. 21 Cash 2 0 90 Accounts Payable 3 Error in recording check 4 5 21 J. M., Drawing 200 00 6 7 8 9 10 11 Since the ATM withdrawal was for “personal expenses,” the drawing account should be debited. 7-26 BANK RECONCILIATION JOURNAL ENTRIES 1 2 3 DATE DESCRIPTION 20-Nov. 21 Cash PR DEBIT CREDIT 0 90 Accounts Payable 0 90 Error in recording check 4 5 6 21 J. M., Drawing 100 00 Cash 100 00 7 8 9 10 11 The $200 withdrawal was never recorded. This entry will remove the $100.00 from the cash account. 7-27 Maple Consulting Bank Reconciliation November 21, 20-Bank statement balance, November 21 Add deposit in transit Deduct outstanding checks: No. 219 No. 224 No. 227 Adjusted bank balance Book balance, November 21 Add error on check no. 214 Deduct: Unrecorded ATM withdrawal NSF check Bank service charge Adjusted book balance $1,748.09 637.02 $2,385.11 $200.00 25.00 67.78 $100.00 200.00 1.80 292.78 $2,092.33 $2,393.23 0.90 $2,394.13 301.80 $2,092.33 7-28 BANK RECONCILIATION JOURNAL ENTRIES DATE 10 11 12 DESCRIPTION 21 Accounts Receivable PR DEBIT CREDIT 200 00 Cash 200 00 Unrecorded NSF check 13 14 15 16 17 18 19 20 The amount of the bounced check is placed into Accounts Receivable and Cash is reduced. 7-29 Maple Consulting Bank Reconciliation November 21, 20-Bank statement balance, November 21 Add deposit in transit Deduct outstanding checks: No. 219 No. 224 No. 227 Adjusted bank balance Book balance, November 21 Add error on check no. 214 Deduct: Unrecorded ATM withdrawal NSF check Bank service charge Adjusted book balance $1,748.09 637.02 $2,385.11 $200.00 25.00 67.78 $100.00 200.00 1.80 292.78 $2,092.33 $2,393.23 0.90 $2,394.13 301.80 $2,092.33 7-30 BANK RECONCILIATION JOURNAL ENTRIES DATE 10 11 12 DESCRIPTION 21 Accounts Receivable PR DEBIT CREDIT 200 00 Cash 200 00 Unrecorded NSF check 13 14 15 16 17 18 19 20 21 Service Fee Expense Cash 1 80 1 80 Bank service charge 7-31 LEARNING OBJECTIVE 3 ESTABLISH AND USE A PETTY CASH FUND. 7-32 THE PETTY CASH FUND A fund set up to pay for small items with cash Checks for very small amounts are cumbersome To establish the fund: A check is written to the petty cash custodian for the amount to be set aside in the fund The custodian cashes the check and places the money in a petty cash box The custodian should be the only person authorized to make payments from the fund 7-33 JOURNAL ENTRY FOR ESTABLISHING A PETTY CASH FUND 1 2 3 DATE DESCRIPTION 20-1 Petty Cash Dec. Cash PR DEBIT CREDIT 200 00 200 00 Establish petty cash fund 4 5 6 7 8 9 10 11 7-34 PETTY CASH PAYMENTS RECORD A special multi-column record that supplements the regular accounting records Provides a record of each petty cash payment Broken down by account – e.g.: Travel/Entertainment Expense, Postage Expense, etc. Used to prepare the replenishment journal entry 7-35 REPLENISHING THE PETTY CASH FUND The petty cash fund should be replenished whenever the fund runs low and at the end of each accounting period Once the fund is established by debiting Petty Cash and crediting Cash, no further entries are made to Petty Cash To replenish the fund, debits are made to appropriate expense accounts and Cash is credited Only if the amount of the fund itself is being changed would there be a debit or credit to Petty Cash 7-36 EXAMPLE At the end of the month, the petty cash fund contains eight vouchers and only $21.20 in cash. The fund needs to be replenished. To replenish the fund: A check is written for $178.80, which is the total of the eight vouchers A journal entry is made to recognize: – The expenses shown on the vouchers – The outflow of cash via the check 7-37 JOURNAL ENTRY FOR REPLENISHING THE PETTY CASH FUND 1 2 3 4 5 6 DATE DESCRIPTION 20-Dec. 24 Automobile Expense Postage Expense Travel & Entertain. Exp. Miscellaneous Expense James Maple, Drawing Cash PR DEBIT CREDIT 40 80 39 50 30 25 38 25 30 00 178 80 7 Cash should be credited for the amount needed to restore the fund to its established amount. 9 10 ($200.00 fund – $21.20 in box = $178.80 needed) 8 11 7-38 JOURNAL ENTRY FOR REPLENISHING THE PETTY CASH FUND 1 2 3 4 5 6 7 8 DATE DESCRIPTION 20-Dec. 31 Automobile Expense Postage Expense Travel & Entertain. Exp. Miscellaneous Expense James Maple, Drawing Cash PR DEBIT CREDIT 40 80 39 50 30 25 38 25 30 00 178 80 Replenishment of petty cash fund 9 10 11 7-39 LEARNING OBJECTIVE 4 ESTABLISH A CHANGE FUND AND USE THE CASH SHORT AND OVER ACCOUNT. 7-40 CHANGE FUND A supply of currency and coins kept in the cash register or cash drawer Allows businesses to make change when customers pay in cash At the end of the day, cash received during the day is deposited – But the change fund is held back for use on the following day 7-41 EXAMPLE Sporty’s Cleaners is opening for business on June 3. Sporty needs to establish a $200 change fund. CASH 200 Just like the petty cash fund, a change fund starts by withdrawing from the cash account. 7-42 EXAMPLE Sporty’s Cleaners is opening for business on June 3. Sporty needs to establish a $200 change fund. CASH 200 CHANGE FUND 200 Change Fund is an ASSET. 7-43 JOURNAL ENTRY FOR ESTABLISHING THE CHANGE FUND DATE DESCRIPTION 20-1 June 1 Change Fund 2 Cash 3 Establish change fund 4 PR DEBIT CREDIT 200 00 200 00 5 6 7 8 9 10 11 7-44 EXAMPLE At the close of its first day of business, Sporty’s had $1,450.00 in the cash register. CASH IN DRAWER Less: CHANGE FUND CASH FROM SALES $1,450.00 – 200.00 $1,250.00 The CASH from sales should agree with the sales recorded on the cash REGISTER TAPE. 7-45 EXAMPLE At the close of its first day of business, Sporty’s had $1,450.00 in the cash register. $1,450.00 CASH IN DRAWER Less: CHANGE FUND – 200.00 CASH FROM SALES $1,250.00 Sales from the cash register tape are also $1,250.00!!! 7-46 JOURNAL ENTRY FOR RECORDING CASH FROM SALES 1 2 3 4 5 6 DATE DESCRIPTION 20-June 3 Cash PR DEBIT CREDIT 1,250 00 Only the $1,250.00 is debited to Cash and deposited. The change fund is not deposited. 7 8 9 10 11 7-47 JOURNAL ENTRY FOR RECORDING CASH FROM SALES (CONT.) DATE DESCRIPTION PR DEBIT CREDIT 20-1 June 1,250 00 3 Cash 2 Service Fees 1,250 00 3 Cash received from services 4 5 6 7 8 What would have happened if the cash register tape didn’t agree with the cash from sales? 9 10 11 7-48 CASH SHORTAGE EXAMPLE At the close of its first day of business, Sporty’s had $1,450.00 in the cash register. $1,450.00 CASH IN DRAWER Less: CHANGE FUND – 200.00 CASH FROM SALES $1,250.00 What if the cash register tape had shown sales of $1,252.00 or $1,247.00? 7-49 CASH SHORTAGE EXAMPLE CASH IN DRAWER Less: CHANGE FUND CASH FROM SALES CASH REGISTER TAPE SHORTAGE $1,450.00 – 200.00 $1,250.00 $1,252.00 $ 2.00 Overages and shortages are recorded in an account called “CASH SHORT AND OVER.” 7-50 JOURNAL ENTRY FOR RECORDING A CASH SHORTAGE 1 2 3 4 5 6 DATE DESCRIPTION 20-June 3 Cash PR DEBIT CREDIT 1,250 00 Cash is debited for the amount deposited. 7 8 9 10 11 7-51 JOURNAL ENTRY FOR RECORDING A CASH SHORTAGE (CONT.) DATE DESCRIPTION 20-1 June 3 Cash 2 Cash Short and Over 3 4 5 6 PR DEBIT CREDIT 1,250 00 2 00 Cash Short and Over is debited for shortages and credited for overages. 7 8 9 10 11 7-52 JOURNAL ENTRY FOR RECORDING A CASH SHORTAGE (CONT.) 1 2 3 DATE DESCRIPTION 20-June 3 Cash Cash Short and Over PR DEBIT CREDIT 1,250 00 2 00 Service Fees 1,252 00 4 5 6 7 8 9 10 11 Service Fees is credited for the amount on the cash register tape even though this was not the amount collected. 7-53 CASH OVERAGE EXAMPLE At the close of its first day of business, Sporty’s had $1,450.00 in the cash register… But the cash register tape showed $1,247.00 CASH IN DRAWER Less: CHANGE FUND CASH FROM SALES CASH REGISTER TAPE OVERAGE $1,450.00 – 200.00 $1,250.00 $1,247.00 $ 3.00 7-54 JOURNAL ENTRY FOR RECORDING A CASH OVERAGE 1 2 3 DATE DESCRIPTION 20-June 3 Cash PR DEBIT CREDIT 1,250 00 Cash Short and Over 3 00 4 5 6 7 8 Cash Short and Over is debited for shortages and credited for overages. 9 10 11 7-55 JOURNAL ENTRY FOR RECORDING A CASH OVERAGE (CONT.) 1 2 3 DATE DESCRIPTION 20-June 3 Cash PR DEBIT CREDIT 1,250 00 Cash Short and Over Service Fees 3 00 1,247 00 4 5 6 7 8 9 10 11 Service Fees is credited for the amount on the cash register tape even though this was not the amount collected. 7-56