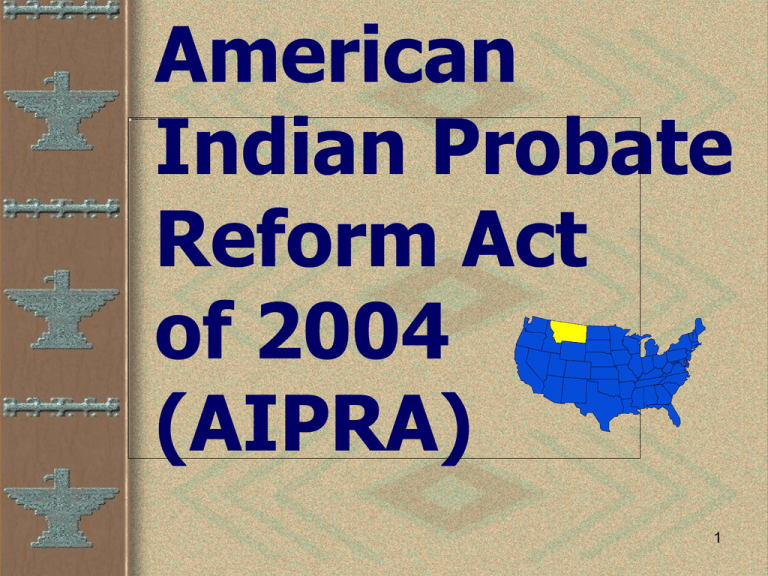

(ITI) report and What happens to interests of less than 5%

advertisement

American Indian Probate Reform Act of 2004 (AIPRA) 1 Floyd H. Azure II Montana State University Extension Undergraduate Student Assistant Marsha A. Goetting Montana State University Extension Family Economics Specialist; Department of Agricultural Economics & Economics 2 Purpose of AIPRA • To Prevent Further Fractionation of Trust Lands. • To Encourage Consolidation of Indian Land Ownership. 3 AIPRA: Probate Sections •Effective for persons who pass away on or after June 20, 2006 4 AIPRA • State law no longer applies to Trust Property when a person passes away without a will. 5 14 Fact Sheets • Highlight • Describe • Illustrate 6 AIPRA distribution among eligible heirs: • Depends on percentage of undivided interest owned by the person who passed away 7 Do you own: 5% or more? Less than 5%? 8 Fact Sheet #4 •Your Individual Trust Interest (ITI) Report: How to read it 9 Where do I get my ITI Report? •Local BIA Office Realty Department Fort Peck 406-768-5112 10 Where do I get my ITI Report? • BIA Regional Office Rocky Mountain Region Billings 406-247-7943 11 Important fact on ITI Report: • Amount of undivided interest owned in each parcel. 12 ITI Report AGGREGATE DECIMAL • Right side, lower middle • Decimal C – .0173611111 13 Because AIPRA uses percent Convert C Decimal to % •.0173611111 =1.7% 14 Example: ITI Report • • • • • • .0173661111 = 1.7% .156250000 = 15.6% .0078125000 = 0.8% .114583333 = 11.5% .0078125000 = 0.8% .0260416667 = 2.6% Ft Peck Ft Belknap Blackfeet Ft Peck Standing R Ft Hall 15 Use ITI Report to determine % of ownership •5% or more? •Less than 5%? 16 Fact Sheet #7 If your undivided interest in each allotment is: less than 5% What Happens If You Pass Away Without Writing a Will? 17 Single Heir Rule • Undivided interest of less than 5% passes to one person in following order….. 18 Single Heir Rule (less than 5% & no will) • First priority: Oldest surviving eligible child 19 Single Heir Rule (less than 5% & no will) • If no surviving eligible child Oldest surviving eligible grandchild 20 Single Heir Rule (less than 5% & no will) • If no surviving eligible grandchild Oldest surviving eligible greatgrandchild 21 Single Heir Rule (less than 5% & no will) • If no surviving eligible child, grandchild or great-grandchild Tribe 22 Single Heir Rule (less than 5% & no will) • If tribe does not have jurisdiction Equal shares to Co-owners 23 Single person-•Never married •Widowed •Divorced •Common Law (less than 5% & no will) 24 Example 1: • Person has no written will No Spouse No Children No Grandchildren No Great Grandchildren 25 ITI Report .0173661111 = 1.7% .0156250000 = 1.6% .0078125000 = 0.8% .0114583333 = 1.1% .0078125000 = 0.8% .0260416667 = 2.6% Ft Peck Ft Belknap Blackfeet Ft Peck Standing R Ft Hall (Each is less than 5%) 26 Single Heir Rule (no will) • Undivided interest of less than 5% passes to: Tribe with jurisdiction 27 Tribe Inherits .0173661111 = 1.7% .0156250000 = 1.6% .0078125000 = 0.8% .0114583333 = 1.1% .0078125000 = 0.8% .0260416667 = 2.6% Ft Peck Ft Belknap Blackfeet Ft Peck Standing R Ft Hall (Each is less than 5%) 28 Example 2: Single, no spouse •Has living Children (less than 5% & no will) 29 Children defined (AIPRA) •Biological •Legally adopted 30 Example 2: Dad passes Survivors: 2 kids DAD Child Age 19 Child Age 29 (less than 5% & no will) 31 Dad’s ITI Report .0173661111 = 1.7% .0156250000 = 1.6% .0078125000 = 0.8% .0114583333 = 1.1% .0078125000 = 0.8% .0260416667 = 2.6% Ft Peck Ft Belknap Blackfeet Ft Peck Standing R Ft Hall (Each is less than 5%) 32 Single Heir Rule •All interests pass to oldest surviving eligible child (less than 5% & no will) 33 Which child receives? DAD (less than 5% & no will) Child Age 19 Child Age 29 34 Oldest Child – Age 29 .017366111 = 1.7% .015625000 = 1.6% .007812500 = 0.8% .011458333 = 1.1% .007812500 = 0.8% .026041666 = 2.6% Ft Peck Ft Belknap Blackfeet Ft Peck Standing Ft Hall (Receives <5% interest on each reservation) 35 Married--AIPRA • Includes Separated Legal separation 36 Example 3: Married (less than 5% & no will) • Husband passes away • Survivor: •Wife not living on a parcel No Children 37 Husband’s ITI Report .0173661111 = 1.7% .0156250000 = 1.6% .0078125000 = 0.8% .0114583333 = 1.1% .0078125000 = 0.8% .0260416667 = 2.6% Ft Peck Ft Belknap Blackfeet Ft Peck Standing R Ft Hall (Each is less than 5%) 38 Single Heir Rule (less than 5% & no will) •There is no surviving eligible: child or grandchild or great-grandchild 39 Example 3: Wife not on parcel • All interests pass to Tribe. •Spouse receives nothing. (less than 5% & no will) 40 Passes to Tribe where interest is located .0173661111 = 1.7% .0156250000 = 1.6% .0078125000 = 0.8% .0114583333 = 1.1% .0078125000 = 0.8% .0260416667 = 2.6% Ft Peck Ft Belknap Blackfeet Ft Peck Standing R Ft Hall (Each is less than 5%) 41 Example 4: (less than 5% •Survivors: & no will) Husband Not living on the parcel 3 Children 42 Example 4: Ages of Children Wife (less than 5% & no will) Husband Child Child Child Age 18 Age 22 Age 24 43 Mom’s ITI Report .0173661111 = 1.7% .0156250000 = 1.6% .0078125000 = 0.8% .0114583333 = 1.1% .0078125000 = 0.8% .0260416667 = 2.6% Ft Peck Ft Belknap Blackfeet Ft Peck Standing R Ft Hall (Each is less than 5%) 44 Single Heir Rule (no will) •Interests of less than 5% pass to oldest surviving eligible child 45 Survivors: Husband & Children (less than 5% & no will) Husband Wife 0 Child Age 18 Child Age 22 0 0 Child Age 24 All 46 24 year old receives all .0173661111 = 1.7% .0156250000 = 1.6% .0078125000 = 0.8% .0114583333 = 1.1% .0078125000 = 0.8% .0260416667 = 2.6% Ft Peck Ft Belknap Blackfeet Ft Peck Standing R Ft Hall (Each is less than 5%) 47 Family Example 5 •Survivors Wife •living on one of the parcels 3 Children (less than 5% & no will) 48 Spouse lives on parcel .017366111 = 1.7% .015625000 = 1.6% .007812500 = 0.8% .011458333 = 1.1% .007812500 = 0.8% .026041666 = 2.6% Ft Peck Ft Belknap Blackfeet Ft Peck Standing Ft Hall (less than 5% & no will) 49 Children & Spouse Husband Child Age 18 Spouse Lives on Fort Peck parcel Child Child Age 22 Age 24 50 Exception: Single Heir Rule • If spouse living on parcel: He/she receives life estate on that parcel, including the family home (less than 5% & no will) 51 Life Estate • Allows life tenant to have possession of property during his/her lifetime –But not ownership of property (less than 5% & no will) 52 Single Heir Rule: No will • Oldest child receives: Remainder interest home land Receives parcels with interests of less than 5%. 53 Remainderman •Person entitled to property after the life tenant has passed away 54 Oldest Child Spouse – life estate .017366111 = 1.7% Ft Peck .015625000 = 1.6% Ft Belknap .007812500 = 0.8% Blackfeet .011458333 = 1.1% Ft Peck .007812500 = 0.8% Standing .026041666 = 2.6% Ft Hall (less than 5% & no will) 55 Trust Land (less than 5%& no will) Husband Child Age 18 0 Wife Life Estate Child Age 22 0 Child Age 24 parcels with less than 5% 56 Spouse passes away (less than 5% & no will) Wife Husband Child 0 Child 0 Oldest Child Age 24 57 Upon Mother’s passing oldest child receives: • Remainder interest –1.7% parcel Fort Peck • Includes family home 58 Oldest Child Receives remainder interest .017366111 = 1.7% .015625000 = 1.6% .007812500 = 0.8% .011458333 = 1.1% .007812500 = 0.8% .026041666 = 2.6% Ft Peck Ft Belknap Blackfeet Ft Peck Standing Ft Hall (less than 5% & no will) 59 Summary: Less than 5% (no will) • Single Heir Rule: Less than 5% interests pass to oldest child. Exception spouse living on parcel receives life estate. 60 More information: •Fact Sheet #7 Your Undivided Interest of less than 5%: What Happens If You Pass Away Without a Written Will ? 61 American Indian Probate Reform Act of 2004 (AIPRA) 62