Year End Tax Planning

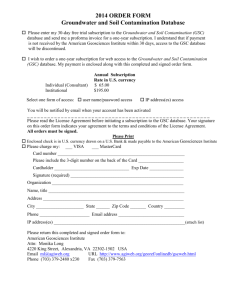

advertisement

Year End Tax Planning Do You Know the difference between Tax Avoidance and Tax Evasion? 30 Years (In Prison) What’s New In 2012 What is an Accountant? Someone who solves a problem you didn’t know you had in a way you don’t understand at a price you cannot afford. Standard Deduction 2012 • Single - $5950 (up $150) – Add $1150 if over age 65 • MFJ - $11900 (up $300) – Add $1450 if over age 65 • HOH - $8700 (up $200) – Add $1150 if over age 65 • MFS - $5950 (up $150) – Add $1150 if over age 65 But Wait….There’s More • Personal Exemption • $3800 (up $100) • Kiddie Tax Threshold • $1900 • < 24 years old is taxed at parents rates if full time student • Changes in the tax brackets but not the tax rates • FICA Portion of Social Security Earning Limit • $110,100 up $3300 • Mileage Rates • 55.5 cents per business mile • 14 cents per charitable mile • 23.5 cents per medical and moving mile Year End Tax Tips 3 Basic Techniques – Due to New Proposals • Accelerate Income Into 2012 • Defer Deductions Into 2013 • Take Advantage of Expiring Tax Laws Accelerate Income into 2012 The Goal is to Lock-in Known Tax Rates • This can be achieved by…. – Asking employers to pay 2012 bonuses by 12/31/12 – Sell Stocks and Investments to lock in historically low 15% tax on gains or harvest losses – Take distributions from IRA’s if over 59 ½. – Rollover Traditional IRA to Roth to lock in known rate. – Redeem U.S. Savings Bonds Defer Deductions into 2013 • Defer Certain Payments into 2013 –Medical Bills –Charity –Property Taxes Take Advantage of Expiring Tax Laws • 10% Tax Bracket ($7000 for singles, $14000 for MFJ) becomes 15% after 2012. • No Limit on over all Itemized Deductions in 2012 – 2013 Phases out at 3% of total AGI when it exceeds $254,350 MFJ or $169,500 Single. • Child Tax Credit – $1000 per eligible child lowers to $500 in 2013 • Debt Forgiveness on a principle residence in foreclosure on a mortgage workout is not taxable. This expires after 2012 Crazy Times For Planning Bush-era income tax rates & Capital Gains Rates • One of Four Directions 1. Complete Sunset for all taxpayers 2. Complete extension for all taxpayer 3. Sunset for Higher Income Individuals only 4. Sunset for Millionaires only 2013 • The Proposed rate for L/T Capital Gains is 20% up from 15%. • New 3.8% contribution tax on net investment income (unearned income). • Affects Taxpayers with AGI of $250,000 or more MFJ. ($200,000 single filers) • Applies to the LESSER of Investment Income or AGI over $250,000. ($200,000 for single) • AGI $140,000 + Capital Gain $120,000 = AGI $260,000 • $260,000 - $250,000 = $10,000 x 3.8% = $380 (Lesser) • This Levy applies to taxable interest, dividends, rents, some annuities, royalties, and capital gains. • Includes sale of Home after $500,000 exclusion. ($250,000 for single) 2013 Continued • New 0.9% Medicare Tax on earned income • On self employment earnings or wages in excess of $250,000 MFJ or $200,000 single. (From 1.45% to 2.35%) • Dividends will be taxed at ordinary income tax rate regardless of bracket (15%-39.6%) • Medical Deduction Increase from 7.5% of AGI to 10% AGI • Remains 7.5% for taxpayers 65 years or older until 2016 • 2012 Payroll tax holiday is scheduled to expire 12/31/12 • from 4.2% back to 6.2% Tax Mess Deepens 2008-2012 (MFJ) Ordinary Income Tax Rate S/T Capital Gains Tax Rate L/T Capital Gains Tax Rate 10% 10% 0% ($0-17400) ($0-17400) ($0-17400) 15% 15% 0% ($17,400-70,700) ($17,400-70,700) ($17,400-70,700) 25% 25% 15% ($70,700-142,700) ($70,700-142,700) ($70,700-142,700) 28% 28% 15% ($142,700-217,450) ($142,700-217,450) ($142,700-217,450) 33% 33% 15% ($217,450-388,350) ($217,450-388,350) ($217,450-388,350) 35% 35% 15% ($388,350-Above) ($388,350-Above) ($388,350-Above) 2013 Ordinary Income Tax Rate S/T Capital Gains Tax Rate L/T Capital Gains Tax Rate 5 Year Capital Gains Tax Rate 15% 15% 10% 15% 28% 28% 20% 28% 31% 31% 20% 31% 36% 36% 20% 36% 39.6% 39.6% 20% 39.6% Estate Taxes (The Death Tax) 2012 • 5.12 Million Per Person Exemption (indexed for inflation) 5.12 MM Taxpayer + 5.12 MM Spouse 10.24 Could Avoid Estate Tax • Maximum rate is 35% beginning at $500,000 • Lifetime Gifting is 5.12 2013 • Proposed 1.0 Million Per Person Exemption (Not indexed for inflation) • Maximum rate is 55% beginning at 3 Million • Lifetime gifting 1 Million. • Regular Gifting Without Gift Tax Remains @ $13,000 per person Smiley CPAs • Melody J. Smiley CPA • 1650 Murfreesboro Rd Ste. 100 • Franklin, TN 37067 • Phone 615-794-8881 • Fax 615-791-5532 • Smileycpas.com • melody@smileycpas.com