a

Underwriting – Role,

Challenges & Solutions

Jagbir Sodhi, FIA, MAAA, FIAI

INSURANCE INSTITUTE OF INDIA, MUMBAI

23rd February 2012

What is Underwriting?

a

The process of determining the level or risk presented

by the applicant, and deciding whether to accept the

policy, and if so, at what terms and at what price

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

2

a

Role of Underwriting

Risk Management

Distribution Management

Cost Management

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

3

a

Top Underwriting Challenges

Jagbir

JagbirSodhi|

Sodhi|Insurance

InsuranceInstitute

InstituteofofIndia

India| |Mumbai

Mumbai| |23rd

23rdFebruary

February2012

2012

4

Top 3 Challenges

a

Disclosures

UW Skills

Processing Hurdles

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

5

Non-disclosure & adverse selection

Applicant A

Applicant B

a

Adverse

selection

35 year old

Goes to gym everyday

Yearly routine health check ups

No ailments

Healthy and fit

No adverse disclosure

Premium Rs 1000

35 year old

No physical activity

Back pain on and off

Diagnosed with hypertension a month back

Recommended blood test for sugar

No adverse disclosure

Premium Rs 1000

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

6

Risk Management Tools

a

Underwriting

Adverse

Selection

•

•

•

•

Waiting Periods

Exclusions

Risk Classification

Risk Assessment - rating

Moral

Hazard

•

•

•

•

Deductible

Coinsurance, Copays

Fee Negotiation

Limits, Exclusions

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

7

a

• Impact

• Inappropriate,

inconsistent

decisions

• Loss of credibility

• Increased medical

evidence

• Higher declinature

rate

• Loss of business

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

Processing Hurdles

• Impact

• Low NM Limits

• Increase in cost

• Asymmetrical

portfolio

• Claims Repudiation

• Extreme customer

discomfort

UW Skills ??

Disclosures

Top 3 Challenges

• Impact

• Delay in issuance

• Customer cools off

• Dissatisfied

customer, agent

• Reduced business

volumes

8

a

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

9

Adopt A New Approach :

Because sound decisions are important !!

Tele-Underwriting

a

Automated Expert

Underwriting System

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

10

a

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

Tele-Underwriting:

11

a

Tele-underwriting

Little

"t"

Big

"T"

• Basic data gathered by Tele

Interviewer

• Information sent to UW

• Decision communicated off-line

• All application information

• "Interactive" scripts using

automated "expert" UW systems

• Decision provided instantly

Interviews usually done by skilled underwriters

"Skilled" personnel not required if "Expert" engines are used

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

12

a

Operational Process

Applicant Disclosures

Tele / Internet

Paper Application

Tele-uw

Expert

Underwriting

Interactive Questions

UW Decisions

Branch

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

13

Tele-underwriting - Benefits

Customer

• Faster & simpler process

• Interview in privacy

• Skilled interview by trained

staff

• No sharing of sensitive

information with intermediary

• Better chances of claim being

paid

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

a

Insurer

• Reduced non-disclosure :

Better risk information

• Fewer "incomplete"

applications

• Higher conversion rate

• New distribution channel :

More business !

• Improved customer service :

Brand building !

14

Impairment Disclosures:

Improvement with mode of deployment

a

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

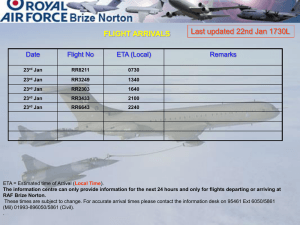

Paper Based UK Paper Based ZA

POS Interactive

UK

Tele UW ZA

Tele Sales / UW

UK

Paper Based

India

Source: Swiss Re Study

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

15

a

Tele-underwriting

Did U

Know ?

Tele UW IMPROVES

disclosure rates by

nearly 30% than

compared to any

other point of sale

UW.

Did U

Know ?

More than 75 % of

American &

European markets

USE Tele-UW or

Interviewing in

some form !

Teleunderwriting

REDUCES APS

medical evidence by

~ 50% ?!

Tele UW grown at a

pace of 15% per

year in the last three

years.

UK

Tele-underwritten CI

products nondisclosure has

dropped from 25%

to 7%

UK

In Life products the

drop in nondisclosure has gone

from 11 to 4%

Source: SR study in US/Hank George Survey/ Medicals Direct

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

16

a

Automated "Expert"

Underwriting System

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

17

Automated UW System - Concept

a

Most automated systems available do some of the following :

– Identify Yes/No questions

– Refer applications with non-standard disclosures

– Calculate BMI

Expert UW Systems

– Do more than the obvious

– Logic based "Rules" driven engines catering to Life and Health insurance

products

– Capable of identifying "medical conditions" ,"treatments", other disclosures and

triggering appropriate "interactive" questions

– i.e. questions based on the answers received from the customer

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

18

Interactive Questions

a

Example :

If "Appendicitis" is disclosed,the following questions could be

asked

"Do you currently suffer from this condition ?"

Customer Answer = "No"

"Have you undergone a surgery to remove the appendix ? If

Yes, When?"

Customer Answer = "Yes, 5 yrs back"

"Do you suffer from any complications due to the treatment or surgery ?"

Customer Answer = "No"

Underwriting Decision : Standard

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

19

a

Expert UW System – Benefits

UW

Decisions

Distribution

• consistent

• appropriate for the

nature of risk

• objective

Technology

• Multi Channel Support

• On – Line

• Tele UW

• Agency

• Banc assurance

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

Cost

• Ability to handle

different lines of

business ( Life and

Health)

• Faster "turn around"

• Saving in hiring &

training costs

• Improved business

turn-over

20

Creating an Underwriting Professional

Attract Talent

Nurture Talent

Retain Talent

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

a

21

a

Way Ahead

Tele-Underwriting

Automated Expert

Underwriting System

Create UW Professionals

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

22

a

Thank you

a

Legal notice

©2010 Swiss Re. All rights reserved. You are not permitted to create any

modifications or derivatives of this presentation or to use it for commercial

or other public purposes without the prior written permission of Swiss Re.

Although all the information used was taken from reliable sources, Swiss Re

does not accept any responsibility for the accuracy or comprehensiveness of

the details given. All liability for the accuracy and completeness thereof or

for any damage resulting from the use of the information contained in this

presentation is expressly excluded. Under no circumstances shall Swiss Re

or its Group companies be liable for any financial and/or consequential loss

relating to this presentation.

Jagbir Sodhi| Insurance Institute of India | Mumbai | 23rd February 2012

24