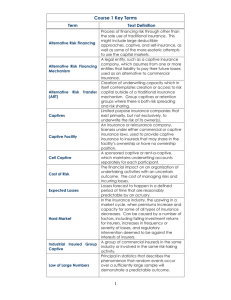

Employer Medical Stop Loss - Barreca - Cary - Carnell

advertisement

Is There a Place in My Captive for Employer Medical Stop Loss? Lauree Barreca, The Johns Hopkins Health System Eric Melchior, Greater Baltimore Medical Center Kevin Carnell, RCM&D Dana Serafin Cary, RCM&D Medical Stop Loss 2 • A form of insurance that employers purchase to limit their losses when self-funding their employee’s health plan • Two Forms: • Specific Stop Loss • Aggregate Stop Loss Specific Stop Loss 3 • Insures against a single catastrophic claim that exceeds a dollar limit – the specific deductible • Protects against large individual claims • Claim must be paid within a specific period of time • Specific deductible determined by size of employer or as percentage of the expected paid claim Aggregate Stop Loss 4 • Insures against total claims exceeding an estimated dollar amount plus a margin during the plan year • Limits total financial liability of the plan • Margin is typically 125 to 150% of expected claims, depending on size of health plan • Usually offered with Specific Stop Loss Commercial Market Issues 5 • Target loss ratio is 60 to 75% • Premium is volatile • Rates immediately reflect recent claims history • No “smoothing” of risk transfer costs • The employer stop loss market is hardening • The removal of plan maximums • Ever increasing large claims (medical inflation) • Coverage with “reasonable” retentions are “unreasonably” priced Medical Stop Loss through a Captive 6 • Allows employer to control more of the risk and cost of self-insuring medical benefits: • The captive provides a mechanism to spread the risk over a reasonable time period and across various entities or divisions • Employer retains underwriting profit and almost all of the “expenses” that “cost” 25 to 40% of the premium • Captive can structure reinsurance using the commercial market to protect it from catastrophic losses (or less than catastrophic losses) Advantages of Using a Captive 7 • Cost Savings • Losses can be higher than expected in any given year, but the overall cost will be less over a longer period of time • Cash flow benefits from retaining premium dollars in the captive • The captive has a lower cost structure Advantages of Using a Captive 8 • Managing Volatility • Fund commercial market rates in first few years • Build up surplus to support the program (if claims are incurred at expected claim levels) • Reduce rates once sufficient excess funds have been accumulated Advantages of Using a Captive 9 • Customized Coverage Terms • The stop loss policy issued by the captive can be tailored to meet specialized or current policy requirements • Reduce one sided contractual provisions and possible claim disputes • Disclosure of known claims or conditions requirement • Exclusions different than coverage of medical plan • Claim filing deadlines Advantages of Using a Captive 10 • Risk Diversification • If medical stop loss is placed into a captive covering property and casualty exposures, risk distribution can improve because stop loss exposure is “unrelated” to those other risks • Having unrelated risks insured together can reduce overall funding • Any excess reserves in the captive can serve as the required capital for the stop loss insurance Continuum 11 Reinsurance Stop Loss Policy Captive Layer Entity 3 Captive Layer Capitated Procedure Each Claim Hospital’s Responsibility MCO Entity 2 Entity 1 GBMC Story 12 Stop Loss Policy 500,000 Losses in Captive Layer: 2013: None 2012: $150,000 2011: $300,000 2010: $300,000 Captive Layer Premium Difference Between: $500,000 and $350,000 is $255,000 350,000 Each Claim GBMC Responsibility Differences of Note for Medical Stop Loss Coverage 13 • Medical stop loss coverage provides protection to the plan sponsor (not the plan) and is not considered as funding • It is not subject to Employee Retirement Income Security Act of 1974 (ERISA) and should not require U.S. Department of Labor approval • Actuarial analysis – inquire about alternatives for funding Differences of Note for Medical Stop Loss Coverage 14 • Confirm other services provided by stop loss insurer • Stop loss is “short tail” exposure and will not have significant IBNR reserves. Therefore, underwriting profit can be realized quickly and accounting treatment is important to watch (so reserves can be built) Hopkins Story 15 Reinsurance • Stop loss for programs other than an Employer Health Plan • An MCO or a high-dollar capitated procedure (transplants) have the same type of exposure Captive Layer Entity 3 Capitated Procedure MCO Entity 2 Entity 1 • Different entities can take different retention levels for employer stop loss and use the captive to bring each entity to the attachment point of “affordable” reinsurance Moving Forward 16 • Experience Analysis • Analyze the risk by reviewing prior loss history, claims and actuarial tables to project losses • Compare loss projection with the cost of purchasing stop loss from a commercial carrier at various retentions • Determine the appropriate level of risk to transfer to the captive stop loss policy Moving Forward 17 • Reserves • Forecast the funding (actuarially determined reserves and capital requirements) needed to cover unexpected losses • Policy Issuance • Captive will issue a policy to the employer, specifying the terms under which claims will be paid – dovetail with excess or reinsurance 18 Questions? Thank You LBarrec1@jhmi.edu Eric.Melchior@gbmc.org KCarnell@rcmd.com DCary@rcmd.com